- Full Year 2018 GAAP Revenue of

$614.3 million

- Full Year 2018 GAAP Net Income of

$49.1 million

- Full Year 2018 GAAP Diluted Earnings

Per Share of $1.43

- Full Year 2018 Adjusted Earnings Per

Share of $2.16

- Full Year 2018 Adjusted EBITDA of

$124 million

Novanta Inc. (Nasdaq: NOVT) (the “Company”), a trusted

technology partner to medical and advanced technology equipment

manufacturers, today reported financial results for the fourth

quarter and full year 2018.

Financial

Highlights

Three Months Ended December 31, Year Ended December

31, (In millions, except per share amounts)

2018

2017 2018 2017

GAAP Revenue $ 156.2 $ 146.9 $ 614.3 $ 521.3 Operating

Income $ 15.7 $ 19.1 $ 71.0 $ 57.6 Net Income Attributable to

Novanta Inc. $ 11.6 $ 8.9 $ 49.1 $ 60.1 Diluted EPS $ 0.33 $ (0.00

) $ 1.43 $ 1.13

Non-GAAP* Adjusted Operating Income $ 25.5 $

25.8 $ 104.7 $ 90.8 Adjusted Diluted EPS $ 0.56 $ 0.44 $ 2.16 $

1.60 Adjusted EBITDA $ 30.8 $ 30.0 $ 123.8 $ 106.1 *Reconciliations

of GAAP to non-GAAP financial measures, as well as definitions for

the non-GAAP financial measures included in this press release and

the reasons for their use, are presented below.

“2018 was an excellent year for Novanta with solid execution and

good financial results,” said Matthijs Glastra, Chief Executive

Officer of Novanta. “We delivered on our promises for robust top

line growth and bottom-line profitability. For the full year,

reported revenue growth was very strong at 18%, our Adjusted EPS

grew 35% and Adjusted EBITDA grew 17%. As we head into 2019, we

remain very confident in our strategy, our business model and our

team’s commitment and ability to deliver results.”

Fourth Quarter

During the fourth quarter of 2018, Novanta generated GAAP

revenue of $156.2 million, an increase of $9.3 million, or 6.3%,

versus the fourth quarter of 2017. The Company’s acquisition

activities resulted in an increase in revenue of $3.3 million, or

2.2%, compared to the fourth quarter of 2017. Changes in foreign

currency exchange rates year over year adversely impacted our

revenue by $1.6 million, or 1.1%, during the fourth quarter of

2018. Our year-over-year Organic Revenue Growth, which excludes the

net impact of acquisitions and changes in foreign currency exchange

rates, was 5.2% for the fourth quarter of 2018 (see “Organic

Revenue Growth” in the non-GAAP reconciliation below).

In the fourth quarter of 2018, GAAP operating income was $15.7

million, compared to $19.1 million in the fourth quarter of 2017.

GAAP net income attributable to Novanta was $11.6 million in the

fourth quarter of 2018, compared to $8.9 million in the fourth

quarter of 2017. GAAP diluted earnings per share (“EPS”) was $0.33

in the fourth quarter of 2018, compared to ($0.00) in the fourth

quarter of 2017.

Adjusted Diluted EPS was $0.56 in the fourth quarter of 2018,

compared to $0.44 in the fourth quarter of 2017. The Company ended

the fourth quarter of 2018 with 35.5 million weighted average

shares outstanding. Adjusted EBITDA was $30.8 million in the fourth

quarter of 2018, compared to $30.0 million in the fourth quarter of

2017.

Operating cash flow for the fourth quarter of 2018 was $21.9

million, compared to $22.1 million for the fourth quarter of

2017.

Full Year

For the full year 2018, Novanta generated GAAP revenue of $614.3

million, an increase of $93.0 million, or 17.8%, versus the full

year 2017. The Company’s acquisition activities resulted in an

increase in revenue of $52.9 million, or 10.2%. Changes in foreign

currency exchange rates year over year favorably impacted our

revenue by $3.7 million, or 0.6%, in 2018. Our year-over-year

Organic Revenue Growth, which excludes the net impact of

acquisitions and changes in foreign currency exchange rates, was

7.0% for the full year 2018 (see “Organic Revenue Growth” in the

non-GAAP reconciliation below).

For the full year 2018, GAAP operating income was $71.0 million,

compared to $57.6 million in 2017. GAAP net income attributable to

Novanta was $49.1 million for the full year 2018, compared to $60.1

million in 2017. GAAP diluted EPS was $1.43 for the full year 2018,

compared to $1.13 in 2017. In 2018, the Company purchased the

remaining equity interest in Laser Quantum, resulting in a reversal

of $1.8 million of the previously recorded redemption value

adjustment, to reduce the carrying value of the noncontrolling

interest to the actual purchase price. This nontaxable adjustment

was recognized in retained earnings instead of net income, but

resulted in a $0.05 increase in EPS under U.S. GAAP accounting

rules.

Adjusted Diluted EPS was $2.16 for the full year 2018, compared

to $1.60 in 2017. The Company ended the full year 2018 with 35.5

million weighted average shares outstanding. Adjusted EBITDA was

$123.8 million for the full year 2018, compared to $106.1 million

in 2017.

