As

filed with the Securities and Exchange Commission on November 16, 2020

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ORGENESIS

INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

98-0583166

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Identification

Number)

|

20271

Goldenrod Lane

Germantown,

MD 20876

(480)

659-6404

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Vered

Caplan

Chief

Executive Officer

Orgenesis

Inc.

20271

Goldenrod Lane

Germantown,

MD 20876

(480)

659-6404

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

|

Jeffrey

P. Schultz, Esq.

Mintz,

Levin, Cohn, Ferris, Glovsky and Popeo P.C.

666

Third Avenue

New

York, NY 10017

Tel:

(212) 935-3000

|

Mark

Cohen, Esq.

Pearl

Cohen Zedek Latzer Baratz LLP

1500

Broadway

New

York, NY 10036

Tel:

(646) 878-0800

|

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. [ ]

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box. [X]

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. [ ]

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. [ ]

If

this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer [ ]

|

Accelerated

filer [X]

|

|

Non-accelerated

filter [ ]

|

Smaller

reporting company [X]

|

|

|

Emerging

growth company [ ]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

[ ]

CALCULATION

OF REGISTRATION FEE

Title of Each Class of

Securities to be Registered

|

|

Amount to be

Registered(1)

|

|

|

Proposed Maximum

Offering Price Per

Share(2)

|

|

|

|

Proposed Maximum

Aggregate Offering

Price(2)

|

|

|

|

Amount of

Registration

Fee

|

|

|

Common Stock, par value $0.0001 per share

|

|

4,825,962 shares

|

|

$

|

4.82

|

|

|

$

|

23,261,136.84

|

|

|

$

|

2,537.79

|

|

|

(1)

|

This

Registration Statement registers 4,825,962 shares of common stock of the Registrant.

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this Registration

Statement shall also cover any additional shares of the Registrant’s common stock

that become issuable by reason of any stock dividend, stock split, recapitalization or

other similar transaction effected without receipt of consideration that increases the

number of the Registrant’s outstanding shares of common stock.

|

|

(2)

|

Estimated

in accordance with Rule 457(c) solely for purposes of calculating the registration fee

on the basis of the average of the high and low prices of the Registrant’s common

stock as reported on The Nasdaq Capital Market on November 10, 2020.

|

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective

on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. A registration statement relating to these securities has been

filed with the Securities and Exchange Commission. The selling stockholders may not sell these securities until the Securities

and Exchange Commission declares the registration statement effective. This prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED NOVEMBER 16, 2020

PROSPECTUS

ORGENESIS

INC.

4,825,962

Shares of Common Stock

The

selling stockholders of Orgenesis Inc. (“Orgenesis,” “we,” “us” or the “Company”)

listed beginning on page 8 of this prospectus may offer and resell under this prospectus up to 4,825,962 shares of our

common stock, par value $0.0001 per share (the “Common Stock”) acquired by the selling stockholders pursuant to the

Purchase Agreement and the Merger Agreement (each as defined below). Certain of the selling stockholders acquired an aggregate

of 3,400,000 shares of Common Stock (the “Tamir selling stockholders”) from us pursuant to an Asset Purchase Agreement

(the “Purchase Agreement”), dated April 12, 2020, by and among the Company and Tamir Biotechnology, Inc. (“Tamir”).

The shares of Common Stock issued to Tamir were distributed to Tamir’s stockholders that qualified as accredited investors

pursuant to a plan of liquidation effected by Tamir following the closing of the Tamir Transaction (as defined below). Certain

of the selling stockholders acquired 1,425,962 shares of Common Stock (the “Koligo selling stockholders” and, together

with the Tamir selling stockholders, the “selling stockholders”) from us pursuant to an Agreement and Plan of Merger

and Reorganization, dated as of September 26, 2020 (the “Merger Agreement”), by and among the Company, Orgenesis Merger

Sub, Inc. (“Merger Sub”), Koligo Therapeutics Inc. (“Koligo”), the shareholders of Koligo (collectively,

the “Koligo Shareholders”), and Long Hill Capital V, LLC (“Long Hill”), solely in its capacity as the

representative, agent and attorney-in-fact of the Koligo Shareholders.

Pursuant

to the Purchase Agreement and a Joinder Agreement entered into by the Tamir selling stockholders, we are registering the resale

of 3,400,000 shares of Common Stock covered by this prospectus as required by the Registration Rights Agreement we entered into

with the Tamir selling stockholders on April 23, 2020 (the “Tamir Registration Rights Agreement”). Pursuant

to the Merger Agreement entered into by the Koligo selling stockholders, we are registering the resale of 1,425,962 shares of

Common Stock covered by this prospectus as required by the Registration Rights and Lock-Up Agreement we entered into with the

Koligo selling stockholders on October 15, 2020 (the “Koligo Registration Rights Agreement”). The selling stockholders

will receive all of the proceeds from any sales of the shares of Common Stock offered hereby. We will not receive any of the proceeds,

but we will incur expenses in connection with the offering.

The

selling stockholders may sell these shares of Common Stock through public or private transactions at market prices prevailing

at the time of sale or at negotiated prices. The timing and amount of any sale are within the sole discretion of the selling stockholders.

Our registration of the shares of Common Stock covered by this prospectus does not mean that the selling stockholders will offer

or sell any of the shares. For further information regarding the possible methods by which the shares may be distributed, see

“Plan of Distribution” beginning on page 16 of this prospectus.

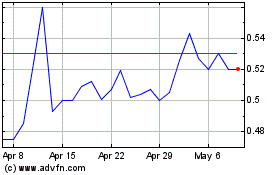

Our

Common Stock is listed on The Nasdaq Capital Market under the symbol “ORGS.” The last reported sale price of our Common

Stock on November 13, 2020 was $4.86 per share.

Investing

in our Common Stock is highly speculative and involves a significant degree of risk. Please consider carefully the specific factors

set forth under “Risk Factors” beginning on page 5 of this prospectus and in our filings with the Securities

and Exchange Commission.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is _______________, 2020

Table

of Contents

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”)

pursuant to which the selling stockholders named herein may, from time to time, offer and sell or otherwise dispose of the shares

of our Common Stock covered by this prospectus. You should not assume that the information contained in this prospectus is accurate

on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated

by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus

is delivered or shares of Common Stock are sold or otherwise disposed of on a later date. It is important for you to read and

consider all information contained in this prospectus, including the documents incorporated by reference therein, in making your

investment decision. You should also read and consider the information in the documents to which we have referred you under “Where

You Can Find Additional Information” and “Information Incorporated by Reference” in this prospectus.

