Office Depot de Mexico to Prepay Dollar Debt, Citing International Conditions

November 18 2016 - 3:25PM

Dow Jones News

By Anthony Harrup

MEXICO CITY -- Mexican retailer Grupo Gigante SAB said Friday

its unit Office Depot de Mexico will take advantage of currency

hedges and other sources of financing to pay ahead of schedule $350

million in dollar-denominated notes, citing complicated

international conditions.

Gigante, which has office supplies and home goods stores,

restaurants and real estate operations, said Office Depot de Mexico

will pay all of the outstanding 6.875% notes due 2020 on Dec.

19.

Gigante acquired the 50% of Office Depot de Mexico that it

didn't own from joint-venture partner Office Depot Inc. in

2013.

Taking advantage of currency hedges at 19.02 pesos per U.S.

dollar, the unit will use cash from its operations, $200 million in

capital from shareholders Grupo Gigante and Gigante Retail, as well

as a 3 billion peso ($146 million) long-term loan from Mexican

development bank Bancomext to cover the payment.

"In accordance with its strategic plan, Grupo Gigante is

reducing by more than 98% its dollar-denominated liabilities, while

Office Depot de Mexico converts its foreign currency debt into

pesos, refinancing at a longer term and under better conditions,"

Gigante said in a filing with the Mexican stock exchange.

The Mexican peso, already reeling from lower oil prices that cut

into Mexican government revenue and the prospects of higher U.S.

interest rates, hit new all-time lows against the dollar following

the election of Donald Trump, who has said he would seek to

renegotiate the North American Free Trade Agreement under better

terms for the U.S. The peso was trading in Mexico City on Friday

around 20.5425 to the dollar.

The uncertainty over the impact Mr. Trump's administration could

have on trade and investment has led economists to lower growth

estimates for Mexico, and this week prompted the central bank to

raise interest rates for the fourth time this year.

Gigante said it would continue to implement a cautious strategy

"careful of the new international environment."

Gigante has a history of conservative debt management. In late

2007, it used proceeds from the sale of its supermarkets to buy

back dollar debt, just months before the peso sank in the midst of

the 2008 financial crisis. Many Mexican corporations have been in

the habit of hedging their foreign currency exposure since that

crisis, which caused several local companies to restructure debt as

the peso depreciation caught them unprepared.

Write to Anthony Harrup at anthony.harrup@wsj.com

(END) Dow Jones Newswires

November 18, 2016 15:10 ET (20:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

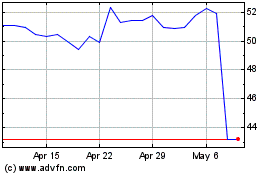

ODP (NASDAQ:ODP)

Historical Stock Chart

From Aug 2024 to Sep 2024

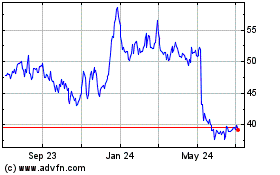

ODP (NASDAQ:ODP)

Historical Stock Chart

From Sep 2023 to Sep 2024