Oncolytics Biotech Inc. (“Oncolytics”

or the “Corporation”) has entered into an equity distribution agreement dated March 4, 2021 (the “Equity

Distribution Agreement”) with Canaccord Genuity LLC (the “Agent”) relating to our common shares (“Common

Shares”) pursuant to which we may offer and sell Common Shares having an aggregate offering price of up to US$80,000,000.

This Prospectus Supplement qualifies for distribution an aggregate of up to US$80,000,000 of our Common Shares that may be offered

and sold through the Agent, as our agent, under the Equity Distribution Agreement (the “Offering”). See “Plan

of Distribution” beginning on page S-19 of this Prospectus Supplement for more information regarding these arrangements.

Upon delivery of a placement notice by

us, if any, the Agent may sell the Common Shares in the United States only and such sales will only be made by transactions that

may be considered to be “at-the-market distributions” as defined in National Instrument 44-102 – Shelf Distributions

(“NI 44-102”), including, without limitation, sales made directly on NASDAQ, or on any other existing trading

market for the Common Shares in the United States. No Common Shares will be sold on the TSX or on other trading markets in Canada

as at-the-market distributions. The Agent will make all sales using commercially reasonable efforts consistent with their normal

sales and trading practices and on mutually agreed upon terms between the Agent and us. The Common Shares will be distributed at

the market prices prevailing at the time of the sale of such Common Shares. As a result, prices may vary as between purchasers

and during the period of distribution. There is no arrangement for funds to be received in escrow, trust or similar arrangement.

The compensation to the Agent for sales

of our Common Shares under this Prospectus Supplement will not exceed three percent (3%) of the gross proceeds from the sale of

such Common Shares. See “Plan of Distribution” in this Prospectus Supplement.

The net proceeds, if any, from sales under

this Prospectus Supplement will be used as described under the section titled “Use of Proceeds” in this Prospectus

Supplement. The proceeds we receive from sales will depend on the number of Common Shares actually sold and the offering price

of such Common Shares. We estimate the total expenses of this Offering, excluding the Agent’s fee, will be approximately

US$200,000.

In connection with the sale of the Common

Shares on our behalf, the Agent will be deemed to be an “underwriter” within the meaning of Section 2(a)(11) of the

U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), and the compensation of the Agent

will be deemed to be an underwriting commission or discount. We have agreed to provide indemnification and contribution to the

Agent against certain liabilities, including liabilities under the U.S. Securities Act.

The financial information of the Corporation

incorporated by reference in the Prospectus is presented in Canadian dollars. Unless otherwise noted herein, all references to

“US$”, “United States dollars” or “US dollars” are to United States dollars and all references

to “C$” are to Canadian dollars. See “Currency and Exchange Rate Information”.

Our head office and principal place of

business is located at 210, 1167 Kensington Crescent N.W., Calgary, Alberta, T2N 1X7. Our registered office is located at 4000,

421 - 7th Avenue S.W., Calgary, Alberta, T2P 4K9.

Base

Shelf Prospectus dated June 12, 2020

IMPORTANT NOTICE

ABOUT INFORMATION IN THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first

part is this Prospectus Supplement, which describes the specific terms of the Offering and Common Shares and the method of distribution

of the Common Shares and also supplements and updates information regarding Oncolytics Biotech Inc. contained and incorporated

by reference in the Prospectus. The second part is the accompanying Prospectus, which gives more general information, some of which

may not apply to the Common Shares. Both documents contain important information you should consider when making your investment

decision. If the description of the Common Shares varies between this Prospectus Supplement and the accompanying Prospectus, investors

should rely on the information in this Prospectus Supplement. This Prospectus Supplement is deemed to be incorporated by reference

into the Prospectus solely for the purpose of the Offering. If information in this Prospectus Supplement is inconsistent with the

Prospectus or the information incorporated by reference in the Prospectus, you should rely on this Prospectus Supplement. You should

read both this Prospectus Supplement and the accompanying Prospectus, together with the additional information about us to which

we refer you in the section of this Prospectus Supplement entitled “Where You Can Find Additional Information.”

You should rely only on the information

contained in this Prospectus Supplement, the Prospectus and the documents incorporated by reference in the Prospectus. Neither

the Corporation nor the Agent have authorized anyone to provide you with different information. If anyone provides you with any

different or inconsistent information, you should not rely on it. The Corporation is offering the Common Shares only in jurisdictions

where such offers are permitted by law.

You should assume that the information

contained in this Prospectus Supplement, the Prospectus and the documents incorporated by reference in the Prospectus is accurate

only as of their respective dates, regardless of the time of delivery of this Prospectus Supplement and the accompanying Prospectus.

Our business, financial condition, results of operations and prospects may have changed since those dates.

Market data and certain industry forecasts

used in this Prospectus Supplement, the Prospectus and the documents incorporated by reference in the Prospectus were obtained

from market research, publicly available information and industry publications. We believe that these sources are generally reliable,

but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and

we do not make any representation as to the accuracy of such information.

In this Prospectus Supplement, “Oncolytics,”

the “Corporation,” “we,” “us,” and “our” refer to Oncolytics

Biotech Inc. and its subsidiaries.

FORWARD-LOOKING STATEMENTS

This Prospectus Supplement, the Prospectus

and the documents incorporated by reference in the Prospectus contain certain statements relating to future events or the Corporation’s

future performance which constitute forward-looking statements. Such forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation, or industry

results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking

statements. Forward-looking statements are statements that are not historical facts, and include, but are not limited to, estimates

and their underlying assumptions; statements regarding plans, objectives and expectations with respect to the efficacy of our technologies;

the timing and results of clinical studies related to our technologies; future operations, products and services; the impact of

regulatory initiatives on our operations; the size of and opportunities related to the markets for our technologies; general industry

and macroeconomic growth rates; expectations related to possible joint and/or strategic ventures and statements regarding future

performance. Forward-looking statements generally, but not always, are identified by the words “expects,” “anticipates,”

“believes,” “intends,” “estimates,” “projects”, “potential”, “possible”

and similar expressions, or that events or conditions “will,” “may,” “could” or “should”

occur.

The forward-looking statements in this

Prospectus Supplement, the Prospectus and the documents incorporated by reference in the Prospectus are subject to various risks

and uncertainties, most of which are difficult to predict and generally beyond the Corporation’s control. The summary of

risk factors below is not exhaustive of the factors that may affect any of the Corporation’s forward-looking statements.

