Full Year 2019

Highlights

- Company exceeded its full year 2019 guidance, making

consistent progress in its transformation into an IP-driven,

high-performing toy company.

- Net Sales of $4,505 million, flat as reported, including the

negative foreign exchange impact of $75 million, and up 1% in

constant currency, versus prior year.

- Gross Sales of $5,065 million, flat as reported, including

the negative foreign exchange impact of $92 million, and up 2% in

constant currency.

- Structural Simplification run-rate savings of $875 million

exiting 2019, exceeding target of $650 million by $225 million, or

35%.

- Reported Gross Margin of 44.0%, an improvement of 420 basis

points; Adjusted Gross Margin of 44.9%, an improvement of 480 basis

points.

- Reported Operating Income of $39 million, an improvement of

$274 million; Adjusted Operating Income of $156 million, an

improvement of $269 million.

- Cash Flows Provided by Operating Activities of $181 million,

an improvement of $208 million, achieving positive operating cash

flow for the first time in three years.

- Free Cash Flow of $65 million, an improvement of $244

million, achieving positive Free Cash Flow for the first time in

three years.

- Mattel was the #1 U.S. and global toy company in 2019, per

NPD.

Fourth Quarter 2019

Highlights

- Net Sales of $1,474 million, down 3% as reported, including

the negative foreign exchange impact of $9 million, and down 3% in

constant currency, versus the prior year’s fourth quarter.

- Gross Sales of $1,665 million, down 3% as reported,

including the negative foreign exchange impact of $12 million, and

down 2% in constant currency.

- Reported Gross Margin of 48.4%, an improvement of 180 basis

points; Adjusted Gross Margin of 48.9%, an improvement of 230 basis

points.

- Reported Operating Income of $68 million, a decline of $38

million; Adjusted Operating Income of $109 million, a decline of $2

million.

Mattel, Inc. (NASDAQ: MAT) today reported full year and fourth

quarter 2019 financial results.

Ynon Kreiz, Chairman and CEO, Mattel said: “2019 was an

important inflection point in our turnaround. We stabilized our

topline after five consecutive years of revenue decline, continued

to significantly improve profitability, and achieved positive

operating cash flow and positive free cash flow for the first time

in three years. We are very encouraged by the consistent progress

the company is making and expect to continue to build on this

momentum. We remain focused on the execution of our multi-year

turnaround strategy to transform Mattel into an IP-driven,

high-performing toy company and create long term shareholder

value.”

Joseph Euteneuer, CFO, Mattel said: “In 2019, our methodical

execution of our strategy to restore profitability generated

significant improvements across key metrics, including margins,

operating income, EBITDA, and cash flows. We are extremely pleased

with our results to date and are very proud of the efforts made by

the Mattel team.”

For the year, Net Sales were flat as reported including the

negative foreign exchange impact of $75 million, and up 1% in

constant currency, versus the prior year. Gross Sales were flat as

reported including the negative foreign exchange impact of $92

million, and up 2% in constant currency. Reported Operating Income

was $39.2 million, an improvement of $273.6 million, and Adjusted

Operating Income was $156.2 million, an improvement of $269.3

million. Reported Loss Per Share was $0.62, an improvement of

$0.93, and Adjusted Loss Per Share was $0.30, an improvement of

$0.85.

For the fourth quarter, Net Sales were down 3% as reported

including the negative foreign exchange impact of $9 million, and

down 3% in constant currency, versus the prior year’s fourth

quarter. Gross Sales were down 3% as reported including the

negative foreign exchange impact of $12 million, and down 2% in

constant currency. Reported Operating Income was $67.6 million, a

decline of $38.0 million, and Adjusted Operating Income was $109.3

million, a decline of $2.2 million. Reported Earnings Per Share was

$0.00, a decline of $0.03, and Adjusted Earnings Per Share was

$0.11, an improvement of $0.08.

Financial Overview

Full Year 2019

Net Sales in the North America segment were flat as reported and

in constant currency, versus the prior year.

Gross Sales in the North America segment were flat as reported,

and up 1% in constant currency, primarily driven by growth in

Vehicles (including Hot Wheels® partially offset by lower sales of

Jurassic World® and CARS® vehicles), Dolls (including Barbie®

partially offset by lower sales of Enchantimals™) and Action

Figures, Building Sets and Games (including Toy Story 4 and MEGA™

partially offset by lower sales of Jurassic World). This growth was

partially offset by a decline in Infant, Toddler and Preschool

(including Fisher-Price Friends, and Power Wheels®).

Net Sales in the International segment increased 3% as reported,

and 7% in constant currency.

Gross Sales in the International segment increased 2% as

reported and 6% in constant currency, driven by growth in Dolls

(including Barbie and Polly Pocket®), Vehicles (including Hot

Wheels partially offset by lower sales of CARS and Jurassic World

vehicles), and Action Figures, Building Sets and Games (including

Toy Story 4 partially offset by lower sales of Jurassic World).

This growth was partially offset by a decline in Infant, Toddler

and Preschool (including Fisher-Price and Thomas & Friends®,

and Fisher-Price Friends).

