Nano Dimension Ltd. (“Nano Dimension” or the “Company”) (Nasdaq:

NNDM), an industry-leader in

Additively

Manufactured

Electronics

(

AME),

Printed

Electronics (

PE), and

Micro

Additive

Manufacturing

(

Micro-

AM), today announced

financial results for the third quarter ended September 30,

2021.

Nano Dimension reported revenues of $1,340,000

and $2,962,000 for the third quarter and nine-month periods ended

September 30, 2021, respectively, compared to revenues of $438,000

and $1,428,000 for the third quarter and nine-month periods ended

September 30, 2020, respectively. The Company ended the quarter

with a cash and deposits balance of $1,385,391,000 (including

short-term unrestricted bank deposits). Total operating loss for

the third quarter was $24,507,000 (including approximately

$12,521,000 of non-cash share-based compensation plus depreciation

and amortization expenses).

CEO MESSAGE TO SHAREHOLDERS:

Mr. Yoav Stern, Chairman and Chief Executive

Officer of Nano Dimension, commented:

“Our revenue for the nine months ended September

30, 2021, was up by more than 107% compared to the same period in

2020, with an increase of 65% in quarter-over-quarter (compared to

the second quarter of 2021). While this is a substantial early

indication of the build-up of our sales and marketing network, as

I’ve mentioned before, these results are not necessarily a

comprehensive attestation of the status of the company. Our

business is positively affected by sporadic yet repetitive

adjustments of the relevant industrial communities toward a ‘living

with Covid-19 mentality.’ Encouraging as they are, our revenue

numbers are still too small in absolute magnitude to derive any

meaningful conclusions.

"More important is the introduction of our new

DragonFly IV system, combined with the efficiency-enhancing FLIGHT

Software package. Both were introduced last week at the

strategically important Productronica trade show in Munich,

Germany, which resumed after a two-year hiatus resulting from the

Covid-19 shutdowns.

"DragonFly IV is a unique and innovative,

first-to-market Dielectric & Conductive-Materials

Additive Manufacturing System for the fabrication of

High-Performance Electronic Devices (Hi-PEDs®) by depositing layers

of proprietary materials simultaneously, while concurrently

integrating in-situ capacitors, antennas, coils, transformers, and

electro-mechanical components. DragonFly IV delivers improved

accuracy of traces, spacing, and vias, improved high end printed

circuit board (PCB) quality and the ability to design and produce

3D Hi-PEDs® in a one-step production process. New capabilities

include integration with Nano Dimension’s new FLIGHT software,

integration of 3D elements in PCB, 3D designed Hi-PEDs®, support of

HDI level elements, 75µm traces; 100µm spacing; 150µm via, enhanced

print quality, yield optimization with predictable conductivity and

low thickness variation <5%.

"No less important is our announcement from

early November regarding the acquisition of Essemtec AG from

Lucerne, Switzerland. Essemtec’s product portfolio is comprised of

production equipment for placing and assembling electronic

components on printed circuit boards. The products are leaders in

adaptive highly flexible surface mount technology (SMT)

pick-and-place equipment, sophisticated dispenser suitable for both

high-speed and micro-dispensing, and intelligent production

material storage and logistic system. The systems are equipped with

a software package which makes extensive and efficient material

management possible. Essemtec’s products portfolio will continue to

be available to the thousands of organizations that have called

themselves a customer of Essemtec, while also being integrated with

additive 3D-printing technologies, becoming part of the AME

revolution that Nano Dimension is driving with its existing product

line.”

“In summary,” added Mr. Stern, “Within the foreseeable future,

our three business development pillars:

- Synergetic mergers and acquisitions (M&A),

- Accelerated research and development (R&D), and

- Revolution in go-to-market efforts

are planned to converge and are designed to fuel

a mutually accelerated scalable growth. The companies we have

acquired as well as future potential M&A targets are analyzed

based on their ability to drive R&D efforts in ways not

otherwise possible. Additionally, they are chosen based on

their expected amalgamation with the marketing channels of the

products we develop, contributing to the market presence we need in

order to maximize our success. In parallel, we have planned

and are currently executing and hoping to surpass any present

solutions for 'robotic brains' in manufacturing, material

technologies and 3D-printing performance. Those, in turn, are aimed

to create a business-disruptive set of inflection points. While, as

usual, there is no guaranty for the timing thereof, these

milestones will hopefully cause an increase of value by step

functions and create an exceptional time-weighted return on

investment for all our long-term investors,” Mr. Stern

concluded.

