Current Report Filing (8-k)

October 29 2021 - 5:26PM

Edgar (US Regulatory)

0001442836

false

0001442836

2021-10-29

2021-10-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2021

MERSANA THERAPEUTICS, INC.

(Exact Name of Company as Specified in

its Charter)

|

Delaware

|

|

001-38129

|

|

04-3562403

|

|

|

|

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

840 Memorial Drive

Cambridge, MA 02139

|

|

|

|

|

|

(Address of Principal Executive Offices) (Zip Code)

|

Company's telephone number, including area code: (617) 498-0020

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

|

Title

of each class

|

Trading

symbol(s)

|

Name

of each exchange on which

registered

|

|

Common Stock, $0.001 par value

|

MRSN

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material

Definitive Agreement.

Loan and Security Agreement

On October 29, 2021 (the “Closing Date”), Mersana

Therapeutics, Inc. (the “Company”) entered into a Loan and Security Agreement (the “Loan Agreement”) by and

among the Company, Oxford Finance LLC, in its capacity as collateral agent (in such capacity, the “Agent”) and a lender, and

Silicon Valley Bank as a lender (collectively, the “Lenders”), pursuant to which term loans of up to an aggregate principal

amount of $100.0 million is available to the Company, consisting of (i) a tranche A term loan in the aggregate principal amount of

up to $60.0 million available at any time on or prior to December 31, 2022 at the option of the Company, $25.0 million of which was

disbursed on the Closing Date and utilized, in part, to repay existing indebtedness of the Company; (ii) a contingent tranche B term

loan in the aggregate principal amount of $10.0 million available to the Company at any time on or prior to December 31, 2022, within

90 days of the Company having both (x) enrolled and dosed the first patient in a Phase I trial for XMT-2056 and (y) enrolled

and dosed the first patient in a Phase I trial for XMT-1660, so long as the UpRi UPLIFT cohort intended to support a submission of a Biologics

License Application is ongoing; (iii) a contingent tranche C term loan in the aggregate principal amount of $10.0 million available

to the Company at any time on or prior to June 30, 2023, within 90 days of the Company having received positive data from the UpRi

UPLIFT registrational trial sufficient to support a Biologics License Application; and (iv) a contingent tranche D term loan in the

aggregate principal amount of $20.0 million available at any time on or prior to November 1, 2024 (extended to November 1, 2025

if the tranche C term loan milestone is achieved), which is available in the sole discretion of the Lenders, subject, in each case of

the foregoing, to certain other terms and conditions.

The term loans bear interest at a floating rate equal to the greater

of (i) 8.50% and (ii) the prime rate plus 5.25%. The Loan Agreement provides for interest-only payments until November 1,

2024 (extended to November 1, 2025 if the tranche C term loan milestone is achieved) (the “Amortization Date”). The aggregate

outstanding principal balance of the term loans are required to be repaid in monthly installments starting on the Amortization Date based

on a repayment schedule equal to (i) 24 months if the tranche C term loan milestone is not achieved and (ii) 12 months if the

tranche C term loan milestone is achieved. All unpaid principal and accrued and unpaid interest with respect to each term loan is due

and payable in full on October 1, 2026 (the “Maturity Date”).

The Company paid a facility fee of $125,000 on the Closing Date and

has agreed to pay a facility fee equal to 0.50% of the original principal amount of each subsequent funding under the facility. The Company

will be required to make a final payment fee of 4.25% of the original principal amount of any funded term loan being repaid on the earliest

of (i) the prepayment of such term loan, (ii) the Maturity Date and (iii) acceleration of the obligations. At the Company’s

option, the Company may elect to prepay all, or any part, of the outstanding loans, subject to a prepayment fee equal to the following

percentage of the principal amount being prepaid: 3.00% if an advance is prepaid during the first 12 months following the applicable advance

date, 2.00% if an advance is prepaid after 12 months but on or prior to 24 months following the applicable advance date, and 1.00% if

an advance is prepaid any time after 24 months following the applicable advance date but prior to the Maturity Date.

In connection with its entry into the Loan Agreement, the Company granted

the Agent a security interest in substantially all of the Company’s personal property owned or later acquired, excluding intellectual

property (but including the right to payments and proceeds of intellectual property), and a negative pledge on intellectual property.

The Loan Agreement also contains customary representations and warranties and affirmative and negative covenants, as well as customary

events of default. Certain of the customary negative covenants limit the ability of the Company and its subsidiaries, among other things,

to incur future debt, grant liens, make investments, make acquisitions, distribute dividends, make certain restricted payments and sell

assets, subject in each case to certain exceptions. The failure by the Company to comply with these covenants would result in an event

of default under the Loan Agreement and could result in the acceleration of the obligations owed pursuant to the Loan Agreement.

The foregoing description of the Loan Agreement is qualified in its

entirety by reference to the full text of the Loan Agreement which the Company intends to file as an exhibit to its Annual Report on Form 10-K

for the year ending December 31, 2021.

Item 1.02. Termination of a Material Definitive Agreement.

On October 29, 2021, concurrently with the closing of the Loan

Agreement and the initial borrowing under the tranche A term loan, the Company utilized a portion of the proceeds from such borrowing

to repay in full all outstanding amounts owed under the Company’s existing Loan and Security Agreement, dated May 8, 2019,

as amended to date, by and between the Company and Silicon Valley Bank, and terminated all commitments by the lenders to extend further

credit thereunder and all guarantees and security interests granted by the Company to the lenders thereunder.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The information contained in Item 1.01 of this Current Report on Form 8-K

is incorporated herein by reference

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MERSANA THERAPEUTICS, INC.

|

|

|

|

|

|

Date: October 29, 2021

|

By:

|

/s/ Brian DeSchuytner

|

|

|

|

Name: Brian DeSchuytner

|

|

|

|

Title: Chief Financial Officer

|

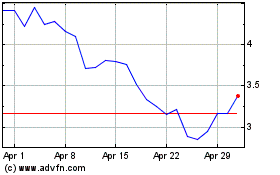

Mersana Therapeutics (NASDAQ:MRSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mersana Therapeutics (NASDAQ:MRSN)

Historical Stock Chart

From Apr 2023 to Apr 2024