We

have not authorized anyone to give any information or to make any representation to you other than those contained or incorporated

by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference

in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our shares

of Common Stock other than the shares of our Common Stock covered hereby, nor does this prospectus constitute an offer to sell

or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer

or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United

States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this

prospectus applicable to those jurisdictions.

Unless

we have indicated otherwise, or the context otherwise requires, references in this prospectus to “Orgenesis,” the

“Company,” “we,” “us” and “our” refer to Orgenesis Inc.

PROSPECTUS

SUMMARY

This

summary description about us and our business highlights selected information contained elsewhere in this prospectus or incorporated

by reference into this prospectus. It does not contain all the information you should consider before investing in our securities.

Important information is incorporated by reference into this prospectus. To understand this offering fully, you should read carefully

the entire prospectus, including “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements,”

together with the additional information described under “Information Incorporated by Reference.”

Corporate

Overview

We

are a pioneering global biotech company in the Cell & Gene Therapy (“CGT”) industry focused on unlocking the full

potential of personalized therapies and closed processing systems with the ultimate aim of providing life-changing treatments

to large numbers of patients at reduced costs in a point-of-care setting. We pursue this strategy through a point-of-care platform

(“CGT Biotech Platform”) that combines therapeutics and technologies via a network of collaborative research institutes

and hospitals, and including via its mobile processing units, around the world.

We

had historically also operated a Contract Development and Manufacturing Organization (“CDMO”) platform, which provided

contract manufacturing and development services for biopharmaceutical companies (the “CDMO Business”). On February

2, 2020, we sold our CDMO Business when we entered into a Stock Purchase Agreement (the “Purchase Agreement”) with

GPP-II Masthercell LLC (“GPP” and together with the Company, the “Sellers”), Masthercell Global Inc. (“Masthercell”

) and Catalent Pharma Solutions, Inc. (the “Buyer”). Pursuant to the terms and conditions of the Purchase Agreement,

on February 10, 2020, the Sellers sold 100% of the outstanding equity interests of Masthercell to Buyer (the “Masthercell

Sale”) for an aggregate nominal purchase price of $315 million, subject to customary adjustments. After accounting for GPP’s

liquidation preference and equity stake in Masthercell as well as other investor interests in MaSTherCell, S.A., distributions

to Masthercell option holders and transaction costs, we received approximately $126.7 million. We determined that the Masthercell

business (“Discontinued Operation”) met the criteria to be classified as a discontinued operation as of the first

quarter of 2020. The Discontinued Operation includes most of the previous CDMO Business, including majority-owned Masthercell,

including its subsidiaries Cell Therapy Holdings S.A., MaSTherCell, S.A. and Masthercell U.S.

|

|

|

We conduct

our operations through our wholly-owned subsidiaries. The subsidiaries are as follows:

|

|

|

●

|

United

States: Orgenesis Maryland Inc. (the “U.S. Subsidiary”) is the center of

activity in North America currently focused on technology licensing and the setting up

of the POCare Network (as defined below).

|

|

|

|

|

|

|

●

|

European

Union: Orgenesis Belgium SRL (the “Belgian Subsidiary”) is the center of

activity in Europe currently focused on process development and preparation of European

clinical trials.

|

|

|

|

|

|

|

●

|

Israel:

Orgenesis Ltd. (the “Israeli Subsidiary”) is the center for research and

technology, as well as a provider of regulatory, clinical and pre-clinical services,

and Atvio Biotech Ltd. is a provider of cell-processing services in Israel.

|

|

|

|

|

|

|

●

|

Korea:

Orgenesis Korea Co. Ltd. (the “Korean Subsidiary”), previously known as CureCell

Co. Ltd., is a provider of processing and pre-clinical services in Korea. We own 94.12%

of the Korean Subsidiary.

|

CGT

Biotech Platform

Business

Strategy

Our

CGT Biotech Platform consists of: (a) POCare Therapeutics, a pipeline of licensed CGTs, anti-viral and proprietary scientific

know-how; (b) POCare Technologies, a suite of proprietary and in-licensed technologies which are engineered to create customized

processing systems for affordable point-of-care therapies; and (c) a POCare Network, a collaborative, international ecosystem

of leading research institutions and hospitals committed to clinical development and supply of CGTs at the point-of-care (“POCare

Network”). By combining science, technologies and a collaborative network, we believe that we are able to identify the most

promising new autologous therapies and provide a pathway for them to reach patients more quickly, more efficiently and in a scalable

way, thereby unlocking the power of cell and gene therapy for all patients. Autologous therapies are produced from a patient’s

own cells, instead of mass-cultivated donor-cells, or allogeneic cells. Allogeneic therapies are derived from donor cells and,

through the construction of master and working cell banks, are produced on a large scale. Autologous therapies are derived from

the treated patient and manufactured through a defined protocol before re-administration and generally demand a more complex supply

chain. Currently with the CGT market relying heavily on production and supply chain of manufacturing sites, we believe our CGT

Biotech Platform may help overcome some of the development and supply challenges with bringing these therapies to patients.

In

pursuit of this focus, we have been forming key strategic relationships with leading research institutions and hospitals around

the world. We are also licensing breakthrough technologies, including via our mobile processing units, which complement our offerings

and support our model. As a result, we believe that we now have significant expertise and capabilities across a wide range of

therapies and supporting technologies, including, but not limited to, Tumor Infiltrating Lymphocytes (“TILs”), CAR-T

and CAR-NK, dendritic cell technologies, exosomes and bioxomes and viral vectors. We believe that these capabilities enable us

to launch an aggressive push into a wide array of promising new potential therapies.

We

are developing an efficient and streamlined organization, whereby we are able to share both costs and revenues with our partners

in order to avoid the historically high development costs associated with CGT drug development. We believe we have developed a

truly unique model with the ability to cost-effectively develop and produce CGTs at scale, which we believe has the potential

to transform the CGT industry.