Net Sales in the American Girl® segment decreased by 21% as

reported, and in constant currency. Gross Sales in the American

Girl segment decreased by 21% as reported, and in constant

currency, primarily driven by lower sales in retail stores.

Reported Gross Margin increased to 44.0%, versus 39.8% in the

prior year, and Adjusted Gross Margin increased to 44.9%, versus

40.1%. The increase in Reported and Adjusted Gross Margin was

primarily driven by savings from our Structural Simplification

program.

Reported Other Selling and Administrative Expenses decreased by

$118.7 million, or 8%, to $1,390.0 million. Adjusted Other Selling

and Administrative Expenses decreased by $85.6 million, or 6%, to

$1,313.4 million. The decrease in Reported and Adjusted Other

Selling and Administrative Expenses was primarily driven by savings

from our Structural Simplification program.

For the twelve months ended December 31, 2019, Cash Flows

provided by Operating Activities improved by $208 million to $181

million, primarily driven by a lower net loss, excluding the impact

of non-cash charges. Cash Flows Used for Investing Activities

decreased by $47 million to $114 million, primarily driven by lower

capital spending. Cash Flows Used for Financing Activities and

Other decreased by $266 million to $31 million, primarily driven by

net repayments of long-term borrowings of $278 million in 2018.

Fourth Quarter 2019

Net Sales in the North America segment decreased 3% as reported

and in constant currency, versus the prior year’s fourth

quarter.

Gross Sales in the North America segment decreased 1% as

reported, and in constant currency, primarily driven by a decline

in Dolls (including Barbie and owned brands) and Infant, Toddler

and Preschool (including Fisher-Price Friends, and Fisher-Price and

Thomas & Friends). This was partially offset by growth in

Vehicles (including Hot Wheels partially offset by lower sales of

CARS and Jurassic World vehicles), and Action Figures, Building

Sets and Games (including Toy Story 4 and UNO® partially offset by

lower sales of Jurassic World).

Net Sales in the International segment were flat as reported,

and up 1% in constant currency.

Gross Sales in the International segment decreased 1% as

reported and were flat in constant currency, driven by a decline in

Infant, Toddler and Preschool (including Fisher-Price Friends, and

Fisher-Price and Thomas & Friends) and Vehicles (including CARS

and Jurassic World vehicles partially offset by growth in Hot

Wheels). The decrease was partially offset by growth in Dolls

(including Barbie partially offset by owned brands), and Action

Figures, Building Sets and Games (including Toy Story 4 partially

offset by lower sales of Jurassic World).

Net Sales in the American Girl segment decreased by 20% as

reported, and in constant currency. Gross Sales in the American

Girl segment decreased by 19% as reported, and in constant

currency, primarily driven by lower sales in retail stores.

Reported Gross Margin increased to 48.4%, versus 46.6% in the

prior year’s fourth quarter, and Adjusted Gross Margin increased to

48.9%, versus 46.6%. The increase in Reported and Adjusted Gross

Margin was primarily driven by savings from our Structural

Simplification program.

Reported Other Selling and Administrative Expenses increased by

$20.2 million, or 5%, to $418.4 million. Adjusted Other Selling and

Administrative Expenses decreased by $8.5 million, or 2%, to $383.8

million. The increase in Reported Other Selling and Administrative

Expenses was primarily driven by asset impairment expenses

partially offset by savings from our Structural Simplification

program. The decrease in Adjusted Other Selling and Administrative

Expenses was primarily driven by savings from our Structural

Simplification program.

Sales by Categories

Full Year 2019

For the year, Worldwide Gross Sales for Dolls were $1,724.0

million, flat as reported, and up 2% in constant currency, versus

the prior year, driven by growth in Barbie partially offset by a

decline in American Girl.

Worldwide Gross Sales for Infant, Toddler and Preschool were

$1,257.6 million, down 11% as reported, and down 10% in constant

currency, driven by declines in Fisher-Price Friends, and

Fisher-Price and Thomas & Friends.

Worldwide Gross Sales for Vehicles were $1,101.3 million, up 3%

as reported, and up 6% in constant currency, driven by growth in

Hot Wheels partially offset by a decline in CARS and Jurassic World

vehicles.

Worldwide Gross Sales for Action Figures, Building Sets and

Games were $981.6 million, up 14% as reported, and up 15% in

constant currency, driven by Toy Story 4 partially offset by a

decline in Jurassic World.

Fourth Quarter 2019

For the fourth quarter, Worldwide Gross Sales for Dolls were

$630.1 million, down 6% as reported, and down 5% in constant

currency, versus the prior year’s fourth quarter, primarily driven

by a decline in American Girl partially offset by growth in

Barbie.

Worldwide Gross Sales for Infant, Toddler and Preschool were

$381.1 million, down 9% as reported and in constant currency,

driven by declines in Fisher-Price Friends, and Fisher-Price and

Thomas & Friends.

Worldwide Gross Sales for Vehicles were $356.9 million, up 1% as

reported in constant currency, primarily driven by growth in Hot

Wheels partially offset by a decline in CARS vehicles.