Operating cash flow for the full year 2018 was $89.6 million,

compared to $63.4 million in 2017. The Company finished 2018 with

approximately $207.4 million of total debt and $82.0 million of

total cash. Net Debt, as defined in the non-GAAP reconciliation

below, was $127.5 million.

Financial Outlook

For the full year 2019, the Company expects GAAP revenue of

approximately $645 million to $655 million, Adjusted EBITDA in the

range of $131 million to $135 million, and Adjusted Diluted EPS to

be in the range of $2.30 to $2.36. The Company’s Adjusted Diluted

EPS and Adjusted EBITDA guidance assumes no significant changes in

foreign exchange rates.

For the first quarter of 2019, the Company expects GAAP revenue

of approximately $154 million to $157 million, Adjusted EBITDA in

the range of $27 million to $29 million, and Adjusted Diluted EPS

to be in the range of $0.44 to $0.49. The Company’s Adjusted

Diluted EPS and Adjusted EBITDA guidance assumes no significant

changes in foreign exchange rates.

Novanta provides earnings guidance on a non-GAAP basis and does

not provide earnings guidance on a GAAP basis, with the exception

of GAAP revenue guidance. A reconciliation of the Company’s

forward-looking Adjusted EBITDA and Adjusted EPS guidance to the

most directly comparable GAAP financial measures is not provided

because of the inherent difficulty in forecasting and quantifying

certain amounts that are necessary for such reconciliations,

including future changes in the fair value of contingent

considerations; significant discrete income tax expenses

(benefits); divestiture related expenses; acquisition related

expenses; impact of purchase price allocations for recently

completed acquisitions; gains and losses from sale of real estate

assets; costs related to product line closures; intangible asset

impairment charges and related asset write-offs; future

restructuring expenses; foreign exchange gains/(losses) on proceeds

from divestitures; benefits or expenses associated with the

completion of tax audits; and other charges reflected in the

Company’s reconciliation of historical non-GAAP financial measures,

the amounts of which, based on past experience, could be material.

For additional information regarding Novanta’s non-GAAP financial

measures, see “Use of Non-GAAP Financial Measures” below.

Conference Call Information

The Company will host a conference call on Wednesday, February

27, 2019 at 10:00 a.m. ET to discuss these results. To access the

call, please dial (888) 346-3959 prior to the scheduled conference

call time. Alternatively, the conference call can be accessed

online via a live webcast on the Presentations and Events page of

the Investor Relations section of the Company's website at

www.novanta.com.

A replay of the audio webcast will be available approximately

three hours after the conclusion of the call on the Investor

Relations section of the Company's website at www.novanta.com. The

replay will remain available until Friday, April 5, 2019.

Use of Non-GAAP Financial Measures

The non-GAAP financial measures used in this press release are

Organic Revenue Growth, Adjusted Gross Profit, Adjusted Gross

Profit Margin, Adjusted Operating Income and Operating Margin,

Adjusted Income before Income Taxes, Adjusted Income Tax Provision

and Effective Tax Rate, Adjusted Net Income Attributable to Novanta

Inc., Net of Tax, Adjusted Diluted EPS, Adjusted EBITDA, Adjusted

EBITDA Margin, Free Cash Flow, Free Cash Flow as a Percentage of

Net Income Attributable to Novanta Inc. and Net Debt.

The Company believes that these non-GAAP financial measures

provide useful and supplementary information to investors regarding

the operating performance of the Company. It is management’s belief

that these non-GAAP financial measures would be particularly useful

to investors because of the significant changes that have occurred

outside of the Company’s day-to-day business in accordance with the

execution of the Company’s strategy. This strategy includes

streamlining the Company’s existing operations through site and

functional consolidations, strategic divestitures and product line

closures, expanding the Company’s business through significant

internal investments, and broadening the Company’s product and

service offerings through acquisition of innovative and

complementary technologies and solutions. The financial impact of

certain elements of these activities, particularly acquisitions,

divestitures, and site and functional restructurings, is often

large relative to the Company’s overall financial performance and

can adversely affect the comparability of its operating results and

investors’ ability to analyze the business from period to

period.

The Company’s Adjusted EBITDA and Organic Revenue Growth are

used by management to evaluate operating performance, communicate

financial results to the Board of Directors, benchmark results

against historical performance and the performance of peers, and

evaluate investment opportunities, including acquisitions and

divestitures. In addition, Adjusted EBITDA and Organic Revenue

Growth are used to determine bonus payments for senior management

and employees. The Company also uses Adjusted Diluted EPS as a

measurement for performance shares issued to certain executives.

Accordingly, the Company believes that these non-GAAP measures

provide greater transparency and insight into management’s method

of analysis.

Non-GAAP financial measures should not be considered as

substitutes for, or superior to, measures of financial performance

prepared in accordance with GAAP. They are limited in value because

they exclude charges that have a material effect on the Company’s

reported results and, therefore, should not be relied upon as the

sole financial measures to evaluate the Company’s financial

results. The non-GAAP financial measures are meant to supplement,

and to be viewed in conjunction with, GAAP financial measures.

Investors are encouraged to review the reconciliation of these

non-GAAP financial measures to their most directly comparable GAAP

financial measures as provided in the tables accompanying this

press release.

