By Jay Greene and Tripp Mickle

Microsoft Corp. briefly unseated longtime rival Apple Inc. on

Tuesday as the world's most valuable company, reflecting investors'

faith in its revival under Chief Executive Satya Nadella while the

iPhone maker adjusts to slowing momentum for its most profitable

product.

Shares in Microsoft opened at $106.27, pushing its market

capitalization to $815.75 billion, elbowing past Apple's opening

value of $813.88 billion. After the first minute of trading, Apple

was back on top. The two swapped spots several times later in the

day before Apple at the close reclaimed the title it has held for

most of the past seven years.

Apple finished with a market value of $826.84 billion while

Microsoft was at $822.43 billion. Market values are calculated

using data provided by FactSet, which draws information from public

filings.

The move comes nearly four months after Apple became the first

U.S. company to surpass $1 trillion in market value, an achievement

since matched by Amazon.com Inc. Both companies' shares fell below

that mark in recent weeks as investors dealt tech a sharp blow.

Apple peaked at $1.103 trillion on Oct. 3, but has shed nearly $300

billion in market value since, in part to do with investors'

concerns about the future of the iPhone.

President Trump added to those concerns, telling The Wall Street

Journal Monday that tariffs could be placed on Apple hardware

imported from China.

Apple first took the crown as the largest company by market

capitalization in August 2011, when it edged out Exxon Mobil Corp.

in a symbolic moment underscoring that tech -- not oil -- was king.

At the time, Apple was valued at roughly $340 billion, with

Microsoft at a little more than $200 billion.

Microsoft's resurgence hasn't been flashy. The company built its

recent fortunes in the cloud, a market analysts say has delivered

only a fraction of its future growth. But doing so involved letting

go of the past -- specifically a not-invented-here mind-set that

stopped Microsoft from working with the rising technologies of its

peers.

These days, Microsoft's best-known apps are on smartphones run

by Apple and Google operating systems. It also is placing

forward-looking if less-certain bets on opportunities such as

augmented reality and voice recognition, building on those efforts

as well as its cloud business with acquisitions big and small.

"Microsoft has already made the switch to a services business.

Apple is trying to do that, and they probably will, but the

question is: At what pace?" said James Armstrong, president of

Henry H. Armstrong Associates, which has $750 million under

management with about $107 million invested in Microsoft and $3.5

million in Apple.

"That may not be a problem for the company, but it could be for

the stock price," he said. "Apple has to prove there are other legs

to the stool" that can match the iPhone.

Nabbing the top market-cap spot is a stunning reversal for

Microsoft, a 43-year-old company that last held it on Nov. 3, 2003,

at about $289 billion, dwarfing Apple's market value at the time of

about $8 billion. Back then, Microsoft was still feared for the

dominance of its Windows operating system, which it had used as a

powerful launchpad to muscle into adjacent markets such as web

browsing and streaming media.

It was years before the launch of the iPhone, a device that

catapulted Apple's value and profits to unforeseen heights.

Alphabet Inc.'s Google hadn't yet gone public and Amazon was still

a young online retailer whose future as an economic force was far

from guaranteed.

But Microsoft fell out of favor with investors. Bruising battles

in the U.S. and abroad about its Windows monopoly led to

settlements with government regulators that curtailed some of the

conduct that led to its rise. Microsoft's shares stagnated for much

of the following decade as rivals surpassed it in mobile devices

and internet computing -- tectonic shifts that fueled the rise of

Apple, Google and Amazon. Apple passed Microsoft in value in

2010.

Microsoft turned the page in 2014, when Satya Nadella replaced

Steve Ballmer as chief executive. The new CEO unwound some of

Microsoft's failed bets, including its acquisition of Nokia Corp.'s

handset business. And he expanded Microsoft's focus on cloud

computing, a rapidly growing market pioneered and led by

Amazon.

"Satya has shaken up the business model," said Mike Frazier,

president of Bedell Frazier Investment Counselling, which has $500

million under management and bought Microsoft shares in October for

the first time in more than a decade. "He's taken a startup

approach and brought Microsoft to the new millennium."

While Microsoft was creating new revenue streams, Apple leaned

heavily on the smartphone business that turned it into the world's

most valuable company. The iPhone, which made its debut in 2007,

accounts for about two-thirds of annual sales and three-quarters of

the company's gross profits. And while Apple continues to generate

record profits, the growth in the number of iPhones it sells

annually has been slowing.

Facing that challenge, Apple is trying to transition from a

business focused on selling more iPhones to one that charges higher

prices for feature-rich gadgets while selling software and

services. Apple this month said it would stop disclosing data on

the number of iPhones, iPads and Macs it sells to better reflect

this shift.

Though Apple has more than doubled research-and-development

spending since 2014 to $14.24 billion annually, it hasn't been able

to jump into new categories at the rate and pace of some of its

tech rivals.

The last major industry it disrupted was the watch industry,

which is valued at about $68 billion, according to Euromonitor

International, a market-research firm.

Write to Jay Greene at Jay.Greene@wsj.com and Tripp Mickle at

Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

November 27, 2018 17:04 ET (22:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

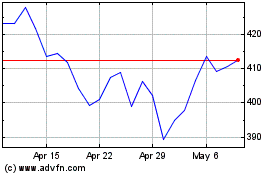

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024