Worldwide Gross Sales for Action Figures, Building Sets and

Games were $297.2 million, up 9% as reported and up 10% in constant

currency, primarily driven by Toy Story 4, UNO and MEGA partially

offset by a decline in Jurassic World.

Conference Call and Live Webcast

At 5:00 p.m. (Eastern Time) today, Mattel will host a conference

call with investors and financial analysts to discuss its 2019 full

year and fourth quarter financial results. The conference call will

be webcast on Mattel's Investor Relations website,

https://mattel.gcs-web.com/. To listen to the live call, log on to

the website at least 10 minutes early to register, download and

install any necessary audio software. An archive of the webcast

will be available on Mattel's Investor Relations website for 90

days and may be accessed beginning approximately two hours after

the completion of the live call. A telephonic replay of the call

will be available beginning at 8:30 p.m. Eastern time the evening

of the call until Thursday, February 20, 2020 and may be accessed

by dialing +1-404-537-3406. The passcode is 5764607.

Forward-Looking Statements

This press release contains a number of forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. The use of words such as “anticipates,”

“expects,” “intends,” “plans,” “confident that” and “believes,”

among others, generally identify forward-looking statements. These

forward-looking statements are based on currently available

operating, financial, economic and other information, and are

subject to a number of significant risks and uncertainties. A

variety of factors, many of which are beyond our control, could

cause actual future results to differ materially from those

projected in the forward-looking statements. Specific factors that

might cause such a difference include, but are not limited to: (i)

Mattel’s ability to design, develop, produce, manufacture, source

and ship products on a timely and cost-effective basis, as well as

interest in and purchase of those products by retail customers and

consumers in quantities and at prices that will be sufficient to

profitably recover Mattel’s costs; (ii) downturns in economic

conditions affecting Mattel’s markets which can negatively impact

retail customers and consumers, and which can result in lower

employment levels, lower consumer disposable income and spending,

including lower spending on purchases of Mattel’s products; (iii)

other factors which can lower discretionary consumer spending, such

as higher costs for fuel and food, drops in the value of homes or

other consumer assets, and high levels of consumer debt; (iv)

potential difficulties or delays Mattel may experience in

implementing cost savings and efficiency enhancing initiatives; (v)

other economic and public health conditions or regulatory changes

in the markets in which Mattel and its customers and suppliers

operate, which could create delays or increase Mattel’s costs, such

as higher commodity prices, labor costs or transportation costs, or

outbreaks of disease; (vi) currency fluctuations, including

movements in foreign exchange rates, which can lower Mattel’s net

revenues and earnings, and significantly impact Mattel’s costs;

(vii) the concentration of Mattel’s customers, potentially

increasing the negative impact to Mattel of difficulties

experienced by any of Mattel’s customers, such as the bankruptcy

and liquidation of Toys “R” Us, Inc., or changes in their

purchasing or selling patterns; (viii) the future willingness of

licensors of entertainment properties for which Mattel currently

has licenses or would seek to have licenses in the future to

license those products to Mattel; (ix) the inventory policies of

Mattel’s retail customers, including retailers’ potential decisions

to lower their inventories, even if it results in lost sales, as

well as the concentration of Mattel’s revenues in the second half

of the year, which coupled with reliance by retailers on quick

response inventory management techniques increases the risk of

underproduction of popular items, overproduction of less popular

items and failure to achieve compressed shipping schedules; (x) the

increased costs of developing more sophisticated digital and smart

technology products, and the corresponding supply chain and design

challenges associated with such products; (xi) work disruptions,

which may impact Mattel’s ability to manufacture or deliver product

in a timely and cost-effective manner; (xii) the bankruptcy and

liquidation of Mattel’s significant retailers, such as Toys “R” Us,

Inc., or the general lack of success of one of Mattel’s significant

retailers which could negatively impact Mattel’s revenues or bad

debt exposure; (xiii) the impact of competition on revenues,

margins and other aspects of Mattel’s business, including the

ability to offer products which consumers choose to buy instead of

competitive products, the ability to secure, maintain and renew

popular licenses and the ability to attract and retain talented

employees; (xiv) the risk of product recalls or product liability

suits and costs associated with product safety regulations; (xv)

changes in laws or regulations in the United States and/or in other

major markets, such as China, in which Mattel operates, including,

without limitation, with respect to taxes, tariffs, trade policies

or product safety, which may increase Mattel’s product costs and

other costs of doing business, and reduce Mattel’s earnings; (xvi)

failure to realize the planned benefits from any investments or

acquisitions made by Mattel; (xvii) the impact of other market

conditions, third party actions or approvals and competition which

could reduce demand for Mattel’s products or delay or increase the

cost of implementation of Mattel’s programs or alter Mattel’s

actions and reduce actual results; (xviii) changes in financing

markets or the inability of Mattel to obtain financing on

attractive terms; (xix) the impact of litigation, arbitration, or

regulatory decisions or settlement actions; (xx) uncertainty from

the expected discontinuance of LIBOR and transition to any other

interest rate benchmark; (xxi) an inability to remediate the

material weakness in our internal control over financial reporting

or additional material weaknesses or other deficiencies in the

future or the failure to maintain an effective system of internal

controls; and (xxii) other risks and uncertainties as may be

described in Mattel’s periodic filings with the Securities and

Exchange Commission, including the “Risk Factors” section of

Mattel’s Amended Annual Report on Form 10-K/A for the fiscal year

ended December 31, 2018, as well as in Mattel’s other public

statements. Mattel does not update forward-looking statements and

expressly disclaims any obligation to do so, except as required by

law.

