Annualized Cloud Revenue Run Rate Surpasses

$800 Million

Q3 Cash Flow From Operations Increased 20%

to $99 Million

NICE (NASDAQ: NICE) today announced results for the third quarter

ended September 30, 2020.

Third Quarter 2020 Financial Highlights

GAAP

Non-GAAP

Cloud

revenue of $202 million, growth of 34% year-over-year

Cloud

revenue of $204 million, growth of 35% year-over-year

Total

revenue of $410 million, growth of 6% year-over-year

Total

revenue of $412 million, growth of 7% year-over-year

Gross

margin of 65.8% compared to 65.7% last year

Gross

margin of 71.0% compared to 70.9% last year

Cloud

gross margin of 56.6% compared to 51.6% last year

Cloud

gross margin of 65.6% compared to 61.9% last year

Operating income of $62 million compared to

$56 million last year, an increase of 11%

Operating income of $117 million compared to

$106 million last year, an increase of 10%

Operating margin of 15.1% compared to 14.4%

last year

Operating margin of 28.3% compared to 27.4%

last year

Diluted

EPS of $0.76 versus $0.69 last year, 10% growth

year-over-year

Diluted

EPS of $1.41 versus $1.30 last year, 8% growth

year-over-year

Operating cash flow of $99 million compared

to $82 million last year

“We are pleased to report a very strong third quarter driven by

continued rapid acceleration in our cloud business,” said Barak

Eilam, CEO, NICE. “Cloud grew a record 35 percent and now

represents 50 percent of our total revenue, which is a major

milestone for NICE. We achieved 10 percent sequential growth in the

cloud compared to the second quarter of this year, and we already

surpassed the more than 800 million dollar cloud revenue run rate

that we had originally expected by the end of the year.”

Mr. Eilam continued, “The acceleration in our cloud growth is

being driven by several factors, including substantial growth in

new customers, rapid adoption by large enterprises, new verticals

that are embracing remote service and digital transformation that

has become front and center for organizations of all sizes. We

witnessed an increase of over 50 percent in new customers compared

to the same quarter last year. Additionally, we saw a 91 percent

sequential increase in digital volumes for CXone, and a 154 percent

increase year-over-year, confirming the strength of our leadership

in digital.”

GAAP Financial Highlights for the Third Quarter Ended

September 30:

Revenues: Third quarter 2020 total revenues increased

6.1% to $409.8 million compared to $386.3 million for the third

quarter of 2019.

Gross Profit: Third quarter 2020 gross profit and gross

margin increased to $269.7 million and 65.8%, respectively,

compared to $253.6 million and 65.7%, respectively, for the third

quarter of 2019.

Operating Income: Third quarter 2020 operating income and

operating margin increased to $62.0 million and 15.1%,

respectively, compared to $55.7 million and 14.4%, respectively,

for the third quarter of 2019.

Net Income: Third quarter 2020 net income and net income

margin increased to $50.7 million and 12.4%, respectively, compared

to $45.0 million and 11.7%, respectively, for the third quarter of

2019.

Fully Diluted Earnings Per Share: Fully diluted earnings

per share for the third quarter of 2020 increased 10.1% to $0.76,

compared to $0.69 in the third quarter of 2019.

Operating Cash Flow and Cash Balance: Third quarter 2020

operating cash flow was $99.0 million. As of September 30, 2020,

total cash and cash equivalents, short term investments were

$1,542.5 million, and total debt was $891.3 million.

Non-GAAP Financial Highlights for the Third Quarter Ended

September 30:

Revenues: Third quarter 2020 non-GAAP total revenues

increased to $412.4 million, up 6.5% from $387.1 million for the

third quarter of 2019.

Gross Profit: Third quarter 2020 non-GAAP gross profit

and gross margin increased to $292.9 million and 71.0%,

respectively, from $274.4 million and 70.9%, respectively for the

third quarter of 2019.

