Amended Current Report Filing (8-k/a)

February 28 2020 - 2:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): December 13, 2019

MediaCo Holding Inc.

(Exact name of registrant as specified in its

charter)

INDIANA

(State of incorporation or organization)

001-39029

(Commission file number)

84-2427771

(I.R.S. Employer

Identification No.)

ONE EMMIS PLAZA

40 MONUMENT CIRCLE

SUITE 700

INDIANAPOLIS, INDIANA 46204

(Address of principal executive offices)

(317) 266-0100

(Registrant’s Telephone Number,

Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Class A common stock, $0.01 par value

|

MDIA

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

This Amendment No. 1 to Current Report on Form 8-K (this “Amendment No. 1”) amends and supplements the Current Report on Form 8-K of MediaCo Holding Inc., an Indiana corporation (the “Company”) filed with the Securities and Exchange Commission (the “SEC”) on December 18, 2019 (the “Original Form 8-K”). On December 13, 2019, the Company entered into an Assignment and Assumption of Purchase Agreement (the “Assignment and Assumption Agreement”) by and between Billboards LLC, a Delaware limited liability company (“Billboards LLC”) and the Company, regarding that certain Equity Purchase Agreement, dated as of October 16, 2019 (the “Purchase Agreement”), by and among Billboards LLC, FMG Kentucky, LLC, a Delaware limited liability company (“FMG Kentucky), FMG Valdosta, LLC, a Delaware limited liability company (together with FMG Kentucky, the “Acquired Companies”), and Fairway Outdoor Advertising Group, LLC, a Delaware limited liability company. The transactions contemplated by the Purchase Agreement closed concurrently with the Company’s entry into the Assignment and Assumption Agreement, and accordingly, the Company acquired the Acquired Companies (the “Acquisition”).

This Amendment No. 1 amends Item 9.01 of the Original Form 8-K for the purpose of filing the financial information required by Item 9.01(a) of Form 8-K and the pro forma financial information required by Item 9.01(b) of Form 8-K. This Amendment No. 1 does not otherwise update, modify or amend the Original Form 8-K and should be read in conjunction with the Original Form 8-K.

Item 9.01 Financial Statements and Exhibits

(a) Financial statements of businesses acquired

The audited financial statements of the Acquired Companies as of and for the years ended December 31, 2018 and 2017 and the unaudited financial statements of the Acquired Companies as of and for the nine months ended September 30, 2019 and 2018, which are filed as Exhibits 99.1 and 99.2 hereto and are incorporated by reference herein.

(b) Pro forma financial information.

The unaudited pro forma condensed combined balance sheet as of September 30, 2019, and the unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2019 and the year ended February 28, 2019 (collectively the “Unaudited Pro Forma Financial Statements”), which are filed as Exhibit 99.2 hereto and are incorporated by reference herein. The Unaudited Pro Forma Financial Statements give effect to the Acquisition and related transactions.

(d) Exhibits

See the Exhibit Index below, which is incorporated by reference herein.

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

99.1

|

Audited financial statements of FMG Kentucky, LLC and FMG Valdosta, LLC as of and for the years ended December 31, 2018 and 2017.

|

|

99.2

|

Unaudited financial statements of FMG Kentucky, LLC and FMG Valdosta, LLC as of and for the nine months ended September 30, 2019 and 2018.

|

|

99.3

|

Unaudited pro forma condensed combined balance sheet of MediaCo Holding Inc. as of September 30, 2019, and unaudited pro forma condensed combined statements of operations of MediaCo Holding Inc. for the nine months ended September 30, 2019 and the year ended February 28, 2019.

|

Note to this Form 8-K: Certain statements included in this report which are not statements of historical fact, including but not limited to those identified with the words “expect,” “will” or “look” are intended to be, and are, by this Note, identified as “forward-looking statements,” as defined in the Securities and Exchange Act of 1934, as amended. Such statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future result, performance or achievement expressed or implied by such forward-looking statement. Such factors include, among others:

• general economic and business conditions;

• fluctuations in the demand for advertising and demand for different types of advertising media;

• our ability to obtain additional capital or to service our outstanding debt;

• competition from new or different media and technologies;

• increased competition in our markets and the broadcasting industry, including our competitors changing the format of a station they operate to more directly compete with a station we operate in the same market;

• our ability to attract and secure programming, on-air talent, writers and photographers;

• inability to obtain (or to obtain timely) necessary approvals for purchase or sale transactions or to complete the transactions for other reasons generally beyond our control;

• increases in the costs of programming, including on-air talent;

• inability to grow through suitable acquisitions or to consummate dispositions;

• new or changing technologies, including those that provide additional competition for our businesses;

• new or changing regulations of the Federal Communications Commission or other governmental agencies;

• war, terrorist acts or political instability; and

• other factors mentioned in documents filed by the Company with the Securities and Exchange Commission.

MediaCo does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDIACO HOLDING INC.

|

|

Date: February 28, 2020

|

|

|

|

|

|

|

By:

|

/s/ J. Scott Enright

|

|

|

|

|

J. Scott Enright, Executive Vice President,

|

|

|

|

|

General Counsel and Secretary

|

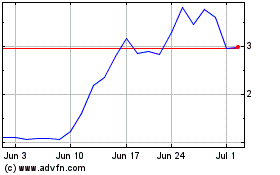

Mediaco (NASDAQ:MDIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

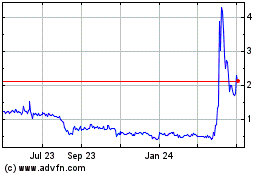

Mediaco (NASDAQ:MDIA)

Historical Stock Chart

From Apr 2023 to Apr 2024