Partnering with the X-Sight Marketplace, Alloy

will offer a single API to allow real-time decision making on

identity and risk

Helping financial services organizations keep

up with a changing market landscape, NICE Actimize,

a NICE business (Nasdaq: NICE) and leader

in autonomous financial crime management, today announced that

Alloy has joined the X-Sight Marketplace, the industry’s first

financial crime risk management-focused ecosystem designed to

assist financial services organizations evaluate new point

solutions and move to stay on top of a challenging regulatory and

criminal environment.

The X-Sight Marketplace leverages the X-Sight

Platform-as-a-Service and further expands the functionality offered

by the platform. The NICE Actimize X-Sight Platform-as-a-Service

offers a single, unified, cost-effective way for financial service

organizations to rapidly innovate and to introduce new services

while supporting best-in-class financial crime, risk and compliance

management capabilities.

Alloy, known for its identity and risk decisioning, will offer a

single API and dashboard to the X-Sight MarketPlace community.

Alloy will bring the NICE Actimize Marketplace community stronger

capabilities to allow them to make better decisions around KYC,

AML, fraud and more, from signup and throughout the life of the

customer. NICE Actimize customers will be able to utilize this

capability to reduce their fraud rates, improve customer experience

and grow their topline revenue.

Technology providers such as Alloy that join the NICE Actimize

X-Sight Marketplace ecosystem, are reviewed for their ability to

complement financial crime and compliance solutions. Once approved,

software and service providers become available to the NICE

Actimize community via the X-Sight Marketplace. FSOs can quickly

browse through X-Sight Marketplace solution categories to find

scalable options that solve their unique business problems.

“Alloy appreciates this partnership with NICE Actimize as we

bring innovation and business value to financial services

organizations looking for a faster selection and assessment process

that bolster their financial crime operations,” said Tommy

Nicholas, CEO, Alloy. “There is strong synergy and

alignment between the industry-leading financial crime solutions

and platforms that NICE Actimize offers its community and Alloy. We

look forward to building our presence on this innovative community

platform.”

“We are excited that Alloy, who shares our common goal of

fighting financial crime through the benefits of a Marketplace

ecosytem, is partnering with us and joining the X-Sight Marketplace

community,” said Craig Costigan, CEO, NICE Actimize.

“By connecting via a Cloud environment, community

participants will experience a quicker time to value and minimized

integration cost as they evaluate new solutions for their financial

services organizations.”

Additional categories that will be added to NICE Actimize’s

X-Sight Marketplace from other partner participants will include:

ID Verification, Ultimate Beneficial Ownership, Value-added Data

& Adverse Media, Watchlist, Device Identification, and User

Authentication & Fraud. Additional partners will be announced

as the X-Sight Marketplace grows.

About Alloy Alloy helps companies make

better decisions with better information, using a single API

service and dashboard to manage identity verification from signup

through the lifecycle of the customer. Alloy makes it easy for

financial services companies to quickly and safely decision more

customers and transactions, mitigating fraud and high-cost

financial risk.

Visit www.alloy.co to learn more and follow them on Twitter

@UseAlloy.

For more information on the X-Sight Marketplace, please

click here.

If you are a technology company or financial institution wishing

to be part of the first financial crime and compliance marketplace,

please contact us at

info@niceactimize.com.

About NICE Actimize NICE Actimize is the

largest and broadest provider of financial crime, risk and

compliance solutions for regional and global financial

institutions, as well as government regulators. Consistently ranked

as number one in the space, NICE Actimize experts apply innovative

technology to protect institutions and safeguard consumers and

investors assets by identifying financial crime, preventing fraud

and providing regulatory compliance. The company provides

real-time, cross-channel fraud prevention, anti-money laundering

detection, and trading surveillance solutions that address such

concerns as payment fraud, cybercrime, sanctions monitoring, market

abuse, customer due diligence and insider trading. Find us at

www.niceactimize.com, @NICE_Actimize or Nasdaq: NICE.

About NICE NICE (Nasdaq: NICE) is the

worldwide leading provider of both cloud and on-premises enterprise

software solutions that empower organizations to make smarter

decisions based on advanced analytics of structured and

unstructured data. NICE helps organizations of all sizes deliver

better customer service, ensure compliance, combat fraud and

safeguard citizens. Over 25,000 organizations in more than 150

countries, including over 85 of the Fortune 100 companies, are

using NICE solutions. www.nice.com

Trademark Note: NICE and the NICE logo are

trademarks or registered trademarks of NICE Ltd. All other marks

are trademarks of their respective owners. For a full list of

NICE’s marks, please see: www.nice.com/nice-trademarks.

Forward-Looking Statements This press

release contains forward-looking statements as that term is defined

in the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements, including the statements by Mr.

Costigan are based on the current beliefs, expectations and

assumptions of the management of NICE Ltd. (the Company). In some

cases, such forward-looking statements can be identified by terms

such as believe, expect, may, will, intend, project, plan, estimate

or similar words. Forward-looking statements are subject to a

number of risks and uncertainties that could cause the actual

results or performance of the Company to differ materially from

those described herein, including but not limited to the impact of

the global economic environment on the Company’s customer base

(particularly financial services firms) potentially impacting our

business and financial condition; competition; changes in

technology and market requirements; decline in demand for the

Company's products; inability to timely develop and introduce new

technologies, products and applications; difficulties or delays in

absorbing and integrating acquired operations, products,

technologies and personnel; loss of market share; an inability to

maintain certain marketing and distribution arrangements; and the

effect of newly enacted or modified laws, regulation or standards

on the Company and our products. For a more detailed description of

the risk factors and uncertainties affecting the company, refer to

the Company's reports filed from time to time with the Securities

and Exchange Commission, including the Company’s Annual Report on

Form 20-F. The forward-looking statements contained in this press

release are made as of the date of this press release, and the

Company undertakes no obligation to update or revise them, except

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190806005378/en/

Corporate Media Cindy Morgan-Olson, 551-256-5202,

cindy.morgan-olson@niceactimize.com

Investors Marty Cohen, +1 551 256 5354, ET, ir@nice.com

Yisca Erez +972 9 775 3798, CET, ir@nice.com

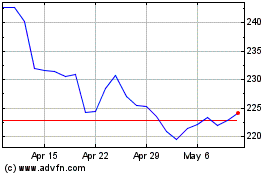

NICE (NASDAQ:NICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

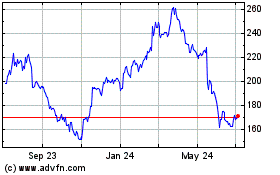

NICE (NASDAQ:NICE)

Historical Stock Chart

From Apr 2023 to Apr 2024