Safe Harbor and Forward-Looking Information

Certain statements in this release are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 and are based on current expectations and

assumptions that are subject to risks and uncertainties. All

statements contained in this news release that do not relate to

matters of historical fact should be considered forward-looking

statements, and are generally identified by words such as “expect,”

“intend,” “anticipate,” “estimate,” “believe,” “future,” “could,”

“should,” “plan,” “aim,” and other similar expressions. These

forward-looking statements include, but are not limited to,

statements regarding our confidence in our strategy and our

business model and our team’s commitment and ability to deliver

results; anticipated financial performance, including our financial

outlook for the first quarter and full year 2019; expectations

regarding market conditions; and other statements that are not

historical facts.

These forward-looking statements are neither promises nor

guarantees, but involve risks and uncertainties that may cause

actual results to differ materially from those contained in the

forward-looking statements. Our actual results could differ

materially from those anticipated in these forward-looking

statements for many reasons, including, but not limited to, the

following: economic and political conditions and the effects of

these conditions on our customers’ businesses and level of business

activity; our significant dependence upon our customers’ capital

expenditures, which are subject to cyclical market fluctuations;

our dependence upon our ability to respond to fluctuations in

product demand; our ability to continually innovate and

successfully commercialize our innovations; failure to introduce

new products in a timely manner; customer order timing and other

similar factors beyond our control; disruptions or breaches in

security of our information technology systems; our failure to

comply with data privacy regulations; changes in interest rates,

credit ratings or foreign currency exchange rates; risks associated

with our operations in foreign countries; risks associated with

increased outsourcing of components manufacturing; our exposure to

increased tariffs, trade restrictions or taxes on our products; our

failure to comply with local import and export regulations in the

jurisdictions in which we operate; negative effects on global

economic conditions, financial markets and our business as a result

of the United Kingdom’s impending withdrawal from the European

Union and the actions of the current U.S. government, including its

policies on trade tariffs and reactions from other countries to any

new tariffs imposed by the U.S.; violations of our intellectual

property rights and our ability to protect our intellectual

property against infringement by third parties; risk of losing our

competitive advantage; our failure to successfully integrate recent

and future acquisitions into our businesses; our ability to attract

and retain key personnel; our restructuring and realignment

activities and disruptions to our operations as a result of

consolidation of our operations; product defects or problems

integrating our products with other vendors’ products; disruptions

in the supply of certain key components or other goods from our

suppliers; production difficulties and product delivery delays or

disruptions; our exposure to medical device regulation, which may

impede or hinder the approval or sale of our products and, in some

cases, may ultimately result in an inability to obtain approval of

certain products or may result in the recall or seizure of

previously approved products; changes in governmental regulation of

our businesses or products; our failure to comply with

environmental regulations; our failure to implement new information

technology systems and software successfully; our failure to

realize the full value of our intangible assets; our exposure to

the credit risk of some of our customers and in weakened markets;

our reliance on third party distribution channels; being subject to

U.S. federal income taxation even though we are a non-U.S.

corporation; tax audits by tax authorities; changes in tax laws,

and fluctuations in our effective tax rates; anticipated impact

from the U.S. Tax Cuts and Jobs Act; any need for additional

capital to adequately respond to business challenges or

opportunities and repay or refinance our existing indebtedness,

which may not be available on acceptable terms or at all; our

existing indebtedness limiting our ability to engage in certain

activities; volatility in the market price for our common shares;

our ability to access cash and other assets of our subsidiaries;

provisions of our corporate documents that may delay or prevent a

change in control; and our failure to maintain appropriate internal

controls in the future.

Other important risk factors that could affect the outcome of

the events set forth in these statements and that could affect the

Company’s operating results and financial condition are discussed

in Item 1A of our Annual Report on Form 10-K for the fiscal

year ended December 31, 2018, our subsequent filings with the

Securities and Exchange Commission (“SEC”), and in our future

filings with the SEC. Such statements are based on the Company’s

beliefs and assumptions and on information currently available to

the Company. The Company disclaims any obligation to update any

forward-looking statements as a result of developments occurring

after the date of this document except as required by law.

About Novanta

Novanta is a leading global supplier of core technology

solutions that give medical and advanced industrial original

equipment manufacturers (“OEMs”) a competitive advantage. We

combine deep proprietary technology expertise and competencies in

photonics, vision, and precision motion with a proven ability to

solve complex technical challenges. This enables Novanta to

engineer core components and sub-systems that deliver extreme

precision and performance, tailored to our customers' demanding

applications. The driving force behind our growth is the team of

innovative professionals who share a commitment to innovation and

customer success. Novanta’s common shares are quoted on Nasdaq

under the ticker symbol “NOVT.”

More information about Novanta is available on the Company’s

website at www.novanta.com. For additional information, please

contact Novanta Investor Relations at (781) 266-5137 or

InvestorRelations@novanta.com.