Non-GAAP Financial Measures

To supplement our financial results presented in accordance with

generally accepted accounting principles in the United States

(“GAAP”), Mattel presents certain non-GAAP financial measures

within the meaning of Regulation G promulgated by the Securities

and Exchange Commission. The non-GAAP financial measures that

Mattel uses in this earnings release include Gross Sales, Adjusted

Gross Profit, Adjusted Gross Margin, Adjusted Other Selling and

Administrative Expenses, Adjusted Operating Income (Loss), Adjusted

Earnings (Loss) Per Share, earnings before interest expense, taxes,

depreciation and amortization (“EBITDA”), Adjusted EBITDA, Free

Cash Flow, and constant currency. Mattel uses these metrics to

analyze its continuing operations and to monitor, assess and

identify meaningful trends in its operating and financial

performance, and each is discussed in detail below. Mattel believes

that the disclosure of non-GAAP financial measures provides useful

supplemental information to investors to be able to better evaluate

ongoing business performance and certain components of the

Company’s results. These measures are not, and should not be viewed

as, substitutes for GAAP financial measures and may not be

comparable to similarly titled measures used by other companies.

Reconciliations of the non-GAAP financial measures to the most

directly comparable GAAP financial measures are attached to this

earnings release as exhibits and to our earnings slide presentation

as an appendix.

This earnings release and our earnings slide presentation are

available on Mattel's Investor Relations website,

https://mattel.gcs-web.com/, under the subheading “Financial

Information – Earnings Releases.”

Gross Sales

Gross Sales represent sales to customers, excluding the impact

of Sales Adjustments. Net Sales, as reported, include the impact of

Sales Adjustments, such as trade discounts and other allowances.

Mattel presents changes in Gross Sales as a metric for comparing

its aggregate, categorical, brand and geographic results to

highlight significant trends in Mattel’s business. Changes in Gross

Sales are discussed because, while Mattel records the details of

such Sales Adjustments in its financial accounting systems at the

time of sale, such Sales Adjustments are generally not associated

with brands and individual products, making Net Sales less

meaningful. Since Sales Adjustments are determined by customer

rather than at the brand level, Mattel believes that the disclosure

of Gross Sales by categories and brand is useful supplemental

information for investors to be able to assess the performance of

its underlying brands (e.g., Barbie) and also enhances their

ability to compare sales trends over time.

Adjusted Gross Profit and Adjusted Gross Margin

Adjusted Gross Profit and Adjusted Gross Margin represent

reported Gross Profit and Reported Gross Margin, respectively,

adjusted to exclude asset impairments, severance and restructuring

expenses and the impact of the inclined sleeper product recalls.

Adjusted Gross Margin represents Mattel’s Adjusted Gross Profit, as

a percentage of Net Sales. Adjusted Gross Profit and Adjusted Gross

Margin are presented to provide additional perspective on

underlying trends in Mattel’s core Gross Profit and Gross Margin,

which Mattel believes is useful supplemental information for

investors to be able to gauge and compare Mattel’s current business

performance from one period to another.

Adjusted Other Selling and Administrative Expenses

Adjusted Other Selling and Administrative Expenses represents

Mattel’s Reported Other Selling and Administrative Expenses,

adjusted to exclude asset impairments, non-recurring executive

compensation, severance and restructuring expenses, the impact of

the inclined sleeper product recalls, and sale of assets, which are

not part of Mattel’s core business. Adjusted Other Selling and

Administrative Expenses is presented to provide additional

perspective on underlying trends in Mattel’s core other selling and

administrative expenses, which Mattel believes is useful

supplemental information for investors to be able to gauge and

compare Mattel’s current business performance from one period to

another.

Adjusted Operating Income (Loss)

Adjusted Operating Income (Loss) represents Mattel’s reported

Operating Income (Loss), adjusted to exclude the impact of asset

impairments, non-recurring executive compensation, severance and

restructuring expenses, sale of assets, and the impact of the

inclined sleeper product recalls, which are not part of Mattel’s

core business. Adjusted Operating Income (Loss) is presented to

provide additional perspective on underlying trends in Mattel’s

core operating results, which Mattel believes is useful

supplemental information for investors to be able to gauge and

compare Mattel’s current business performance from one period to

another.

