ByJoe Flint and Micah Maidenberg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 22, 2020).

Netflix Inc. missed its forecast for U.S. subscriber growth for

the third straight quarter, but blew through its expectations for

overseas expansion, a mixed performance that comes as the streaming

giant faces heightened competition from a gaggle of rivals.

The Los Gatos, Calif., company said Tuesday that it added

423,000 domestic subscribers in the fourth quarter, compared with

its forecast of 600,000 additions. It also posted an increase of

8.3 million subscribers in overseas markets, more than the seven

million the company was expecting. It now has 167 million

subscribers world-wide, including 60.4 million in the U.S.

Shares in Netflix were up 2.3% in after-hours trading on

Tuesday.

The results underscore that Netflix has two very different

stories to tell Wall Street at the moment. Its operations abroad

look as promising as ever, without any sign of a significant

competitive threat, while clouds are beginning to gather in the

company's home market, where rivals are offering new services and

chasing creative talent in Hollywood.

In November, Walt Disney Co.'s Disney+ streaming platform went

live with a $6.99 monthly service that offers a range of content

including animated classics and the "Star Wars" and Pixar

franchises. Disney said a day after the service began that it had

signed up 10 million users, but the company has yet to provide

updated results.

Apple Inc. launched Apple TV+ the same month, offering consumers

access for $4.99 a month. Netflix's standard plan costs $12.99 a

month. Apple has a relatively small offering of original shows and

doesn't possess the vast libraries of classic programming that

Netflix and others have.

This spring, Comcast Corp.'s NBCUniversal and AT&T Inc.'s

WarnerMedia plan to introduce their direct-to-consumer streaming

services: Peacock and HBO Max, respectively.

On a call with investors and analysts, Netflix Chairman and

Chief Executive Reed Hastings said the new competition wouldn't

prompt significant strategy changes at the company. "We've had the

same strategy for 20 years: Please our members and they help us

grow," Mr. Hastings said.

Disney+, Mr. Hastings said, is likely to take just "a little

from us" and pose a bigger threat to traditional television.

"We compete very broadly for viewing...and our viewing on a

per-member basis is up," he said.

In a letter to shareholders, Netflix attributed the company's

softness in the U.S. and Canada to the new competition, as well as

to the effects of price increases being rolled out to its

users.

The company said it has a "big head start in streaming" and

believes it will "continue to prosper," even in a tougher

battleground. The growing number of streaming services, Netflix

told shareholders, will harm traditional TV, not its own

business.

Mr. Hastings also explained why Netflix doesn't want to

introduce an advertising-supported version of its service. "There's

not easy money there," he said, adding that the company would be

hard-pressed to take ad business away from Amazon.com Inc.,

Facebook Inc. and Alphabet Inc.'s Google.

He said Netflix wants to be "the safe respite" for its

subscribers, with "none of the controversy around exploiting users

with advertising."

Netflix's Europe, Middle East and Africa segment powered the

company's international growth, with 4.4 million subscriber

additions and a 42% jump in revenue. The Latin America segment

added 2.04 million users. The Asia region is growing the fastest,

but it is also the smallest -- with just 16 million paid

subscribers.

Netflix reported a fourth-quarter profit of $586.9 million, or

$1.30 a share, as a one-time tax adjustment bolstered the bottom

line. Revenue rose 31% to $5.47 billion.

New content the company premiered during the quarter included

"The Irishman," a film about organized crime, and "Marriage Story,"

a movie about the demise of a marriage. Each film received multiple

Oscar nominations.

Netflix has begun to face questions about the sustainability of

its growth, particularly in the U.S. The company lost domestic

customers for the first time in nearly a decade in the second

quarter of 2019, and narrowly missed its growth forecast the next

period. Netflix has said price increases have damped growth to some

extent as they roll out across the company's footprint, and has

pointed to rising revenue per customer.

Still, Netflix has a huge lead over streaming rivals and is

adding international customers at a rapid rate the rest of

Hollywood envies. Wall Street has remained optimistic about

Netflix's potential, with shares in the company rallying over the

past several months after a skid last year.

Alongside the race for subscribers, Netflix is also battling new

competitors -- including some whose services have yet to be

launched -- to sign up talent and rights to key programming.

Holding on to popular old shows is proving challenging. "Friends"

ended its run on Netflix at the end of last year and will be

available on HBO Max later this year, while Comcast's Peacock

service will carry reruns of "The Office" starting in 2021. Other

popular Netflix content, such as "Grey's Anatomy, " is expected to

roll off the service as contracts expire.

Ted Sarandos, Netflix's chief content officer, said on the

analyst call that the service hasn't experienced any negative

impact from the loss of "Friends," a situation-comedy.

Netflix did acquire streaming rights to "Seinfeld" when it

leaves Hulu in 2021, and continues to bid aggressively for popular

shows.

The company is investing heavily in original TV shows and

movies, betting that such content will ultimately keep subscribers

happy.

Among the original titles Netflix said performed well in the

fourth quarter were "The Witcher," the stalker drama "You," "The

Crown" and the cartoon "Big Mouth."

Netflix still discloses little viewing data for its content. In

previous quarters, it provided the number of member households that

watched 70% or more of a title. Now it is providing the number of

member households that started watching a title and stuck with it

for at least two minutes.

The company said it made the change because the 70% methodology

favored shorter-form content. However, the new approach can also

boost the numbers by 35%, the company said.

Using the new metric, Netflix said "The Witcher" had the biggest

debut season of any series on the service, with 76 million members

watching at least two minutes during the show's first month on the

platform. The latest season of "The Crown" attracted 21 million

member households in its first month of availability.

Netflix is estimating it will add seven million paid users in

the first quarter, compared with 9.6 million a year earlier, in

part because of the challenges in the U.S market.

Write to Joe Flint at joe.flint@wsj.com and Micah Maidenberg at

micah.maidenberg@wsj.com

Corrections & Amplifications Netflix has 167 million

subscribers world-wide. An earlier version of this article

incorrectly stated the figure as 174 million in one instance. (Jan.

21)

(END) Dow Jones Newswires

January 22, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

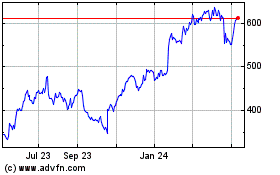

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

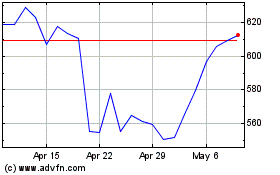

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024