|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

Not applicable.

Item 7. Material

to Be Filed as Exhibits

Exhibit No. Description of Exhibit

|

1

|

Certain Information about the Reporting Persons

|

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

By: /s/ Terry Regas

Terry Regas

CCO-TLS Advisors LLC

Director of Compliance-TradeLink Securities LLC

|

By: /s/ Jennifer Lidel

Jennifer Lidel, President

TLS Advisors LLC

11/27/19

|

By: /s/ Jennifer Lidel

Jennifer Lidel, President

Shira Capital LLC

11/27/19

|

|

|

|

By: /s/ Jennifer Lidel

Jennifer Lidel, President

TradeLink Securities LLC

11/27/19

|

By: /s/ Jennifer Lidel

Jennifer Lidel, President

TLS Advisors

LLC-General Partner

Tripletail Capital Management LP

11/27/19

|

|

|

|

|

By: /s/ Mark Feldberg

Mark Feldberg

11/27/19

|

|

The original statement shall be signed by each person on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf

of a person by his authorized representative (other than an executive officer or general partner of this filing person), evidence of the representatives authority to sign on behalf of such person shall be filed with the statement, provided,

however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his signature.

Attention: Intentional misstatements or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001).

EXHIBIT 1

CERTAIN INFORMATION ABOUT THE REPORTING PERSONS

AND EXECUTIVE OFFICERS/DIRECTORS OF THE REPORTING PERSONS

Set forth below is information about (i) the name, state of organization, principal business, and the address of the principal office of each of the Reporting

Persons and (ii) the name and title of each executive officer and director of the Reporting Persons, his or her business address, and his or her present principal occupation or employment, and the name, principal business, and address of

any corporation or other organization in which such employment is conducted.

Each natural person listed below is a citizen of the United States. The principal business address of Mark Feldberg and Jennifer Lidel is 100 North Biscayne Blvd

Suite 3000Miami, FL 33132. The principal business address of Harlan Moeckler and Michael Ryan is 71 S. Wacker Dr. Suite 1900 Chicago, IL 60606.

(1) TLS Advisors LLC

TLS Advisors LLC., a Delaware corporation (“TLS”), is an SEC Exempt Reporting Advisor and serves as Investment Advisor to entities affiliated with TLS, including

Shira Capital LLC, TradeLink Securities LLC and Tripletail Capital Management LP. The principal office of TLS is located at 100 North Biscayne Blvd Suite 3000 Miami, FL 33132. The executive officers of TLS are Mark Feldberg (Chairman),

Jennifer Lidel (President) and Harlan Moeckler (Treasurer).

(2) Shira Capital LLC

Shira Capital LLC., a Delaware corporation (“Shira”), is a company organized for the purpose of making investments. The principal office of Shira is located at 100

North Biscayne Blvd Suite 3000 Miami, FL 33132. The executive officers of Shira are Mark Feldberg (Chairman) Jennifer Lidel (President) and Harlan Moeckler (Treasurer).

(3) TradeLink Securities LLC

TradeLink Securities LLC., a Delaware corporation (“TradeLink”), is an SEC registered Broker/Dealer and FINRA Member. The principal office of TradeLink is located

at 100 North Biscayne Blvd Suite 3000 Miami, FL 33132. The executive officers of TradeLink are Mark Feldberg (Chairman), Jennifer Lidel (President), Michael Ryan (Secretary) and Harlan Moeckler (Treasurer).

(4) Tripletail Capital Management LP

Tripletail Capital Management LP, a Delaware corporation (“Tripletail”), is Partnership organized for the purpose of investing and trading in Investments. The

principal office of Tripletail is located at 100 North Biscayne Blvd Suite 3000 Miami, FL 33132. The General Partner of Tripletail is TLS Advisors LLC.

(5) Mark Feldberg

The present principal occupation of Mr. Feldberg is Chairman of TLS Advisors LLC, an entity through which Mr. Feldberg manages various private investment companies.

Mr. Feldberg may be deemed to control the entities listed above, and may be deemed to have beneficial ownership of the Shares. The principal office of Mr. Feldberg is located at 100 North Biscayne Blvd Suite 3000 Miami, FL 33132.

EXHIBIT 2

JOINT FILING AGREEMENT

The undersigned agree that the statement on Schedule 13D with

respect to the common stock of OVID Therapeutics Inc., dated as of October 4th, 2019, is, and any amendments thereto signed by each of the undersigned shall be, filed on behalf of each of them pursuant to and in accordance with the provisions of Rule 13d-1(k) under the Securities

Exchange Act of 1934, as amended.

|

By: /s/ Jennifer Lidel

Jennifer Lidel, President

TLS Advisors LLC

11/27/19

|

By: /s/ Jennifer Lidel

Jennifer Lidel, President

Shira Capital LLC

11/27/19

|

|

|

|

By: /s/ Jennifer Lidel

Jennifer Lidel, President

TradeLink Securities LLC

11/27/19

|

By: /s/ Jennifer Lidel

Jennifer Lidel, President

TLS Advisors

LLC-General Partner

Tripletail Capital Management LP

11/27/19

|

|

By: /s/ Mark Feldberg

Mark Feldberg

11/27/19

|

|

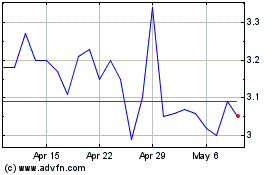

Ovid Therapeutics (NASDAQ:OVID)

Historical Stock Chart

From Mar 2024 to Apr 2024

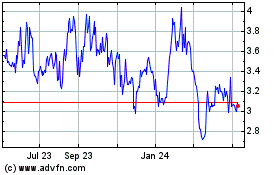

Ovid Therapeutics (NASDAQ:OVID)

Historical Stock Chart

From Apr 2023 to Apr 2024

See More Message Board Posts

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.