Adjusted Earnings (Loss) Per Share

Adjusted Earnings (Loss) Per Share represents Mattel’s Reported

Diluted Earnings (Loss) Per Common Share, adjusted to exclude the

impact of asset impairments, severance and restructuring expenses,

and the impact of the inclined sleeper product recalls, which are

not part of Mattel’s core business. The aggregate tax effect of the

adjustments is calculated by tax effecting the adjustments by the

current effective tax rate, adjusting for certain discrete tax

items, and dividing by the reported weighted average number of

common shares. Adjusted Earnings (Loss) Per Share is presented to

provide additional perspective on underlying trends in Mattel’s

core business. Mattel believes it is useful supplemental

information for investors to gauge and compare Mattel’s current

earnings results from one period to another. Adjusted Earnings

(Loss) Per Share is a performance measure and should not be used as

a measure of liquidity.

EBITDA and Adjusted EBITDA

EBITDA represents Mattel’s Net Income (Loss), adjusted to

exclude the impact of interest expense, taxes, depreciation and

amortization. Adjusted EBITDA represents EBITDA adjusted to exclude

the impact of asset impairments, share-based compensation,

severance and restructuring expenses, sale of assets, and the

impact of the inclined sleeper product recalls, which are not part

of Mattel’s core business. Mattel believes EBITDA and Adjusted

EBITDA are useful supplemental information for investors to gauge

and compare Mattel’s business performance to other companies in our

industry with similar capital structures. The presentation of

Adjusted EBITDA differs from how we will calculate EBITDA for

purposes of covenant compliance under the indenture governing our

6.75% senior notes due 2025, the indenture governing our 5.875%

senior notes due 2027, and the syndicated facility agreement

governing our senior secured revolving credit facilities. Because

of these limitations, EBITDA and Adjusted EBITDA should not be

considered as measures of discretionary cash available to us to

invest in the growth of our business. As a result, we rely

primarily on our GAAP results and use EBITDA and Adjusted EBITDA

only supplementally.

Free Cash Flow

Free cash flow represents Mattel’s net cash flows from operating

activities less capital expenditures. Mattel believes free cash

flow is useful supplemental information for investors to gauge

Mattel’s liquidity and performance and to compare Mattel’s business

performance to other companies in our industry. Free cash flow does

not represent cash available to Mattel for discretionary

expenditure.

Constant currency

Percentage changes in results expressed in constant currency are

presented excluding the impact from changes in currency exchange

rates. To present this information, Mattel calculates constant

currency information by translating current period and prior period

results for entities reporting in currencies other than the US

dollar using consistent exchange rates. The constant currency

exchange rates are determined by Mattel at the beginning of each

year and are applied consistently during the year. They are

generally different from the actual exchange rates in effect during

the current or prior period due to volatility in actual foreign

exchange rates. Mattel considers whether any changes to the

constant currency rates are appropriate at the beginning of each

year. The exchange rates used for these constant currency

calculations are generally based on prior year actual exchange

rates. The difference between the current period and prior period

results using the consistent exchange rates reflects the changes in

the underlying performance results, excluding the impact from

changes in currency exchange rates. Mattel analyzes constant

currency results to provide additional perspective on changes in

underlying trends in Mattel’s operating performance. Mattel

believes that the disclosure of the percentage change in constant

currency is useful supplemental information for investors to be

able to gauge Mattel’s current business performance and the

longer-term strength of its overall business since foreign currency

changes could potentially mask underlying sales trends. The

disclosure of the percentage change in constant currency enhances

investor’s ability to compare financial results from one period to

another.

About Mattel

Mattel is a leading global children’s entertainment company that

specializes in design and production of quality toys and consumer

products. We create innovative products and experiences that

inspire, entertain and develop children through play. We engage

consumers through our portfolio of iconic franchises, including

Barbie®, Hot Wheels®, American Girl®, Fisher-Price®, Thomas &

Friends® and MEGA®, as well as other popular brands that we own or

license in partnership with global entertainment companies. Our

offerings include film and television content, gaming, music and

live events. We operate in 40 locations and sell products in more

than 150 countries in collaboration with the world’s leading retail

and technology companies. Since its founding in 1945, Mattel is

proud to be a trusted partner in exploring the wonder of childhood

and empowering kids to reach their full potential. Visit us online

at www.mattel.com.

MAT-FIN MAT-CORP

MATTEL, INC. AND SUBSIDIARIES EXHIBIT I

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)1

For the Three Months Ended December 31, For the

Year Ended December 31, % Change % Change %

Change % Change (In millions,

except per share and

2019

2018

as in Constant

2019

2018

as in Constant percentage

information) $ Amt % Net Sales $

Amt % Net Sales Reported Currency $

Amt % Net Sales $ Amt % Net Sales

Reported Currency Net Sales

$

1,473.7

$

1,524.3

-3%

-3%

$

4,504.6

$

4,514.8

0%

1%

Cost of sales

760.5

51.6%

814.7

53.4%

-7%

2,523.8

56.0%

2,716.1

60.2%

-7%

Gross Profit

713.2

48.4%

709.6

46.6%

1%

1%

1,980.8

44.0%

1,798.7

39.8%

10%

12%

Advertising and promotion expenses

227.2

15.4%

205.8

13.5%

10%

551.5

12.2%

524.3

11.6%

5%

Other selling and administrative expenses

418.4

28.4%

398.2

26.1%

5%

1,390.0

30.9%

1,508.7

33.4%

-8%

Operating Income (Loss)

