Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

January 05 2022 - 9:13AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

For

the month of: January 2022 (Report No. 2)

Commission

file number: 001-37600

NANO

DIMENSION LTD.

(Translation

of registrant’s name into English)

2

Ilan Ramon

Ness

Ziona 7403635 Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(1):_____

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(7):_____

CONTENTS

On

January 4, 2022, Nano Dimension Ltd. (the “Company”) entered into, and simultaneously closed, a share purchase agreement

(the “Share Purchase Agreement”) with the shareholders of Global Inkjet Systems Ltd. (“Selling Shareholders”

and “GIS,” respectively) to purchase GIS, by way of a share purchase of all of the issued and outstanding share capital of

GIS. At the closing, the Company paid the Selling Shareholders for their shares £17,441,000 in cash (approximately $23,371,0000)

in immediately available funds, of which £2,200,000 (approximately $2,948,000) was deposited in escrow for a period of 36 months

in connection with certain indemnification obligations of the Selling Shareholders pursuant to the Share Purchase Agreement. In addition,

the Selling Shareholders are entitled to deferred consideration of £1,000,000 (approximately $1,340,000), to be paid on April 1,

2024 and may be entitled to an earn-out consideration (the “Earn-Out Consideration”) in an aggregate amount of up to £7,000,000

(approximately $9,380,000), subject to meeting certain EBITDA performance targets in the fiscal year ending on March 31, 2022, and revenues

and gross profit performance targets in the fiscal year ending on March 31, 2023. Additionally, the Selling Shareholders identified as

key management need to remain engaged by the Company during the aforementioned earn-out/deferred compensation period(s).

This

Report on Form 6-K is incorporated by reference into the registration statements on Form F-3 (File No. 333-233905 and 333-251155)

and Form S-8 (File No. 333-214520 and 333-248419)

of the Company, filed with the Securities and Exchange Commission (“SEC”), to be a part thereof from the date on which this

report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

Forward

Looking Statements

This

Report on Form 6-K contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995 and other Federal securities laws. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions

or variations of such words are intended to identify forward-looking statements. For example, the Company is using forward-looking statements

in this report when it discusses the potential for additional payments to the shareholders of GIS. Because such statements deal with

future events and are based on the Company’s current expectations, they are subject to various risks and uncertainties. Actual

results, performance or achievements of the Company could differ materially from those described in or implied by the statements in this

report. The forward-looking statements contained or implied in this report are subject to other risks and uncertainties, including market

conditions and the satisfaction of all conditions to any additional payments to the shareholder of GIS, as well as those discussed under

the heading “Risk Factors” in the Company’s annual report on Form 20-F filed with the SEC on March 11, 2021, and in

any subsequent filings with the SEC. Except as otherwise required by law, the Company undertakes no obligation to publicly release any

revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of

unanticipated events.

|

*

|

Certain identified information

in the exhibit has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm

to Nano Dimension Ltd. if publicly disclosed.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

Nano Dimension Ltd.

|

|

|

(Registrant)

|

|

|

|

|

|

Date: January 5, 2021

|

By:

|

/s/ Yael Sandler

|

|

|

Name:

|

Yael Sandler

|

|

|

Title:

|

Chief Financial Officer

|

2

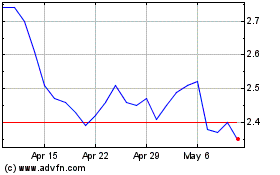

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

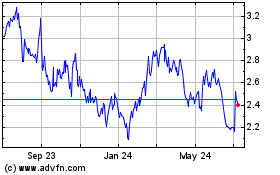

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Apr 2023 to Apr 2024