Some of the important risks and uncertainties that could affect forward-looking statements are described further under the heading

“Risk Factors” in this Prospectus Supplement, in the Prospectus and in the Corporation’s Annual Report (as defined

below). If one or more of these risks or uncertainties materializes, or if underlying assumptions prove incorrect, our actual results

may vary materially from those expected, estimated or projected. Forward-looking statements in this document are not a prediction

of future events or circumstances, and those future events or circumstances may not occur. Given these uncertainties, users of

the information included herein, including investors and prospective investors, are cautioned not to place undue reliance on such

forward-looking statements. Investors should consult our quarterly and annual filings with the securities commissions or similar

regulatory authorities in Canada and the SEC for additional information on risks and uncertainties relating to forward-looking

statements.

|

|

·

|

risks related to all of our products, including pelareorep, being in the research and development

stage and requiring further development and testing before they can be marketed commercially;

|

|

|

·

|

risks inherent in pharmaceutical research and development;

|

|

|

·

|

risks related to timing and possible delays in our clinical trials;

|

|

|

·

|

risks related to our ability to develop our products for use in combination with third-party drugs,

including immune checkpoint inhibitors;

|

|

|

·

|

uncertainties regarding our estimated market opportunities;

|

|

|

·

|

risks related to our operations being adversely impacted by the COVID-19 pandemic;

|

|

|

·

|

risks related to toxicity, undesirable side effects and adverse safety events;

|

|

|

·

|

risks related to our lack of operating revenues and history of losses;

|

|

|

·

|

risks related to our ability to obtain additional financing to fund future research and development

of our products and to meet ongoing capital requirements;

|

|

|

·

|

risks related to expenses in foreign currencies and our exposure to foreign currency exchange rate

fluctuations;

|

|

|

·

|

risks related to our pharmaceutical products being subject to intense regulatory approval processes

in the United States and other foreign jurisdictions;

|

|

|

·

|

risks related to being subject to government manufacturing and testing regulations;

|

|

|

·

|

risks related to some of our clinical trials being conducted in countries outside of the United

States;

|

|

|

·

|

risks related to our reliance on patents and proprietary rights to protect our technology;

|

|

|

·

|

risks related to development in patent law;

|

|

|

·

|

risks related to the extremely competitive biotechnology industry and if our competitors develop

and market products that are more effective, our business could be adversely impacted;

|

|

|

·

|

risks related to potential products liability claims;

|

|

|

·

|

risks related to future legal proceedings and any finding of liability or damages;

|

|

|

·

|

risks related to our new products not being accepted by the medical community or consumers;

|

|

|

·

|

risks related to our technologies becoming obsolete;

|

|

|

·

|

risks related to our dependence on third-party relationships for research, clinical trials, manufacturing,

raw materials and other third-party arrangements;

|

|

|

·

|

risks related to our license, development, supply and distribution agreement with Adlai Nortye

Biopharma Co. Ltd.;

|

|

|

·

|

risks related to negative developments in the field of immuno-oncology;

|

|

|

·

|

risks related to potential increases in the cost of director and officer liability insurance;

|

|

|

·

|

risks related to our dependence on key employees and collaborators;

|

|

|

·

|

risks related to Barbados law, including those relating to the enforcement of judgments obtained

in Canada or the United States;

|

|

|

·

|

risks related to the effect of changes in the law on our corporate structure;

|

|

|

·

|

risks related to data privacy laws;

|

|

|

·

|

risks related to our information technology systems and security breaches;

|

|

|

·

|

risks related to our compliance with the Sarbanes-Oxley Act of 2002, as amended;

|

|

|

·

|

U.S. civil liabilities may not be enforceable against us or certain of our directors or officers;

|

|

|

·

|

risks related to our status as a foreign private issuer;

|

|

|

·

|

risk related to possible “passive foreign investment company” status; and

|

|

|

·

|

risks related to our Common Shares, such as volatility of market price, potential dilution and

no cash dividend in the foreseeable future.

|

The Corporation cautions that the foregoing

list of factors that may affect future results is not exhaustive. The forward-looking information contained in this Prospectus

Supplement, the Prospectus and the documents incorporated by reference in the Prospectus is made as of the date of such documents.

The forward-looking information contained in this Prospectus Supplement, the Prospectus and in the documents incorporated by reference

in the Prospectus is expressly qualified by this cautionary statement. The Corporation does not undertake any obligation to publicly

update or revise any forward-looking information except as required pursuant to applicable securities laws.

DOCUMENTS INCORPORATED

BY REFERENCE

This Prospectus Supplement is deemed

to be incorporated by reference into the Prospectus solely for the purposes of the Offering.

Information has been incorporated by

reference in the Prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the

documents incorporated herein by reference may be obtained on request without charge from our Corporate Secretary at 210, 1167

Kensington Crescent N.W., Calgary, Alberta, T2N 1X7 telephone (403) 670-7377, and are available electronically under the Corporation’s

profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov/edgar.shtml).

The following documents, filed with the

securities commissions or similar regulatory authorities in each of the provinces of Canada and filed with, or furnished to, the

SEC are specifically incorporated by reference into, and form an integral part of, the Prospectus:

|

|

·

|

our annual report on Form 20-F (“Annual Report”) dated March 5, 2021, for the

year ended December 31, 2020 (filed in Canada with certain Canadian securities regulatory authorities as our annual information

form for the year ended December 31, 2020);

|

|

|

·

|

our audited consolidated financial statements, together with the notes thereto, as at December

31, 2020 and 2019, which comprise the consolidated statements of financial position as at December 31, 2020 and 2019, and the consolidated

statements of loss and comprehensive loss, changes in equity, and cash flows for the years ended December 31, 2020, 2019 and 2018,

together with the independent auditors’ report thereon; and

|

Any documents of the type required by National

Instrument 44-101 - Short Form Prospectus Distributions to be incorporated by reference in a short form Prospectus, including

any annual information form, annual report on Form 20-F, comparative annual consolidated financial statements and the auditors’

report thereon, comparative interim consolidated financial statements, management’s discussion and analysis of financial

condition and results of operations, material change report (except a confidential material change report), business acquisition

report and information circular, if filed by us with the securities commissions or similar authorities in Canada after the date

of this Prospectus Supplement and prior to the date on which the Offering under this Prospectus Supplement ends, shall be deemed

to be incorporated by reference in the Prospectus.

In addition, to the extent that any document

or information incorporated by reference in the Prospectus is included in any report filed with or furnished to the SEC pursuant

to the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), after the date of

this Prospectus Supplement and prior to the date on which the Offering under this Prospectus Supplement ends, such document or

information shall be deemed to be incorporated by reference as an exhibit to the registration statement of which this Prospectus

Supplement and the Prospectus forms a part (in the case of documents or information deemed furnished on Form 6-K or Form 8-K, only

to the extent specifically stated therein).

Any statement contained in this Prospectus

Supplement, the Prospectus or in a document incorporated or deemed to be incorporated by reference in the Prospectus shall be deemed

to be modified or superseded for the purposes of this Prospectus Supplement and the Prospectus to the extent that a statement contained

herein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference in the Prospectus

or therein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or

superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making

of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement,

when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that

was required to be stated or that was necessary to make a statement not misleading in light of the circumstances in which it was

made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of

this Prospectus Supplement or the Prospectus.

DOCUMENTS FILED AS

PART OF THE REGISTRATION STATEMENT

The following documents have been or will

be filed with the SEC as part of the registration statement of which this Prospectus Supplement and the Prospectus forms a part:

(i) the documents set out under the heading “Documents Incorporated by Reference” in this Prospectus Supplement

and the Prospectus; (ii) the consents of the Corporation’s auditor; (iii) the powers of attorney from the directors and certain

officers of the Corporation and (iv) the Equity Distribution Agreement described in this Prospectus Supplement.