NOVANTA INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(In thousands of U.S.

dollars or shares, except per share

amounts)(Unaudited)

Three Months Ended December 31, Year

Ended December 31, 2018 2017 2018

2017 Revenue $ 156,178 $ 146,918 $ 614,337 $ 521,290

Cost of revenue 91,672 84,677 352,809

300,759 Gross profit 64,506 62,241 261,528

220,531 Operating expenses: Research and development and

engineering 13,280 11,795 51,024 41,673 Selling, general and

administrative 28,302 27,380 115,900 101,654 Amortization of

purchased intangible assets 4,012 2,683 15,550 12,096

Restructuring, acquisition and divestiture related costs

3,236 1,310 8,041 7,542 Total operating

expenses 48,830 43,168 190,515 162,965

Operating income 15,676 19,073 71,013 57,566 Interest income

(expense), net (2,499 ) (2,291 ) (9,814 ) (7,165 ) Foreign exchange

transaction gains (losses), net 311 (271 ) 147 (447 ) Other income

(expense), net 87 59 (44 ) (229 ) Gain on acquisition of business

— — — 26,409 Income before income taxes

13,575 16,570 61,302 76,134 Income tax provision 1,931

6,893 10,207 13,827 Consolidated net income

11,644 9,677 51,095 62,307 Less: Net income attributable to

noncontrolling interest — (812 ) (1,986 )

(2,256 ) Net income attributable to Novanta Inc. $ 11,644 $

8,865 $ 49,109 $ 60,051 Earnings (loss) per common share

attributable to Novanta Inc. Basic $ 0.33 $ (0.00 ) $ 1.46 $ 1.14

Diluted $ 0.33 $ (0.00 ) $ 1.43 $ 1.13 Weighted average

common shares outstanding—basic 34,897 34,842 34,913 34,817

Weighted average common shares outstanding—diluted 35,485 34,842

35,473 35,280

NOVANTA INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(In thousands of U.S.

dollars)(Unaudited)

December 31,2018

December 31,2017 ASSETS Current Assets Cash

and cash equivalents $ 82,043 $ 100,057 Accounts receivable, net

83,955 81,482 Inventories 104,764 91,278 Other current assets

11,007 15,062 Total current assets 281,769 287,879

Property, plant and equipment, net 65,464 61,718 Intangible assets,

net 142,920 155,048 Goodwill 217,662 210,988 Other assets

11,761 11,070 Total assets $ 719,576 $ 726,703

LIABILITIES, NONCONTROLLING INTEREST AND STOCKHOLDERS’

EQUITY Current Liabilities Current portion of long-term debt $

4,535 $ 9,119 Accounts payable 50,733 39,793 Accrued expenses and

other current liabilities 48,928 49,256 Total current

liabilities 104,196 98,168 Long-term debt 202,843 225,500 Other

long-term liabilities 44,282 44,567 Total liabilities

351,321 368,235 Redeemable noncontrolling interest

— 46,923 Stockholders’ Equity: Total stockholders’

equity 368,255 311,545

Total liabilities, noncontrolling interest

and stockholders’ equity

$ 719,576 $ 726,703

NOVANTA INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(In thousands of U.S.

dollars)(Unaudited)

Three Months EndedDecember

31,

Year Ended December 31, 2018 2017

2018 2017 Cash flows from operating

activities: Consolidated net income $ 11,644 $ 9,677 $ 51,095 $

62,307 Adjustments to reconcile consolidated net income to

net cash provided by operating

activities:

Depreciation and amortization 9,666 8,318 37,052 30,758 Share-based

compensation 2,239 1,270 7,714 5,493 Gain on acquisition of

business — — — (26,409 ) Deferred income taxes (2,767 ) 353 (6,076

) (2,560 ) Inventory acquisition fair value adjustment — — — 4,754

Other non-cash items 519 (144 ) 2,794 2,886 Changes in assets and

liabilities which provided/(used) cash,

excluding effects from business

acquisitions:

Accounts receivable 4,591 1,782 (1,156 ) (2,077 ) Inventories

(6,562 ) (1,781 ) (15,603 ) (13,587 ) Other operating assets and

liabilities 2,597 2,616 13,827 1,813

Net cash provided by operating activities 21,927

22,091 89,647 63,378

Cash flows from investing

activities: Purchases of property, plant and equipment (3,013 )

(2,592 ) (14,658 ) (9,094 ) Acquisition of businesses, net of cash

acquired and working capital adjustments — — (29,600 ) (168,332 )

Acquisition of assets (374 ) — (1,599 ) — Other investing

activities 54 2 267 46 Net cash used in

investing activities (3,333 ) (2,590 ) (45,590

) (177,380 )

Cash flows from financing activities:

Borrowings under revolving credit facility — — 55,253 176,769

Repayments of term loan and revolving credit facility (45,589 )

(11,300 ) (74,648 ) (26,925 ) Acquisition of noncontrolling

interest — — (30,800 ) — Repurchase of common stock (2,085 ) —

(5,850 ) (370 ) Other financing activities (216 )

(468 ) (4,119 ) (6,144 ) Net cash provided by (used

in) financing activities (47,890 ) (11,768 )

(60,164 ) 143,330 Effect of exchange rates on cash and cash

equivalents (475 ) 175 (1,907 ) 2,621

Increase (decrease) in cash and cash equivalents (29,771 ) 7,908

(18,014 ) 31,949 Cash and cash equivalents, beginning of period

111,814 92,149 100,057 68,108 Cash and

cash equivalents, end of period $ 82,043 $ 100,057 $ 82,043 $

100,057

NOVANTA INC.Revenue by

Reportable Segment(In thousands of U.S.