Operating Income: Third quarter 2020 non-GAAP operating

income and non-GAAP operating margin increased to $116.8 million

and 28.3%, respectively, from $105.9 million and 27.4%,

respectively, for the third quarter of 2019.

Net Income: Third quarter 2020 non-GAAP net income and

non-GAAP net income margin increased to $93.6 million and 22.7%,

respectively, from $84.3 million and 21.8%, respectively, for the

third quarter of 2019.

Fully Diluted Earnings Per Share: Third quarter 2020

non-GAAP fully diluted earnings per share increased 8.5% to $1.41,

compared to $1.30 for the third quarter of 2019.

Full-Year 2020 Guidance:

Full-year 2020 Non-GAAP total revenues are expected to be in a

range of $1,645 million to $1,655 million. Full-year 2020 Non-GAAP

fully diluted earnings per share are expected to be in a range of

$5.63 to $5.73.

Quarterly Results Conference Call

NICE management will host its earnings conference call today

November 12th, 2020 at 8:30 AM ET, 13:30 GMT, 15:30 Israel, to

discuss the results and the company's outlook. To participate in

the call, please dial into the following numbers: United States

1-866-804-8688 or +1-718-354-1175, International

+44(0)1296-480-100, United Kingdom 0-800-783-0906, Israel

1-809-344-364. The Passcode is 308 565 57. Additional access

numbers can be found at

http://www.btconferencing.com/globalaccess/?bid=54_attended. The

call will be webcast live on the Company’s website at

https://www.nice.com/investor-relations/upcoming-event. An online

replay will also be available approximately two hours following the

call. A telephone replay of the call will be available for 7 days

after the live broadcast and may be accessed by dialing: United

States 1-877-482-6144, International +44(0)20-7136-9233, United

Kingdom 0-800-032-9687. The Passcode for the replay is 783 390

51.

Non-GAAP financial measures are included in this press release.

Non-GAAP financial measures consist of GAAP financial measures

adjusted to exclude share-based compensation, amortization of

acquired intangible assets, acquisition related expenses,

amortization of discount on long term debt and the tax effect of

the Non-GAAP adjustments. Business combination accounting rules

require the recognition of a legal performance obligation related

to a revenue arrangement of an acquired entity as a liability. The

amount assigned to such liability should be based on its fair value

at the date of acquisition. The Non-GAAP adjustment for a revenue

arrangement is intended to reflect the full amount of such revenue.

The Company believes that these Non-GAAP financial measures, used

in conjunction with the corresponding GAAP measures, provide

investors with useful supplemental information about the financial

performance of our business. We believe Non-GAAP financial measures

are useful to investors as a measure of the ongoing performance of

our business. Our management regularly uses our supplemental

Non-GAAP financial measures internally to understand, manage and

evaluate our business and to make financial, strategic and

operating decisions. These Non-GAAP measures are among the primary

factors management uses in planning for and forecasting future

periods. Our Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

These Non-GAAP financial measures may differ materially from the

Non-GAAP financial measures used by other companies. Reconciliation

between results on a GAAP and Non-GAAP basis is provided in a table

immediately following the Consolidated Statements of Income. The

Company provides guidance only on a Non-GAAP basis. A

reconciliation of guidance from a GAAP to Non-GAAP basis is not

available due to the unpredictability and uncertainty associated

with future events that would be reported in GAAP results and would

require adjustments between GAAP and Non-GAAP financial measures,

including the impact of future possible business acquisitions.

Accordingly, a reconciliation of the guidance based on Non-GAAP

financial measures to corresponding GAAP financial measures for

future periods is not available without unreasonable effort.

About NICE NICE (Nasdaq: NICE) is the worldwide leading

provider of both cloud and on-premises enterprise software

solutions that empower organizations to make smarter decisions

based on advanced analytics of structured and unstructured data.

