Microsoft Posts Record Sales as Cloud Business Continues to Grow -- Update

January 29 2020 - 6:06PM

Dow Jones News

By Aaron Tilley

Microsoft Corp. posted higher quarterly earnings on record

sales, driven by continued strong growth in its cloud-computing

business.

The software giant Wednesday reported fiscal second-quarter

earnings per share of $1.51, up from $1.08 for the same period last

year. Analysts surveyed by FactSet had expected earnings per share

of $1.32. Revenue rose 14% to $36.91 billion, beating analysts'

expectations of $35.67 billion.

Microsoft has enjoyed a period of earnings growth under Chief

Executive Satya Nadella, who has bolstered the company's

cloud-computing business that enables customers to rent rather than

buy data storage and processing. The company has become the No. 2

provider of cloud-computing services behind Amazon.com Inc.

"We are innovating across every layer of our differentiated

technology stack and leading in key secular areas that are critical

to our customers' success," said Mr. Nadella.

Microsoft's intelligent cloud unit, which includes its Azure

cloud services, had sales of $11.87 billion, up 27% from the

year-ago period and exceeding analysts' expectations of $11.4

billion, according to FactSet.

In October, Microsoft beat out Amazon to provide cloud-services

to the Pentagon. The deal is valued at up to $10 billion over the

next decade, the Pentagon has said. Amazon is protesting the

decision to award the contract to Microsoft.

The Redmond, Wash.-based company has spent heavily to bolster

its cloud business and narrow the gap with Amazon, which still has

a dominant market share. Microsoft has also benefited from

increasing cloud profit margins, bolstering its financial

results.

Azure sales increased 62% in the second quarter from a year ago,

a faster pace than the 59% year-over-year rise in the first

quarter.

Azure growth is "confirmation that they're continuing to take

market share while offering more efficiency as they take market

share," said Alex Zukin, an analyst at RBC Capital Markets.

"They're growing at twice the rate that AWS [Amazon Web Services]

is growing."

Microsoft's shares, which have risen 63% over the past year,

were up nearly 3% in after-hours trading.

The division that includes the legacy Windows personal-computer

operating system business, the Xbox gaming business and Surface

hardware also surprised Wall Street as the company had forecast for

sales to be down as much as 3% from the second quarter last year.

Instead, sales increased 1.7% to $13.21 billion, helped by stronger

Windows operating system installs.

"We don't think we'll see sustainable growth with Windows, but

we also don't think a cliff is coming," Jonathan Neilson, a finance

director with investor relations at Microsoft. "The underlying

demand is there."

Microsoft this month ended support of Windows 7 software. That

deadline helped drive PC sales in recent months as customers such

as large enterprises bought devices featuring the newer Windows 10

operating system.

Microsoft's productivity and business-process division, which

includes LinkedIn and commercial subscriptions to the Office 365

product suite, had $11.83 billion in sales, up 17% from the same

quarter a year ago. Analysts were expecting sales of $11.43 billion

for the quarter.

Write to Aaron Tilley at aaron.tilley@wsj.com

(END) Dow Jones Newswires

January 29, 2020 17:51 ET (22:51 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

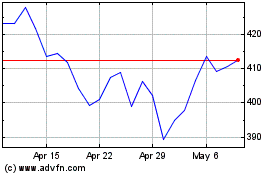

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024