Kraft, Mondelez to End Fight With Regulator Over Manipulation Claims

March 06 2020 - 5:34PM

Dow Jones News

By Dave Michaels

WASHINGTON -- Kraft Foods Group Inc. and Mondelez Global LLC are

poised to pay $16 million to settle regulatory allegations they

manipulated the market for wheat futures.

The deal, if approved by a federal court in Chicago, would

resolve an unusual legal standoff: The companies had accused the

Commodity Futures Trading Commission of violating an earlier

settlement with them by commenting on it. The deal had limited what

could be said about the case.

A judge has considered sanctioning the CFTC and its

commissioners over the comments.

Now, the CFTC and the companies appear to have reached a pact

with the same penalty amount as the one announced in 2019, a person

familiar with the matter said, but without restrictions on what

CFTC commissioners can say about the outcome.

On Wednesday, Kraft and Mondelez -- previously a single

corporate entity -- withdrew their request for the CFTC to be

sanctioned. The judge, John Robert Blakey, said in a notice posted

in the court's docket Thursday that he would take the motion "under

advisement." He has scheduled another hearing for March 26.

The companies cried foul last year after the CFTC released three

statements -- a press release, a statement by all five

commissioners, and a separate statement by its two Democrats --

that explained the settlement and its unusual gag order.

The original settlement didn't explain how the company's trading

ran afoul of the law, an unusual omission in regulatory enforcement

orders. It also didn't require the companies to agree with the

regulator's claims that they had violated the law.

A spokeswoman for Kraft on Thursday declined to comment. A

spokesman for Mondelez didn't respond to a request seeking

comment.

Judge Blakey last month said the CFTC statements were "egregious

misconduct" and indicated he would issue findings that could spell

out consequences for the commission. An appeals court panel said

last year that CFTC commissioners can't be held in contempt

individually because the law authorizes them to opine about any

enforcement action.

The judge said at a hearing on Thursday that he blames the

"collective entity" of the CFTC for the statements, according to a

transcript. Judge Blakey said the result of his findings could be

"an admonishment" to not "do this kind of thing again."

Judge Blakey also said Thursday that he didn't know "why you

guys are agreeing to $16 million, but, you know, that's your call,

not mine."

The case before Judge Blakey involves claims from 2015 that

Kraft illegally manipulated the price of wheat by amassing a huge

position in futures contracts while never intending to take

delivery of the commodity.

Kraft's strategy, the CFTC alleged, was to use its enormous

trading position to drive down the spot-market price of wheat,

which it could then buy, while increasing the price of the futures

contracts it could later sell for a profit.

--Dylan Tokar contributed to this article.

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

March 06, 2020 17:19 ET (22:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

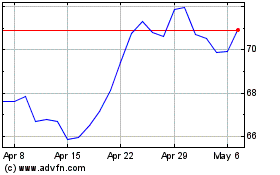

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Apr 2023 to Apr 2024