BATS Exchange Lands iShares Funds As First Listings

January 12 2012 - 12:30AM

Dow Jones News

BATS Global Markets made an agreement with asset manager

BlackRock Inc. (BLK) to list eight new exchange-traded funds, the

first primary listings to be landed by the Kansas City exchange

group as it seeks to expand its profile.

The new funds run by BlackRock's iShares unit are linked to

indices of international stocks and the first will become available

for trading on Jan. 24, according to an announcement by the

companies planned for Thursday, a copy of which was reviewed by Dow

Jones Newswires.

Winning the listings represents the first success by BATS, a

seven-year-old operator of electronic markets, as it aims to

compete for share issues against larger and more well-known rivals

like the New York Stock Exchange and Nasdaq Stock Market. Those

venues battle intensely for the prestige and fees that come from

primary listings, and smaller venues historically have found it

difficult to gain an edge.

BATS oversees 11% of daily trading in U.S.-listed shares, making

it the third-largest stock market operator by volume. The company

built its market share through a mix of robust technology and

attractive fee schemes aimed at the sophisticated electronic

trading firms that now dominate exchange trading.

Its gambit to win listings is similar. BATS has proposed an

incentive plan to encourage trading firms to offer more competitive

prices in securities listed on its market, and intends to leverage

its systems to provide to issuers a clearer idea of why their

shares trade the way they do. The exchange group has also

positioned itself as a generally lower-cost venue to list shares,

compared with Nasdaq and NYSE.

Noel Archard, global head of product management and development

for iShares at BlackRock, said BATS' "innovative approach" to the

listings business factored into his firm's decision to offer its

new products there.

The new ETFs to be listed at BATS are linked to indices run by

MSCI Inc., covering shares of countries like Norway, India, Canada

and Australia.

BATS, which officially opened its primary listings venue in

December, aims to lure initial public offerings and existing

company listings alongside structured products like ETFs. But the

potential for lower listing fees and improved liquidity for

just-launched products is seen as particularly appealing to ETF

issuers like iShares.

"It's an extremely cost-competitive world, and wherever you can

eke out efficiencies, you're going to explore it," said Paul

Justice, who leads ETF research for North America at Morningstar.

He estimated that there currently are 1,380 exchange-traded

products now competing to draw investor assets, which were

estimated to stand at about $1 trillion in the U.S. late last

year.

BATS has also been playing on its Midwestern roots to recruit

new share issuers. The company maintains a presence in New York and

in London but was founded and remains headquartered in Kansas City,

where most of its 117 staff work.

There is one initial public offering already slated for BATS --

the company's own, which is seen on track for sometime in 2012. The

firm aims to sell shares following its acquisition of Chi-X Europe,

a rival London platform for trading European stocks.

-By Jacob Bunge, Dow Jones Newswires; 312 750 4117; jacob.bunge@dowjones.com

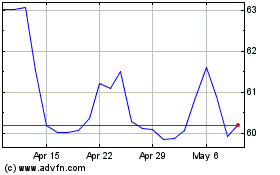

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Aug 2024 to Sep 2024

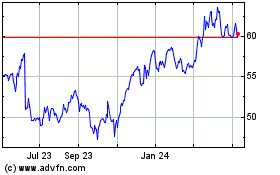

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Sep 2023 to Sep 2024