We

consider the following to be the four pillars in order to advance our business strategy under our CGT Biotech Platform:

|

|

●

|

Innovation

– This leverages our unique know-how and expertise for industrial processes, operational

excellence, process development and optimization, quality control assays development,

quality management systems and regulatory expertise.

|

|

|

|

|

|

|

●

|

Systems

– We are developing cell production cGMP systems utilizing sensor technology and

unique systems for biological production, closed system technology for processing cells,

proprietary virus/ media technologies and partnerships with key system providers.

|

|

|

|

|

|

|

●

|

Cell

& Gene Products – We intend to grow our internal asset pipeline consisting

of our unique portfolio of immuno-oncology related technologies, anti-viral therapies,

MSC and liver-based therapies and secretome-based therapies.

|

|

|

|

|

|

|

●

|

Distribution

– This is our POCare Network which is designed to enable development, commercialization

and distribution of CGTs via the installation of point-of-care systems in major hospitals

in key geographies (i.e., Europe, North America, Asia, South America etc.), thereby creating

a regional and international system network to serve as our distribution channel.

|

While

our CGT Biotech Platform is currently limited to early stage development to overcome certain industry challenges, we intend to

continue developing our global POCare Network, with the goal of developing CGTs via joint ventures with partners who bring strong

regional networks. Such networks include partnerships with leading research institutions and local hospitals which allows us to

engage in continuous in-licensing of, namely, autologous therapies from academia and research institutes, co-development of hospital

and academic-based therapies, and utilization of hospital networks for clinical development of therapies.

Risks

Associated with Our Business

Our

business and our ability to implement our business strategy are subject to numerous risks, as more fully described in the section

entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and in our Quarterly

Reports on Form 10-Q for each of the quarter ended March 31, 2020, the quarter ended June 30, 2020, and for the quarter ended

September 30, 2020, each incorporated herein by reference. You should read these risks before you invest in our securities. We

may be unable, for many reasons, including those that are beyond our control, to implement our business strategy.

Corporate

Information

We

were incorporated in the state of Nevada on June 5, 2008 under the name Business Outsourcing Services, Inc. Effective August 31,

2011, we completed a merger with our subsidiary, Orgenesis Inc., a Nevada corporation, which was incorporated solely to effect

a change in its name. As a result, we changed our name from “Business Outsourcing Services, Inc.” to “Orgenesis

Inc.”

Our

website address is www.orgenesis.com. The information contained on, or that can be accessed through, our website does not constitute

part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Our

executive offices are located at 20271 Goldenrod Lane, Germantown, MD 20876, and our telephone number is (480) 659-6404.

THE

OFFERING

|

Shares

of Common Stock that May be Offered by the Selling Stockholders

|

|

Up

to 4,825,962 shares of Common Stock.

|

|

|

|

|

|

Use

of Proceeds

|

|

We

will not receive any proceeds from the sale of the Common Stock by the selling stockholders.

|

|

|

|

|

|

Offering

Price

|

|

The

selling stockholders may sell all or a portion of their shares through public or private transactions at prevailing market

prices or at privately negotiated prices.

|

|

|

|

|

|

Nasdaq

Capital Market Symbol

|

|

ORGS

|

|

|

|

|

|

Risk

Factors

|

|

Investing

in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus,

and any other risk factors described in the documents incorporated by reference herein, for a discussion of certain factors

to consider carefully before deciding to invest in our Common Stock.

|

Throughout

this prospectus, when we refer to the shares of our Common Stock being registered on behalf of the selling stockholders for offer

and sale, we are referring to the shares of Common Stock sold to the selling stockholders, as described under “The Acquisitions”

and “Selling Stockholders.” When we refer to the selling stockholders in this prospectus, we are referring to the

selling stockholders identified in this prospectus and, as applicable, their donees, pledgees, transferees or other successors-in-interest

selling shares of Common Stock or interests in shares of Common Stock received after the date of this prospectus from a selling

stockholder as a gift, pledge, partnership distribution or other transfer.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider and evaluate all of the information contained

in this prospectus, the accompanying prospectus and in the documents we incorporate by reference into this prospectus and accompanying

prospectus before you decide to purchase our securities. In particular, you should carefully consider and evaluate the risks and

uncertainties described under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2019 and in our Quarterly Reports on Form 10-Q for each of the quarter ended March 31, 2020, for the quarter ended

June 30, 2020, and for the quarter ended September 30, 2020. Any of the risks and uncertainties set forth in that report, as updated

by annual, quarterly and other reports and documents that we file with the SEC and incorporate by reference into this prospectus

or any prospectus, could materially and adversely affect our business, results of operations and financial condition, which in

turn could materially and adversely affect the value of any securities offered by this prospectus. As a result, you could lose

all or part of your investment.

THE

ACQUISITIONS

On

April 12, 2020, we entered into the Purchase Agreement with Tamir, pursuant to which we issued 3,400,000 shares of Common Stock

and $2,500,000 in cash for certain assets and liabilities of Tamir related to the discovery, development and testing of therapeutic

products for the treatment of diseases and conditions in humans, including all rights to ranpirnase and use for antiviral therapy

(the “Tamir Transaction”). The shares of Common Stock issued to Tamir were distributed to the selling stockholders

that qualified as accredited investors pursuant to a plan of liquidation effected by Tamir following the closing of the Tamir

Transaction. Pursuant to a Joinder Agreement entered into by the selling stockholders, the selling stockholders that hold at least

5,000 shares of Common Stock are subject to a standstill and lock-up agreement prohibiting transfer or other disposition of such

shares for a period of one year following the Tamir closing and are subject to limited dispositions for an additional six months

thereafter.

In

connection with the Tamir Transaction, we entered into the Tamir Registration Rights Agreement with the Tamir selling stockholders

pursuant to which we are obligated, among other things, to file a registration statement with the SEC for purposes of registering

their shares of Common Stock for resale by the Tamir selling stockholders, use our commercially reasonable efforts to have the

registration statement declared effective as soon as practicable after filing and maintain the registration until all registrable

securities may be sold pursuant to Rule 144 under the Securities Act, without restriction as to volume.

The

foregoing descriptions of the Purchase Agreement and the Tamir Registration Rights Agreement are not complete and are subject

to and qualified in their entirety by reference to the Purchase Agreement and the form of Tamir Registration Rights Agreement,

respectively, copies of which are attached as Exhibit 10.1 and Exhibit C to Exhibit 10.1, respectively, to the Current Report

on Form 8-K dated April 13, 2020, and are incorporated herein by reference.

On

September 26, 2020, we entered into the Merger Agreement with Koligo, pursuant to which we acquired Koligo through the merger

of Merger Sub with and into Koligo, with Koligo surviving as our wholly-owned subsidiary (the “Merger” and, together

with the Tamir Transaction, the “Acquisitions”). At the closing of the Merger (the “Effective Time”),

the shares of capital stock of Koligo that were issued and outstanding immediately prior to the Effective Time were automatically

cancelled and converted into the right to receive, subject to customary adjustments, an aggregate of 2,061,713 shares of Common

Stock which were issued to Koligo’s accredited investors (with certain non-accredited investors being paid solely in cash

in the amount of approximately $20,000) in accordance with the terms of the Merger Agreement.

