PepsiCo to Acquire Rockstar in a Grab for Energy Drinks -- WSJ

March 12 2020 - 3:02AM

Dow Jones News

By Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 12, 2020).

PepsiCo Inc. agreed to buy Rockstar Energy Beverages, in a move

to expand the beverage giant's presence in the fast-growing

energy-drink category.

PepsiCo is to pay $3.85 billion for closely held Rockstar, the

companies said Wednesday, confirming an earlier Wall Street Journal

report.

PepsiCo and rivals including Coca-Cola Co. have been working for

years to shift their beverage sales away from sugary sodas and

toward lower-calorie offerings including water and tea as well as

coffee drinks.

Energy drinks are a weak spot for both Coca-Cola and PepsiCo,

and neither owns a major brand in the category. Coke, which owns a

stake in Monster Beverage Corp. and distributes its products,

recently launched an energy drink in the U.S. over Monster

Beverage's objections.

Rockstar, which PepsiCo already distributes, is one of a handful

of major energy-drink brands. The entrepreneur Russell Weiner

founded the company in 2001, when Rockstar was the first energy

drink to come in now-ubiquitous 16-ounce cans. The number of

energy-drink offerings has since exploded and begun edging out

sodas for space in store coolers. Austria-based Red Bull GmbH and

Monster Beverage dominate the market, which in addition to Rockstar

counts another brand, Bang, as a significant player.

In addition to traditional energy drinks with loud labels and

flavors including Killer Black Cherry, Rockstar makes several

sugar-free and low-calorie energy drinks as well as an organic

version and others made with fruit juice.

The deal marks the first big move since Ramon Laguarta took over

as PepsiCo's chief executive from Indra Nooyi in 2018. The

Purchase, N.Y., company's last multibillion-dollar deal was the

acquisition of SodaStream, the seltzer-machine maker. Mr. Laguarta

was deeply involved in that deal, which came in the final months of

Ms. Nooyi's tenure.

While PepsiCo has distributed Rockstar drinks in North America

since 2009, the existing agreement limits what it can do with other

external brands and with those it sells under its own Mountain Dew

label.

Once the deal closes, PepsiCo could do more with its Mountain

Dew brands, including Kickstart and Game Fuel, and potentially

distribute other energy-drink brands. It would also be able to

expand distribution and product offerings under the Rockstar

brand.

Buying Rockstar "gives us the ability to play in energy from

soup to nuts," PepsiCo Chief Financial Officer Hugh Johnston said

in an interview.

It should also enable the company to sidestep any legal tussle

like the one that ensnared Coca-Cola. PepsiCo's rival has for years

held a significant stake in Monster Beverage. Coca-Cola last year

won an arbitration claim that allows it to expand sales of its own

Coke-branded energy drinks after Monster Beverage tried to stop the

rollout.

When Mr. Laguarta was asked about PepsiCo's energy-drink

strategy on its earnings call last month, he pointed to success in

a partnership with Starbucks Corp. that allows PepsiCo to sell

ready-to-drink coffee beverages and said it plans to do "a better

job with Rockstar," without further elaborating.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

March 12, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

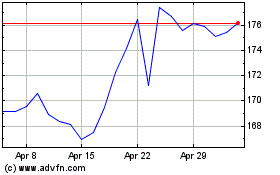

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

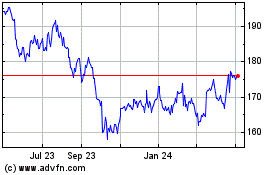

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024