UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Date of Report

(Date of earliest event reported)

|

|

May 1, 2019

|

|

|

|

|

MidWest

One

Financial Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Commission file number 001-35968

|

|

|

|

|

|

|

|

|

Iowa

|

|

42-1206172

|

|

(State or other jurisdiction

of incorporation)

|

|

(I.R.S. Employer

Identification Number)

|

102 South Clinton Street

Iowa City, Iowa 52240

(Address of principal executive offices, including zip code)

(319) 356-5800

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2 below):

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

EXPLANATORY NOTE

This Current Report on Form 8-K is being filed in connection with the consummation on May 1, 2019 of the transactions contemplated by the Agreement and Plan of Merger, dated as of August 21, 2018 (the “Merger Agreement”), by and between MidWest

One

Financial Group, Inc., an Iowa corporation (the “Company”), and ATBancorp, an Iowa corporation (“ATBancorp”), including the merger of ATBancorp with and into the Company (the “Merger”), with the Company as the surviving corporation in the Merger.

Item 2.01.

Completion of Acquisition or Disposal of Assets.

The information set forth in the Introductory Note is incorporated herein by reference.

Closing of Merger

On May 1, 2019, pursuant to the terms of the Merger Agreement, ATBancorp merged with and into the Company, with the Company continuing as the surviving entity in the Merger. Immediately after the Merger, ATBancorp’s wholly owned bank subsidiaries, American Trust & Savings Bank (“ATSB”) and American Bank & Trust Wisconsin, each merged with and into the Company’s wholly owned bank subsidiary, MidWest

One

Bank (the “Bank Merger”), with MidWest

One

Bank as the surviving entity in the Bank Merger.

Under the terms of the Merger Agreement, at the effective time of the Merger (the “Effective Time”) each share of common stock, no par value per share (except for shares that were owned directly by the Company or ATBancorp, subject to certain customary exceptions, which were canceled in the Merger, and dissenters’ shares) of ATBancorp (“ATBancorp Common Stock”) converted into the right to receive $992.51 and 117.5500 shares of common stock, $1.00 par value per share, of the Company (“Company Common Stock”). No fractional shares of Company Common Stock were issued in the Merger, and ATBancorp’s shareholders became entitled to receive cash in lieu of fractional shares. As a result of the Merger, the Company will deliver approximately 4,117,541 shares of Company Common Stock to the former holders of ATBancorp Common Stock. Each outstanding share of Company Common Stock existing immediately prior to the Effective Time remained outstanding and was unaffected by the Merger.

In connection with the completion of the Merger, on May 1, 2019, the Company entered into supplemental indentures and related agreements pursuant to which it assumed ATBancorp’s obligations as required by the indentures and certain related agreements with respect to ATBancorp’s outstanding Floating Rate Junior Subordinated Deferrable Interest Debentures due 2036 (and ATBancorp’s guarantee of certain outstanding trust preferred securities relating thereto) and Floating Rate Junior Subordinated Deferrable Interest Debentures due 2037 (and ATBancorp’s guarantee of certain outstanding trust preferred securities relating thereto), which collectively have an aggregate principal amount of approximately $20.1 million, in each case before related acquisition accounting fair market value adjustments. Also on May 1, 2019, the Company also entered into an assignment and assumption agreement pursuant to which it assumed ATBancorp’s 6.50% Subordinated Debentures due 2023, which have an aggregate principal amount of approximately $10,835,000 before related acquisition accounting fair market value adjustments.

Amendment to Merger Agreement

Prior to the closing of the Merger, on April 30, 2019, ATBancorp and the Company entered into the First Amendment to the Agreement and Plan of Merger (the “Amendment”), a copy of which is attached hereto as Exhibit 2.2.

The Merger Agreement provides that, as a condition to the consummation of the Merger, ATBancorp must dispose of certain assets relating to its retirement services business (the “Assets”). Pursuant to the Merger Agreement, ATBancorp intends to pay its shareholders, concurrent with the closing of the Merger, a special dividend of the Net Proceeds (as defined in the Merger Agreement) from the sale of the Assets.

