Mondelez Is Stung by Coronavirus Lockdowns in Emerging Markets -- 2nd Update

July 28 2020 - 8:19PM

Dow Jones News

By Annie Gasparro

Mondelez International Inc. said tough lockdowns to fight the

coronavirus in emerging markets hurt sales of its cookies and other

snacks in the second quarter.

Comparable sales for the maker of Oreo cookies, Toblerone

chocolate and Ritz crackers rose 11% in North America, but in Latin

America, where coronavirus cases have multiplied rapidly, sales by

that metric fell 11%. In its Asia, Middle East and Africa division,

where some countries have imposed stricter social-distancing

regulations than in North America, comparable sales decreased 3%,

the company said Tuesday.

Mondelez Chief Executive Dirk Van de Put said the company's

emerging-markets business improved in June and July as store

closures eased and more consumers were able to access its snacks.

"The majority of these markets are on better footing," he said.

Mondelez said the surge in snacking in North America has

continued while sales in India, China and Southeast Asia have

returned to growth, likely leading to stronger revenue in the

second half of the year.

Still, executives said Latin America will be a continuing

struggle. Mondelez's business in countries such as Brazil is

concentrated more in gum and candy -- categories that have been hit

harder by the pandemic and economic fallout as people go to

convenience stores less often and cut back on indulgences. Mondelez

said that overall, the global business environment remains volatile

and susceptible to a second wave of lockdowns.

"We are now clearly talking about this change to our lives

continuing well into 2021," Mr. Van de Put said.

Mondelez shares were flat in after-hours trading at $55.64.

Food companies in the U.S. have been inundated with orders from

grocery stores since the pandemic exploded in March. In a country

where a lot of people are staying home and can afford to stock up

on food, the coronavirus has buoyed sales for the food

industry.

But Mondelez has benefited less than its U.S.-centric rivals

such as Campbell Soup Co. and Conagra Brands Inc.

Mondelez has also spent more to boost production to meet the

unprecedented demand in regions such as North America. The company

said Covid-19-related costs, higher prices for raw materials and

unfavorable exchange rates contributed to a lower profit margin in

the latest period.

Mondelez said it is removing 25% of the varieties to simplify

its supply chain and innovation process and reduce inventories. The

cost-saving move will also help meet higher demand for core

products such as Oreos.

In the latest quarter, Mondelez said it gained market share in

many segments, such as cookies in the U.S. and China, and chocolate

in India and the U.K.

Mr. Van de Put said he is investing more in its brands to

leverage the momentum furthered by the pandemic. He also is

investing in e-commerce, and figuring out how to best handle

pricing and sizes of snacks to weather the recession. For instance,

he said, Mondelez can work with product developers and packaging

designers in India to find ways to reduce the cost of its chocolate

for consumers.

Mondelez's total revenue fell 2.5% from last year's second

quarter to $5.9 billion, in line with analysts' estimates,

according to FactSet. Adjusted profit of 63 cents a share marked a

16% increase from the prior year excluding currency fluctuations

and topped analysts' projection of 56 cents a share.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

July 28, 2020 20:04 ET (00:04 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

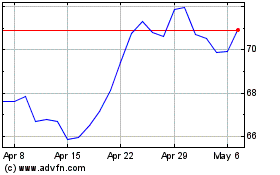

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Apr 2023 to Apr 2024