S&P Lowers CME Group's ICR - Analyst Blog

February 13 2012 - 11:38AM

Zacks

Last week, ratings agency Standard & Poor’s Ratings Services

(S&P) downgraded the long-term issuer credit rating (ICR) of

CME Group Inc. (CME) to “AA-” from “AA”.

Additionally, S&P gave a “Negative” outlook to the rating,

thereby indicating the possibility of a further downgrade in the

near future.

The move came on the back of S&P’s concern over the $100

million fund announced by CME to protect the interest of farmers

and ranchers affected by the crash of MF Global. Under the Family

Farmer and Rancher Protection Fund, expected to be in effect by

March 1, 2012, farmers and ranchers using CME Group products will

be eligible for up to $25,000 per account in case of losses

resulting from the future insolvency of a clearing member or other

market participant.

Last year, the exchange had also announced a guarantee of $250

million to the estate trustees of MF Global, following the collapse

of the commodities firm, in order to make the process of returning

customers’ funds more rapid.

CME, as the regulator of MF Global, announced the guarantees to

protect consumers’ interest as well as boost its sagging trading

volume subsequent to the company’s collapse. Nevertheless, S&P

views the move unfavorably.

While the ratings agency concedes the financial risk posed by

the guarantees is minimal and can be covered by CME from its free

operating cash flow within six months, it believes that the move

will raise customers’ expectations regarding future guarantees.

S&P is also apprehensive about CME’s increasing exposure to

credit default swaps, as the exchange has limited experience in

managing the product. The ratings agency opines that some of the

counterparty risk of the off-exchange businesses gets transferred

to the clearing house. Nevertheless, CME’s ICR is still strong,

with only 21 companies in the S&P 500 having equivalent or

better ratings.

CME’s main competitors are CBOE Holdings, Inc.

(CBOE) and Nasdaq OMX Group Inc. (NDAQ). The

shares of CME carry a Zacks #3 Rank, which translates into a

short-term ‘Hold’ rating. However, considering the fundamentals, we

maintain our long-term ‘Neutral’ recommendation on the stock.

CBOE HOLDINGS (CBOE): Free Stock Analysis Report

CME GROUP INC (CME): Free Stock Analysis Report

NASDAQ OMX GRP (NDAQ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

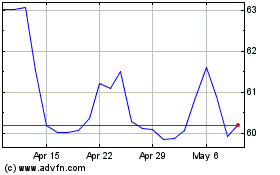

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Aug 2024 to Sep 2024

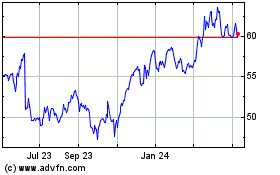

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Sep 2023 to Sep 2024