The Amendment provides that ATBancorp will deposit in escrow $7,000,000 from the cash portion of the Merger consideration received from the Company to secure certain contingent obligations of ATSB in favor of the buyer of the Assets. The Amendment also provides that ATBancorp will deposit in escrow $4,000,000 from the cash portion of the Merger consideration received from the Company to secure certain contingent obligations of ATSB in favor of the Company. Additionally, the Amendment provides that ATBancorp will deposit in escrow $100,000 from the cash portion of the Merger consideration received from the Company to secure certain contingent obligations of ATSB in favor of the purchaser of certain assets related to its trust business in California, which was sold in April 2019, and will also deposit in escrow $1,300,000 from the cash portion of the Merger consideration received from the Company to cover any expenses incurred by Nicholas J. Schrup III, R. Rourke Holscher and Douglas H. Greeff, as the ATBancorp shareholder representatives, in connection with their oversight and management of the funds held in the escrow accounts discussed above.

Upon the expiration of the escrow agreements discussed above, to the extent any funds remain in such escrow accounts, such funds shall be disbursed pro rata to the holders of ATBancorp common stock who are identified in the respective escrow agreement governing such funds and such disbursement shall be considered a portion of the Merger consideration.

The foregoing description of the Merger, the Merger Agreement and the Amendment is not complete and is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on August 22, 2018, and to the Amendment, which is filed as Exhibit 2.2 hereto, each of which is incorporated herein by reference.

|

|

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

The information set forth in the Introductory Note is incorporated herein by reference.

Immediately following the Effective Time, Douglas H. Greeff and Richard J. Hartig were appointed to the Board of Directors of the Company (the “Board”). Mr. Greeff was appointed as a Class I director for a term expiring at the 2020 annual meeting of the Company’s shareholders. Mr. Hartig was appointed as a Class II director for a term expiring at the 2021 annual meeting of the Company’s shareholders.

Other than the Merger Agreement, there are no arrangements between Messrs. Greeff or Hartig and any other persons pursuant to which either Mr. Greeff or Mr. Hartig was selected as a director. There are no transactions in which Mr. Greeff or Mr. Hartig have an interest requiring disclosure under Item 404(a) of Regulation S-K.

|

|

|

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On April 18, 2019, effective at the Effective Time, the Board amended the Bylaws of the Company by amending Section 3.2 (the “Amendment”) to permit for an increase the number of directors constituting the Board of Directors and to update outdated language in the Bylaws.

The Amendment is filed with this Current Report on Form 8-K as Exhibit 3.1 and is incorporated by reference herein. The foregoing summary of the Amendment is qualified in its entirety by reference to the full text of the Amendment.

On May 1, 2019, the Company issued a press release announcing the completion of the Merger, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(a)

Financial Statements of Businesses Acquired.

The Company intends to file the financial statements of ATBancorp required by Item 9.01(a) as part of an amendment to this Current Report on Form 8-K not later than 71 calendar days after the date that this Current Report on Form 8-K is required to be filed.

(b)

Pro Forma Financial Information.

The Company intends to file the pro forma financial information required by Item 9.01(b) as part of an amendment to this Current Report on Form 8-K not later than 71 calendar days after the date that this Current Report on Form 8-K is required to be filed.

(d)

Exhibits.

Exhibit No.

Description

2.1

Agreement and Plan of Merger by and between MidWest

One

Financial Group, Inc. and ATBancorp, dated August 21, 2018 (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed on August 22, 2018).*

2.2

First Amendment to the Agreement and Plan of Merger, by and between MidWest

One

Financial Group, Inc. and ATBancorp, dated April 30, 2019.

99.1

Press Release, dated May 1, 2019.

* The schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K and will be provided to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

M

ID

W

EST

O

NE

F

INANCIAL

G

ROUP

, I

NC

.

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

May 1, 2019

|

By:

|

|

/s/ B

ARRY

S. R

AY

|

|

|

|

|

|

|

|

Barry S. Ray

|

|

|

|

|

|

|

|

Senior Executive Vice President and Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

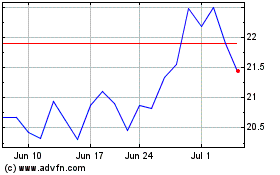

MidWestOne Financial (NASDAQ:MOFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

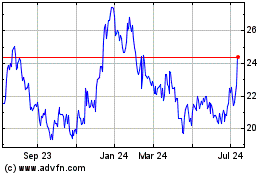

MidWestOne Financial (NASDAQ:MOFG)

Historical Stock Chart

From Apr 2023 to Apr 2024