Goldman, BNP Take Minority Stake In Trading Software Firm

December 13 2011 - 4:31PM

Dow Jones News

Goldman Sachs Group Inc. (GS) acquired a minority stake in

Broadway Technology LLC, a firm that develops electronic trading

software used by big banks and hedge funds to build their own

large-scale systems.

Terms of the transaction were not disclosed. BNP Paribas SA

(BNPQY, BNP.FR) also invested in the firm, people familiar with the

matter said, though its name wasn't announced by Broadway

Technology.

Big Wall Street firms have historically taken stakes in

companies that develop trading technology, market infrastructure

and distribution platforms, and data and content systems, in part

to support innovation and in part to save on the costs of

developing systems in-house. The investments also can help position

the banks for technology and regulatory changes as they evolve.

Goldman has 62 investments in market structure-related ventures,

according to a November company presentation reviewed by Dow Jones

Newswires, many of them made alongside key competitors like

Citadel, Morgan Stanley (MS), UBS AG (UBS, UBSN.VX), Credit Suisse

Group AG (CS, CSGN.VX) and Knight Capital Group Inc. (KCG).

For example, Goldman has a 19.9% stake in Direct Edge, an

alternative stock exchange that sprung up in recent years to

challenge the dominance of NYSE Euronext (NYX) and Nasdaq OMX Group

Inc. (NDAQ). Citadel and Knight also have 19.9% stakes, while

International Securities Exchange Holdings Inc. owns a 31% share,

according to Direct Edge's website.

Goldman's other investments include a 9% stake in the

130-year-old London Metal Exchange, where it is battling for top

minority ownership with J.P. Morgan Chase & Co. (JPM), which

recently bought MF Global Holdings' stake to push its ownership to

10.9%.

Goldman also has investments in a variety of trading platforms

like Tora Trading, an electronic platform in Asia, and FX Alliance

Inc., an electronic currency trading firm that recently filed for

an initial public offering.

Broadway Technology was founded in 2003 by Tyler Moeller and

Joshua Walsky, who have backgrounds in software and high frequency

trading. It develops software big banks can use as the basis to

build their trading operations.

The firm, with expertise in fixed income and foreign exchange

systems, is expanding into new markets outside the U.S. and new

asset classes, including swaps, stocks and equities, Moeller said

in an interview Tuesday.

-By Liz Moyer, Dow Jones Newswires; 212-416-2512;

liz.moyer@dowjones.com

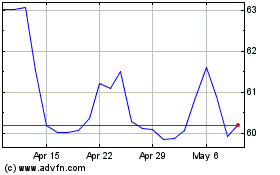

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Aug 2024 to Sep 2024

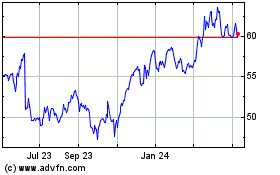

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Sep 2023 to Sep 2024