dollars)(Unaudited)

Three Months Ended

December 31, Year Ended December 31, 2018

2017 2018 2017

Revenue Photonics $ 62,161 $ 61,856 $ 249,339 $ 232,359

Vision 60,757 58,131 232,902 183,074 Precision Motion 33,260

26,931 132,096 105,857

Total $ 156,178

$ 146,918 $ 614,337 $ 521,290

NOVANTA INC.Reconciliation of

GAAP to Non-GAAP Financial Measures(In thousands of U.S.

dollars)(Unaudited)

Adjusted Gross

Profit and Adjusted Gross Profit Margin by Segment

(Non-GAAP):

Three Months Ended December 31, Year Ended December

31, 2018 2017 2018

2017 Photonics Gross Profit (GAAP) $ 27,599 $ 28,694

$ 117,109 $ 106,117 Gross Profit Margin (GAAP) 44.4 % 46.4 % 47.0 %

45.7 % Amortization of intangible assets 664 1,020 2,750 4,005

Acquisition fair value adjustments — — —

699 Adjusted Gross Profit (Non-GAAP) $ 28,263 $ 29,714 $

119,859 $ 110,821 Adjusted Gross Profit Margin (Non-GAAP) 45.5 %

48.0 % 48.1 % 47.7 %

Vision Gross Profit (GAAP) $

22,876 $ 21,871 $ 87,198 $ 69,249 Gross Profit Margin (GAAP) 37.7 %

37.6 % 37.4 % 37.8 % Amortization of intangible assets 1,732 1,636

6,658 4,460 Acquisition fair value adjustments — —

— 4,055 Adjusted Gross Profit (Non-GAAP) $ 24,608 $

23,507 $ 93,856 $ 77,764 Adjusted Gross Profit Margin (Non-GAAP)

40.5 % 40.4 % 40.3 % 42.5 %

Precision Motion Gross

Profit (GAAP) $ 14,727 $ 12,006 $ 59,477 $ 46,564 Gross Profit

Margin (GAAP) 44.3 % 44.6 % 45.0 % 44.0 % Amortization of

intangible assets 203 90 652 359 Acquisition fair value adjustments

— — — — Adjusted Gross Profit

(Non-GAAP) $ 14,930 $ 12,096 $ 60,129 $ 46,923 Adjusted Gross

Profit Margin (Non-GAAP) 44.9 % 44.9 % 45.5 % 44.3 %

Unallocated Corporate and Shared Services Gross Profit

(GAAP) $ (696 ) $ (330 ) $ (2,256 ) $ (1,399 ) Amortization of

intangible assets — — — — Acquisition fair value adjustments

— — — — Adjusted Gross Profit (Non-GAAP) $

(696 ) $ (330 ) $ (2,256 ) $ (1,399 )

Novanta Inc.

Gross Profit (GAAP) $ 64,506 $ 62,241 $ 261,528 $ 220,531 Gross

Profit Margin (GAAP) 41.3 % 42.4 % 42.6 % 42.3 % Amortization of

intangible assets 2,599 2,746 10,060 8,824 Acquisition fair value

adjustments — — — 4,754 Adjusted Gross

Profit (Non-GAAP) $ 67,105 $ 64,987 $ 271,588 $ 234,109 Adjusted

Gross Profit Margin (Non-GAAP) 43.0 % 44.2 % 44.2 % 44.9 %

NOVANTA INC.Reconciliation of

GAAP to Non-GAAP Financial Measures(Amounts in thousands

except per share amounts)(Unaudited)

Adjusted

Operating Income and Adjusted EPS (Non-GAAP):

Three Months Ended December 31, 2018

Operatingincome

OperatingMargin

Income beforeIncome Taxes

Income TaxProvision

Effective TaxRate

Net IncomeAttributableto NovantaInc., Net

ofTax

Diluted EPS

GAAP results $

15,676 10.0 % $ 13,575

$ 1,931 14.2 % $

11,644

$

0.33

Non-GAAP Adjustments: Amortization of intangible

assets 6,611 4.2 % 6,611 Restructuring, divestiture and other costs

900 0.6 % 900 Acquisition related costs 2,336 1.5 % 2,336 Tax

effect on non-GAAP adjustments 1,210 Non-GAAP tax adjustments

372 Total non-GAAP

adjustments 9,847 6.3 % 9,847 1,582

8,265 0.23

Adjusted results (Non-GAAP)

$ 25,523 16.3 % $

23,422 $ 3,513 15.0 %

$ 19,909 $ 0.56 Weighted average

shares outstanding - Diluted 35,485

NOVANTA INC.Reconciliation of

GAAP to Non-GAAP Financial Measures(Amounts in thousands

except per share amounts)(Unaudited)

Adjusted

Operating Income and Adjusted EPS (Non-GAAP):

Three Months Ended December 31, 2017

Operatingincome

OperatingMargin

Income beforeIncome Taxes

Income TaxProvision

Effective TaxRate

Net IncomeAttributableto NovantaInc., Net

ofTax

Diluted EPS

GAAP results $ 19,073

13.0 % $ 16,570 $

6,893 41.6 % $ 8,865

Less: Redeemable noncontrolling interest redemption value

adjustment (8,941 )