Third Quarter 2021 Financial

Results

- Total revenues for the third quarter of 2021 were $1,340,000,

compared to $811,000 in the second quarter of 2021, and $438,000 in

the third quarter of 2020. The increase is attributed to more sales

of DragonFly systems in the third quarter of 2021, as well as

revenues generated by Fabrica 2.0 machines.

- Research and development (R&D) expenses for the third

quarter of 2021 were $13,726,000, compared to $9,129,000 in the

second quarter of 2021, and $2,556,000 in the third quarter of

2020. The increase compared to both the second quarter of 2021 and

the third quarter of 2020 is attributed to an increase in payroll

and related expenses, as well as an increase in materials,

subcontractors, depreciation, and share-based payment expenses, as

the Company is enhancing its R&D and product development

efforts. The R&D expenses for the third quarter of 2021 include

approximately $7,338,000 of non-cash share-based compensation plus

depreciation expenses.

- Sales and marketing (S&M) expenses for the third quarter of

2021 were $6,301,000, compared to $6,009,000 in the second quarter

of 2021, and $2,475,000 in the third quarter of 2020. The increase

compared to the second quarter of 2021 is attributed to an increase

in share-based payment expenses. The increase compared to the third

quarter of 2020 is attributed to an increase in payroll and related

expenses, as well as an increase in marketing and promotion and

share-based payment expenses.

- General and administrative (G&A) expenses for the third

quarter of 2021 were $4,843,000, compared to $4,906,000 in the

second quarter of 2021, and $14,805,000 in the third quarter of

2020. The decrease compared to the second quarter of 2021 is

attributed to a decrease in professional services expenses. The

decrease compared to the third quarter of 2020 is attributed to a

decrease in share-based payment expenses.

- Net loss for the third quarter of 2021 was $18,237,000, or

$0.07 per share, compared to $13,602,000, or $0.05 per share, in

the second quarter of 2021, and $20,716,000, or $0.45 per

share, in the third quarter of 2020.

Nine Months Ended September 30, 2021

Financial Results

- Total revenues for the nine months ended September 30, 2021,

were $2,962,000, compared to $1,428,000 in the nine months ended

September 30, 2020. The increase is attributed to more sales of

DragonFly systems in the third quarter of 2021, as well as revenues

generated by Fabrica 2.0 machines.

- R&D expenses for the nine months ended September 30, 2021,

were $26,587,000, compared to $6,153,000 in the nine months ended

September 30, 2020. The increase is attributed to an increase in

payroll and related expenses, as well as an increase in materials,

subcontractors, depreciation, and share-based payment expenses, as

the Company is enhancing its R&D and product development

efforts. The R&D expenses for the nine months ended September

30, 2021 include approximately $13,817,000 of non-cash share-based

compensation plus depreciation expenses.

- S&M expenses for the nine months ended September 30, 2021,

were $15,023,000, compared to $4,224,000 in the nine months ended

September 30, 2020. The increase is mainly attributed to an

increase in payroll and related expenses, as well as an increase in

marketing and promotion and share-based payment expenses.

- G&A expenses for the nine months ended September 30, 2021,

were $13,174,000, compared to $16,748,000 in the nine months ended

September 30, 2020. The decrease is mainly attributed to a decrease

in share-based payment expenses, which is partially offset by an

increase in professional services expenses.

- Net loss for the nine months ended September 30, 2021, was

$41,153,000, or $0.17 per share, compared to $31,055,000, or

$1.11 per share, in the nine months ended September 30, 2020.

Balance Sheet Highlights

- Cash and cash equivalents, together with short-term bank

deposits, totaled $1,385,391,000 as of September 30, 2021, compared

to $670,934,000 as of December 31, 2020. The increase compared to

December 31, 2020, mainly reflects proceeds received from the sale

of American Depositary Shares representing the Company’s ordinary

shares, less cash used in operations, during the nine months ended

September 30, 2021.

- Total equity totaled $1,495,236,000 as of September 30, 2021,

compared to $667,116,000 as of December 31, 2020.