67.6

4.6%

105.6

6.9%

-36%

-33%

39.2

0.9%

(234.3)

-5.2%

n/m

n/m

Interest expense

60.2

4.1%

49.2

3.2%

22%

201.0

4.5%

181.9

4.0%

11%

Interest (income)

(1.5)

-0.1%

(0.8)

-0.1%

85%

(6.2)

-0.1%

(6.5)

-0.1%

-5%

Other non-operating (income) expense, net

(0.2)

3.0

2.6

7.3

Income (Loss) Before Income Taxes

9.2

0.6%

54.3

3.6%

-83%

-81%

(158.3)

-3.5%

(417.1)

-9.2%

-62%

-65%

Provision for income taxes

9.0

44.7

55.2

116.2

Net Income (Loss)

$

0.2

0.0%

$

9.6

0.6%

-98%

$

(213.5)

-4.7%

$

(533.3)

-11.8%

-60%

Net Income (Loss) Per Common Share - Basic

$

0.00

$

0.03

$

(0.62)

$

(1.55)

Weighted average number of common shares

346.7

345.7

346.1

345.0

Net Income (Loss) Per Common Share - Diluted

$

0.00

$

0.03

$

(0.62)

$

(1.55)

Weighted average number of common and potential common shares

348.3

345.8

346.1

345.0

1 Amounts may not foot due to rounding. n/m - Not Meaningful

MATTEL, INC. AND SUBSIDIARIES EXHIBIT II CONDENSED

CONSOLIDATED BALANCE SHEETS1 December 31,

2019

2018

(In millions)

(Unaudited) Assets Cash and equivalents

$

630.0

$

594.5

Accounts receivable, net

936.4

970.1

Inventories

495.5

542.9

Prepaid expenses and other current assets

186.1

239.7

Total current assets

2,248.0

2,347.2

Property, plant, and equipment, net

550.1

657.6

Right-of-use assets, net2

303.2

-

Other noncurrent assets

2,223.9

2,233.4

Total Assets

$

5,325.2

$

5,238.2

Liabilities and Stockholders' Equity Short-term

borrowings

$

-

$

4.2

Accounts payable and accrued liabilities2

1,228.9

1,232.2

Income taxes payable

48.0

13.5

Total current liabilities

1,276.9

1,249.9

Long-term debt

2,846.8

2,851.7

Noncurrent lease liabilities2

270.9

-

Other noncurrent liabilities

439.0

469.7

Total stockholders' equity

491.7

666.9

Total Liabilities and Stockholders' Equity

$

5,325.2

$

5,238.2

SUPPLEMENTAL BALANCE SHEET AND CASH FLOW DATA

(Unaudited)1 December 31,

2019

2018

Key Balance Sheet Data:

Accounts receivable, net days of sales outstanding (DSO)

57

57

For the Year Ended December 31, (In millions)

2019

2018

Condensed Cash Flow Data: Cash

flows provided by (used for) operating activities $

181

$

(27)

Cash flows used for investing activities

(114)

(161)

Cash flows used for financing activities and other

(31)

(297)

Increase (decrease) in cash and equivalents $

36

$

(485)

1 Amounts may not foot due to rounding. 2 Mattel adopted ASU

2016-02, Leases (Topic 842), on January 1, 2019 using the modified

retrospective transition method. Upon adoption, Mattel recorded a

right-of-use asset and lease liability on its balance sheet. Prior

periods were not retrospectively adjusted.

MATTEL, INC. AND

SUBSIDIARIES EXHIBIT III WORLDWIDE GROSS SALES

INFORMATION (Unaudited)1 RECONCILIATION OF GAAP AND NON-GAAP

FINANCIAL MEASURES For the Three Months Ended

December 31, For the Year Ended December 31,

(In millions, except percentage

information)