NICE helps organizations of all sizes deliver better customer

service, ensure compliance, combat fraud and safeguard citizens.

Over 25,000 organizations in more than 150 countries, including

over 85 of the Fortune 100 companies, are using NICE solutions.

www.nice.com.

Trademark Note: NICE and the NICE logo are trademarks or

registered trademarks of NICE. All other marks are trademarks of

their respective owners. For a full list of NICE' marks, please

see: http://www.nice.com/nice-trademarks.

Forward-Looking Statements

This press release contains forward-looking statements as that

term is defined in the Private Securities Litigation Reform Act of

1995. In some cases, forward-looking statements may be identified

by words such as “believe,” “expect,” “seek,” “may,” “will,”

“intend,” “should,” “project,” “anticipate,” “plan,” and similar

expressions. Forward-looking statements are based on the current

beliefs, expectations and assumptions of the Company’s management

regarding the future of the Company’s business, future plans and

strategies, projections, anticipated events and trends, the economy

and other future conditions. Examples of forward-looking statements

include guidance regarding the Company’s revenue and earnings and

the growth of our cloud business.

Forward looking statements are inherently subject to significant

economic, competitive and other uncertainties and contingencies,

many of which are beyond the control of management. The Company

cautions that these statements are not guarantees of future

performance, and investors should not place undue reliance on them.

There are or will be important known and unknown factors and

uncertainties that could cause actual results to differ materially

from those expressed or implied in the forward-looking statements.

These factors, include, but are not limited to, risks associated

with changes in economic and business conditions, competition,

successful execution of the Company’s growth strategy, success and

growth of the Company’s cloud Software-as-a-Service business,

difficulties in making additional acquisitions or effectively

integrating acquired operations, products, technologies and

personnel, the Company’s dependency on third-party cloud computing

platform providers, hosting facilities and service partners,

rapidly changing technology, cyber security attacks or other

security breaches against the Company, privacy concerns and

legislation impacting the Company’s business, changes in currency

exchange rates and interest rates, the effects of additional tax

liabilities resulting from our global operations and various other

factors and uncertainties discussed in our filings with the U.S.

Securities and Exchange Commission (the “SEC”). In addition,

COVID-19 is contributing to a general slowdown in the global

economy and may affect the Company’s business, results of

operations, financial condition and our future strategic plans. At

this time, the extent to which the COVID-19 may impact the

Company’s financial condition or results of operations is

uncertain. Furthermore, due to our subscription based business

model, the effect of the COVID-19 may not be fully reflected in our

results of operations until future periods, if at all. You are

encouraged to carefully review the section entitled “Risk Factors”

in our latest Annual Report on Form 20-F and our other filings with

the SEC for additional information regarding these and other

factors and uncertainties that could affect our future performance.

The forward-looking statements contained in this presentation speak

only as of the date hereof, and the Company undertakes no

obligation to update or revise them, whether as a result of new

information, future developments or otherwise, except as required

by law.

###

NICE LTD. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS U.S. dollars in thousands

