Current Report Filing (8-k)

November 14 2018 - 11:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 13, 2018

Merit Medical Systems, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Utah

|

|

0-18592

|

|

87-0447695

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

1600 West Merit Parkway

|

|

|

|

South Jordan, Utah

|

|

84095

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(801) 253-1600

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.01.

Completion of Acquisition or Disposition of Assets

.

As previously reported in a Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on October 1, 2018, Merit Medical Systems, Inc. ("Merit") entered into an Agreement and Plan of Merger (the “Agreement”) by and among Merit, Cianna Medical, Inc. (“Cianna”), CMI Transaction Co. (“Merger Sub”) and Fortis Advisors LLC, as the Securityholders' Representative, related to Merit’s prospective acquisition of Cianna. On November 13, 2018, Merit closed the transaction contemplated by the Agreement. As previously reported, Merit has agreed to pay up to $200 million in connection with its acquisition of Cianna, as follows:

|

|

|

|

•

|

$135 million in cash in connection with closing, subject to standard adjustments for cash at closing, working capital and other matters;

|

|

|

|

|

•

|

an earn-out payment of $15 million payable upon the achievement by Cianna of certain manufacturing capacity and manufacturing cost milestones on or before June 30, 2019; and

|

|

|

|

|

•

|

earn-out payments of up to $50 million in the aggregate, payable at the rate of 175% of the amount by which annual net sales of Cianna products in each of 2019, 2020, 2021 and 2022 exceed annual net sales of Cianna products in the preceding fiscal year.

|

Safe Harbor for Forward-Looking Statements

This Current Report, including the exhibit hereto, contains statements which are not purely historical, including, without limitation, statements regarding Merit's forecasted plans, revenues, earnings per share, gross margins or financial results (on a GAAP or non-GAAP basis) or Merit’s acquisition of Cianna, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties such as those described in Merit's Annual Report on Form 10-K for the year ended December 31, 2017 and subsequent filings with the SEC. Such risks and uncertainties include the following: Merit's potential inability to successfully manage the integration of Cianna and achieve anticipated financial results, product development and other anticipated benefits; uncertainties as to whether Merit will achieve sales, gross margin, cost of goods sold, cash flow and other results from the Cianna acquisition which are comparable to the experience of Cianna; unknown costs and risks associated with the business and operations of Cianna or Merit’s internal models or projections; governmental scrutiny and regulation of the medical device industry, including governmental inquiries, investigations and proceedings involving Merit or the business and operations conducted by Cianna; how the occurrence of any unanticipated event or cost in connection with the integration of Cianna may affect Merit’s projected ability to comply with debt covenants; infringement of acquired technology or the assertion that acquired technology infringes the rights of other parties; the potential of fines, penalties or other adverse consequences if Merit's or Cianna’s employees or agents violate the U.S. Foreign Corrupt Practices Act or other laws or regulations; laws and regulations targeting fraud and abuse in the healthcare industry; potential for significant adverse changes in governing regulations; changes in tax laws and regulations in the United States or other countries; increases in the prices of commodity components; negative changes in economic and industry conditions in the United States or other countries; termination or interruption of relationships with Merit's or Cianna’s suppliers, or failure of such suppliers to perform; the effects of fluctuations in exchange rates on projected financial results; development of new products and technology that could render Merit's or Cianna’s products obsolete; changes in healthcare policies or markets related to healthcare reform initiatives; failure to comply with applicable environmental laws; changes in key personnel; work stoppage or transportation risks; price and product competition; availability of labor and materials; fluctuations in and obsolescence of inventory; and other factors referred to in Merit's Annual Report on Form 10-K for the year ended December 31, 2017 and other materials filed with the SEC. All subsequent forward-looking statements attributable to Merit or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Actual results will likely differ, and may differ materially, from anticipated results. Financial estimates are subject to change and are not intended to be relied upon as predictions of future operating results, and Merit assumes no obligation to update or disclose revisions to those estimates.

Item 2.03

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

.

The closing amounts paid by Merit under the Agreement were funded through a draw down under the Second Amended and Restated Credit Agreement dated July 6, 2016 (as amended on September 28, 2016, March 20, 2017, December 13, 2017 and March 28, 2018, the “

Credit Agreement

”) with certain lenders identified therein, Wells Fargo Bank, National Association, as administrative agent, swingline lender and Lender, and Wells Fargo Securities, LLC, as sole lead arranger and sole bookrunner. Information regarding the Credit Agreement, and copies thereof, are provided in Merit’s Current Reports on Form 8-K filed with the SEC on July 6, 2016, March 20, 2017 and December 13, 2017 (including Exhibit 10.1 thereof), the exhibits to Merit’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2016 filed with the SEC on August 8, 2016, the exhibits to Merit’s

Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2018 filed with the SEC on May 10, 2018 and the exhibits to Merit’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC on March 1, 2017.

Item 7.01.

Regulation FD Disclosure

.

On November 13, 2018, Merit issued a press release, entitled “Merit Medical Closes Cianna Medical, Inc. Deal” related to the Agreement, a copy of which is filed as Exhibit 99.1 to this Current Report.

The information contained in this Item 7.01 and in the attached Exhibit 99.1 is being furnished and shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not deemed incorporated by reference by any general statements incorporating by reference this Current Report or future filings into any filings under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that Merit specifically incorporates the information by reference. By filing this Current Report and furnishing this information, Merit makes no admission or statement as to the materiality of any information in this Current Report that is required to be disclosed solely by reason of Regulation FD.

Item 9.01.

Financial Statements and Exhibits

.

(d) Exhibits

|

|

|

|

|

|

|

99.1

|

|

Press release entitled “Merit Medical Closes Cianna Medical, Inc. Deal” issued on November 13, 2018

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

MERIT MEDICAL SYSTEMS, INC.

|

|

|

|

|

|

|

|

|

|

Date: November 14, 2018

|

By:

|

/s/ Brian G. Lloyd

|

|

|

|

Brian G. Lloyd

|

|

|

|

Chief Legal Officer and Corporate Secretary

|

EXHIBIT INDEX

|

|

|

|

|

|

|

EXHIBIT NUMBER

|

|

DESCRIPTION

|

|

|

|

|

|

|

|

|

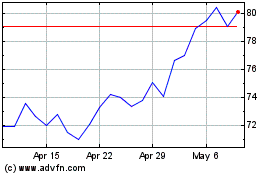

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

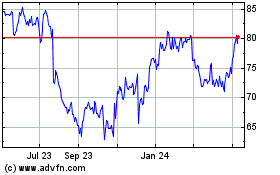

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Apr 2023 to Apr 2024