2019

2018

% Changeas Reported % Change inConstantCurrency

2019

2018

% Changeas Reported % Change inConstantCurrency

Worldwide Gross Sales: Net Sales

$ 1,473.7

$ 1,524.3

-3

%

-3

%

$ 4,504.6

$ 4,514.8

0

%

1%

Sales Adjustments2

191.6

190.5

560.0

560.7

Gross Sales

$ 1,665.3

$ 1,714.8

-3

%

-2

%

$ 5,064.6

$ 5,075.5

0

%

2%

Worldwide Gross Sales by

Categories:3 Dolls

$ 630.1

$ 668.5

-6

%

-5

%

$ 1,724.0

$ 1,730.9

0

%

2%

Infant, Toddler and Preschool

381.1

419.7

-9

-9

1,257.6

1,417.8

-11

-10

Vehicles

356.9

355.0

1

1

1,101.3

1,065.5

3

6

Action Figures, Building Sets and Games

297.2

271.5

9

10

981.6

861.3

14

15

Gross Sales

$ 1,665.3

$ 1,714.8

-3

%

-2

%

$ 5,064.6

$ 5,075.5

0

%

2%

Supplemental Gross Sales

Disclosures Worldwide

Gross Sales by Top 3 Power Brands: Barbie

$ 396.9

$ 390.8

2

%

3

%

$ 1,159.8

$ 1,089.0

7

%

9%

Hot Wheels

306.8

286.8

7

8

925.9

834.1

11

14

Fisher-Price and Thomas & Friends

340.6

352.2

-3

-3

1,131.8

1,185.7

-5

-3

Other

620.9

684.9

-9

-9

1,847.2

1,966.8

-6

-5

Gross Sales

$ 1,665.3

$ 1,714.8

-3

%

-2

%

$ 5,064.6

$ 5,075.5

0

%

2%

1 Amounts may not foot due to rounding. 2 Sales Adjustments

are not allocated to individual products. As such, Net Sales are

not presented on a categories or brand level. 3 Mattel modified its

reporting structure for revenues in the first quarter of 2019 to

disclose revenues by categories. Refer to Note 23, Segment

Information, in the Form 10-Q for additional information.

MATTEL, INC. AND SUBSIDIARIES EXHIBIT IV GROSS

SALES BY SEGMENT (Unaudited)1 RECONCILIATION OF GAAP AND

NON-GAAP FINANCIAL MEASURES For the Three Months

Ended December 31, For the Year Ended December 31,

(In millions, except percentage

information)

2019

2018

% Changeas Reported % Change inConstantCurrency

2019

2018

% Changeas Reported % Change inConstantCurrency

North America Segment Gross Sales: Net Sales

$ 689.6

$ 708.3

-3

%

-3

%

$ 2,275.8

$ 2,272.8

0

%

0

%

Sales Adjustments2

45.5

36.2

156.5

149.3

Gross Sales

$ 735.1

$ 744.5

-1

%

-1

%

$ 2,432.3

$ 2,422.1

0

%

1

%

North America Gross Sales by

Categories:3 Dolls

$ 211.9

$ 229.7

-8

%

-8

%

$ 636.2

$ 624.7

2

%

2

%

Infant, Toddler and Preschool

205.1

222.0

-8

-8

730.3

808.2

-10

-10

Vehicles

166.5

154.0

8

8

510.8

488.6

5

5

Action Figures, Building Sets and Games

151.6

138.8

9

9

555.0

500.6

11

11

Gross Sales

$ 735.1

$ 744.5

-1

%

-1

%

$ 2,432.3

$ 2,422.1

0

%

1

%

Supplemental Gross Sales

Disclosures North

America Gross Sales by Top 3 Power Brands: Barbie

$ 189.4

$ 197.3

-4

%

-4

%

$ 558.3

$ 535.7

4

%

4

%

Hot Wheels

142.6

125.2

14

14

419.0

380.2

10

10

Fisher-Price and Thomas & Friends

178.7

182.4

-2

-2

650.7

665.9

-2

-2

Other

224.5

239.7

-6

-6

804.2

840.3

-4

-4

Gross Sales

$ 735.1

$ 744.5

-1

%

-1

%

$ 2,432.3

$ 2,422.1

0

%

1

%

1 Amounts may not foot due to rounding. 2 Sales Adjustments are not

allocated to individual products. As such, Net Sales are not

presented on a categories or brand level. 3 Mattel modified its

reporting structure for revenues in the first quarter of 2019 to

disclose revenues by categories. Refer to Note 23, Segment

Information, in the Form 10-Q for additional information.

MATTEL, INC. AND SUBSIDIARIES EXHIBIT V

GROSS SALES BY SEGMENT (Unaudited)1 RECONCILIATION OF

GAAP AND NON-GAAP FINANCIAL MEASURES For the Three

Months Ended December 31, For the Year Ended December

31, (In millions, except

percentage information)