Net income (loss)

attributable to Novanta Inc. after adjustment for redeemable

noncontrolling interest redemption value $ (76

) $ (0.00 ) Redeemable noncontrolling

interest redemption value adjustment 8,941 0.25

Net

income attributable to Novanta Inc. $ 8,865

Non-GAAP Adjustments: Amortization of intangible assets 5,429 3.7 %

5,429 Restructuring, divestiture and other costs 146 0.1 % 146

Acquisition related costs 1,164 0.8 % 1,164 Tax effect on non-GAAP

adjustments 2,845 Non-GAAP tax adjustments

(2,584 ) Total non-GAAP adjustments

6,739 4.6 % 6,739 261 6,478

0.19

Adjusted results (Non-GAAP) $

25,812 17.6 % $ 23,309

$ 7,154 30.7 % $

15,343 $ 0.44 Weighted average shares

outstanding - Diluted 34,842

NOVANTA INC.Reconciliation of

GAAP to Non-GAAP Financial Measures(Amounts in thousands

except per share amounts)(Unaudited)

Adjusted

Operating Income and Adjusted EPS (Non-GAAP):

Year Ended December 31, 2018

Operatingincome

OperatingMargin

Income beforeIncome Taxes

Income TaxProvision

Effective TaxRate

Net IncomeAttributableto NovantaInc., Net

ofTax

Diluted EPS

GAAP results $ 71,013

11.6 % $ 61,302 $

10,207 16.7 % $ 49,109

Less: Redeemable noncontrolling interest redemption value

adjustment 1,781

Net income attributable to

Novanta Inc. after adjustment for redeemable noncontrolling

interest redemption value $ 50,890 $

1.43 Redeemable noncontrolling interest redemption value

adjustment (1,781 ) (0.05 )

Net income attributable to

Novanta Inc. $ 49,109 Non-GAAP Adjustments:

Amortization of intangible assets 25,610 4.2 % 25,610

Restructuring, divestiture and other costs 2,025 0.3 % 2,025

Acquisition related costs 6,016 0.9 % 6,016 Tax effect on non-GAAP

adjustments 5,920 Non-GAAP tax adjustments

377 Total non-GAAP adjustments

33,651 5.4 % 33,651 6,297 27,354

0.78

Adjusted results (Non-GAAP) $

104,664 17.0 % $ 94,953

$ 16,504 17.4 % $

76,463 $ 2.16 Weighted average shares

outstanding - Diluted 35,473

NOVANTA INC.Reconciliation of

GAAP to Non-GAAP Financial Measures(Amounts in thousands

except per share amounts)(Unaudited)

Adjusted

Operating Income and Adjusted EPS (Non-GAAP):

Year Ended December 31, 2017

Operatingincome

OperatingMargin

Income beforeIncome Taxes

Income TaxProvision

Effective TaxRate

Net IncomeAttributableto NovantaInc., Net

ofTax

Diluted EPS

GAAP results $ 57,566

11.0 % $ 76,134 $

13,827 18.2 % $ 60,051

Less: Redeemable noncontrolling interest redemption value

adjustment (20,244 )

Net income attributable to

Novanta Inc. after adjustment for redeemable noncontrolling

interest redemption value $ 39,807 $

1.13 Redeemable noncontrolling interest redemption value

adjustment 20,244 0.57

Net income attributable to Novanta

Inc. $ 60,051 Non-GAAP Adjustments: Amortization

of intangible assets 20,920 4.0 % 20,920 Restructuring, divestiture

and other costs 346 0.1 % 346 Acquisition related costs 7,196 1.4 %

7,196 Acquisition fair value adjustments 4,754 0.9 % 4,754 Gain on

acquisition of business (26,409 ) Tax effect on non-GAAP

adjustments 9,641 Non-GAAP tax adjustments

759 Total non-GAAP adjustments

33,216 6.4 % 6,807 10,400 (3,593 )

(0.10 )

Adjusted results (Non-GAAP) $

90,782 17.4 % $ 82,941

$ 24,227 29.2 % $

56,458 $ 1.60 Weighted average shares

outstanding - Diluted 35,280

NOVANTA INC.Reconciliation of GAAP to

Non-GAAP Financial Measures(In thousands of U.S.

dollars)(Unaudited)

Adjusted EBITDA

(Non-GAAP):

Three Months EndedDecember

31,

Year Ended December 31, 2018 2017

2018 2017 Consolidated Net Income

(GAAP) $ 11,644 $ 9,677 $ 51,095 $ 62,307

Net Income

Margin 7.5 % 6.6 % 8.3 % 12.0

%

Interest (income) expense, net 2,499 2,291 9,814 7,165 Income tax

provision 1,931 6,893 10,207 13,827 Depreciation and amortization

9,666 8,318 37,052 30,758 Share-based compensation 2,172 1,270

7,647 5,493 Restructuring, acquisition and divestiture related

costs 3,236 1,310 8,041 7,542 Acquisition fair value adjustments —

— — 4,754 Gain on acquisition of business — — — (26,409

)