September 30,

December 31,

2020

2019

Unaudited

Audited

ASSETS CURRENT ASSETS: Cash and cash

equivalents

$

753,116

$

228,323

Short-term investments

789,415

210,772

Trade receivables

294,176

319,622

Prepaid expenses and other current assets

128,926

116,972

Total current assets

1,965,633

875,689

LONG-TERM ASSETS: Long-term investments

-

542,389

Property and equipment, net

140,262

141,647

Deferred tax assets

25,808

30,513

Other intangible assets, net

395,809

411,019

Operating lease right-of-use assets

102,132

106,196

Goodwill

1,496,429

1,378,418

Other long-term assets

145,343

124,034

Total long-term assets

2,305,783

2,734,216

TOTAL ASSETS

$

4,271,416

$

3,609,905

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES: Trade payables

$

33,685

$

30,376

Deferred revenues and advances from customers

260,059

245,792

Current maturities of operating leases

21,846

21,519

Exchangeable senior notes

257,732

251,583

Accrued expenses and other liabilities

366,658

391,685

Total current liabilities

939,980

940,955

LONG-TERM LIABILITIES: Deferred revenues and advances

from customers

35,871

26,045

Operating leases

97,764

103,490

Deferred tax liabilities

44,088

52,509

Long-term debt

633,584

213,313

Other long-term liabilities

17,052

16,327

Total long-term liabilities

828,359

411,684

SHAREHOLDERS' EQUITY Nice Ltd's equity

2,478,555

2,257,266

Non-controlling interests

24,522

-

Total shareholders' equity

2,503,077

2,257,266

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

$

4,271,416

$

3,609,905

NICE LTD. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

INCOME U.S. dollars in thousands (except per share amounts)

Quarter ended

Year to date

September 30,

September 30,

2020

2019

2020

2019

Unaudited

Unaudited

Unaudited

Unaudited

Revenue: Product

$

38,746

$

56,950

$

141,611

$

188,999

Services

169,358

178,609

513,529

525,947

Cloud

201,723

150,704

558,295

428,758

Total revenue

409,827

386,263

1,213,435

1,143,704

Cost of revenue: Product

5,434

5,318

16,711

16,850

Services

47,008

54,476

150,558

164,218

Cloud

87,637

72,877

248,628

213,418

Total cost of revenue

140,079

132,671

415,897

394,486

Gross profit

269,748

253,592

797,538

749,218

Operating expenses: Research and development, net

55,482

48,531

162,019

141,553

Selling and marketing

97,011

96,138

294,332

293,083

General and administrative

45,801

42,438

135,312

121,181

Amortization of acquired intangible assets

9,496

10,780

28,951

32,276

Total operating expenses

207,790

197,887

620,614

588,093

Operating income

61,958

55,705

176,924

161,125

Financial and other expense/(income), net

1,032

(252

)

2,259

3,890

Income before tax

60,926

55,957

174,665

157,235

Taxes on income

10,273

10,918

33,293

33,074

Net income

$

50,653

$

45,039

$

141,372

$

124,161

Less: net loss attributable to non-controlling interests

112

-

378

-

Net income attributable to Nice Ltd.'s shareholders

$

50,765

$

45,039

$

141,750

$

124,161

Earnings per share: Basic

$

0.81

$

0.72

$

2.26

$

2.00

Diluted

$

0.76

$

0.69

$

2.15

$

1.93

Weighted average shares outstanding: Basic

62,756

62,160

62,624

62,041

Diluted

66,253

65,066

65,741

64,493

NICE LTD. AND SUBSIDIARIES RECONCILIATION OF GAAP TO

NON-GAAP RESULTS U.S. dollars in thousands (except per share

amounts)

Quarter ended

Year to date

September 30,

September 30,

2020

2019

2020

2019

GAAP revenues

$

409,827

$

386,263

$

1,213,435

$

1,143,704

Valuation adjustment on acquired deferred product revenue

-

-

-

15

Valuation adjustment on acquired deferred services revenue

81

3

81

5

Valuation adjustment on acquired deferred cloud revenue

2,458

867

5,187

2,692

Non-GAAP revenues

$

412,366

$

387,133

$

1,218,703

$

1,146,416

GAAP cost of revenue

$

140,079

$

132,671

$

415,897

$

394,486

Amortization of acquired intangible assets on cost of product

(1,135

)

(1,123

)

(3,394

)

(2,972

)

Amortization of acquired intangible assets on cost of services

(322

)

(1,535

)

(3,341

)

(4,604

)

Amortization of acquired intangible assets on cost of cloud

(16,800

)

(15,270

)

(48,422

)

(45,118

)

Valuation adjustment on acquired deferred cost of cloud

200

575

737

1,893

Cost of product revenue adjustment (1)

(69

)

(97

)

(205

)