In

connection with the Merger, we entered into the Koligo Registration Rights Agreement, pursuant to which we are obligated, among

other things, to (i) file a registration statement with the SEC within 45 days after receipt of a request for a Demand Registration

(as defined in the Koligo Registration Rights Agreement) for purposes of registering their shares of Common Stock for resale by

the Koligo selling stockholders, (ii) cause the registration statement declared effective as soon as reasonably practicable after

filing, and in any event no later than 90 days after receipt of such Demand Registration (or 120 days after receipt of such Demand

Registration if the registration statement is reviewed by the SEC), and (iii) maintain the registration for a period of three

years from the date of its initial effectiveness, unless prior to the end of such three-year period, (A) all registrable securities

that are the subject of the registration statement are disposed, or (B) after two years from the effective date of the registration

statement, all registrable securities that are the subject of the registration statement are sold without registration pursuant

to Rule 144 under the Securities Act, without restrictions as to volume or manner-of-sale.

The

foregoing descriptions of the Merger Agreement and the Koligo Registration Rights Agreement are not complete and are subject to

and qualified in their entirety by reference to the Merger Agreement and the form of Koligo Registration Rights Agreement, respectively,

copies of which are attached as Exhibit 2.1 and Exhibit 10.1, respectively, to the Current Report on Form 8-K dated October 1,

2020, and are incorporated herein by reference.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference contain forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended,

or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information currently

available to us. Discussions containing these forward-looking statements may be found, among other places, in the sections entitled

“Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” incorporated by reference from our most recent annual report on Form 10-K and in our most recent

quarterly report on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC.

Examples

of forward-looking statements in this prospectus include, but are not limited to, our expectations regarding our business strategy,

business prospects, operating results, operating expenses, working capital, liquidity and capital expenditure requirements. Important

assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the

cost, terms and availability of components, pricing levels, the timing and cost of capital expenditures, competitive conditions

and general economic conditions. These statements are based on our management’s expectations, beliefs and assumptions concerning

future events affecting us, which in turn are based on currently available information. These assumptions could prove inaccurate.

Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations

may prove to be incorrect.

Forward-looking

statements made in this prospectus include statements about:

Corporate

|

|

●

|

our

ability to increase revenues;

|

|

|

●

|

our

ability to achieve profitability;

|

|

|

●

|

our

ability to grow the size and capabilities of our organization through further collaboration

and strategic alliances to expand our point-of-care cell therapy business;

|

|

|

●

|

our

ability to manage the growth of our company;

|

|

|

●

|

our

ability to attract and retain key scientific or management personnel and to expand our

management team;

|

|

|

●

|

the

accuracy of estimates regarding expenses, future revenue, capital requirements, profitability,

and needs for additional financing;

|

|

|

●

|

our

belief that our therapeutic related developments have competitive advantages and can

compete favorably and profitably in the cell and gene therapy industry;

|

|

|

●

|

the

effects that the COVID-19 outbreak, or similar pandemics, could have on our business

and CGT Biotech Platform;

|

POC

Business

|

|

●

|

our

ability to adequately fund and scale our various collaboration, license, partnership

and joint venture agreements for the development of therapeutic products and technologies;

|

|

|

●

|

our

ability to develop, through our Israeli Subsidiary, to the clinical stage a new technology

to transdifferentiate liver cells into functional insulin-producing cells, thus enabling

normal glucose regulated insulin secretion, via cell therapy;

|

|

|

●

|

our

ability to advance our therapeutic collaborations in terms of industrial development,

clinical development, regulatory challenges, commercial partners and manufacturing availability;

|

|

|

●

|

our

ability to implement our point-of-care cell therapy (“POC”) strategy in order

to further develop and advance autologous therapies to reach patients;

|

|

|

●

|

expectations

regarding the ability of our U.S. Subsidiary, Israeli Subsidiary and Belgian Subsidiary

to obtain additional and maintain existing intellectual property protection for our technologies

and therapies;

|

|

|

●

|

our

ability to commercialize products in light of the intellectual property rights of others;

|

|

|

●

|

our

ability to obtain funding necessary to start and complete such clinical trials;

|

|

|

●

|

our

belief that Diabetes Mellitus will be one of the most challenging health problems in

the 21st century and will have staggering health, societal and economic impact;

|

|

|

●

|

our

belief that our diabetes-related treatment seems to be safer than other options;

|

|

|

●

|

our

relationship with Tel Hashomer Medical Research Infrastructure and Services Ltd. (“THM”)

and the risk that THM may cancel the License Agreement;

|

|

|

●

|

expenditures

not resulting in commercially successful products;

|

Sale

of Masthercell and the CDMO Business

|

|

●

|

our

dependence on the financial results of our POC business;

|

|

|

●

|

our

ability to grow our POC business and to develop additional joint venture relationships

in order to produce demonstrable revenues;

|

|

|

●

|

our

ability to effectively utilize the proceeds from the sale of Masthercell;

|

|

|

●

|

potential

adverse effects to our POC business resulting from the announcement of the sale of Masthercell;

|

|

|

●

|

the

restriction on our ability to engage in the CDMO business outside Israel and Korea pursuant

to a non-competition covenant in the Masthercell purchase agreement;

|

|

|

●

|

our

obligation to indemnify Catalent Pharma Solutions for certain losses and litigation resulting

from breaches of certain representations and warranties set forth in the Purchase Agreement

relating to the sale of Masthercell; and

|

|

|

●

|

our

ability to meet the continued listing requirements of the Nasdaq Capital Market.

|

These

statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the

section entitled “Risk Factors” set forth in our Annual Report on Form 10-K for the year ended December 31, 2019 and

in our Quarterly Report on Form 10-Q for each of the quarter ended March 31, 2020 and for the quarter ended June 30, 2020, any

of which may cause our Company’s or our industry’s actual results, levels of activity, performance or achievements

to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these

forward-looking statements. These risks may cause the Company’s or its industry’s actual results, levels of activity

or performance to be materially different from any future results, levels of activity or performance expressed or implied by these

forward looking statements.

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results,

levels of activity or performance. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness

of these forward-looking statements. The Company is under no duty to update any forward-looking statements after the date of this

prospectus to conform these statements to actual results.

You

should also consider carefully the statements set forth in the sections titled “Risk Factors” or elsewhere in this

prospectus, in the accompanying prospectus and in the documents incorporated or deemed incorporated herein or therein by reference,

which address various factors that could cause results or events to differ from those described in the forward-looking statements.