Other, net (398 ) 212 (103 ) 676

Adjusted EBITDA (Non-GAAP) $ 30,750 $ 29,971 $ 123,753 $

106,113

Adjusted EBITDA Margin (Non-GAAP) 19.7 % 20.4 % 20.1

% 20.4

%

Organic Revenue

Growth (Non-GAAP):

Three Months EndedDecember 31,

2018Compared toThree Months EndedDecember 31,

2017

Year EndedDecember 31,

2018Compared toYear EndedDecember 31,

2017

Reported growth (GAAP) 6.3 % 17.8 % Less: Change

attributable to acquisitions 2.2 % 10.2 % Plus: Change due to

foreign currency 1.1 % (0.6 )%

Organic growth

(Non-GAAP) 5.2 % 7.0 %

Net Debt

(Non-GAAP):

December 31, 2018 December 31, 2017 Total

Debt (GAAP) $ 207,378 $ 234,619 Plus: Deferred financing costs

2,205 3,159

Gross Debt 209,583 237,778 Less:

Cash and cash equivalents (82,043 ) (100,057 )

Net

Debt (Non-GAAP) $ 127,540 $ 137,721

Free Cash Flow

(Non-GAAP):

Three Months EndedDecember

31,

Year Ended December 31, 2018 2017

2018 2017 Cash Provided by Operating Activities

(GAAP) $ 21,927 $ 22,091 $ 89,647 $ 63,378 Less: Purchases of

property, plant and equipment (3,013 ) (2,592 ) (14,658 ) (9,094 )

Plus: Proceeds from sale of property, plant and equipment 54

2 267 46

Free Cash Flow (Non-GAAP) $

18,968 $ 19,501 $ 75,256 $ 54,330

Net Income Attributable to

Novanta Inc. (GAAP) $ 11,644 $ 8,865 $ 49,109 $ 60,051

Cash

Provided by Operating Activities as a Percentage of Net Income

Attributable to Novanta Inc. 188.3 % 249.2 % 182.5 % 105.5 %

Free Cash Flow as a Percentage of Net Income Attributable to

Novanta Inc. 162.9 % 220.0 % 153.2 % 90.5 %

Non-GAAP Measures

Organic Revenue Growth

The Company defines the term “organic revenue” as revenue

excluding the impact from business acquisitions, divestitures,

product line discontinuations, and the effect of foreign currency

translation. The Company uses the related term “organic revenue

growth” to refer to the financial performance metric of comparing

current period organic revenue with the reported revenue of the

corresponding period in the prior year. The Company believes that

this non-GAAP measure, when taken together with our GAAP financial

measures, allows the Company and its investors to better measure

the Company’s performance and evaluate long-term performance

trends. Organic revenue growth also facilitates easier comparisons

of the Company’s performance with prior and future periods and

relative comparisons to its peers. The Company excludes the effect

of foreign currency translation from these measures because foreign

currency translation is subject to volatility and can obscure

underlying business trends. The Company excludes the effect of

acquisitions and divestitures because these activities can vary

dramatically between reporting periods and between the Company and

its peers, which the Company believes makes comparisons of

long-term performance trends difficult for management and

investors. Beginning in 2017, Organic Revenue Growth is also used

as a performance metric to determine bonus payments for senior

management and employees.

Adjusted Gross Profit and Adjusted Gross Profit

Margin

The calculation of Adjusted Gross Profit and Adjusted Gross

Profit Margin is displayed in the tables above. Adjusted Gross

Profit and Adjusted Gross Profit Margin exclude amortization of

acquired intangible assets and inventory fair value adjustments

related to business acquisitions because: (1) the amounts are

non-cash; (2) the Company cannot influence the timing and amount of

future expense recognition; and (3) excluding such expenses

provides investors and management better visibility into the

components of operating costs.

Adjusted Operating Income and Adjusted Operating

Margin

The calculation of Adjusted Operating Income and Adjusted

Operating Margin is displayed in the tables above. Adjusted

Operating Income and Adjusted Operating Margin exclude amortization

of acquired intangible assets and inventory fair value adjustments

related to business acquisitions because: (1) the amounts are

non-cash; (2) the Company cannot influence the timing and

amount of future expense recognition; and (3) excluding such

expenses provides investors and management better visibility into

the components of operating costs. The Company also excluded

restructuring, acquisition and divestiture related costs due to the

significant changes that have occurred outside of the Company’s

day-to-day business for the reasons described above in the

introductory paragraphs of the “Use of Non-GAAP Financial

Measures.”

Adjusted Income before Income Taxes

The calculation of Adjusted Income before Income Taxes is

displayed in the tables above. The calculation of Adjusted Income

before Income Taxes excludes amortization of acquired intangible

assets, inventory fair value adjustments related to business

acquisitions, and restructuring, acquisition and divestiture

related costs for the reasons described for Adjusted Operating

Income and Adjusted Operating Margin above. In addition, the

Company excluded the prior year gain recognized upon increasing its

equity ownership position in Laser Quantum from approximately 41%

to approximately 76% because the gain is unusual and nonrecurring

in nature and should be excluded from the assessment of long-term

performance trends of the Company.