(304

)

Cost of services revenue adjustment (1)

(1,677

)

(2,106

)

(4,957

)

(6,251

)

Cost of cloud revenue adjustment (1)

(809

)

(358

)

(2,601

)

(2,142

)

Non-GAAP cost of revenue

$

119,467

$

112,757

$

353,714

$

334,988

GAAP gross profit

$

269,748

$

253,592

$

797,538

$

749,218

Gross profit adjustments

23,151

20,784

67,451

62,210

Non-GAAP gross profit

$

292,899

$

274,376

$

864,989

$

811,428

GAAP operating expenses

$

207,790

$

197,887

$

620,614

$

588,093

Research and development (1,2)

(2,565

)

(2,033

)

(7,553

)

(5,182

)

Sales and marketing (1,2)

(5,561

)

(7,737

)

(19,623

)

(19,211

)

General and administrative (1,2)

(14,065

)

(8,962

)

(38,239

)

(24,378

)

Amortization of acquired intangible assets

(9,496

)

(10,780

)

(28,951

)

(32,276

)

Valuation adjustment on acquired deferred commission

35

76

106

245

Non-GAAP operating expenses

$

176,138

$

168,451

$

526,354

$

507,291

GAAP financial and other expense/(income), net

$

1,032

$

(252

)

$

2,259

$

3,890

Amortization of discount on debt

(3,070

)

(2,377

)

(7,944

)

(6,847

)

Non-GAAP financial and other income, net

$

(2,038

)

$

(2,629

)

$

(5,685

)

$

(2,957

)

GAAP taxes on income

$

10,273

$

10,918

$

33,293

$

33,074

Tax adjustments re non-GAAP adjustments

14,911

13,324

39,701

33,258

Non-GAAP taxes on income

$

25,184

$

24,242

$

72,994

$

66,332

GAAP net income

$

50,653

$

45,039

$

141,372

$

124,161

Valuation adjustment on acquired deferred revenue

2,539

870

5,268

2,712

Valuation adjustment on acquired deferred cost of cloud revenue

(200

)

(575

)

(737

)

(1,893

)

Amortization of acquired intangible assets

27,753

28,708

84,108

84,970

Valuation adjustment on acquired deferred commission

(35

)

(76

)

(106

)

(245

)

Share-based compensation (1)

22,404

21,293

69,255

56,625

Acquisition related expenses (2)

2,342

-

3,923

843

Amortization of discount on long term debt

3,070

2,377

7,944

6,847

Tax adjustments re non-GAAP adjustments

(14,911

)

(13,324

)

(39,701

)

(33,258

)

Non-GAAP net income

$

93,615

$

84,312

$

271,326

$

240,762

GAAP diluted earnings per share

$

0.76

$

0.69

$

2.15

$

1.93

Non-GAAP diluted earnings per share

$

1.41

$

1.30

$

4.13

$

3.73

Shares used in computing GAAP diluted earnings per share

66,253

65,066

65,741

64,493

Shares used in computing non-GAAP diluted earnings per share

66,253

65,066

65,741

64,493

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP RESULTS (continued) U.S.

