Microsoft Rode Cloud To Market-Cap Prize -- WSJ

December 03 2018 - 3:02AM

Dow Jones News

By Jay Greene

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 3, 2018).

Microsoft Corp. tried through the years to compete in a range of

buzzy consumer businesses, but it was Chief Executive Satya

Nadella's focus on selling humdrum yet fast-growing computing

services to companies that allowed it to reclaim the title of

world's most valuable company.

Microsoft unseated Apple Inc. for the top spot, closing Friday

with a market cap of $851.36 billion, nearly $4 billion higher than

the iPhone maker. To get there, Microsoft also had to outpace

Amazon.com Inc., Facebook Inc. and Google owner Alphabet Inc., once

red-hot tech titans that have been roiled by congressional

hearings, investor concerns about growth and caustic tweets from

President Trump, controversies Mr. Nadella largely has avoided.

The resurgence -- Microsoft last wore the most-valuable crown in

2003 -- can be traced to Mr. Nadella's vigorous pursuit of

web-based services known as cloud computing, which had threatened

to undermine Microsoft's own business selling productivity and

data-center software companies and people installed on their own

computers.

"They built a strategy for the cloud when the cloud was really

starting to emerge," said Matt McIlwain, managing director of

Madrona Venture Group, a Seattle firm that invests in cloud

startups. "Enterprises started embracing the cloud just as

Microsoft was starting to get it right."

Microsoft's first ascent up the market-cap mountain was powered

by its ubiquitous Windows operating system and Office productivity

software, and the aggressive leadership of co-founder Bill Gates.

The CEO leveraged his Windows monopoly to move into new markets, a

strategy that launched battles with regulators in the U.S. and

abroad.

Settling those matters led to new rules for Microsoft's conduct

that slowed the company's growth. Its stock stagnated for a decade.

Since Mr. Nadella took over as CEO five years ago, Microsoft's

shares have tripled, buttressing the statuses of Mr. Gates and

former CEO Steve Ballmer -- still two of Microsoft's biggest

shareholders -- as some of the world's wealthiest individuals.

At The Wall Street Journal's WSJ Tech D.Live conference in

November, Mr. Ballmer said enterprise business powers Microsoft

today. Mr. Nadella took a company with good profit streams and

technology "to whole new levels," he said.

Microsoft's Azure cloud business has been key, with revenue

climbing more than 76% every quarter since the company began

reporting the metric in October 2015.

"I think Satya has done a great job," Mr. Ballmer said. "I think

that's fantastic and as a shareholder I think it's double and

triple fantastic."

Mr. Nadella has sought to change Microsoft's culture. On his

watch, it has taken public positions on contentious issues, calling

for regulation of facial-recognition tech and responsible use of

artificial-intelligence software. He moved away from some of Mr.

Ballmer's bets, dismantling the company's mobile-phone business,

and prioritized working with partners in the cloud and elsewhere,

putting popular Microsoft apps on Apple's iOS and Google's Android

software.

"They've succeeded under Satya because they have developed a

different persona," said Bob Muglia, a former Microsoft executive

who is now CEO of Snowflake Computing Inc., a data-warehousing

service.

Amazon still dominates the cloud. The online retail giant last

year held a 51.8% share of the world-wide cloud-infrastructure

market, according to the market-research firm Gartner Inc.

Microsoft is second, with 13.3% of the market.

Wall Street expects the cloud to keep booming. Gartner estimated

the world-wide market for cloud-infrastructure services like the

ones Microsoft and Amazon sell will grow to $63 billion in 2021

from $23.6 billion last year.

Amazon is aware of Microsoft's presence. At the Amazon Web

Services annual conference Wednesday in Las Vegas, Amazon

cloud-computing chief Andy Jassy told attendees that Amazon is

pulling in more actual dollars than Microsoft, even if its rate of

growth is slower. And he introduced a new service that lets

customers run Amazon's cloud-computing offerings in their own data

centers, taking aim at Microsoft's area of strength.

Also contributing to Microsoft's rebirth is productivity

software, which helped Microsoft gain the most-valuable crown

nearly two decades ago. The commercial version of Office 365 -- a

cloud-based subscription version of the traditional Office software

-- is among the fastest-growing pieces of a segment that accounts

for roughly a third of Microsoft's revenue.

Microsoft was once the dominant force in tech, and its use of

that power led the U.S. to sue to break it apart. But in recent

years, regulators and legislators haven't focused as much on

Microsoft.

Microsoft never built a successful social network like Facebook

that could generate concerns over data security and misinformation.

It is a distant second to Google in web search, escaping scrutiny

over data harvesting. Its Surface computer and Xbox gaming units

are a small enough part of its business that they don't appear to

be jeopardized by the trade battle between Washington and Beijing,

or a lightning rod for criticism over U.S.-based manufacturing.

Microsoft's foray into selling smartphones was a failure -- the

company ultimately took charges that exceeded the $9.4 billion

Microsoft paid for Nokia Corp. That costly period years ago ended

up insulating Microsoft today from a slowdown in the smartphone

market that has hammered Apple's stock in recent weeks.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

December 03, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

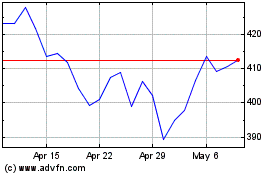

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024