Current Report Filing (8-k)

January 19 2022 - 4:31PM

Edgar (US Regulatory)

false0001472091NASDAQ00014720912022-01-192022-01-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

January 19, 2022

Date of Report (Date of earliest event reported)

PDS Biotechnology Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-37568

|

|

26-4231384

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number

|

|

(IRS Employer Identification No.)

|

|

25B Vreeland Road, Suite 300

Florham Park,

NJ

|

|

07932

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(800) 208-3343

|

|

Registrant’s telephone number, including area code

|

|

|

|

(Former name or former address if changed since last report,)

|

Securities registered pursuant to Section 12 (b) of the Act:

|

Title of each class:

|

Trading Symbol(s)

|

Name of each exchange on which

registered:

|

|

Common Stock, par value $0.00033 per share

|

PDSB

|

The Nasdaq Capital Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4© under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities

Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(e)

PDS Biotechnology Corporation (the “Company”) held a special meeting of stockholders on January 19, 2022 (the “Special Meeting”).

As previously disclosed, on December 8, 2020, the Board of Directors of the Company (the “Board”) approved the Second Amended and

Restated PDS Biotechnology Corporation 2014 Equity Inventive Plan (the “2014 Plan”), subject to stockholder approval at the Company’s 2021 annual meeting of stockholders (the “2021 Annual Meeting of Stockholders”). The 2014 Plan was previously

submitted for consideration by the Company’s stockholders at the 2021 Annual Meeting of Stockholders. At the 2021 Annual Meeting of Stockholders, the Company determined that the proposal to approve the 2014 Plan received the requisite number of votes

for approval. As part of this determination, broker non-votes were treated as having no effect on the outcome of this proposal. Following the 2021 Annual Meeting of Stockholders, a complaint (the “Complaint”) was filed in the Court of Chancery of the

State of Delaware (C.A. No. 2021-0644 JRS) against the Company, certain executive officers of the Company, and the members of the Board, in which it was alleged that, under the voting standard contained in the Company’s bylaws in effect at the time

of the 2021 Annual Meeting of Stockholders, broker non-votes should have been treated as a vote “AGAINST” the proposal. If the broker non-votes were treated as a vote “AGAINST,” the proposal would not have been approved at the 2021 Annual Meeting of

Stockholders.

Although the Company does not believe that the interpretation reflected in the Complaint regarding the bylaws of the Company that

were in effect as of the time of the 2021 Annual Meeting of Stockholders was correct, in an effort to resolve any ambiguity regarding the approval of the 2014 Plan at the 2021 Annual Meeting of Stockholders raised by the Complaint, the Company asked

its stockholders, at the Special Meeting, to ratify the prior approval of the 2014 Plan, which was adopted at the 2021 Annual Meeting of Stockholders.

At the Special Meeting, the stockholders of the Company voted in favor of the ratification of the prior approval of the 2014

Plan, which was adopted at the 2021 Annual Meeting of Stockholders. A copy of the 2014 Plan is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

At the Special Meeting, the following proposal was submitted to the stockholders of the Company: a proposal to ratify the prior

approval of the Second Amended and Restated PDS Biotechnology Corporation 2014 Equity Incentive Plan,

which was adopted at the Company’s 2021 annual meeting of stockholders.

For more information about the foregoing proposal, see the Company’s definitive proxy statement on Schedule 14A filed with the

United States Securities and Exchange Commission on December 16, 2021. Of the 28,437,940 shares of the Company’s common stock entitled to vote at the Special Meeting, 15,698,729 shares, or approximately 55.20%, were represented at the Special Meeting

in person or by proxy, constituting a quorum.

The number of votes cast for, against or withheld, as well as abstentions in respect of the proposal is set forth below.

|

Proposal 1:

|

Ratification of the prior approval of the Second Amended and Restated PDS Biotechnology Corporation 2014 Equity Incentive Plan, which was adopted at the Company’s 2021 annual meeting of

stockholders.

|

The Company’s stockholders ratified the prior approval of the Second Amended and Restated PDS Biotechnology Corporation 2014 Equity

Incentive Plan, which was adopted at the Company’s 2021 annual meeting of stockholders. The votes regarding this proposal were as follows:

|

Votes For

|

|

Votes Against

|

|

Votes Abstaining

|

|

Broker Non-Votes

|

|

|

14,471,905

|

|

1,046,389

|

|

180,435

|

|

0

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

Exhibit

Number

|

Description

|

|

|

Second Amended and Restated PDS Biotechnology Corporation 2014 Equity Incentive Plan (filed as Exhibit 10.3 to the Company’s Current Report on Form 8-K on December 9, 2020, and incorporated by

reference herein).

|

|

104

|

Cover Page Interactive Data File - the cover page interactive date file does not appear in the Interactive Date File because its XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

PDS Biotechnology Corporation

|

|

|

|

|

Date: January 19, 2022

|

By:

|

/s/ Frank Bedu-Addo, Ph.D.

|

|

|

|

Name: Frank Bedu-Addo, Ph.D.

|

|

|

|

Title: President and Chief Executive Officer

|

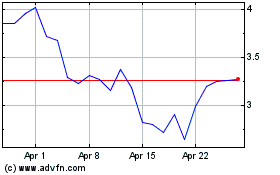

PDS Biotechnology (NASDAQ:PDSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

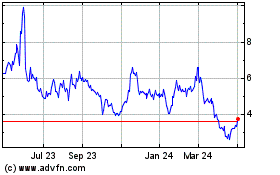

PDS Biotechnology (NASDAQ:PDSB)

Historical Stock Chart

From Apr 2023 to Apr 2024