New Netflix CFO to Tackle Cash Flow Conundrum

January 02 2019 - 9:06PM

Dow Jones News

By Tatyana Shumsky

Spencer Neumann, who on Wednesday was named Netflix Inc.'s new

finance chief, joins the video streaming service at a critical

juncture in its evolution.

His main objective in the top finance post, analysts say, will

be clear from the start: Wrestle with a cash-sucking content

development pipeline while convincing investors that efforts to

convert original content into more subscriptions and profits

ultimately will materialize.

Co-founder and Chief Executive Reed Hastings and Chief Content

Officer Ted Sarandos, who have driven transformation away from a

licensing-heavy model in an attempt to fend off competitors such as

Amazon.com Inc., Hulu LLC and AT&T Inc.'s HBO, will continue to

set business and content strategy.

Mr. Neumann's job "is to make sure that the financial engine can

support their vision," said Neil Macker, a senior equity analyst

with Morningstar Inc.

Mr. Neumann, who joins Netflix from videogame maker Activision

Blizzard Inc., was previously a longtime Walt Disney Co. executive

who held roles at both Walt Disney Parks and Resorts Worldwide Inc.

and the company's ABC Television Network unit. Netflix declined to

make Mr. Neumann available for comment.

The move to create more original content has led to a funding

gap at Netflix. It takes roughly two years to get a new show from

production to screen, and Netflix's investment is tied up for that

period with no returns, analysts say. As a result, while the

company's earnings and profit margins have grown, it has spent cash

more quickly than its operations can replace.

Netflix's spending also has increased as it lured away talented

showrunners, including "Glee" producer Ryan Murphy and "Grey's

Anatomy" creator Shonda Rhimes.

Mr. Neumann's main objective will be "to instill confidence that

this growth is going to translate to cash generation in a few years

and a self-funding company," said Matthew Thornton, an analyst with

investment bank SunTrust Robinson Humphrey Inc.

Netflix in October said it expects to have negative cash flow of

$3 billion in 2018, with roughly the same figure in 2019. The

company expects material improvements in 2020.

For now, Netflix has plugged the increase in working capital by

turning to the debt market, a move that has concerned some

investors, analysts say. Mr. Neumann will need to monitor the

company's growing debt and determine what is a sustainable debt

load in an environment of rising interest rates, said Mr. Macker of

Morningstar.

Recent pressure on the company's stock price adds to the

complexity of this balancing act. Netflix previously said it could

shoulder a capital structure that is up to 20% to 25% debt, but a

decline in the value of its stock could change that calculus, Mr.

Macker said. Netflix shares, which closed flat on Wednesday at

$267.66, were down 29% from three months ago.

Mr. Neumann succeeds longtime Netflix finance chief David Wells,

who in August announced plans to resign after 14 years with the

company, eight of them as CFO.

Mr. Neumann was most recently finance chief at Santa Monica,

Calif.-based Activision Blizzard, which on Monday said it would

fire him for a reason unrelated to the company's financials.

An Activision Blizzard spokeswoman declined to comment beyond

the company's press release and filing. A Netflix spokesman

declined to comment but pointed to the company's statement on Mr.

Neumann's appointment.

"Spencer is a stellar entertainment executive and we're thrilled

that he will help us provide amazing stories to people all over the

world," Mr. Hastings said in the statement.

An executive dismissed for cause typically forfeits whatever

earned but not vested equity and other severance they were due to

receive, lawyers and recruiters said.

For Mr. Neumann, that figure could be substantial, recruiters

said. Mr. Neumann joined the videogame maker in May 2017 under a

contract that was due to expire in April 2020, according to a

regulatory filing.

The contract included a $14 million equity grant that would vest

in four installments over four years, and could be worth as much as

$23 million, depending on company performance. Mr. Neumann's

compensation also included a $2 million signing bonus that fully

vested in May 2018.

Write to Tatyana Shumsky at tatyana.shumsky@wsj.com

(END) Dow Jones Newswires

January 02, 2019 20:51 ET (01:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

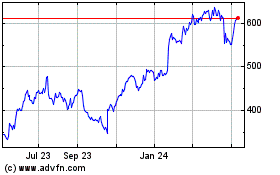

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

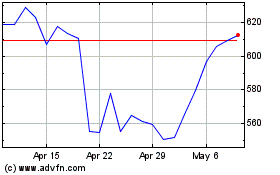

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024