Mercer International Inc. Announces Plans to Issue $350 Million of Senior Notes in Private Offering

November 28 2018 - 7:41AM

Mercer International Inc. (Nasdaq: MERC) (the "Company") today

announced that it intends to offer for sale (the "Offering") $350

million in aggregate principal amount of senior notes due 2025 (the

"2025 Notes"). The net proceeds of the Offering, together with cash

on hand, will be used to finance the purchase price under the

previously announced acquisition of all of the outstanding shares

of Daishowa-Marubeni International Ltd. (the "Acquisition") and to

pay fees and expenses.

The Offering is not conditioned upon the

completion of the Acquisition. However, in the event that the

Acquisition is not consummated on or prior to January 31, 2019 or

if the share purchase agreement respecting the Acquisition is

terminated any time prior thereto, the Company will be required to

redeem in whole and not in part the aggregate principal amount of

the outstanding notes on a special mandatory redemption date at a

redemption price equal to 100% of the aggregate principal amount of

the notes plus accrued and unpaid interest.

The 2025 Notes will be offered and sold to

qualified institutional buyers in reliance on Rule 144A under the

Securities Act of 1933, as amended (the "Securities Act"), and

outside the United States to non-U.S. persons in reliance on

Regulation S under the Securities Act. The 2025 Notes have not been

registered under the Securities Act, or any state securities laws,

and unless so registered, may not be offered or sold in the United

States except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

and applicable state securities laws. This press release

shall not constitute an offer to sell or the solicitation of an

offer to buy, nor shall there be any sale of the 2025 Notes in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful.

Mercer International Inc. is a global forest

products company with operations in Germany and Canada.

The preceding contains "forward looking

statements" within the meaning of federal securities laws and is

intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995, including,

without limitation, the Company's intentions regarding the

consummation of the Offering, the completion of the Acquisition and

the intended use of proceeds. "Forward looking statements" involve

unknown risks and uncertainties which may cause the Company's

actual results in future periods to differ materially from

forecasted results. These statements are based on the Company's

management's estimates and assumptions with respect to future

events, which include uncertainty as to its ability to consummate

the Offering, which estimates are believed to be reasonable, though

inherently uncertain and difficult to predict. A discussion of

factors that could cause actual results to vary is included in the

Company's Annual Report on Form 10-K and other periodic reports

filed with the Securities and Exchange Commission.

APPROVED BY:

Jimmy S.H. LeeExecutive Chairman(604) 684-1099

David M. Gandossi, FCPA, FCAChief Executive Officer(604)

684-1099

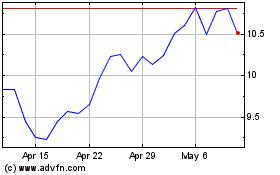

Mercer (NASDAQ:MERC)

Historical Stock Chart

From Mar 2024 to Apr 2024

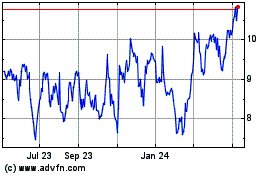

Mercer (NASDAQ:MERC)

Historical Stock Chart

From Apr 2023 to Apr 2024