All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly

qualified in their entirety by the applicable cautionary statements. We have no plans to update these forward-looking statements.

USE

OF PROCEEDS

We

will not receive any of the proceeds from the sale of the Common Stock by the selling stockholders named in this prospectus. The

selling stockholders will receive all of the proceeds from this offering.

SELLING

STOCKHOLDERS

This

prospectus relates to the sale or other disposition of up to 4,825,962 shares of our Common Stock by the selling stockholders

named below, and their donees, pledgees, transferees or other successors-in-interest selling shares of Common Stock or interests

in shares of Common Stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership

distribution or other transfer. The shares of Common Stock covered hereby were issued by us in the Acquisitions. See “The

Acquisitions” beginning on page 5 of this prospectus.

The

table below sets forth information as of November 16, 2020, to our knowledge, for the selling stockholders and other information

regarding the beneficial ownership (as determined under Section 13(d) of the Exchange Act and the rules and regulations thereunder)

of the shares of Common Stock held by the selling stockholders. The second column lists the number of shares of Common Stock and

percentage beneficially owned by the selling stockholders as of November 16, 2020. The third column lists the maximum number of

shares of Common Stock that may be sold or otherwise disposed of by the selling stockholders pursuant to the registration statement

of which this prospectus forms a part. The selling stockholders may sell or otherwise dispose of some, all or none of their shares.

Pursuant to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any shares of our Common Stock as to which

a stockholder has sole or shared voting power or investment power, and also any shares of our Common Stock which the stockholder

has the right to acquire within 60 days of November 16, 2020. The percentage of beneficial ownership for the selling stockholders

is based on 24,156,183 shares of our Common Stock outstanding as of November 16, 2020 and the number of shares of our Common Stock

issuable upon exercise or conversion of convertible securities that are currently exercisable or convertible or are exercisable

or convertible within 60 days of November 16, 2020 beneficially owned by the applicable selling stockholder. Except as described

below, to our knowledge, none of the selling stockholders has been an officer or director of ours or of our affiliates within

the past three years or has any material relationship with us or our affiliates within the past three years. Our knowledge is

based on information provided by the selling stockholders in connection with the filing of this prospectus, as well as information

obtained from relevant Schedule 13D and 13G filings.

The

shares of Common Stock being covered hereby may be sold or otherwise disposed of from time to time during the period the registration

statement of which this prospectus is a part remains effective, by or for the account of the selling stockholders. After the date

of effectiveness of such registration statement, the selling stockholders may have sold or transferred, in transactions covered

by this prospectus or in transactions exempt from the registration requirements of the Securities Act, some or all of their Common

Stock.

Information

about the selling stockholders may change over time. Any changed information will be set forth in an amendment to the registration

statement or supplement to this prospectus, to the extent required by law.

|

|

|

Shares owned prior to the closing

|

|

Number of Shares of

|

|

|

Shares of Common Stock to Be

Beneficially Owned Upon

|

|

Selling Stockholder

|

|

of the Offer

|

|

Common Stock Being

|

|

|

Completion of this Offering

|

|

|

|

Number

|

|

|

%(1)

|

|

Offered

|

|

|

Number

|

|

|

%

|

|

Gakasa Holding, LLC

|

|

|

1,316,364

|

(2)

|

|

5

|

%

|

|

1,316,364

|

|

|

|

-

|

|

|

-

|

|

Unilab LP

|

|

|

476,004

|

(3)

|

|

2

|

%

|

|

476,004

|

|

|

|

-

|

|

|

-

|

|

Jamie Sulley

|

|

|

28,923

|

(4)

|

|

*

|

|

|

28,923

|

|

|

|

-

|

|

|

-

|

|

Joanne Barsa

|

|

|

1,348

|

(5)

|

|

*

|

|

|

1,348

|

|

|

|

-

|

|

|

-

|

|

John P. Brancaccio

|

|

|

2,158

|

(6)

|

|

*

|

|

|

2,158

|

|

|

|

-

|

|

|

-

|

|

Paul M. Weiss

|

|

|

2,158

|

(7)

|

|

*

|

|

|

2,158

|

|

|

|

-

|

|

|

-

|

|

Francis Patrick Ostronic

|

|

|

4,636

|

(8)

|

|

*

|

|

|

4,636

|

|

|

|

-

|

|

|

-

|

|

Matthias Bohn

|

|

|

6,439

|

(9)

|

|

*

|

|

|

6,439

|

|

|

|

-

|

|

|

-

|

|

Global Restructuring Advisors GmbH

|

|

|

51,513

|

(10)

|

|

*

|

|

|

51,513

|

|

|

|

-

|

|

|

-

|

|

Emerance Gummels

|

|

|

3,226

|

(11)

|

|

*

|

|

|

3,226

|

|

|

|

-

|

|

|

-

|

|

Midor Investments

|

|

|

165,515

|

(12)

|

|

*

|

|

|

165,515

|

|

|

|

-

|

|

|

-

|

|

Fragrant Partners

|

|

|

457,991

|

(13)

|

|

2

|

%

|

|

457,991

|

|

|

|

-

|

|

|

-

|

|

Rubin Children Trust

|

|

|

55,049

|

(14)

|

|

*

|

|

|

55,049

|

|

|

|

-

|

|

|

-

|

|

Revach Fund LP

|

|

|

114,042

|

(15)

|

|

*

|

|

|

114,042

|

|

|

|

-

|

|

|

-

|

|

Chaim Davis

|

|

|

35,788

|

(16)

|

|

*

|

|

|

35,788

|

|

|

|

-

|

|

|

-

|

|

W-Net Fund I, LP

|

|

|

195,992

|

(17)

|

|

*

|

|

|

195,992

|

|

|

|

-

|

|

|

-

|

|

Eric Stoppenhagen

|

|

|

88,891

|

(18)

|

|

*

|

|

|

88,891

|

|

|

|

-

|

|

|

-

|

|

Artic Investments LLC

|

|

|

55,023

|

(19)

|

|

*

|

|

|

55,023

|

|

|

|

-

|

|

|

-

|

|

Fridator Trust No. 4

|

|

|

47,892

|

(20)

|

|

*

|

|

|

47,892

|

|

|

|

-

|

|

|

-

|

|

Stephen and Suzanne Loughrey

|

|

|

100,574

|

(21)

|

|

*

|

|

|

100,574

|

|

|

|

-

|

|

|

-

|

|

Boris Ratiner

|

|

|

14,110

|

(22)