CURRENCY AND EXCHANGE

RATE INFORMATION

In this Prospectus Supplement and the accompanying

Prospectus, unless otherwise indicated, all dollar amounts and references to “US$” are to U.S. dollars and references

to “C$” are to Canadian dollars. This Prospectus Supplement and the accompanying Prospectus and the documents incorporated

by reference in the Prospectus contain translations of some Canadian dollar amounts into U.S. dollars solely for your convenience.

The following table sets forth, for the periods indicated, the

high, low, average and period-end rates of exchange for US$1.00, expressed in Canadian dollars, posted by the Bank of Canada:

|

|

|

|

Year Ended December 31(1)

|

|

|

|

|

|

2020

|

|

|

|

2019

|

|

|

|

2018

|

|

|

Highest rate during the period

|

|

|

C$1.4496

|

|

|

|

C$1.3600

|

|

|

|

C$1.3642

|

|

|

Lowest rate during the period

|

|

|

C$1.2718

|

|

|

|

C$1.2988

|

|

|

|

C$1.2288

|

|

|

Average rate for the period

|

|

|

C$1.3415

|

|

|

|

C$1.3269

|

|

|

|

C$1.2957

|

|

|

Rate at the end of the period

|

|

|

C$1.2732

|

|

|

|

C$1.2988

|

|

|

|

C$1.3642

|

|

Note:

|

(1)

|

Data from the Bank of Canada reflects the daily average

rates.

|

On March 4, 2021, the daily average exchange

rate posted by the Bank of Canada for conversion of U.S. dollars into Canadian dollars was US$1.00 = C$1.2637. Unless otherwise

indicated, currency translation in this Prospectus Supplement reflect the March 4, 2021 rate.

OFFERING SUMMARY

|

Issuer:

|

|

Oncolytics Biotech Inc.

|

|

|

|

|

|

Offering:

|

|

In accordance with the Equity Distribution Agreement, we may offer and sell our Common Shares through the Agent, as agent, up to an aggregate offering amount of US$80,000,000. Common Shares having an aggregate Offering amount of up to US$80,000,000 are being offered under this Prospectus Supplement.

|

|

|

|

|

|

Manner of Offering:

|

|

“At-the-market” offering that may be made from time to time through our sales agent, the Agent. See “Plan of Distribution” on page S- 19.

|

|

|

|

|

|

Common Shares Outstanding Before this Offering:

|

|

52,083,924 Common Shares (non-diluted)

|

|

|

|

|

|

Common Shares Outstanding Immediately Following this Offering:

|

|

78,313,432 Common Shares (non-diluted) after the issuance of up to 26,229,508 Common Shares, assuming an aggregate of US$80,000,000 of our Common Shares are issued pursuant to the Offering at a sales price of US$3.05 per Common Share(1). The actual number of Common Shares issued and outstanding will vary depending on the actual sales prices and aggregate dollar amount sold under the Offering.

|

|

|

|

|

|

Use of Proceeds:

|

|

We intend to use the net proceeds from the Offering, if any, for the advancement of the Corporation’s clinical development program, related support costs and general corporate and administrative expenses. The amounts actually expended for the purposes described above may vary significantly depending upon a number of factors, including those listed under the heading “Risk Factors” in this Prospectus Supplement. See “Use of Proceeds”.

|

|

|

|

|

|

Listing Symbols:

|

|

NASDAQ: ONCY

|

|

|

|

|

|

|

|

TSX: ONC

|

|

|

|

|

|

Risk Factors:

|

|

This investment involves a high degree of risk. You should carefully read and consider the information set forth under the heading “Risk Factors” beginning on page S-10 of this Prospectus Supplement and on page 6 of the Prospectus.

|

Note:

|

|

(1)

|

Unless otherwise stated, all information contained in this Prospectus Supplement reflects an assumed

public offering price of US$3.05 per Common Share, which was the last reported sale price of our Common Shares on the NASDAQ on

March 4, 2021.

|

RISK FACTORS

Prospective purchasers of Common Shares

should consider carefully the risk factors set out in this Prospectus Supplement, the Prospectus and the documents incorporated

by reference in the Prospectus. Discussions of certain risks affecting Oncolytics in connection with its business are set forth

under “Risk Factors” in the Prospectus and in our annual disclosure documents filed with the various securities

regulatory authorities which are incorporated by reference in the Prospectus.

Volatility of market price of the Common

Shares

The market price of the Common Shares may

be volatile. The volatility may affect the ability of holders of Common Shares to sell the Common Shares at an advantageous price.

Market price fluctuations in the Common Shares may be due to the Corporation’s operating results failing to meet the expectations

of securities analysts or investors in any quarter, downward revision in securities analysts’ estimates, governmental regulatory

action, adverse change in general market conditions or economic trends, acquisitions, dispositions or other material public announcements

by the Corporation or its competitors, along with a variety of additional factors, including, without limitation, those set forth

under “Forward-Looking Statements” in this Prospectus Supplement. In addition, the market price for securities

in the stock markets, including the NASDAQ and the TSX, recently experienced significant price and trading fluctuations. These

fluctuations have resulted in volatility in the market prices of securities that often has been unrelated or disproportionate to

changes in operating performance. These broad market fluctuations may adversely affect the market price of the Common Shares.

The Corporation will have broad discretion

over the use of the net proceeds from the Offering and the Corporation may not use these proceeds in a manner desired by the Corporation’s

shareholders

Management will have broad discretion with

respect to the use of the net proceeds from the Offering and investors will be relying on the judgment of management regarding

the application of these proceeds. Management could spend most of the net proceeds from the Offering in ways that the Corporation’s

shareholders may not desire or that do not yield a favorable return. You will not have the opportunity, as part of your investment

in the Common Shares, to influence the manner in which the net proceeds of the Offering are used. At the date of this Prospectus

Supplement, the Corporation intend to use the net proceeds from the Offering as described under the heading “Use of Proceeds”.

However, the Corporation’s needs may change as the business and the industry the Corporation addresses evolve. As a result,

the proceeds to be received in the Offering may be used in a manner significantly different from the Corporation’s current

expectations.

The Common Shares offered hereby will

be sold in “at-the-market” offerings, and investors who buy Common Shares at different times will likely pay different

prices

Investors who purchase Common Shares in

this Offering at different times will likely pay different prices, and so may experience different outcomes in their investment

results. The Corporation will have discretion, subject to market demand, to vary the timing, prices, and numbers of Common Shares

sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their Common Shares as

a result of share sales made at prices lower than the prices they paid.

The Corporation does not currently intend

to pay any cash dividends on the Common Shares; therefore, the Corporation’s shareholders may not be able to receive a return

on their Common Shares until they sell them

The Corporation has not declared or paid

any dividends since its incorporation. The Corporation currently intends to retain earnings, if any, to finance the growth and

development of its business and does not currently intend to pay cash dividends on the Common Shares in the foreseeable future.

Any return on an investment in the Common Shares will likely come from the appreciation, if any, in the value of the Common Shares.

The payment of future cash dividends, if any, will be reviewed periodically by our board of directors and will depend upon, among

other things, conditions then existing including earnings, financial condition and capital requirements, restrictions in financing

agreements, business opportunities and conditions and other factors.