Non-GAAP Income Tax Provision and Effective Tax Rate

The Non-GAAP Income Tax Provision and Effective Tax Rate are

calculated based on the Adjusted Income before Income Taxes by

jurisdiction and the applicable tax rates currently in effect for

the respective jurisdictions. In addition, the Company excluded

significant discrete income tax expenses (benefits) related to

releases of valuation allowances, benefits or expenses associated

with the completion of tax audits, effects of changes in tax laws,

effects of acquisition related tax planning actions on our

effective tax rate, and the income tax effect of non-GAAP

adjustments discussed above.

Adjusted Net Income Attributable to Novanta Inc., Net of

Tax

The calculation of Adjusted Net Income Attributable to Novanta

Inc., Net of Tax, is displayed in the tables above. Because pre-tax

income is included in determining net income attributable to

Novanta Inc., net of tax, the calculation of Adjusted Net Income

Attributable to Novanta Inc., Net of Tax, also excludes

amortization of acquired intangible assets, inventory fair value

adjustments related to business acquisitions, and restructuring,

acquisition and divestiture related costs and prior year gain on

the Laser Quantum acquisition for the reasons described for

Adjusted Income before Income Taxes. In addition, the Company

excluded significant discrete income tax expenses (benefits)

related to releases of valuation allowances, benefits or expenses

associated with the completion of tax audits, effects of changes in

tax laws, effects of acquisition related tax planning actions on

our effective tax rate, and the income tax effect of non-GAAP

adjustments discussed above.

Adjusted Diluted EPS

The calculation of Adjusted Diluted EPS is displayed in the

tables above. Because Net Income Attributable to Novanta Inc., Net

of Tax, is used in the diluted EPS calculation, the calculation of

Adjusted Diluted EPS excludes amortization of acquired intangible

assets, inventory fair value adjustments related to business

acquisitions, restructuring, acquisition and divestiture related

costs, and prior year gain on the Laser Quantum acquisition,

significant discrete income tax expenses (benefits) related to

releases of valuation allowances, benefits or expenses associated

with the completion of tax audits, effects of changes in tax laws,

effects of acquisition related tax planning actions on our

effective tax rate, and the income tax effect of non-GAAP

adjustments for the reasons described above for Adjusted Net Income

Attributable to Novanta Inc., Net of Tax. In addition, the Company

excluded the redeemable noncontrolling interest redemption value

adjustment as (1) the adjustment is unusual; (2) the amount is

noncash; (3) the amount does not represent a measure of earnings

and is excluded from the determination of net income attributable

to Novanta Inc.; and (4) the Company believes it may not be

indicative of future adjustments and that investors may benefit

from an understanding of the Company's operating results without

giving effect to this adjustment.

Adjusted EBITDA and Adjusted EBITDA Margin

The Company defines Adjusted EBITDA as the consolidated net

income before deducting interest (income) expense, income taxes,

depreciation, amortization, non-cash share-based compensation,

restructuring, acquisition and divestiture related costs,

acquisition fair value adjustments, prior year gain on the Laser

Quantum acquisition, other non-operating income (expense) items,

including foreign exchange gains (losses), net periodic pension

costs of the Company’s frozen U.K. defined benefit pension plan,

and earnings from an equity-method investment for the reasons

described above in the introductory paragraphs of the “Use of

Non-GAAP Financial Measures.”

Adjusted EBITDA includes 100% of the results of our consolidated

subsidiaries and therefore does not exclude the Adjusted EBITDA

attributable to noncontrolling interests.

Adjusted EBITDA Margin is defined as Adjusted EBITDA as a

percentage of Revenue.

In evaluating Adjusted EBITDA and Adjusted EBITDA Margin, you

should be aware that in the future the Company may incur expenses

that are the same as, or similar to, some of the adjustments in

this presentation.

Free Cash Flow and Free Cash Flow as a Percentage of Net

Income Attributable to Novanta, Inc.

The Company defines Free Cash Flow as cash provided by (used in)

operating activities less cash paid for purchases of property,

plant and equipment and plus cash proceeds from sale of property,

plant and equipment. Free Cash Flow as a Percentage of Net Income

Attributable to Novanta, Inc. is defined as Free Cash Flow divided

by Net Income Attributable to Novanta, Inc. Management believes

these non-GAAP measures are important indicators of the Company’s

liquidity as well as its ability to service its outstanding debt,

and to fund future growth.

Net Debt

The Company defines Net Debt as its total debt as reported on

the consolidated balance sheet plus unamortized deferred financing

costs and less its cash and cash equivalents as of the end of the

period presented. Management uses Net Debt to monitor the Company’s

outstanding debt obligations that could not be satisfied by its

cash and cash equivalents on hand.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190227005171/en/

Novanta Inc.Investor Relations Contact:Robert J.

Buckley(781) 266-5137

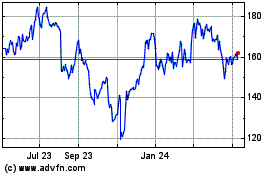

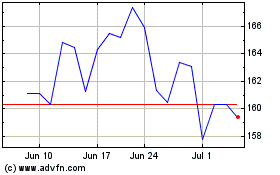

Novanta (NASDAQ:NOVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Novanta (NASDAQ:NOVT)

Historical Stock Chart

From Apr 2023 to Apr 2024