|

|

*

|

|

|

14,110

|

|

|

|

-

|

|

|

-

|

|

Mark H. Jay

|

|

|

18,540

|

(23)

|

|

*

|

|

|

18,540

|

|

|

|

-

|

|

|

-

|

|

Douglas Keller

|

|

|

3,785

|

(24)

|

|

*

|

|

|

3,785

|

|

|

|

-

|

|

|

-

|

|

Richard Patry

|

|

|

9,659

|

(25)

|

|

*

|

|

|

9,659

|

|

|

|

-

|

|

|

-

|

|

Oliver Gödje

|

|

|

2,256

|

(26)

|

|

*

|

|

|

2,256

|

|

|

|

-

|

|

|

-

|

|

Arc Group Ventures LLC

|

|

|

23,445

|

(27)

|

|

*

|

|

|

23,445

|

|

|

|

-

|

|

|

-

|

|

NewCo. Limited

|

|

|

53,918

|

(28)

|

|

*

|

|

|

53,918

|

|

|

|

-

|

|

|

-

|

|

Douglas and Lori Keller

|

|

|

34

|

(29)

|

|

*

|

|

|

34

|

|

|

|

-

|

|

|

-

|

|

Lori Stern

|

|

|

443

|

(30)

|

|

*

|

|

|

443

|

|

|

|

-

|

|

|

-

|

|

Joseph A. Stewart

|

|

|

664

|

(31)

|

|

*

|

|

|

664

|

|

|

|

-

|

|

|

-

|

|

Gary Padykula

|

|

|

829

|

(32)

|

|

*

|

|

|

829

|

|

|

|

-

|

|

|

-

|

|

Judith A. Soniat

|

|

|

3

|

(33)

|

|

*

|

|

|

3

|

|

|

|

-

|

|

|

-

|

|

Albert T. Barlow & Marie C. Barlow

|

|

|

773

|

(34)

|

|

*

|

|

|

773

|

|

|

|

-

|

|

|

-

|

|

Curtis Lee McLendon & Elizabeth Ann McLendon

|

|

|

7

|

(35)

|

|

*

|

|

|

7

|

|

|

|

-

|

|

|

-

|

|

Peter Nordin APS

|

|

|

707

|

(36)

|

|

*

|

|

|

707

|

|

|

|

-

|

|

|

-

|

|

Elizabeth Wilson

|

|

|

19

|

(37)

|

|

*

|

|

|

19

|

|

|

|

-

|

|

|

-

|

|

Natalie R. Suna And Aron Suna JTWROS

|

|

|

11

|

(38)

|

|

*

|

|

|

11

|

|

|

|

-

|

|

|

-

|

|

Claire Louise Suna And Aron Suna JTWROS

|

|

|

11

|

(39)

|

|

*

|

|

|

11

|

|

|

|

-

|

|

|

-

|

|

Aron Suna

|

|

|

7

|

(40)

|

|

*

|

|

|

7

|

|

|

|

-

|

|

|

-

|

|

Marjorie M. Suna

|

|

|

7

|

(41)

|

|

*

|

|

|

7

|

|

|

|

-

|

|

|

-

|

|

Phillip Alexander Suna & Aron Suna JT/WROS

|

|

|

11

|

(42)

|

|

*

|

|

|

11

|

|

|

|

-

|

|

|

-

|

|

James Illing And Roberta Illing JTWROS

|

|

|

22

|

(43)

|

|

*

|

|

|

22

|

|

|

|

-

|

|

|

-

|

|

Molly Karp

|

|

|

286

|

(44)

|

|

*

|

|

|

286

|

|

|

|

-

|

|

|

-

|

|

Stanislaw Mikulski

|

|

|

193

|

(45)

|

|

*

|

|

|

193

|

|

|

|

-

|

|

|

-

|

|

James Francis Cope

|

|

|

1

|

(46)

|

|

*

|

|

|

1

|

|

|

|

-

|

|

|

-

|

|

James O. McCash

|

|

|

284

|

(47)

|

|

*

|

|

|

284

|

|

|

|

-

|

|

|

-

|

|

James Reskin

|

|

|

1

|

(48)

|

|

*

|

|

|

1

|

|

|

|

-

|

|

|

-

|

|

Rhoda Behr Reskin

|

|

|

2

|

(49)

|

|

*

|

|

|

2

|

|

|

|

-

|

|

|

-

|

|

Charles T. Lanktree & Donna B Lanktree

|

|

|

72

|

(50)

|

|

*

|

|

|

72

|

|

|

|

-

|

|

|

-

|

|

Peter J. Marconi

|

|

|

2

|

(51)

|

|

*

|

|

|

2

|

|

|

|

-

|

|

|

-

|

|

McCash Family Limited Partnership

|

|

|

12,718

|

(52)

|

|

*

|

|

|

12,718

|

|

|

|

-

|

|

|

-

|

|

Debra L. McCash

|

|

|

38

|

(53)

|

|

*

|

|

|

38

|

|

|

|

-

|

|

|

-

|

|

Mary M. McCash Trust Declaration Declared October 20 2008

|

|

|

5,961

|

(54)

|

|

*

|

|

|

5,961

|

|

|

|

-

|

|

|

-

|

|

Colleen A. Lowe

|

|

|

5,961

|

(55)

|

|

*

|

|

|

5,961

|

|

|

|

-

|

|

|

-

|

|

David J. McCash

|

|

|

5,961

|

(56)

|

|

*

|

|

|

5,961

|

|

|

|

-

|

|

|

-

|

|

James McCash Revocable Trust of 1997 Restated 2/28/00

|

|

|

8,885

|

(57)

|

|

*

|

|

|

8,885

|

|

|

|

-

|

|

|

-

|

|

Donna M. McCash

|

|

|

2,475

|

(58)

|

|

*

|

|

|

2,475

|

|

|

|

-

|

|

|

-

|

|

The Michael J McCash Living Trust

|

|

|

5,961

|

(59)

|

|

*

|

|

|

5,961

|

|

|

|

-

|

|

|

-

|

|

Corinne M. Poquette

|

|

|

5,961

|

(60)

|

|

*

|

|

|

5,961

|

|

|

|

-

|

|

|

-

|

|

Steven A. Poquette

|

|

|

19

|

(61)

|

|

*

|

|

|

19

|

|

|

|

-

|

|

|

-

|

|

Dennis P. Bowers

|

|

|

3

|

(62)

|

|

*

|

|

|

3

|

|

|

|

-

|

|

|

-

|

|

Michael H. Dickman Or Evelyn A. Dickman

|

|

|

7

|

(63)

