BioScrip, Inc. (NASDAQ: BIOS) ("BioScrip"), the largest independent

national provider of infusion and home care management solutions,

today announced that key members of BioScrip’s leadership team will

continue in executive roles with the combined company following the

close of its pending merger with Option Care Enterprises, Inc.

(“Option Care”).

Dan Greenleaf, President and Chief Executive

Officer of BioScrip, will become Special Advisor to the newly

combined company’s Board Chairman, Harry Kraemer, and Chief

Executive Officer, John Rademacher. Mr. Greenleaf will

provide strategic and operational counsel to ensure a smooth

transition, optimize the integration of both companies, and drive

long-term growth opportunities.

In addition, other members of BioScrip’s

existing senior leadership team will continue with the combined

company in key executive roles following the merger close,

including:

- Harriet Booker, who will continue as Chief Operating

Officer;

- Rich Denness, who will become Chief Strategy Officer;

- John McMahon, who will become SVP Corporate Finance;

- Bob Roose, who will continue as SVP, Procurement; and

- Arcot Prakash, who will become VP Information Technology.

Dan Greenleaf, President and Chief Executive

Officer of BioScrip, commented, “I am really pleased to have the

opportunity to support both Harry and John to drive value in the

newly combined company, and I am equally excited to see that the

new company’s leadership team will have a strong representation

from BioScrip, which has performed exceptionally well through the

first five months of 2019. Speaking of performance, as

reported in our first quarter earnings release, BioScrip achieved

strong gross revenue growth and we expect this to continue in the

second quarter of 2019. Moreover, our daily cash collection

rates continue to improve as we focus on improving the fundamentals

of the business. Our pending combination with Option Care will

provide an incredible platform to accelerate growth for BioScrip,

as the newly combined company will have a significantly improved

capital structure and a market leader position in the attractive

home infusion therapy services industry with unmatched scale, scope

and talent.”

About BioScrip, Inc.

BioScrip, Inc. is the largest independent

national provider of infusion and home care management solutions,

with approximately 2,100 teammates and nearly 70 service locations

across the U.S. BioScrip partners with physicians, hospital

systems, payors, pharmaceutical manufacturers and skilled nursing

facilities to provide patients access to post-acute care services.

BioScrip operates with a commitment to bring customer-focused

pharmacy and related healthcare infusion therapy services into the

home or alternate-site setting. By collaborating with the full

spectrum of healthcare professionals and the patient, BioScrip

provides cost-effective care that is driven by clinical excellence,

customer service, and values that promote positive outcomes and an

enhanced quality of life for those it serves.

FORWARD LOOKING STATEMENTS

This communication, in addition to historical

information, contains “forward-looking statements” (as defined in

the Private Securities Litigation Reform Act of 1995) regarding,

among other things, future events or the future financial

performance of BioScrip and Option Care. All statements other than

statements of historical facts are forward-looking statements. In

addition, words such as “anticipate,” “believe,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” or the negative of these words, and words and

terms of similar substance used in connection with any discussion

of future plans, actions or events identify forward-looking

statements. Forward-looking statements relating to the proposed

transaction include, but are not limited to: statements about the

benefits of the proposed transaction between BioScrip and Option

Care, including future financial and operating results; expected

synergies; BioScrip’s and Option Cares plans, objectives,

expectations and intentions; the expected timing of completion of

the proposed transaction; and other statements relating to the

acquisition that are not historical facts. Forward-looking

statements are based on information currently available to BioScrip

and Option Care and involve estimates, expectations and

projections. Investors are cautioned that all such forward-looking

statements are subject to risks and uncertainties (both known and

unknown), and many factors could cause actual events or results to

differ materially from those indicated by such forward-looking

statements. With respect to the proposed transaction between

BioScrip and Option Care, these factors could include, but are not

limited to: the risk that BioScrip or Option Care may be unable to

obtain governmental and regulatory approvals required for the

transaction, or that required governmental and regulatory approvals

may delay the transaction or result in the imposition of conditions

that could reduce the anticipated benefits from the proposed

transaction or cause the parties to abandon the proposed

transaction; the risk that a condition to closing of the

transaction may not be satisfied; the length of time necessary to

consummate the proposed transaction, which may be longer than

anticipated for various reasons; the risk that the businesses will

not be integrated successfully; the risk that the cost savings,

synergies and growth from the proposed transaction may not be fully

realized or may take longer to realize than expected; the diversion

of management time on transaction-related issues; the effect of

future regulatory or legislative actions on the companies or the

industries in which they operate; the risk that the credit ratings

of the combined company or its subsidiaries may be different from

what the companies expect; economic and foreign exchange rate

volatility; and the other risks contained in BioScrip’s most

recently filed Annual Report on Form 10-K.