You may be unable to enforce actions

against us, certain of our directors and officers, or the experts named in this Prospectus Supplement under U.S. federal securities

laws.

We are a company continued under the laws

of the Province of Alberta, Canada. Most of our directors and officers as well as the certain of the experts named in this Prospectus

Supplement and the accompanying Prospectus, reside principally in Canada. Because all or a substantial portion of our assets and

the assets of these persons are located outside of the United States, it may not be possible for you to effect service of process

within the United States upon us or those persons. Furthermore, it may not be possible for you to enforce against us or those persons

in the United States, judgments obtained in U.S. courts based upon the civil liability provisions of the U.S. federal securities

laws or other laws of the United States. There is doubt as to the enforceability, in original actions in Canadian courts, of liabilities

based upon U.S. federal securities laws and as to the enforceability in Canadian courts of judgments of U.S. courts obtained in

actions based upon the civil liability provisions of the U.S. federal securities laws. Therefore, it may not be possible to enforce

those actions against us, certain of our directors and officers or certain of the experts named in this Prospectus Supplement.

The Corporation is likely a “passive

foreign investment company” which may have adverse U.S. federal income tax consequences for U.S. shareholders

U.S. holders of Common Shares should be

aware that the Corporation believes it was classified as a passive foreign investment company (“PFIC”) during

the tax year ended December 31, 2020, and based on current business plans and financial expectations, the Corporation expects that

it will be a PFIC for the current tax year and may be a PFIC in future tax years. If the Corporation is a PFIC for any year during

a U.S. shareholder’s holding period of the Common Shares, then such U.S. shareholder generally will be required to treat

any gain realized upon a disposition of Common Shares, or any “excess distribution” received on its Common Shares,

as ordinary income, and to pay an interest charge on a portion of such gain or distribution, unless the shareholder makes a timely

and effective “qualified electing fund” election (“QEF Election”) or a “mark-to-market”

election with respect to the Common Shares. A U.S. shareholder who makes a QEF Election generally must report on a current basis

its share of the Corporation’s net capital gain and ordinary earnings for any year in which the Corporation is a PFIC, whether

or not the Corporation distributes any amounts to its shareholders. A U.S. shareholder who makes a mark-to-market election generally

must include as ordinary income each year the excess of the fair market value of the Common Shares over the taxpayer’s adjusted

tax basis therein. This paragraph is qualified in its entirety by the discussion below under the heading “Material United

States Federal Income Tax Considerations.” Each U.S. shareholder should consult its own tax advisors regarding the PFIC

rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of Common Shares.

THE CORPORATION

Oncolytics Biotech Inc. was incorporated

pursuant to the ABCA on April 2, 1998 as 779738 Alberta Ltd. On April 8, 1998, we amended our articles of incorporation

(the “Articles”) and changed our name to Oncolytics Biotech Inc. On July 29, 1999, we amended our Articles

by removing the private company restrictions included therein and subdivided the 2,222,222 Common Shares issued and outstanding

into 6,750,000 Common Shares. On February 9, 2007, we amended our Articles to permit shareholder meetings to be held at any

place in Alberta or at any other location as determined by our board of directors. On May 22, 2019, we amended our Articles of

Incorporation to effect a consolidation of the Common Shares on the basis of 9.5 pre-consolidation Common Shares for each one post-consolidation

Common Share.

We have two material operating subsidiaries:

Oncolytics Biotech (Barbados) Inc. and Oncolytics Biotech (US) Inc., a Delaware corporation. Oncolytics Biotech (Barbados) Inc.

is incorporated pursuant to the laws of Barbados and is a wholly-owned direct subsidiary of the Corporation. Oncolytics Biotech

(U.S.) Inc. is incorporated pursuant to the laws of Delaware and is a wholly-owned direct subsidiary of Oncolytics Biotech (Barbados)

Inc.

Our head office and principal place of

business is located at 210, 1167 Kensington Crescent N.W., Calgary, Alberta, T2N 1X7. Our registered office is located at

4000, 421 - 7th Avenue S.W., Calgary, Alberta, T2P 4K9.

BUSINESS OF THE CORPORATION

Since our inception in April of 1998, Oncolytics

Biotech Inc. has been a development stage company and we have focused our research and development efforts related to pelareorep,

a systemically administered immuno-oncology viral agent with the potential to treat a variety of cancers. We have not been profitable

since our inception and expect to continue to incur substantial losses as we continue research and development efforts. We

do not expect to generate significant revenues until, if and when, pelareorep becomes commercially viable.

Our potential product for human use, pelareorep,

an unmodified reovirus, is a first in class systemically administered immuno-oncology viral agent for the treatment of solid tumors

and hematological malignancies.

For further information regarding our business,

see our Annual Report and other documents incorporated by reference in this Prospectus Supplement which are available electronically

under the Corporation’s profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov/edgar.shtml).

USE OF PROCEEDS

The net proceeds from the Offering are

not determinable in light of the nature of the distribution. The net proceeds of any given distribution of Common Shares through

the Agent in an “at-the-market distribution” will represent the gross proceeds after deducting the compensation payable

to the Agent under the Equity Distribution Agreement and expenses of the distribution. The Agent will receive a cash fee not exceeding

three percent (3%) of the gross proceeds realized from the sale of our Common Shares for services rendered in connection with the

Offering. We estimate the total expenses of the Offering, excluding the fee paid to the Agent, will be approximately US$250,000.

We intend to use the net proceeds from

the Offering, if any, for the advancement of the Corporation’s clinical development program, related support costs and general

corporate and administrative expenses. General corporate and administrative expenses may include funding ongoing operations and/or

capital requirements, discretionary capital programs and potential future acquisitions. Although, the Corporation intends to expend

the net proceeds from the Offering as set forth above, there may be circumstances where for sound business reasons, a reallocation

of funds may be deemed prudent or necessary, and may vary materially from that set forth above. Pending the uses described above,

we plan to invest the net proceeds from the Offering in short- and intermediate-term, interest bearing obligations, investment-grade

instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

The amounts actually expended for the purposes

described above may vary significantly depending upon a number of factors, including those listed under the heading “Risk

Factors” in this Prospectus Supplement.

CONSOLIDATED CAPITALIZATION

Except for the issuance of Common Shares

of the Corporation as set forth under the heading “Prior Sales” in this Prospectus Supplement, there has not

been any material change in the share and loan capital of the Corporation, on a consolidated basis, since the Corporation’s

most recently filed financial statements for the year ended December 31, 2020.

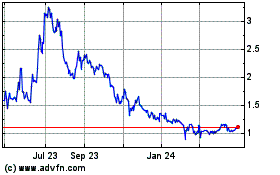

TRADING PRICE AND

VOLUME

The Common Shares are listed and posted

for trading on the TSX under the trading symbol “ONC” and on the NASDAQ under the trading symbol “ONCY”.

On March 4, 2021, the closing bid price of our Common Shares on the NASDAQ was US$3.05 and the closing price of our Common Shares

on the TSX was C$3.91.

