MKS Instruments, Inc. (NASDAQ: MKSI) (“MKS”), a global provider of

technologies that enable advanced processes and improve

productivity, today announced that it has entered into a

definitive agreement pursuant to

which MKS will acquire Photon Control

Inc. (TSX:PHO) for CAD$3.60 per share, in an all-cash

transaction valued at approximately CAD$387 million, with an

estimated enterprise value of CAD$343 million.

Photon Control is headquartered in Richmond,

British Columbia, Canada and had revenues

of CAD$65 million and Adjusted EBITDA of CAD$23

million in 2020. The transaction is expected to be accretive to

MKS’ Non-GAAP net earnings within the first 12 months

post-closing.

“We believe the Photon Control acquisition will help us deliver

on one of our long-term strategic objectives, which is to broaden

our portfolio of key technologies to better serve our customers,”

said MKS President and CEO John T.C. Lee. “We anticipate the

acquisition will further advance the MKS strategy to enhance

our Surround the Chamber® offering by adding optical sensors for

temperature control for critical etch and deposition applications

in semiconductor wafer fabrication. In addition, Photon Control is

a strong strategic fit with similar culture and vision to MKS.”

The transaction has been approved by the MKS and Photon

Control boards of directors and is subject to customary closing

conditions, including approval

by Photon Control’s securityholders and court approval in the

Province of British Columbia, Canada, and is expected to close in

the third quarter of 2021.

Greenhill & Co. is acting as financial

advisor and Stikeman Elliott is acting as legal advisor

to MKS.

About MKS InstrumentsMKS Instruments, Inc. is a

global provider of instruments, systems, subsystems and process

control solutions that measure, monitor, deliver, analyze, power

and control critical parameters of advanced manufacturing processes

to improve process performance and productivity for our customers.

Our products are derived from our core competencies in pressure

measurement and control, flow measurement and control, gas and

vapor delivery, gas composition analysis, electronic control

technology, reactive gas generation and delivery, power generation

and delivery, vacuum technology, lasers, photonics, optics,

precision motion control, vibration control and laser-based

manufacturing systems solutions. We also provide services relating

to the maintenance and repair of our products, installation

services and training. Our primary served markets include

semiconductor, industrial technologies, life and health sciences,

and research and defense. Additional information can be found

at www.mksinst.com.

Non-GAAP Financial MeasuresThis press release

refers to forward-looking Non-GAAP net earnings, a financial

measure that is not in accordance with U.S. generally accepted

accounting principles (“U.S. GAAP”). Non-GAAP net earnings should

be viewed in addition to, and not as a substitute for, GAAP

net earnings, and may be different from Non-GAAP net earnings used

by other companies. In addition, Non-GAAP net earnings is not based

on any comprehensive set of accounting rules or principles. MKS

management believes the presentation of Non-GAAP net earnings is

useful to investors for evaluating the acquisition by MKS of Photon

Control and the projected future operating and financial results of

MKS.

MKS is not providing a quantitative reconciliation of

forward-looking Non-GAAP net earnings to GAAP net earnings because

it is unable to estimate with reasonable certainty the ultimate

timing or amount of certain significant items without unreasonable

efforts. These items include, but are not limited to, acquisition

and integration costs, acquisition inventory step-up, amortization

of intangible assets, restructuring and other expense, asset

impairment, and the income tax effect of these items. These items

are uncertain, depend on various factors, and could have a material

impact on U.S. GAAP reported results for the relevant

period.

This press release also includes a reference to

the Adjusted EBITDA of Photon Control Inc., which is a

Non-GAAP measure in Canada. Photon Control

Inc. defines Adjusted EBITDA as earnings before

finance income, accretion expense on contingent consideration,

income taxes, depreciation of property and equipment,

amortization of intangible assets and foreign exchange

loss. Please refer to “Non-GAAP Measures” in Photon

Control Inc.’s annual management’s discussion and

analysis for the year ended December 31, 2020 for a

discussion of Non-GAAP measures used by Photon Control Inc., and to

“December 2020 Financial Performance Overview – Net Income and

Adjusted EBITDA” for a reconciliation of Photon Control Inc.’s

Adjusted EBITDA to net income. Copies of Photon Control

Inc.’s consolidated financial statements and related notes for the

year ended December 31, 2020 and of the accompanying

MD&A can be found on SEDAR under Photon Control

Inc.’s profile at www.sedar.com.

Safe Harbor for Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934 regarding the future financial

performance, business prospects and growth of MKS, and the expected

time of closing. These statements are only predictions based on

current assumptions and expectations. Any statements that are not

statements of historical fact (including statements containing the

words “will,” “projects,” “intends,” “believes,” “plans,”

“anticipates,” “expects,” “estimates,” “forecasts,” “continues” and

similar expressions) should be considered to be forward-looking

statements. Actual events or results may differ materially from

those in the forward-looking statements set forth herein. Among the

important factors that could cause actual events to differ

materially from those in the forward-looking statements are the

failure or inability of Photon Control or MKS to meet the closing

conditions, including obtaining necessary Photon Control

securityholder and court approvals, or to otherwise consummate the

transaction, the ability to successfully operate or integrate the

Photon Control business into MKS, the ability to retain and

integrate Photon Control employees into MKS, the ability to realize

the expected benefits of the acquisition, and the other factors

described in MKS’ Annual Report on Form 10-K for the year ended

December 31, 2020 and any subsequent Quarterly Reports on Form

10-Q, as filed with the SEC. MKS is under no obligation to, and

expressly disclaims any obligation to, update or alter these

forward-looking statements, whether as a result of new information,

future events or otherwise after the date of this press

release.

MKS Contacts:Investor

Relations:David RyzhikVice President, Investor RelationsTelephone:

(978) 557-5180Email: david.ryzhik@mksinst.com

Press Relations:Bill CaseySenior Director,

Marketing CommunicationsTelephone: (630)

995-6384Email: bill.casey@mksinst.com

Tom Davies / Jeremy FieldingKekst CNC Press

LiaisonsEmails: tom.davies@kekstcnc.com /

jeremy.fielding@kekstcnc.com

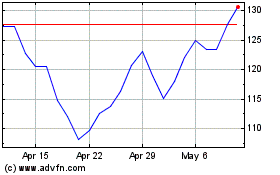

MKS Instruments (NASDAQ:MKSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MKS Instruments (NASDAQ:MKSI)

Historical Stock Chart

From Apr 2023 to Apr 2024