Many of these risks, uncertainties and

assumptions are beyond BioScrip’s ability to control or predict.

Because of these risks, uncertainties and assumptions, you should

not place undue reliance on these forward-looking statements.

Furthermore, forward-looking statements speak only as of the

information currently available to the parties on the date they are

made, and neither BioScrip nor Option Care undertakes any

obligation to update publicly or revise any forward-looking

statements to reflect events or circumstances that may arise after

the date of this communication. Nothing in this communication is

intended, or is to be construed, as a profit forecast or to be

interpreted to mean that earnings per BioScrip share for the

current or any future financial years or those of the combined

company, will necessarily match or exceed the historical published

earnings per BioScrip share, as applicable. Neither BioScrip nor

Option Care gives any assurance (1) that either BioScrip or Option

Care will achieve its expectations, or (2) concerning any result or

the timing thereof, in each case, with respect to any regulatory

action, administrative proceedings, government investigations,

litigation, warning letters, consent decrees, cost reductions,

business strategies, earnings or revenue trends or future financial

results. All subsequent written and oral forward-looking statements

concerning BioScrip, Option Care, the proposed transaction, the

combined company or other matters and attributable to BioScrip or

Option Care or any person acting on their behalf are expressly

qualified in their entirety by the cautionary statements above.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

On April 30, 2019, BioScrip, Inc. (“BioScrip” or

the “Company”) filed with the Securities and Exchange Commission

(“SEC”) a preliminary proxy statement and on June 6, 2019 filed a

revised preliminary proxy statement (collectively, the “preliminary

proxy statement”) in connection with the proposed transaction. The

definitive proxy statement will be sent to the stockholders of

BioScrip and will contain important information about the proposed

transaction and related matters. INVESTORS AND SECURITY

HOLDERS ARE URGED AND ADVISED TO READ THE PRELIMINARY PROXY

STATEMENT AND THE DEFINITIVE PROXY STATEMENT WHEN IT BECOMES

AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. The

proxy statement and other relevant materials (when they become

available) and any other documents filed by the Company with the

SEC may be obtained free of charge at the SEC’s website, at

www.sec.gov. In addition, security holders will be able to

obtain free copies of the proxy statement and other relevant

materials from the Company by contacting Investor Relations by mail

at 1600 Broadway, Suite 700, Denver, CO 80202, Attn: Investor

Relations, by telephone at (720) 697-5200, or by going to the

Company’s Investor Relations page on its corporate web site at

https://investors.bioscrip.com.

PARTICIPANTS IN THE SOLICITATION

The Company and its directors and executive

officers may be deemed to be participants in the solicitation of

proxies from stockholders in connection with the matters discussed

above. Information about the Company’s directors and executive

officers is set forth in the Proxy Statement on Schedule 14A for

the Company’s 2019 annual meeting of stockholders, which was filed

with the SEC on April 30, 2019. This document can be obtained

free of charge from the sources indicated above. Information

regarding the ownership of the Company’s directors and executive

officers in the Company’s securities is included in the Company’s

SEC filings on Forms 3, 4, and 5, which can be found through the

SEC’s website at www.sec.gov. Other information regarding the

participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise,

is contained in the preliminary proxy statement and will be

contained in the definitive proxy statement and other relevant

materials to be filed with the SEC when they become available.

Investor Contacts:

| Stephen

Deitsch Chief Financial Officer & TreasurerT: (720)

697-5200 stephen.deitsch@bioscrip.com

|

|

Kalle Ahl,

CFAThe Equity GroupT: (212) 836-9614kahl@equityny.com |

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

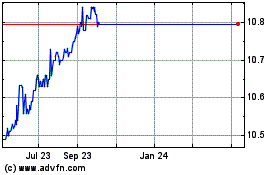

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024