The following table sets forth the market

price ranges and the aggregate volume of trading of the Common Shares on the TSX and NASDAQ for the periods indicated:

|

|

|

TSX

|

|

|

NASDAQ

|

|

|

|

|

High

|

|

|

Low

|

|

|

Close

|

|

|

Volume

|

|

|

High

|

|

|

Low

|

|

|

Close

|

|

|

Volume

|

|

|

Period

|

|

(C$)

|

|

|

(C$)

|

|

|

(C$)

|

|

|

(Shares)

|

|

|

(US$)

|

|

|

(US$)

|

|

|

(US$)

|

|

|

(Shares)

|

|

|

2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March

|

|

|

3.81

|

|

|

|

1.35

|

|

|

|

1.98

|

|

|

|

7,982,156

|

|

|

|

2.85

|

|

|

|

0.94

|

|

|

|

1.38

|

|

|

|

17,768,154

|

|

|

April

|

|

|

2.71

|

|

|

|

1.81

|

|

|

|

2.34

|

|

|

|

4,490,898

|

|

|

|

1.92

|

|

|

|

1.26

|

|

|

|

1.65

|

|

|

|

10,112,601

|

|

|

May

|

|

|

4.02

|

|

|

|

2.02

|

|

|

|

3.34

|

|

|

|

8,413,279

|

|

|

|

2.92

|

|

|

|

1.44

|

|

|

|

2.44

|

|

|

|

34,431,369

|

|

|

June

|

|

|

3.22

|

|

|

|

2.50

|

|

|

|

2.57

|

|

|

|

4,300,369

|

|

|

|

2.36

|

|

|

|

1.83

|

|

|

|

1.88

|

|

|

|

12,959,503

|

|

|

July

|

|

|

2.99

|

|

|

|

2.50

|

|

|

|

2.67

|

|

|

|

1,450,554

|

|

|

|

2.24

|

|

|

|

1.83

|

|

|

|

2.02

|

|

|

|

12,743,011

|

|

|

August

|

|

|

2.85

|

|

|

|

2.08

|

|

|

|

2.27

|

|

|

|

1,692,002

|

|

|

|

2.15

|

|

|

|

1.57

|

|

|

|

1.76

|

|

|

|

11,596,435

|

|

|

September

|

|

|

2.52

|

|

|

|

2.00

|

|

|

|

2.28

|

|

|

|

1,123,822

|

|

|

|

1.92

|

|

|

|

1.52

|

|

|

|

1.69

|

|

|

|

5,843,143

|

|

|

October

|

|

|

3.18

|

|

|

|

2.24

|

|

|

|

2.78

|

|

|

|

2,275,778

|

|

|

|

2.44

|

|

|

|

1.68

|

|

|

|

2.09

|

|

|

|

12,476,651

|

|

|

November

|

|

|

4.69

|

|

|

|

2.58

|

|

|

|

4.50

|

|

|

|

4,034,766

|

|

|

|

3.64

|

|

|

|

1.96

|

|

|

|

3.49

|

|

|

|

23,929,943

|

|

|

December

|

|

|

5.37

|

|

|

|

2.84

|

|

|

|

3.02

|

|

|

|

7,579,906

|

|

|

|

4.19

|

|

|

|

2.22

|

|

|

|

2.38

|

|

|

|

35,361,675

|

|

|

2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January

|

|

|

3.85

|

|

|

|

2.88

|

|

|

|

3.17

|

|

|

|

3,796,827

|

|

|

|

3.03

|

|

|

|

2.25

|

|

|

|

2.50

|

|

|

|

25,038,877

|

|

|

February

|

|

|

5.95

|

|

|

|

3.07

|

|

|

|

4.09

|

|

|

|

8,142,280

|

|

|

|

4.70

|

|

|

|

2.39

|

|

|

|

3.21

|

|

|

|

53,610,626

|

|

|

March 1 to 4

|

|

|

4.29

|

|

|

|

3.64

|

|

|

|

3.91

|

|

|

|

1,052,436

|

|

|

|

3.42

|

|

|

|

2.86

|

|

|

|

3.05

|

|

|

|

4,715,261

|

|

PRIOR SALES

Except as disclosed under this heading,

no other Common Shares or securities exchangeable or convertible into Common Shares have been issued during the twelve month period

preceding the date of this Prospectus Supplement.

Common Shares

During the twelve month period prior to

the date of this Prospectus Supplement, the Corporation has issued:

|

|

(a)

|

an aggregate of 2,904,228 Common Shares pursuant to an equity distribution agreement dated October

25, 2018 between the Corporation and the Agent and prospectus supplements dated January 3, 2020 and March 6, 2020 to a base shelf

prospectus dated May 4, 2018 (the “2018 Prospectus”), at prices ranging from US$1.34 to US$2.34 per Common Share,

with the weighted average price being US$1.72 per Common Share;

|

|

|

(b)

|

an aggregate of 11,126,111 Common Shares pursuant to an equity

distribution agreement dated June 12, 2020 between the Corporation and the Agent and prospectus supplements dated June 15, 2020

and December 4, 2020 to the Prospectus, at prices ranging from US$1.61 to US$3.93 per Common Share, with the weighted average price

being US$2.80 per Common Share;

|

|

|

(c)

|

an aggregate of 428,366 Common Shares upon exercise of Common Share purchase warrants at a price

of US$0.90 per Common Share;

|

|

|

(d)

|

an aggregate of 172,544 Common Shares issued on the vesting of restricted share awards and performance

share awards granted pursuant to its amended and restated incentive share award plan; and

|

|

|

(e)

|

an aggregate of 162,150 Common Shares issued on the exercise of stock options granted pursuant

to its amended and restated stock option plan, particulars of which are set forth in the following table:

|

|

Date of Issue

|

|

Number of Common Shares Issued

|

|

|

Price per Common Share (C$)

|

|

|

June 4, 2020

|

|

|

7,324

|

|

|

|

2.41

|

|

|

October 30, 2020

|

|

|

41,667

|

|

|

|

1.45

|

|

|

November 2, 2020

|

|

|

10,000

|

|

|

|

2.73

|

|

|

December 1, 2020

|

|

|

5,000

|

|

|

|

1.38

|

|

|

December 2, 2020

|

|

|

5,000

|

|

|

|

1.38

|

|

|

December 8, 2020

|

|

|

21,667

|

|

|

|

1.42

|

|

|

December 29, 2020

|

|

|

5,000

|

|

|

|

1.38

|

|

|

January 12, 2021

|

|

|

5,000

|

|

|

|

1.38

|

|

|

January 14, 2021

|

|

|

3,334

|

|

|

|

1.38

|

|

|

February 19, 2021

|

|

|

26,667

|

|

|

|

2.17

|

|

|

February 26, 2021

|

|

|

31,491

|

|

|

|

2.39

|

|

Stock Options

During the twelve month period preceding

the date of this Prospectus Supplement, the Corporation granted stock options pursuant to its amended and restated stock option

plan exercisable for an aggregate of 1,757,500 Common Shares. The particulars of such grants are set forth in the following table:

|

Date of Grant

|

|

Number of Options Granted

|

|

|

Exercise Price (C$)

|

|

|

August 1, 2020

|

|

|

95,000

|

|

|

|

2.84

|

|

|

September 1, 2020

|

|

|

50,000

|

|

|

|

2.27

|

|

|

October 14, 2020

|

|

|

15,000

|

|

|

|

2.77

|

|

|

December 11, 2020

|

|

|

1,597,500

|

|

|

|

3.17

|

|

Share Awards

During the twelve month period preceding

the date of this Prospectus Supplement, the Corporation granted restricted share awards pursuant to its amended and restated incentive

share award plan which, upon vesting, will entitle the holders thereof to receive up to an aggregate of 148,493 Common Shares.

