Actor Zachary Horwitz Arrested Over Alleged $690 Million Hollywood Ponzi Scheme -- Update

April 07 2021 - 1:57PM

Dow Jones News

By Dave Michaels

WASHINGTON -- A Los Angeles actor was the mastermind of a $690

million Ponzi scheme that bilked investors who thought their money

would finance distribution rights for movies that would run on HBO

and Netflix, according to authorities.

Zachary Joseph Horwitz, who went by Zach Avery as an actor, was

arrested Monday and charged with wire fraud, according to the Los

Angeles U.S. attorney's office. The Securities and Exchange

Commission also sued Mr. Horwitz and his firm, 1inMM Capital LLC,

in civil court over the alleged scam, which it says involved an

elaborate plan to portray efforts to sell film-licensing rights,

primarily in Latin American markets.

Mr. Horwitz, 34 years old, has a profile on IMDb, the online

movie database, that shows photos of him, often with a full beard

or stubble, acting in a variety of films. His LinkedIn profile

states he is managing partner of 1inMM. He didn't respond to a

request for comment sent through LinkedIn. Court records on

Wednesday didn't list a lawyer for him.

Mr. Horwitz told investors that he had acquired and distributed

dozens of films including titles such as "Active Measures,"

"Lucia's Grace," and "Blood Quantum." He doctored fake contracts

signed by fictional HBO or Netflix executives, which made it look

like he was doing business with the streaming platforms, according

to a Federal Bureau of Investigation affidavit. For a while, Mr.

Horwitz paid investors their purported returns using proceeds

generated by new investors, the hallmark of a Ponzi scheme,

according to authorities.

But in late 2019, he began defaulting on nearly every payment

due to investors and blamed the problem on HBO and Netflix Inc.

refusing to pay for movies they had licensed from his company,

according to the SEC. Mr. Horwitz even sent emails to investors

that supposedly showed him discussing the status of his agreements

with employees of Netflix and HBO, the FBI said.

In total, he defaulted on about $227 million in payments

anticipated by investors, according to the FBI. He also used

investor funds to pay in cash for a $5.7 million home in LA's

Beverlywood neighborhood, the SEC said.

Mr. Horwitz's investors included personal contacts and people

who knew other investors who had given him money. He promised

returns in excess of 35% on the movie projects, according to the

SEC's federal-court complaint.

The alleged scheme victimized five main groups of investors,

according to an FBI affidavit. The largest source of funds came

from a private firm whose principals live in the Chicago area, JJMT

Capital LLC, which received an annual report that portrayed Mr.

Horwitz's success in the film-distribution business, along with a

bottle of Johnnie Walker Blue Label scotch, according to the FBI

affidavit.

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

April 07, 2021 13:42 ET (17:42 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

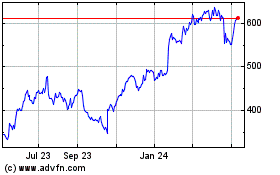

Netflix (NASDAQ:NFLX)

Historical Stock Chart

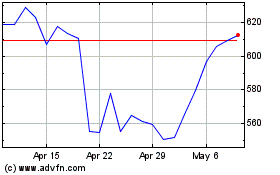

From Mar 2024 to Apr 2024

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024