Conference call information

The Company will host a conference call to

discuss these financial results today, November 24, 2021, at 9:00

a.m. EST (4:00 p.m. IST). U.S. Dial-in Number: 1-866-744-5399,

Israel Dial-in Number: 972-3-9180692. Webcast link:

https://Veidan.activetrail.biz/nanodimensionq3-2021. Please

request the “Nano Dimension NNDM call” when prompted by the

conference call operator. For those unable to participate in the

conference call, there will be a replay available from a link on

Nano Dimension’s website at

http://investors.nano-di.com/events-and- presentations.

About Nano Dimension

Nano Dimension’s (Nasdaq: NNDM) vision is to

transform the electronics and similar additive

manufacturing sectors through the development and delivery

of environmentally friendly and economically efficient additive

manufacturing, Industry 4.0 solution, while enabling a

one-production-step-conversion of digital designs

into functioning devices - on-demand, anytime, anywhere.

Nano Dimension plans to execute on this vision

by building an eco-friendly and intelligent distributed network of

additively manufacturing self-learning & self-improving

systems, which are designed to deliver a superior ROI to their

owners as well as to Nano Dimension shareholders and

stakeholders.

The DragonFly

IV® system serves cross-industry

High-Performance

Electronic

Devices

(Hi-PEDs®) fabrication needs, by

depositing proprietary conductive and dielectric materials

simultaneously, while concurrently integrating in-situ capacitors,

antennas, coils, transformers, and electromechanical components.

The outcomes are Hi-PEDs® which

are integral enablers of autonomous intelligent drones, cars,

satellites, smartphones, and in vivo medical devices. These

products enable iterative development, IP safety, fast

time-to-market, and device performance gains. With DragonFly IV®, a

revolution happens at the click of a button, allowing customers to

go from CAD to a functional device in a matter of hours instead of

weeks; creating products with better performance; reducing the size

and weight of electronic parts and devices; enabling innovation;

and, critically important, protecting IP, all the while limiting

environmental pollution and chemical waste.

Nano Dimension’s Fabrica 2.0

micro additive manufacturing system enables the production of

microparts based on a Digital Light Processor (DLP) engine that

achieves repeatable micron levels resolution. The Fabrica 2.0 is

engineered with a patented array of sensors that allows a closed

feedback loop, using proprietary materials to achieve very high

accuracy while remaining a cost-effective mass manufacturing

solution. It is used in the areas of micron-level resolution of

medical devices, micro-optics, semi-conductors, micro-electronics,

micro-electro-mechanical systems (MEMS), microfluidics, and life

sciences instruments.

For more information, please visit

www.nano-di.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995 and other

Federal securities laws. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates” and similar

expressions or variations of such words are intended to identify

forward-looking statements. Because such statements deal with

future events and are based on Nano Dimension’s current

expectations, they are subject to various risks and uncertainties,

and actual results, performance or achievements of Nano Dimension

could differ materially from those described in or implied by the

statements in this press release. For example, Nano Dimension is

using forward-looking statements when it discusses the benefits and

advantages of DragonFly IV system, that Essemtec’s portfolio of

products will continue to be available to their customers, while

also being part of the AME revolution that the Company is driving

with its existing technology, the potential for completion of and

benefits from any additional M&A transactions, future

performance of our solutions, potential achievement of future

milestones and the potential increase of value by step functions

and returns on investment. The forward-looking statements contained

or implied in this press release are subject to other risks and

uncertainties, including those discussed under the heading “Risk

Factors” in Nano Dimension’s Annual Report on Form 20-F filed with

the Securities and Exchange Commission (“SEC”) on March 11, 2021,

and in any subsequent filings with the SEC. The following factors,

among others, could cause actual results to differ materially from

those described in the forward-looking statements: Nano Dimension’s

ability to increase sales and revenue, its burn rate, and its

ability to continue as a going concern. Except as otherwise

required by law, Nano Dimension undertakes no obligation to

publicly release any revisions to these forward-looking statements

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events. References and

links to websites have been provided as a convenience, and the

information contained on such websites is not incorporated by

reference into this press release. Nano Dimension is not

responsible for the contents of third party websites.

