By Tim Mullaney

What would you call it if you gave a party and just about

everybody came?

Maybe, the Tech Rally of 2019.

After a tough 2018 when riskier or "high beta" stocks got nailed

in the fourth quarter, tech has had a revival this year that is

startling in both its magnitude and its breadth. The average

tech-stock fund tracked by Morningstar was up 22% for the year at

the middle of last week, compared with a 16% climb in the S&P

500. Only seven tech funds in Morningstar's database were trailing

the broad market, but the mean actively managed tech fund was still

5.6 percentage points behind the surge in the S&P 500

Information Tech subindex.

"Information technology was the S&P 500's best-performing

sector during the first half of 2019," Morningstar analyst Robby

Greenhold says. "The sector's gain accounted for almost a third of

the S&P 500's rise."

The most distinctive thing about tech funds so far this year is

how difficult it has been to do badly. Only one fund is in the red,

the $8.2 million Upright Growth fund (UPUPX), and four funds

tracked by Morningstar are up more than 30%. The only funds doing

better are those -- notably gold funds and more recently long-dated

bond and real-estate funds -- which play on the uncertainty that

President Trump's market-moving outbursts brought this summer.

All sorts of different tech-investing strategies are working.

What follows is a look at the portfolios of some of the top

performers.

No. 1 this year is Fidelity Select IT Services fund (FBSOX), up

37%. The $4 billion fund has little of the dot-com flash associated

with the FAANG stocks ( Facebook, Apple, Amazon.com, Netflix and

Google parent Alphabet). The big idea at Select IT Services right

now is payments -- companies that automate or digitize the movement

of money, either from consumers to stores or between institutions.

Most of the fund's investments are in familiar names from before

the days when tech dominated the stock market.

Payments plays

The top four holdings as of June 30 were all payments plays, and

accounted for 43% of the FBSOX portfolio: Visa, Mastercard, PayPal

and Worldpay Inc., which was acquired by Fidelity National

Information Services in July.

"The global migration from cash to electronic payment methods

has continued, creating a rising-tide environment for a number of

payment-related companies," fund co-manager Zach Turner says.

"There has also been significant consolidation."

The top five contributors to the fund's gain, Mr. Turner says,

have all been payments-related stocks such as Visa, Mastercard,

PayPal and First Data Corp. The fund added to its positions in Visa

and Mastercard in the second quarter. After Worldpay and First Data

were acquired the fund added to its positions in the acquirers,

Fidelity National Information Services and Fiserv.

Right behind the Fidelity fund are mutual funds still working

the consumer-internet themes powered by the FAANGs. BlackRock

Technology Opportunities fund (BGSAX), for example, was up 31% as

of last week with a portfolio that has Chinese internet leaders

Tencent and Alibaba as well as Alphabet and Amazon in its top five

holdings. Facebook and Apple are in the top 10.

Another top tech fund is Firsthand Alternative Energy (ALTEX),

considered a tech fund by many because semiconductors are so

important to solar power and power-grid management. This fund's top

two holdings are chip-related companies, Power Integrations (up

more than 40% this year as of last week) and Cree. But Firsthand

has had a weaker track record than most of its top peers, and

Morningstar rates the fund one star out of five.

A common element among many of the top actively managed tech

funds -- except Firsthand -- is a large holding in Microsoft, whose

cloud computing business has driven its stock up more than 30% this

year, Morningstar's Mr. Greengold says. Putnam Global Technology

(PGTAX) has 19% of its holdings in Microsoft.

Passively managed tech funds have seen even bigger returns than

their actively managed brethren.

Exchange-traded funds focused on U.S. tech stocks were up an

average of 21.8% for the year as of Aug. 21, says Stacey Brorup, a

research assistant at ETF.com. Chip and software stocks helped lead

the way. Chip returns were nearly double those of U.S. internet

companies for the same period.

The top-performing tech ETF so far this year, with a gain of

roughly 50%, is Invesco DWA Technology Momentum ETF (PTF), whose

strategy is to make concentrated bets on 30 or more companies that

have recently been near the top of the tech-heavy Nasdaq index. Its

biggest holding, Enphase Energy, which makes equipment to convert

solar power to alternating current from direct current, has doubled

since early May.

The tech disconnect

It's not certain how much longer the tech rally can run, ETF.com

chief executive Dave Nadig says.

"The next 12 months will largely be about the disconnect between

tech and the rest of the market," says Mr. Nadig, who argues that

so far tech has been less exposed to trade tensions than other

stocks. "This can't last forever, and with the additional tariffs

coming on, I think we're set up for a rough patch. That's part of

why we see so much volatility in the sector."

CFRA Research strategist Sam Stovall is still relatively bullish

on tech stocks, which the New York-based firm rates "overweight,"

but is watching the sector and wondering how long this rally can

last. That said, tech stocks' 12% valuation premium to the rest of

the market is equal to its median for the past 21 years, he

adds.

"We have an 'overweight' ranking on tech and are wondering about

the same thing," Mr. Stovall says. "The chart shows tech remaining

strong versus the S&P 500, but the strength has waned over the

past year."

Mr. Mullaney is a writer in Maplewood, N.J. He can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

September 08, 2019 22:22 ET (02:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

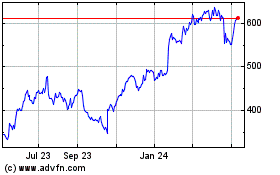

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

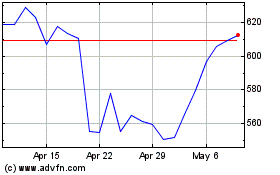

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024