The particulars of such grants are set forth in the following table:

|

Date of Grant

|

|

Number of Share Awards Granted

|

|

|

|

|

|

March 31, 2020

|

|

|

14,230

|

|

|

|

|

|

|

June 30, 2020

|

|

|

11,343

|

|

|

|

|

|

|

September 30, 2020

|

|

|

11,498

|

|

|

|

|

|

|

October 1, 2020

|

|

|

104,898

|

|

|

|

|

|

|

December 31, 2020

|

|

|

6,524

|

|

|

|

|

|

PLAN OF DISTRIBUTION

We have entered into the Equity Distribution

Agreement with the Agent under which we may issue and sell from time to time up to US$80,000,000 of our Common Shares through the

Agent, as agent. Common Shares having an aggregate Offering amount of up to US$80,000,000 are being offered under this Prospectus

Supplement.

Sales of the Common Shares will be made

in transactions that are deemed to be “at-the-market distributions” as defined in NI 44-102, including sales made directly

on the NASDAQ or other existing trading markets in the United States. Subject to the terms and conditions of the Equity Distribution

Agreement and upon delivery of a placement notice from us, the Agent will solicit offers to purchase our Common Shares directly

on the NASDAQ or other existing trading markets in the United States. We will instruct the Agent as to the number of Common Shares

to be sold by them from time to time. No Common Shares will be sold on the TSX or on other trading markets in Canada as at-the-market

distributions. We may instruct the Agent not to the sell Common Shares if the sales cannot be effected at or above the price designated

by us from time to time. We or the Agent may suspend the Offering of the Common Shares upon notice and subject to other conditions.

We will pay the Agent commissions, in cash,

for its services in acting as agent in the sale of our Common Shares. The Agent will be entitled to compensation at a fixed commission

rate of 3.0% of the gross sales price per Common Share sold. Because there is no minimum offering amount required as a condition

to close the Offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at

this time. We have also agreed to reimburse the Agent for certain specified expenses, including the fees and disbursements of its

legal counsel, in an amount not to exceed US$50,000. We estimate that the total expenses for the Offering, excluding compensation

and reimbursements payable to the Agent under the terms of the Equity Distribution Agreement, will be approximately US$200,000.

Settlement for sales of our Common Shares

will occur on the second business day following the date on which any sales are made, or on such other date as is industry practice

for regular-way trading, in return for payment of the net proceeds to us. Sales of our Common Shares as contemplated in this Prospectus

will be settled through the facilities of The Depository Trust Company or by such other means as we and the Agent may agree upon.

There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

The Agent will use its commercially reasonable

efforts, consistent with its sales and trading practices, to solicit offers to purchase the Common Shares under the terms and subject

to the conditions set forth in the Equity Distribution Agreement. In connection with the sale of the Common Shares on our behalf,

the Agent will be deemed to be an “underwriter” within the meaning of the U.S. Securities Act, and the compensation

of the Agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution

to the Agent against certain civil liabilities, including liabilities under the U.S. Securities Act.

The offering of Common Shares pursuant

to the Equity Distribution Agreement will terminate upon the earlier of (i) the sale of all Common Shares subject to the Equity

Distribution Agreement, or (ii) termination of the Equity Distribution Agreement as permitted therein. We and the Agent may each

terminate the Equity Distribution Agreement at any time upon ten days’ prior notice.

The Agent and its affiliates may in the

future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which

services they may in the future receive customary fees. To the extent required by Regulation M, the Agent will not engage in any

market making activities involving our Common Shares while the Offering is ongoing under this Prospectus Supplement.

No underwriter of the Offering, and no

person or company acting jointly or in concert with an underwriter, may, in connection with the distribution under this Prospectus

Supplement, enter into any transaction that is intended to stabilize or maintain the market price of the Common Shares distributed

under this Prospectus Supplement, including selling an aggregate number of Common Shares that would result in the underwriter creating

an over-allocation position in the Common Shares.

The TSX has conditionally approved the

listing of the Common Shares offered by this Prospectus Supplement. Listing is subject to us fulfilling all of the requirements

of the TSX. The Company has provided notice to NASDAQ for the listing of the Common Shares offered hereunder.

CERTAIN CANADIAN

FEDERAL INCOME TAX CONSIDERATIONS

The following is, as of the date of this

Prospectus Supplement, a summary of the principal Canadian federal income tax considerations under the Income Tax Act (Canada)

(“Tax Act”) and the regulations thereunder (the “Regulations”) generally applicable to an

investor who acquires as beneficial owner Common Shares pursuant to the Offering and who, for the purposes of the Tax Act and the

Regulations and at all relevant times deals at arm’s length with the Corporation and the Agent, is not affiliated with the

Corporation or the Agent, is not exempt from tax under Part I of the Tax Act, and who acquires and holds the Common Shares, as

capital property (a “Holder”). Generally, the Common Shares will be considered to be capital property to a Holder

provided that the Holder does not hold the Common Shares in the course of carrying on a business as part of an adventure or concern

in the nature of trade.

This summary is generally applicable to

a Holder who, at all relevant times, for purposes of the Tax Act: (i) is not, and is not deemed to be, resident in Canada for the

purposes of the Tax Act or any applicable income tax treaty or convention; and (ii) does not and will not use or hold, and is not

and will not be deemed to hold, the Common Shares in connection with carrying on a business in Canada (a “Non-Resident

Holder”).

Special rules, which are not discussed

in this summary, may apply to certain holders that are insurers carrying on an insurance business in Canada and elsewhere. Such

Holders should consult their own tax advisors with respect to an investment in Common Shares.

This summary is based upon the current

provisions of the Tax Act and the Regulations in force as of the date hereof and counsel’s understanding of the current administrative

policies and assessing practices of the Canada Revenue Agency (the “CRA”) published in writing by the CRA prior

to the date hereof. This summary takes into account all specific proposals to amend the Tax Act and the Regulations publicly announced

by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Tax Proposals”) and assumes

that the Tax Proposals will be enacted in the form proposed, although no assurance can be given that the Tax Proposals will be

enacted in their current form or at all.

Other than the Tax Proposals, this summary

does not otherwise take into account or anticipate any changes in law, whether by legislative, governmental, administrative or

judicial decision or action, nor does it take into account or consider any provincial, territorial or foreign income tax considerations,

which considerations may differ significantly from the Canadian federal income tax considerations discussed in this summary. This

summary also does not take into account any change in the administrative policies or assessing practices of the CRA.