NANO DIMENSION INVESTOR RELATIONS CONTACT

Yael Sandler, CFO | ir@nano-di.com

Unaudited Consolidated Statements of

Financial Position as at

| |

September 30, |

|

|

December 31, |

|

|

|

2021 |

|

|

2020 |

|

|

2020 |

|

| (In thousands of USD) |

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

1,127,778 |

|

|

21,020 |

|

|

585,338 |

|

|

Bank deposits |

257,613 |

|

|

16,300 |

|

|

85,596 |

|

|

Restricted deposits |

165 |

|

|

60 |

|

|

62 |

|

|

Trade receivables |

1,223 |

|

|

568 |

|

|

713 |

|

|

Other receivables |

3,459 |

|

|

661 |

|

|

1,126 |

|

|

Inventory |

4,035 |

|

|

4,032 |

|

|

3,314 |

|

| Total current

assets |

1,394,273 |

|

|

42,641 |

|

|

676,149 |

|

| |

|

|

|

|

|

|

|

|

|

Bank deposits |

- |

|

|

8,400 |

|

|

- |

|

|

Restricted deposits |

483 |

|

|

379 |

|

|

406 |

|

|

Property plant and equipment, net |

7,523 |

|

|

4,735 |

|

|

5,092 |

|

|

Right of use asset |

4,869 |

|

|

2,478 |

|

|

3,169 |

|

|

Intangible assets |

116,767 |

|

|

4,633 |

|

|

4,440 |

|

| Total non-current

assets |

129,642 |

|

|

20,625 |

|

|

13,107 |

|

| Total

assets |

1,523,915 |

|

|

63,266 |

|

|

689,256 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

Trade payables |

1,796 |

|

|

842 |

|

|

776 |

|

|

Other payables |

7,970 |

|

|

4,420 |

|

|

5,910 |

|

|

Financial derivatives |

4,775 |

|

|

- |

|

|

- |

|

| Total current

liabilities |

14,541 |

|

|

5,262 |

|

|

6,686 |

|

| |

|

|

|

|

|

|

|

|

|

Liability in respect of government grants |

1,910 |

|

|

883 |

|

|

850 |

|

|

Lease liability |

3,577 |

|

|

1,829 |

|

|

2,618 |

|

|

Deferred tax liabilities |

3,128 |

|

|

- |

|

|

- |

|

|

Liability in respect of warrants and rights of purchase |

5,523 |

|

|

2,601 |

|

|

11,986 |

|

| Total non-current

liabilities |

14,138 |

|

|

5,313 |

|

|

15,454 |

|

| Total

liabilities |

28,679 |

|

|

10,575 |

|

|

22,140 |

|

| |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Non-controlling interests |

572 |

|

|

- |

|

|

- |

|

|

Share capital |

386,372 |

|

|

66,252 |

|

|

257,225 |

|

|

Share premium and capital reserves |

1,257,980 |

|

|

77,535 |

|

|

518,426 |

|

|

Treasury shares |

(1,509 |

) |

|

(1,509 |

) |

|

(1,509 |

) |

|

Presentation currency translation reserve |

1,431 |

|

|

1,431 |

|

|

1,431 |

|

|

Accumulated loss |

(149,610 |

) |

|

(91,018 |

) |

|

(108,457 |

) |

| Total

equity |

1,495,236 |

|

|

52,691 |

|

|

667,116 |

|

| Total liabilities and

equity |

1,523,915 |

|

|

63,266 |

|

|

689,256 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Unaudited Consolidated Statements of

Profit or Loss and Other Comprehensive Income(In thousands

of USD, except per share amounts)

