Statement of Changes in Beneficial Ownership (4)

October 19 2021 - 6:31PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Sadana Sumit |

2. Issuer Name and Ticker or Trading Symbol

MICRON TECHNOLOGY INC

[

MU

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

EVP, Chief Business Officer |

|

(Last)

(First)

(Middle)

8000 S. FEDERAL WAY |

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/16/2021 |

|

(Street)

BOISE, ID 83716

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 10/16/2021 | | M | | 6962.00 (1) | A | $0.00 | 214945.00 | D | |

| Common Stock | 10/16/2021 | | M | | 9748.00 (2) | A | $0.00 | 224693.00 | D | |

| Common Stock | 10/16/2021 | | M | | 24278.00 (3) | A | $0.00 | 248971.00 | D | |

| Common Stock | 10/16/2021 | | F | | 10341.00 (4) | D | $67.68 | 238630.00 | D | |

| Common Stock | 10/16/2021 | | F | | 4604.00 (5) | D | $67.68 | 234026.00 | D | |

| Common Stock | 10/16/2021 | | F | | 9783.00 (5) | D | $67.68 | 224243.00 | D | |

| Common Stock | 10/16/2021 | | F | | 3289.00 (5) | D | $67.68 | 220954.00 | D | |

| Common Stock | 10/16/2021 | | F | | 11467.00 (5) | D | $67.68 | 209487.00 | D | |

| Common Stock | 10/16/2021 | | F | | 8588.00 (5) | D | $67.68 | 200899.00 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Performance Restricted Stock Units | $0.00 | 10/16/2021 | | M | | | 4874.00 | (6) | (6) | Common Stock | 9748.00 (2) | $0.00 | 0.00 | D | |

| Performance Restricted Stock Units | $0.00 | 10/16/2021 | | M | | | 9093.00 | (7) | (7) | Common Stock | 24278.00 (3) | $0.00 | 0.00 | D | |

| Performance Restricted Stock Units | $0.00 | 10/16/2021 | | M | | | 10391.00 | (8) | (8) | Common Stock | 6962.00 (1) | $0.00 | 0.00 | D | |

| Explanation of Responses: |

| (1) | The Compensation Committee certified achievement of the pre-established performance goals at a level resulting in a vest of 67% of the total target shares under the FCF performance-based restricted stock units previously awarded on October 16, 2018. As reported at grant, the performance-based restricted stock unit could result in a payout that varies from 0% to an aggregate of 200% of target shares under all related awards based on actual achievement of the goals. |

| (2) | The Compensation Committee certified achievement of the pre-established performance goals at a level resulting in a vest of 100% of the total target shares under the PE Ratio performance-based restricted stock units previously awarded on October 16, 2018. As reported at grant, the performance-based restricted stock unit could result in a payout that varies from 0% to an aggregate of 200% of target shares under all related awards based on actual achievement of the goals. |

| (3) | The Compensation Committee certified achievement of the pre-established performance goals at a level resulting in a vest of 100% of the total target shares under the NAND delivery and solutions performance-based restricted stock units previously awarded on October 16, 2018. As reported at grant, the performance-based restricted stock unit could result in a payout that varies from 0% to an aggregate of 200% of target shares under all related awards based on actual achievement of the goals. |

| (4) | Withholding of shares of common stock to satisfy tax withholding obligations in connection with the vesting of awards under the Issuer's 2007 Equity Incentive Plan. |

| (5) | Withholding of shares of common stock to satisfy tax withholding obligations in connection with the vesting of awards under the Issuer's 2004 Equity Incentive Plan. |

| (6) | Each performance-based restricted stock unit represents the right to receive, following vesting, shares of common stock based upon the achievement of pre-established performance metrics related to PE Ratio over a 3-year performance period beginning August 31, 2018 and ending on September 2, 2021 (payout is from 0% up to a 200% aggregate limit on the total target shares that may be received under the performance-based restricted stock units awarded on October 16, 2018), and certification of such performance by the Compensation Committee. |

| (7) | Each performance-based restricted stock unit represents the right to receive, following vesting, shares of common stock based upon the achievement of pre-established performance metrics related to NAND delivery and solutions over a 3-year performance period beginning August 31, 2018 and ending on September 2, 2021 (payout is from 0% up to a 200% aggregate limit on the total target shares that may be received under the performance-based restricted stock units awarded on October 16, 2018), and certification of such performance by the Compensation Committee. |

| (8) | Each performance-based restricted stock unit represents the right to receive, following vesting, shares of common stock based upon the achievement of pre-established performance metrics related to FCF over a 3-year performance period beginning August 31, 2018 and ending on September 2, 2021 (payout is from 0% up to a 200% aggregate limit on the total target shares that may be received under the performance-based restricted stock units awarded on October 16, 2018), and certification of such performance by the Compensation Committee. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Sadana Sumit

8000 S. FEDERAL WAY

BOISE, ID 83716 |

|

| EVP, Chief Business Officer |

|

Signatures

|

| Rob Beard, Attorney-in-fact | | 10/19/2021 |

| **Signature of Reporting Person | Date |

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

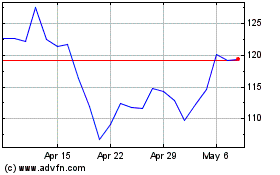

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024