This summary is of a general nature

only, is not exhaustive of all possible Canadian federal income tax considerations and is not intended to be, nor should it be

construed to be, legal or tax advice to any particular Holder. Holders should consult their own tax advisors with respect to their

particular circumstances.

Currency

For purposes of the Tax Act, all amounts

relating to the acquisition, holding or disposition of the Common Shares (including dividends, adjusted cost base and proceeds

of disposition) must, to the extent such amounts are not in Canadian dollars, be converted into Canadian dollars based on an exchange

rate determined in accordance with the Tax Act.

Dividends

Dividends paid or credited or deemed to

be paid or credited on the Common Shares to a Non-Resident Holder by the Corporation are subject to Canadian withholding tax at

the rate of 25% on the gross amount of the dividend, unless such rate is reduced by the terms of an applicable tax treaty. For

example, under the Canada-United States Tax Convention (1980), as amended (the “Treaty”), the rate of withholding

tax on dividends paid or credited to a Non-Resident Holder who is a beneficial owner of dividends and who is a resident of the

United States for purposes of the Treaty and who is entitled to the benefits of the Treaty is generally limited to 15% of the gross

amount of the dividend. Non-Resident Holders are urged to consult their own tax advisors to determine their entitlement to relief

under an applicable income tax treaty.

Dispositions of Common Shares

Upon a disposition (or a deemed disposition)

of a Common Share (other than to the Corporation unless purchased by the Corporation in the open market in the manner in which

shares are normally purchased by any member of the public in the open market), a Non-Resident Holder generally will realize a capital

gain (or a capital loss) equal to the amount by which the proceeds of disposition of such Common Shares, net of any reasonable

costs of disposition, are greater (or are less) than the adjusted cost base of such Common Share to the Non-Resident Holder.

A Non-Resident Holder generally will not

be subject to tax under the Tax Act in respect of a capital gain realized on the disposition or deemed disposition of a Common

Share, unless the Common Share constitutes “taxable Canadian property” and is not “treaty-protected property”

(each as defined under the Tax Act) of the Non-Resident Holder at the time of disposition.

Provided the Common Shares are listed on

a “designated stock exchange”, as defined in the Tax Act (which currently includes the NASDAQ and TSX), at the time

of disposition, the Common Shares generally will not constitute taxable Canadian property of a Non-Resident Holder at that time,

unless at any time during the 60 month period immediately preceding the disposition the following two conditions are met concurrently:

(i) one or any combination of (a) the Non-Resident Holder, (b) persons with whom the Non-Resident Holder did not deal at arm’s

length, and (c) partnerships in which the Non-Resident Holder or a person with whom the Non-Resident Holder did not deal at arm’s

length held a membership interest directly or indirectly through one or more partnerships, owned 25% or more of the issued shares

of any class or series of shares of the Corporation; and (ii) more than 50% of the fair market value of such shares was derived

directly or indirectly from one or any combination of (a) real or immovable property situated in Canada, (b) “Canadian resource

properties” (as defined in the Tax Act), (c) “timber resource properties” (as defined in the Tax Act) or (d)

an option in respect of, an interest in, or for civil law a right in any of the foregoing property, whether or not such property

exists. Notwithstanding the foregoing, a Common Share may otherwise be deemed to be taxable Canadian property to a Non-Resident

Holder for purposes of the Tax Act.

Non-Resident Holders whose Common Shares

may be taxable Canadian property should consult their own tax advisors.

MATERIAL UNITED STATES

FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of certain

material U.S. federal income tax considerations applicable to a U.S. Holder (as defined below) arising from and relating to the

acquisition, ownership, and disposition of Common Shares acquired pursuant to this Offering.

This summary is for general information

purposes only and does not purport to be a complete analysis or listing of all potential U.S. federal income tax considerations

that may apply to a U.S. Holder arising from and relating to the acquisition, ownership, and disposition of Common Shares. In addition,

this summary does not take into account the individual facts and circumstances of any particular U.S. Holder that may affect the

U.S. federal income tax consequences to such U.S. Holder, including, without limitation, specific tax consequences to a U.S. Holder

under an applicable income tax treaty. Accordingly, this summary is not intended to be, and should not be construed as, legal or

U.S. federal income tax advice with respect to any U.S. Holder. This summary does not address the U.S. federal alternative minimum,

U.S. federal net investment income, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences to U.S. Holders

of the acquisition, ownership, and disposition of Common Shares. In addition, except as specifically set forth below, this summary

does not discuss applicable tax reporting requirements. Each prospective U.S. Holder should consult its own tax advisors regarding

the U.S. federal, U.S. federal alternative minimum, U.S. federal net investment income, U.S. federal estate and gift, U.S. state

and local, and non-U.S. tax consequences relating to the acquisition, ownership and disposition of Common Shares.

No legal opinion from U.S. legal counsel

or ruling from the Internal Revenue Service (the “IRS”) has been requested, or will be obtained, regarding the

U.S. federal income tax consequences of the acquisition, ownership, and disposition of Common Shares. This summary is not binding

on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in

this summary. In addition, because the authorities on which this summary is based are subject to various interpretations, the IRS

and the U.S. courts could disagree with one or more of the conclusions described in this summary.

Scope of this Summary

Authorities

This summary is based on the Internal Revenue

Code of 1986, as amended (the “Code”), Treasury Regulations (whether final, temporary, or proposed), published

rulings of the IRS, published administrative positions of the IRS, the Convention Between Canada and the United States of America

with Respect to Taxes on Income and on Capital, signed September 26, 1980, as amended (the “Canada-U.S. Tax Convention”),

and U.S. court decisions that are applicable, and, in each case, as in effect and available, as of the date of this document. Any

of the authorities on which this summary is based could be changed in a material and adverse manner at any time, and any such change

could be applied retroactively. This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed

legislation.

U.S. Holders

For purposes of this summary, the term

“U.S. Holder” means a beneficial owner of Common Shares acquired pursuant to this Offering that is for U.S.

federal income tax purposes:

|

|

·

|

an individual who is a citizen or resident of the United States;

|

|

|

·

|

a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) organized

under the laws of the United States, any state thereof or the District of Columbia;

|

|

|

·

|

an estate whose income is subject to U.S. federal income taxation regardless of its source; or

|

|

|

·

|

a trust that (1) is subject to the primary supervision of a court within the U.S. and the control

of one or more U.S. persons for all substantial decisions or (2) has a valid election in effect under applicable Treasury Regulations

to be treated as a U.S. person.

|

U.S. Holders Subject to Special U.S.

Federal Income Tax Rules Not Addressed

This summary does not address the U.S.

federal income tax considerations applicable to U.S. Holders that are subject to special provisions under the Code, including,

but not limited to, U.S. Holders that: (a) are tax-exempt organizations, qualified retirement plans, individual retirement accounts,

or other tax-deferred accounts; (b) are financial institutions, underwriters, insurance companies, real estate investment trusts,

or regulated investment companies; (c) are broker-dealers, dealers, or traders in securities or currencies that elect to apply

a mark-to-market accounting method; (d) have a “functional currency” other than the U.S. dollar; (e) own Common Shares

as part of a straddle, hedging transaction, conversion transaction, constructive sale, or other arrangement involving more than

one position; (f) acquire Common Shares in connection with the exercise of employee stock options or otherwise as compensation

for services; (g) hold Common Shares other than as a capital asset within the meaning of Section 1221 of the Code (generally, property

held for investment purposes); (h) are required to accelerate the recognition of any item of gross income with respect to Common

Shares as a result of such income being recognized on an applicable financial statement; or (i) own, have owned or will own (directly,

indirectly, or by attribution) 10% or more of the total combined voting power or value of the outstanding shares of the Corporation.

