By Saabira Chaudhuri | Photographs by Zach Gibson for The Wall Street Journal

Glassmakers are betting the backlash against single-use plastics

can stem a decadeslong decline in the use of their bottles and

jars. First they have to boost poor glass-recycling rates that

undercut the material's environmental pitch.

Once the packaging kingpin for milk, ketchup, beer and soft

drinks, glass has been muscled aside by lighter, unbreakable

materials such as plastic and aluminum. Today, just 1% of U.S. soda

comes in glass bottles, down from nearly 58% in 1975, according to

Beverage Marketing Corp., a consulting firm. Over the same period,

plastic jumped to 32.5% from nothing.

Now, mounting concern about the environmental impacts of

single-use plastic is dampening its appeal for some consumers. That

is prompting consumer-goods companies like Nestlé SA, PepsiCo Inc.

and Unilever PLC to explore refillable packaging and alternative

materials.

Glassmakers see this as an opportunity to win back customers. A

recent industry-funded marketing campaign in Europe saw

grocery-store customers thanked by on-screen dolphins for helping

the oceans when they scanned items packaged in glass.

"It's hard for us to ignore the images borne into our minds of

trillions of plastic packages floating around the Pacific Ocean,"

Andres Alberto Lopez, chief executive of O-I Glass Inc., told

investors last year. "Glass represents a wonderful

alternative."

The U.S.'s first new glass container plant in 12 years, a $123

million facility, is being built by Arglass Yamamura LLC in

Georgia. Perrysburg, Ohio-based O-I, the world's biggest maker of

glass containers, is investing more than $60 million to build a new

furnace at its French plant, its first such expansion in the region

in two decades. Glassmakers also are investing in new technology to

quickly swap colors and molds in a bid to woo craft brewers and

small brands, in a break from the long production runs that have

dominated the industry to date.

Glassmakers say their products -- made from sand -- are

all-natural, endlessly recyclable and can be refilled many times.

Glass is the only widely used food packaging material that the Food

and Drug Administration deems "generally recognized as safe,"

meaning it doesn't need premarket approval. It also offers a longer

shelf life for many food and drink products because it is less

permeable than plastic, said Sokhna Gueye, Nestlé's plastics

sustainability manager.

But there are cracks in the glass industry's sustainability

story, particularly in the U.S. Glass containers often break and

are heavy to transport, leading to increased fuel use. Efforts to

bring back refillable glass containers for beer, soda and milk have

remained niche. And most important, about two thirds of glass

containers aren't recycled in the U.S., according to the

Environmental Protection Agency.

Recycling them often isn't cost-effective, processors say. That

is because most American households throw glass containers in the

same recycling bin with paper and plastic, where it breaks and is

hard to separate. Broken glass also rips up conveyor belts at

sorting facilities and costs more to transport to increasingly

faraway glass plants. The number of glass-container plants in the

U.S. has fallen 65% since 1983 as demand for soda bottles has

dropped.

"For a long time there was the thought glass was being recycled,

but in reality it was not," said Erik Grabowsky, head of solid

waste for Arlington, Va., one of a rising number of places that no

longer offers curbside collection of glass. The county's glass

containers had long ended up in landfills because they weren't

clean enough for recyclers to buy, Mr. Grabowsky said.

In response, glassmakers are attempting to boost recycling rates

by funding separate glass-collection programs in areas that lack

the infrastructure. O-I and Mt. Pleasant, Pa.-based recycler CAP

Glass sponsored pop-up recycling events for Pittsburgh residents to

drop off glass containers after the city's residential waste

contractor said it would no longer accept them. The industry

recently set up a foundation to improve recycling

infrastructure.

Arlington and other counties in Northern Virginia last year

began rolling out separate purple bins for glass. Local officials

say the program has proved popular, with some of the glass

collected being used by Strategic Materials Inc. -- the U.S.'s

biggest glass-container recycler -- to make new bottles. But

getting big volumes remains a challenge, recyclers say.

Despite industry efforts, the share of new U.S. drink launches

packaged in glass last year fell to 25% from 37% in 2015, according

to research firm Mintel. "There is an opportunity to capitalize on

the backlash against single-use plastics, but it is very hard,"

said Nipesh Shah, CEO of Tampa-based Anchor Glass Container Corp.

"The first part is preventing the conversion from glass to

plastics."

One hope for glassmakers is that consumer interest will revive

refillable glass containers. The carbon footprint of single-use

glass is a turnoff for companies like PepsiCo, said its head of

sustainability, Simon Lowden. A 0.75 liter glass bottle must be

used three times to bring its carbon footprint in line with that of

a half-liter plastic bottle, according to a study in the

International Journal of Life Cycle Assessment.

Coca-Cola Co., Procter & Gamble Co., Nestlé, PepsiCo and

Unilever are among companies participating in a trial called Loop

through which they sell products like Tropicana orange juice and

Hellmann's mayonnaise in containers designed to be returned,

cleaned and refilled. Of the 300 products included in that trial,

more than half are packaged in glass.

"When a glass bottle is refilled it's very attractive from a

carbon footprint standpoint," said Ben Jordan, senior director of

environmental policy for Coca-Cola. "When it's not, it's at the

other end of the spectrum."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

February 24, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

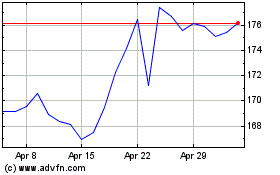

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

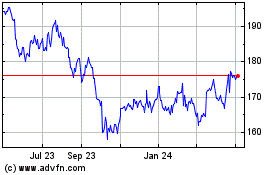

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024