|

|

*

|

|

|

7

|

|

|

|

-

|

|

|

-

|

|

Michael H. Dickmann

|

|

|

38

|

(64)

|

|

*

|

|

|

38

|

|

|

|

-

|

|

|

-

|

|

Estate of Ralph V. St. John

|

|

|

162

|

(65)

|

|

*

|

|

|

162

|

|

|

|

-

|

|

|

-

|

|

Margaret Alice McDaniel

|

|

|

38

|

(66)

|

|

*

|

|

|

38

|

|

|

|

-

|

|

|

-

|

|

Troy E Matherne

|

|

|

19

|

(67)

|

|

*

|

|

|

19

|

|

|

|

-

|

|

|

-

|

|

Michael J Pietila & Kathleen Sue Pietila

|

|

|

203

|

(67)

|

|

*

|

|

|

203

|

|

|

|

-

|

|

|

-

|

|

Gary M Padykula & Pamela Padykula

|

|

|

4

|

(67)

|

|

*

|

|

|

4

|

|

|

|

-

|

|

|

-

|

|

Gail Yamner

|

|

|

3

|

(67)

|

|

*

|

|

|

3

|

|

|

|

-

|

|

|

-

|

|

Vera Wu

|

|

|

5

|

(67)

|

|

*

|

|

|

5

|

|

|

|

-

|

|

|

-

|

|

CARL WU CUST MELANIE WU UTMA VA

|

|

|

13

|

(67)

|

|

*

|

|

|

13

|

|

|

|

-

|

|

|

-

|

|

CARL WU CUST ALEXANDER WU UTMA VA

|

|

|

15

|

(67)

|

|

*

|

|

|

15

|

|

|

|

-

|

|

|

-

|

|

Stan M Mikulski

|

|

|

367

|

(67)

|

|

*

|

|

|

367

|

|

|

|

-

|

|

|

-

|

|

RICHARD MICHAEL PATRY CUST RICHARD EDWARD PATRY UTMA CT

|

|

|

58

|

(67)

|

|

*

|

|

|

58

|

|

|

|

-

|

|

|

-

|

|

Eric R Bober & Andrea Z Bober

|

|

|

13

|

(67)

|

|

*

|

|

|

13

|

|

|

|

-

|

|

|

-

|

|

Richard Michael Patry

|

|

|

286

|

(67)

|

|

*

|

|

|

286

|

|

|

|

-

|

|

|

-

|

|

Jerome J Medney

|

|

|

193

|

(67)

|

|

*

|

|

|

193

|

|

|

|

-

|

|

|

-

|

|

Carl Wu

|

|

|

73

|

(67)

|

|

*

|

|

|

73

|

|

|

|

-

|

|

|

-

|

|

FMTC CUSTODIAN - ROTH IRA FBO ALBERT T BARLOW

|

|

|

40

|

(67)

|

|

*

|

|

|

40

|

|

|

|

-

|

|

|

-

|

|

FMTC CUSTODIAN - ROTH IRA FBO MARIE C BARLOW

|

|

|

9

|

(67)

|

|

*

|

|

|

9

|

|

|

|

-

|

|

|

-

|

|

Diane E & Peter M Buccieri Ttee The Buccieri Family Trust U/A 10/11/19 FBO Peter M & Diane M Buccieri

|

|

|

81

|

(67)

|

|

*

|

|

|

81

|

|

|

|

-

|

|

|

-

|

|

Morris Yamner

|

|

|

3

|

(67)

|

|

*

|

|

|

3

|

|

|

|

-

|

|

|

-

|

|

Mark Charles Rosenblum & Ann Patrice Osterdale

|

|

|

243

|

(67)

|

|

*

|

|

|

243

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA ROLLOVER FBO MELBA I OVALLE

|

|

|

14

|

(67)

|

|

*

|

|

|

14

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA FBO BARBARA L TILLY

|

|

|

1

|

(67)

|

|

*

|

|

|

1

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA ROLLOVER FBO TROY E MATHERNE

|

|

|

167

|

(67)

|

|

*

|

|

|

167

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA FBO PETER M BUCCIERI

|

|

|

829

|

(67)

|

|

*

|

|

|

829

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA FBO SAFWAN MAURICE RACHED

|

|

|

117

|

(67)

|

|

*

|

|

|

117

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST SEPP IRA FBO ROBERT E LEE

|

|

|

23

|

(67)

|

|

*

|

|

|

23

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA ROLLOVER FBO LORI STERN

|

|

|

782

|

(67)

|

|

*

|

|

|

782

|

|

|

|

-

|

|

|

-

|

|

FMTC CUSTODIAN - ROTH IRA FBO RICHARD MICHAEL PATRY

|

|

|

71

|

(67)

|

|

*

|

|

|

71

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA ROLLOVER FBO LOUIS MAZZEO

|

|

|

15

|

(67)

|

|

*

|

|

|

15

|

|

|

|

-

|

|

|

-

|

|

FMTC CUSTODIAN - ROTH IRA FBO JOHN ROBERT GOULD

|

|

|

7

|

(67)

|

|

*

|

|

|

7

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA ROLLOVER FBO CHESTER D TILLYNH 03079-3561

|

|

|

6

|

(67)

|

|

*

|

|

|

6

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA FBO MICHELE DIER

|

|

|

38

|

(67)

|

|

*

|

|

|

38

|

|

|

|

-

|

|

|

-

|

|

FMTC CUSTODIAN - ROTH IRA FBO MICHAEL J PIETILA

|

|

|

195

|

(67)

|

|

*

|

|

|

195

|

|

|

|

-

|

|

|

-

|

|

FMTC CUSTODIAN - ROTH IRA FBO KATHLEEN SUE PIETILA

|

|

|

9

|

(67)

|

|

*

|

|

|

9

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA ROLLOVER FBO RICHARD MICHAEL PATRY

|

|

|

2,000

|

(67)

|

|

*

|

|

|

2,000

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA ROLLOVER FBO CHARLES R RICHTER

|

|

|

79

|

(67)

|

|

*

|

|

|

79

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA ROLLOVER FBO MARK CHARLES ROSENBLUM

|

|

|

101

|

(67)

|

|

*

|

|

|

101

|

|

|

|

-

|

|

|

-

|

|

FMT CO CUST IRA FBO BRUCE NELSON PROCTOR

|

|

|

1

|

(67)

|

|

*

|

|

|

1

|

|

|

|

-

|

|

|

-

|

|

FMTC TTEE MCKESSON CORP PSIP FBO CHI H HO

|

|

|

7

|

(67)

|

|

*

|

|

|

7

|

|

|

|

-

|

|

|

-

|

|

Janet Dudek

|

|

|

38

|

(68)

|

|

*

|

|

|

38

|

|

|

|

-

|

|

|

-

|

|

Tamir Biotechnology, Inc.

