MGE Energy Reports Second-Quarter Earnings

August 07 2018 - 3:00PM

Business Wire

MGE Energy, Inc. (Nasdaq: MGEE) today reported financial results

for the second quarter of 2018.

MGE Energy's earnings for the second quarter of 2018 were

$18.4 million, or 53 cents per share, compared to

$15.5 million, or 45 cents per share, for the same period in

the prior year.

During the second quarter of 2018, gas net income increased over

the same period in the prior year, largely attributable to colder

weather conditions in April 2018. In addition, there was an

increase in gas retail customers. MGE Energy also experienced

higher electric net income this year as a result of higher retail

sales. The improved results are due to favorable weather conditions

experienced in the second quarter of 2018 versus the same period in

2017.

MGE Energy, Inc.

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended June 30, 2018

2017 Operating revenue $124,262 $126,463 Operating income

$24,231 $25,595 Net income $18,351 $15,543 Earnings per share

(basic and diluted) $0.53 $0.45 Weighted average shares outstanding

(basic and diluted) 34,668 34,668

Six Months Ended June

30, 2018 2017 Operating revenue $281,894 $283,286

Operating income $50,419 $57,431 Net income $38,352 $34,843

Earnings per share (basic and diluted) $1.11 $1.01 Weighted average

shares outstanding (basic and diluted) 34,668 34,668

About MGE Energy

MGE Energy is a public utility holding company. Its principal

subsidiary, Madison Gas and Electric, generates and distributes

electricity to 151,000 customers in Dane County, Wis., and

purchases and distributes natural gas to 158,000 customers in seven

south-central and western Wisconsin counties. MGE's roots in the

Madison area date back more than 150 years.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180807005801/en/

MGE Energy, Inc.Steven B. Schultz, 608-252-7219Corporate

Communications Managersbschultz@mge.com

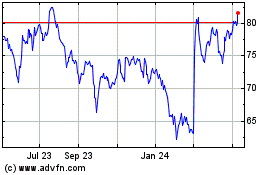

MGE Energy (NASDAQ:MGEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

MGE Energy (NASDAQ:MGEE)

Historical Stock Chart

From Apr 2023 to Apr 2024