This summary also does not address the U.S. federal income tax considerations applicable to U.S. Holders who are: (a) U.S. expatriates

or former long-term residents of the U.S.; (b) persons that have been, are, or will be a resident or deemed to be a resident in

Canada for purposes of the Tax Act; (c) persons that use or hold, will use or hold, or that are or will be deemed to use or hold

Common Shares in connection with carrying on a business in Canada; (d) persons whose Common Shares constitute “taxable Canadian

property” under the Tax Act; or (e) persons that have a permanent establishment in Canada for the purposes of the Canada-U.S.

Tax Convention. U.S. Holders that are subject to special provisions under the Code, including, but not limited to, U.S. Holders

described immediately above, should consult their own tax advisors regarding the U.S. federal, U.S. federal alternative minimum,

U.S. federal net investment income, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating

to the acquisition, ownership and disposition of Common Shares.

If an entity or arrangement that is classified

as a partnership (or other “pass-through” entity) for U.S. federal income tax purposes holds Common Shares, the U.S.

federal income tax consequences to such entity or arrangement and the partners (or other owners or participants) of such entity

or arrangement generally will depend on the activities of the entity or arrangement and the status of such partners (or owners

or participants). This summary does not address the tax consequences to any such partner (or owner or participants). Partners (or

other owners or participants) of entities or arrangements that are classified as partnerships or as “pass-through”

entities for U.S. federal income tax purposes should consult their own tax advisors regarding the U.S. federal income tax consequences

arising from and relating to the acquisition, ownership, and disposition of Common Shares.

Passive Foreign Investment Company Rules

PFIC Status of the Corporation

If the Corporation were to constitute a

“passive foreign investment company” under the meaning of Section 1297 of the Code (a “PFIC”, as

defined below) for any year during a U.S. Holder’s holding period, then certain potentially adverse rules would affect the

U.S. federal income tax consequences to a U.S. Holder as a result of the acquisition, ownership and disposition of Common Shares.

The Corporation believes that it was classified as a PFIC during the tax year ended December 31, 2020, and based on current business

plans and financial expectations, the Corporation expects that it will be a PFIC for the current tax year and may be a PFIC in

future tax years. No opinion of legal counsel or ruling from the IRS concerning the status of the Corporation as a PFIC has been

obtained or is currently planned to be requested. The determination of whether any corporation was, or will be, a PFIC for a tax

year depends, in part, on the application of complex U.S. federal income tax rules, which are subject to differing interpretations.

In addition, whether any corporation will be a PFIC for any tax year depends on the assets and income of such corporation over

the course of each such tax year and, as a result, cannot be predicted with certainty as of the date of this document. Accordingly,

there can be no assurance that the IRS will not challenge any determination made by the Corporation (or any subsidiary of the Corporation)

concerning its PFIC status. Each U.S. Holder should consult its own tax advisors regarding the PFIC status of the Corporation and

each subsidiary of the Corporation.

In any year in which the Corporation is

classified as a PFIC, a U.S. Holder will be required to file an annual report with the IRS containing such information as Treasury

Regulations and/or other IRS guidance may require. In addition to penalties, a failure to satisfy such reporting requirements may

result in an extension of the time period during which the IRS can assess a tax. U.S. Holders should consult their own tax advisors

regarding the requirements of filing such information returns under these rules, including the requirement to file an IRS Form

8621 annually.

The Corporation generally will be a PFIC

if, for a tax year, (a) 75% or more of the gross income of the Corporation is passive income (the “PFIC income test”)

or (b) 50% or more of the value of the Corporation’s assets either produce passive income or are held for the production

of passive income, based on the quarterly average of the fair market value of such assets (the “PFIC asset test”).

“Gross income” generally includes all sales revenues less the cost of goods sold, plus income from investments and

from incidental or outside operations or sources, and “passive income” generally includes, for example, dividends,

interest, certain rents and royalties, certain gains from the sale of stock and securities, and certain gains from commodities

transactions.

For purposes of the PFIC income test and

PFIC asset test described above, if the Corporation owns, directly or indirectly, 25% or more of the total value of the outstanding

shares of another corporation, the Corporation will be treated as if it (a) held a proportionate share of the assets of such other

corporation and (b) received directly a proportionate share of the income of such other corporation. In addition, for purposes

of the PFIC income test and PFIC asset test described above, and assuming certain other requirements are met, “passive income”

does not include certain interest, dividends, rents, or royalties that are received or accrued by the Corporation from certain

“related persons” (as defined in Section 954(d)(3) of the Code) also organized in Canada, to the extent such items

are properly allocable to the income of such related person that is not passive income.

Under certain attribution rules, if the

Corporation is a PFIC, U.S. Holders will generally be deemed to own their proportionate share of the Corporation’s direct

or indirect equity interest in any company that is also a PFIC (a ‘‘Subsidiary PFIC’’), and will

generally be subject to U.S. federal income tax on their proportionate share of (a) any “excess distributions,” as

described below, on the stock of a Subsidiary PFIC and (b) a disposition or deemed disposition of the stock of a Subsidiary PFIC

by the Corporation or another Subsidiary PFIC, both as if such U.S. Holders directly held the shares of such Subsidiary PFIC. In

addition, U.S. Holders may be subject to U.S. federal income tax on any indirect gain realized on the stock of a Subsidiary PFIC

on the sale or disposition of Common Shares. Accordingly, U.S. Holders should be aware that they could be subject to tax under

the PFIC rules even if no distributions are received and no redemptions or other dispositions of Common Shares are made.

Default PFIC Rules

Under Section 1291 of the Code

If the Corporation is a PFIC for any tax

year during which a U.S. Holder owns Common Shares, the U.S. federal income tax consequences to such U.S. Holder of the acquisition,

ownership, and disposition of Common Shares will depend on whether and when such U.S. Holder makes an election to treat the Corporation

and each Subsidiary PFIC, if any, as a “qualified electing fund” or “QEF” under Section 1295 of the Code

(a “QEF Election”) or makes a mark-to-market election under Section 1296 of the Code (a “Mark-to-Market

Election”). A U.S. Holder that does not make either a QEF Election or a Mark-to-Market Election will be referred to in

this summary as a “Non-Electing U.S. Holder.”

A Non-Electing U.S. Holder will be subject

to the rules of Section 1291 of the Code (described below) with respect to (a) any gain recognized on the sale or other taxable

disposition of Common Shares and (b) any “excess distribution” received on the Common Shares. A distribution generally

will be an “excess distribution” to the extent that such distribution (together with all other distributions received

in the current tax year) exceeds 125% of the average distributions received during the three preceding tax years (or during a U.S.

Holder’s holding period for the Common Shares, if shorter).