|

|

|

56

|

(69)

|

|

*

|

|

|

56

|

|

|

|

-

|

|

|

-

|

|

Long Hill Capital V, LLC

|

|

|

1,350,526

|

(70)

|

|

6

|

%

|

|

1,350,526

|

|

|

|

-

|

|

|

-

|

|

Maxim Group LLC

|

|

|

66,910

|

(71)

|

|

*

|

|

|

66,910

|

|

|

|

-

|

|

|

-

|

|

University of Louisville Research Foundation, Inc.

|

|

|

8,526

|

(72)

|

|

*

|

|

|

8,526

|

|

|

|

-

|

|

|

-

|

*Less

than one percent

|

(1)

|

Based

on a denominator equal to the sum of (i) 24,156,183 shares of our Common Stock outstanding

on November 16, 2020 and (ii) the number of shares of our Common Stock issuable upon

exercise or conversion of convertible securities that are currently exercisable or convertible

or are exercisable or convertible within 60 days of November 16, 2020 beneficially owned

by the applicable selling stockholder.

|

|

(2)

|

Fred

Knoll, in his capacity as Manager of Gakasa Holdings, LLC, may be deemed to have investment

discretion and voting power over the shares held by Gakasa Holdings, LLC. The address

of the selling stockholder is 5 East 44th St., Suite 12, New York, NY 10017.

|

|

(3)

|

Unilab

GP, Inc. is the general partner of Unilab LP and each of F. Patrick Ostronic and Katarzyna

Kusmierz are managers of Unilab GP, Inc. Each of Unilab GP, Inc., Mr. Ostronic and Ms.

Kusmierz may be deemed to have investment discretion and voting power over the shares

held by Unilab LP. The address of the selling stockholder is 966 Hungerford Dr Ste 3B,

Rockville, MD, 20850.

|

|

(4)

|

The

address of the selling stockholder is PO Box 1311, Rancho Santa Fe, CA 92067.

|

|

(5)

|

The

address of the selling stockholder is 4920 Sandshore Ct., San Diego, CA 92130.

|

|

(6)

|

The

address of the selling stockholder is 238 Norwich Ct., Madison, NJ 07940.

|

|

(7)

|

The

address of the selling stockholder is 6802 Forest Glade Ct., Middleton, WI 53562.

|

|

(8)

|

The

address of the selling stockholder is 966 Hungerford Dr., Ste 3B, Rockville, MD 20850.

|

|

(9)

|

The

address of the selling stockholder is Wilbrechtstrass E56 A, Munich, Germany 81477.

|

|

(10)

|

Dr.

Oliver Maas, in his capacity as the Managing Director and sole shareholder of Global

Restructuring Advisors GmbH, may be deemed to have investment discretion and voting power

over the shares held by Global Restructuring Advisors GmbH. The address of the selling

stockholder is Brienner Strasse 12, Munich, Germany 80333.

|

|

(11)

|

The

address of the selling stockholder is 2334 SW 24 St, Miami, FL 33145.

|

|

(12)

|

Aryeh

Rubin, in his capacity as President of Midor Investments, may be deemed to have investment

discretion and voting power over the shares held by Midor Investments. The address of

the selling stockholder is 5 East 44th St., Suite 12, New York, NY 10017.

|

|

(13)

|

Aryeh

Rubin, in his capacity as the General Partner of Fragrant Partners, may be deemed to

have investment discretion and voting power over the shares held by Fragrant Partners.

The address of the selling stockholder is 3029 NE 188th Street, Suite 1114,

Aventura, FL 33180.

|

|

(14)

|

Aryeh

Rubin, in his capacity as Trustee of Rubin Children Trust, may be deemed to have investment

discretion and voting power over the shares held by Rubin Children Trust. The address

of the selling stockholder is 3029 NE 188th Street, Suite 1114, Aventura,

FL 33180.

|

|

(15)

|

Chaim

Davis, in his capacity as Managing Member of Revach Fund LP, may be deemed to have investment

discretion and voting power over the shares held by Revach Fund LP. The address of the

selling stockholder is 80 Brainard Road, West Hartford, CT 06117.

|

|

(16)

|

The

address of the selling stockholder is 80 Brainard Road, West Hartford, CT 06117.

|

|

(17)

|

David

Weiner, in his capacity as General Partner of W-Net Fund I, LP, may be deemed to have

investment discretion and voting power over the shares held by W-net Fund I, LP. The

address of the selling stockholder is 12400 Ventura Boulevard #327, Studio City, CA 91604.

|

|

(18)

|

The

address of the selling stockholder is 8908 Splitarrow Dr., Austin, TX 78717.

|

|

(19)

|

Arnold

Giane, in his capacity as Manager of Artic Investments LLC, may be deemed to have investment

discretion and voting power over the shares held by Artic Investments LLC. The address

of the selling stockholder is 10155 Collins Ave, Suite 610, Bal Harbour, FL 33154.

|

|

(20)

|

Tanya

Josefowitz and Pierre Sebaste, in their capacity as Beneficiaries of Fridator Trust No.

4, may be deemed to have investment discretion and voting power over the shares held

by Fridator Trust No. 4. The address of the selling stockholder is 40 Rue de Geneve,

CP 471, 1225 Chene-Bourg, Switzerland.

|

|

(21)

|

The

address of the selling stockholder is 71 Hillside Ave., Short Hills, NJ 07078.

|

|

(22)

|

The

address of the selling stockholder is 18375 Ventura Blvd. #552, Tarzana, CA 91356.

|

|

(23)

|

The

address of the selling stockholder is PO Box E, Short Hills, NJ 07078-0383.

|

|

(24)

|

The

address of the selling stockholder is 49 Ontario Rd., Bellerose Village, NY 11001.

|

|

(25)

|

The

address of the selling stockholder is 22 Crown Street, Milford, CT 06460.

|

|

(26)

|

The

address of the selling stockholder is Ahornweg 1, D-82064 Strasslach, Germany.

|

|

(27)

|

Joseph

Korff, in his capacity as the Principal of Arc Group Ventures LLC, may be deemed to have

investment discretion and voting power over the shares held by Arc Group Ventures LLC.