News Corp Posts Lower Profit, Revenue

February 06 2020 - 7:22PM

Dow Jones News

By Lukas I. Alpert

News Corp reported declines in profit and revenue for its latest

quarter in the face of a sluggish economy in Australia, softness in

its book-publishing unit and foreign-currency headwinds.

The New York-based media company, owner of The Wall Street

Journal and HarperCollins Publishers, said net income for its

fiscal second quarter was $85 million, or 14 cents a share, down

11% from $95 million, or 16 cents a share, in the year-earlier

period.

Revenue fell 5.6% to $2.48 billion for the quarter, which ended

Dec. 31. Analysts polled by Factset expected earnings of 14 cents a

share on revenue of $2.52 billion. Excluding impairment and

restructuring charges, the company reported adjusted earnings per

share of 18 cents.

"We expect improvement in the second half as real-estate markets

show signs of gradual recovery, Dow Jones benefits from new content

licensing arrangements and higher digital subscribers, and

HarperCollins capitalizes on an exciting slate of new releases,"

Chief Executive Robert Thomson said in a statement.

News Corp in October reached a deal to let Facebook Inc. feature

headlines from the Journal and other Dow Jones media properties, as

well as the New York Post, in the social-media giant's news

section. Earlier in 2019, the Journal became a launch partner for

Apple Inc.'s news service.

Mr. Thomson said the deals with Apple and Facebook were

"beginning to yield financial dividends."

As part of an effort to simplify its operations, News Corp last

month agreed to sell video-advertising platform Unruly to Tremor

International Ltd., fetching significantly less than it paid for

the British startup five years earlier.

Mr. Thomson said the company is still "engaged in negotiations

for the sale of News America Marketing," its in-store marketing and

coupon business.

Earnings before interest, taxes, depreciation and amortization,

or Ebitda, fell 4% to $355 million in the latest quarter.

Currency fluctuations, particularly weakness of the Australian

dollar, affected revenue negatively by $50 million, or 2% of the

total, the company said. Economic issues in Australia also resulted

in lower subscription revenue for the company's

satellite-television business and reduced revenue to its

real-estate listing business due to weak housing prices.

News Corp's largest unit, the news and information-services

business that includes the Journal, Times of London and New York

Post, reported a 1.3% decline in revenue to $1.24 billion.

Within the segment, Dow Jones and News UK revenue grew 4% and

2%, respectively, while revenue at News Corp Australia and News

America Marketing declined 9% and 4%.

Advertising revenue for the news unit declined 5%, while

circulation and subscription revenue rose 3% overall. At Journal

parent Dow Jones, circulation revenue rose 5%, boosted in part by a

17% year-over-year increase in digital subscribers, as well as

subscription price increases.

The Journal added 75,000 digital subscribers from the end of the

previous quarter, bringing its total to 1.929 million. That was

more than double the 36,000 new subscribers added in the previous

quarter. As of the end of December, the Journal also had 772,000

print subscribers.

Advertising revenue at Dow Jones fell 5% on the year, the

company said.

Ebitda rose 27% at the news unit to $142 million, primarily due

to a one-time warranty claim settlement related to the company's

print business in the U.K., greater contributions from the

company's British titles and from Dow Jones and lower losses at the

New York Post.

Revenue in the company's book publishing unit fell 11% due to

challenging comparisons to the year-earlier period, which saw high

sales of "Homebody: a Guide to Creating Spaces You Never Want to

Leave," by Joanna Grimes and "Girl, Wash Your Face," by Rachel

Hollis.

The digital real-estate business reported a 5% decline in

revenue to $294 million and a 2% drop in Ebitda to $118

million.

Revenue at News Corp's subscription-video-services unit fell 11%

to $501 million and Ebitda fell 17% to $70 million.

Write to Lukas I. Alpert at lukas.alpert@wsj.com

(END) Dow Jones Newswires

February 06, 2020 19:07 ET (00:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

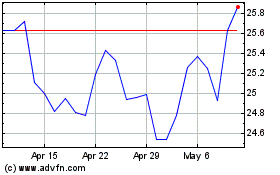

News (NASDAQ:NWS)

Historical Stock Chart

From Mar 2024 to Apr 2024

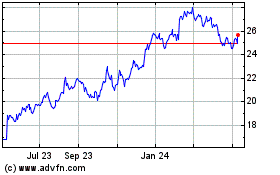

News (NASDAQ:NWS)

Historical Stock Chart

From Apr 2023 to Apr 2024