dollars in thousands

(1) Share-based Compensation

Quarter ended

Year to date

September 30,

September 30,

2020

2019

2020

2019

Cost of product revenue

$

69

$

97

$

205

$

304

Cost of services revenue

1,677

2,106

4,957

6,251

Cost of cloud revenue

809

358

2,601

2,142

Research and development

2,565

2,033

7,553

5,177

Sales and marketing

5,519

7,737

19,493

19,181

General and administrative

11,765

8,962

34,446

23,570

$

22,404

$

21,293

$

69,255

$

56,625

(2) Acquisition related expenses

Quarter ended

Year to date

September 30,

September 30,

2020

2019

2020

2019

Research and development

$

-

$

-

$

-

$

5

Sales and marketing

42

-

130

30

General and administrative

2,300

-

3,793

808

$

2,342

$

-

$

3,923

$

843

NICE LTD. AND SUBSIDIARIES CONSOLIDATED CASH FLOW

STATEMENTS U.S. dollars in thousands

Quarter ended

Year to date

September 30,

September 30,

2020

2019

2020

2019

Unaudited

Unaudited

Unaudited

Unaudited

Operating Activities Net

income

$

50,653

$

45,039

$

141,372

$

124,161

Depreciation and amortization

45,482

43,924

135,133

128,744

Stock based compensation

22,207

21,273

68,839

56,589

Amortization of premium and discount and accrued interest on

marketable securities

2,080

387

(790

)

(187

)

Deferred taxes, net

(6,783

)

(12,485

)

(16,653

)

(31,107

)

Changes in operating assets and liabilities: Trade Receivables

12,795

6,788

27,588

26,900

Prepaid expenses and other assets

3,131

(15,626

)

(31,637

)

(88,157

)

Trade payables

6,036

(8,791

)

5,231

(5,073

)

Accrued expenses and other current liabilities

(15,124

)

44,173

(36,584

)

53,789

Operating lease right-of-use assets, net

4,414

4,346

12,926

11,842

Deferred revenue

(23,481

)

(45,558

)

14,617

13,311

Long term liabilities

-

(20

)

-

(300

)

Operating lease liabilities

(4,608

)

(2,836

)

(14,297

)

(11,995

)

Amortization of discount on long term debt

3,070

2,379

7,945

6,848

Other

(839

)

(672

)

(254

)

(2,656

)

Net cash provided by operating activities

99,033

82,321

313,436

282,709

Investing Activities

Purchase of property and equipment

(4,211

)

(6,545

)

(21,667

)

(21,527

)

Purchase of Investments

(151,589

)

(187,752

)

(306,077

)

(493,894

)

Proceeds from Investments

118,284

113,121

283,149

283,629

Capitalization of software development costs

(9,577

)

(8,549

)

(28,776

)

(25,940

)

Payments for business and asset acquisitions, net of cash acquired

(96,425

)

(184

)

(147,261

)

(25,972

)

Net cash used in investing activities

(143,518

)

(89,909

)

(220,632

)

(283,704

)

Financing Activities

Proceeds from issuance of shares upon exercise of share options

828

1,693

8,177

4,711

Purchase of treasury shares

-

(7,897

)

(27,601

)

(22,612

)

Capital Lease payments

-

(191

)

(177

)

(631

)

Proceeds from issuance of exchangeable notes

451,469

-

451,469

-

Net cash provided by/(used in) financing activities

452,297

(6,395

)

431,868

(18,532

)

Effect of exchange rates on cash and cash equivalents

1,206

(1,489

)

121

(1,733

)

Net change in cash and cash equivalents

409,018

(15,472

)

#

524,793

(21,260

)

Cash and cash equivalents, beginning of period

$

344,098

$

236,311

$

228,323

$

242,099

Cash and cash equivalents, end of period

$

753,116

$

220,839

$

753,116

$

220,839

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201112005477/en/

Contact Investors

Marty Cohen, +1 551 256 5354, ET, ir@nice.com Yisca Erez, +972 9

775-3798, CET, ir@nice.com

Media Contact Chris Irwin-Dudek, +1 (551) 256-5140,

Chris.Irwin-Dudek@nice.com

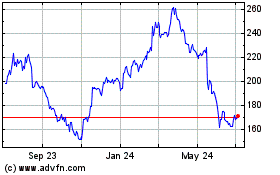

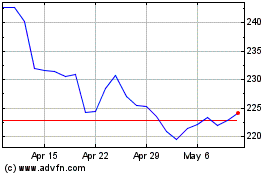

NICE (NASDAQ:NICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

NICE (NASDAQ:NICE)

Historical Stock Chart

From Apr 2023 to Apr 2024