|

|

For the Nine-Month PeriodEndedSeptember 30, |

|

|

For the Three-Month PeriodEndedSeptember 30, |

|

|

For the Year ended December 31, |

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

2,962 |

|

|

1,428 |

|

|

1,340 |

|

|

438 |

|

|

3,399 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

1,380 |

|

|

890 |

|

|

696 |

|

|

301 |

|

|

1,563 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues -

amortization of intangible |

772 |

|

|

579 |

|

|

281 |

|

|

193 |

|

|

771 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

2,152 |

|

|

1,469 |

|

|

977 |

|

|

494 |

|

|

2,334 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit (loss) |

810 |

|

|

(41 |

) |

|

363 |

|

|

(56 |

) |

|

1,065 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development

expenses, net |

26,587 |

|

|

6,153 |

|

|

13,726 |

|

|

2,556 |

|

|

9,878 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing

expenses |

15,023 |

|

|

4,224 |

|

|

6,301 |

|

|

2,475 |

|

|

6,597 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative

expenses |

13,174 |

|

|

16,748 |

|

|

4,843 |

|

|

14,805 |

|

|

20,287 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

(53,974 |

) |

|

(27,166 |

) |

|

(24,507 |

) |

|

(19,892 |

) |

|

(35,697 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance income |

13,065 |

|

|

171 |

|

|

6,036 |

|

|

41 |

|

|

446 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance expense |

910 |

|

|

4,060 |

|

|

282 |

|

|

865 |

|

|

13,243 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss |

(41,819 |

) |

|

(31,055 |

) |

|

(18,753 |

) |

|

(20,716 |

) |

|

(48,494 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxes on income |

648 |

|

|

- |

|

|

498 |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss after

tax |

(41,171 |

) |

|

(31,055 |

) |

|

(18,255 |

) |

|

(20,716 |

) |

|

(48,494 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss

attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling interests |

(18 |

) |

|

- |

|

|

(18 |

) |

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Owners of the Company |

(41,153 |

) |

|

(31,055 |

) |

|

(18,237 |

) |

|

(20,716 |

) |

|

(48,494 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic loss per share (after

1:50 reverse split effective June 29, 2020) |

(0.17 |

) |

|

(1.11 |

) |

|

(0.07 |

) |

|

(0.45 |

) |

|

(1.13 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Changes in

Equity (Unaudited)(In thousands of USD)

|

|

Attributable to owners of the Company |

|

|

|

|

|

|

|

|

|

Sharecapital |

|

|

Share premium and capital reserves |

|

|

Treasury shares |

|

|

Presentation currency translation reserve |

|

|

Accumulated loss |

|

|

Total |

|

|

Non-controlling interests |

|

|

Total equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the nine months

ended September 30, 2021: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of

January 1, 2021 |

257,225 |

|

|

518,426 |

|

|

(1,509 |

) |

|

1,431 |

|

|

(108,457 |

) |

|

667,116 |

|

|

- |

|

|

667,116 |

|

| Issuance of ordinary shares,

net |

123,222 |

|

|

711,844 |

|

|

- |

|

|

- |

|

|

- |

|

|

835,066 |

|

|

- |

|

|

835,066 |

|

| Exercise of warrants and

options |

5,925 |

|

|

(2,944 |

) |

|

- |

|

|

- |

|

|

- |

|

|

2,981 |

|

|

- |

|

|

2,981 |

|

| Share-based payments |

- |

|

|

30,654 |

|

|

- |

|

|

- |

|

|

|

|

|

30,654 |

|

|

- |

|

|

30,654 |

|

| Investment of non-controlling

party in subsidiary |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

590 |

|

|

590 |

|

| Net loss |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(41,153 |

) |

|

(41,153 |

) |

|

(18 |

) |

|

(41,171 |

) |

| Balance as of

September 30, 2021 |

386,372 |

|

|

1,257,980 |

|

|

(1,509 |

) |

|

1,431 |

|

|

(149,610 |

) |

|

1,494,664 |

|

|

572 |

|

|

1,495,236 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the three months

ended September 30, 2021: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of

July 1, 2021 |

386,003 |

|

|

1,248,164 |

|

|

(1,509 |

) |

|

1,431 |

|

|

(131,373 |

) |

|

1,502,716 |

|

|

- |

|

|

1,502,716 |

|

| Exercise of options |

369 |

|

|

(369 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Share-based payments |

- |

|

|

10,185 |

|

|

- |

|

|

- |

|

|

- |

|

|

10,185 |

|

|

- |

|

|

10,185 |

|

| Investment of non-controlling

party in subsidiary |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

590 |

|

|

590 |

|

| Net loss |

- |

|

|

|

|

|

- |

|

|

- |

|

|

(18,237 |

) |

|

(18,237 |

) |

|

(18 |

) |

|

(18,255 |

) |

| Balance as of

September 30, 2021 |

386,372 |

|

|

1,257,980 |

|

|

(1,509 |

) |

|

1,431 |

|

|

(149,610 |

) |

|

1,494,664 |

|

|

572 |

|

|

1,495,236 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

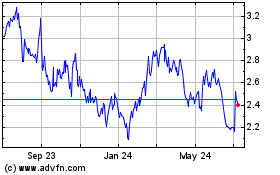

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

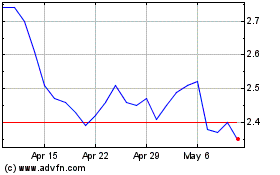

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Apr 2023 to Apr 2024