2019

2018

% Changeas Reported % Change inConstantCurrency

2019

2018

% Changeas Reported % Change inConstantCurrency

Total International Segment Gross Sales: Net

Sales

$ 657.2

$ 658.1

0

%

1

%

$ 1,972.2

$ 1,915.2

3

%

7

%

Sales Adjustments2

139.2

146.8

391.6

397.1

Gross Sales

$ 796.4

$ 805.0

-1

%

0

%

$ 2,363.8

$ 2,312.2

2

%

6

%

International Segment Gross

Sales: EMEA3 Net Sales

$ 353.1

$ 346.4

2

%

4

%

$ 1,056.4

$ 1,018.7

4

%

9

%

Sales Adjustments2

80.7

86.8

236.6

233.7

Gross Sales

$ 433.8

$ 433.3

0

%

2

%

$ 1,292.9

$ 1,252.4

3

%

8

%

Latin America Net Sales

$ 197.5

$ 206.7

-4

%

-3

%

$ 565.4

$ 554.1

2

%

5

%

Sales Adjustments2

38.5

35.5

100.7

99.9

Gross Sales

$ 236.0

$ 242.2

-3

%

-1

%

$ 666.1

$ 654.0

2

%

5

%

Asia Pacific3 Net Sales

$ 106.6

$ 105.0

2

%

3

%

$ 350.4

$ 342.4

2

%

5

%

Sales Adjustments2

20.0

24.5

54.4

63.5

Gross Sales

$ 126.6

$ 129.5

-2

%

-1

%

$ 404.7

$ 405.8

0

%

3

%

International Gross Sales by

Categories:4 Dolls

$ 284.4

$ 273.7

4

%

6

%

$ 819.4

$ 765.6

7

%

12

%

Infant, Toddler and Preschool

176.0

197.8

-11

-10

527.3

609.6

-13

-10

Vehicles

190.4

201.0

-5

-4

590.5

576.9

2

7

Action Figures, Building Sets and Games

145.6

132.5

10

11

426.5

360.2

18

22

Gross Sales

$ 796.4

$ 805.0

-1

%

0

%

$ 2,363.8

$ 2,312.2

2

%

6

%

Supplemental Gross Sales

Disclosures International Gross Sales by Top 3 Power

Brands: Barbie

$ 207.6

$ 193.6

7

%

10

%

$ 601.4

$ 553.2

9

%

14

%

Hot Wheels

164.3

161.6

2

3

506.9

453.9

12

17

Fisher-Price and Thomas & Friends

162.0

169.8

-5

-4

481.0

519.8

-7

-4

Other

262.6

280.0

-6

-5

774.5

785.4

-1

2

Gross Sales

$ 796.4

$ 805.0

-1

%

0

%

$ 2,363.8

$ 2,312.2

2

%

6

%

1 Amounts may not foot due to rounding. 2 Sales Adjustments

are not allocated to individual products. As such, Net Sales are

not presented on a categories or brand level. 3 Mattel reorganized

its regional sales reporting structure in the first quarter of

2019. As a result, the new regions are Europe, the Middle East, and

Africa (“EMEA”), Latin America, and Asia Pacific. The Middle East,

Africa, Russia, and Turkey were previously included in the Asia

Pacific region (previously Global Emerging Markets) and are now

included in EMEA (previously Europe). Prior period amounts have

been reclassified to conform to the current period presentation. 4

Mattel modified its reporting structure for revenues in the first

quarter of 2019 to disclose revenues by categories. Refer to Note

23, Segment Information, in the Form 10-Q for additional

information.

MATTEL, INC. AND SUBSIDIARIES EXHIBIT VI

GROSS SALES BY SEGMENT (Unaudited)1 RECONCILIATION OF

GAAP AND NON-GAAP FINANCIAL MEASURES For the Three

Months Ended December 31, For the Year Ended December

31, (In millions, except

percentage information)

2019

2018

% Changeas Reported % Change inConstantCurrency

2019

2018

% Changeas Reported % Change inConstantCurrency

American Girl Segment Gross Sales: Net Sales

$ 126.9

$ 157.8

-20

%

-20

%

$ 256.6

$ 326.8

-21

%

-21

%

Sales Adjustments

6.9

7.5

11.9

14.4

Gross Sales

$ 133.8

$ 165.3

-19

%

-19

%

$ 268.5

$ 341.2

-21

%

-21

%

1 Amounts may not foot due to rounding.

MATTEL, INC. AND

SUBSIDIARIES EXHIBIT VII SUPPLEMENTAL FINANCIAL

INFORMATION (Unaudited)1 RECONCILIATION OF GAAP AND NON-GAAP

FINANCIAL MEASURES For the Three Months Ended

December 31, For the Year Ended December 31,

(In millions, except per share and

percentage information)

20192

20182

20192

20182

Gross Profit Gross Profit, As

Reported

$

713.2

$

709.6

$

1,980.8

$

1,798.7

Gross Margin

48.4%

46.6%

44.0%

39.8%

Adjustments: Asset Impairments

-

-

-

5.8

Severance and Restructuring Expenses3

6.7

-

18.6

5.7

Inclined Sleeper Product Recalls4

0.4

-

21.7

-

Gross Profit, As Adjusted

$

720.3

$

709.6

$

2,021.1

$

1,810.2

Adjusted Gross Margin

48.9%

46.6%

44.9%

40.1%

Other Selling and Administrative

Expenses Other Selling and Administrative Expenses, As

Reported

$

418.4

$

398.2

$

1,390.0

$

1,508.7

% of Net Sales

28.4%

26.1%

30.9%

33.4%

Adjustments: Asset Impairments8

(25.9)

-

(25.9)

(6.1)

Non-recurring Executive Compensation

-

-

-

(1.0)

Severance and Restructuring Expenses3

(6.1)

(5.9)

(40.5)

(104.1)

Inclined Sleeper Product Recalls4

(2.6)

-

(10.3)

-

Sale of Assets

-

-

-

1.4

Other Selling and Administrative Expenses, As Adjusted

$

383.8

$

392.3

$

1,313.4

$

1,398.9

% of Net Sales

26.0%

25.7%

29.2%

31.0%

Operating Income (Loss)

Operating Income (Loss), As Reported

$

67.6

$

105.6

$

39.2

$

(234.3)

Adjustments: Asset Impairments8

25.9

-

25.9

11.9

Non-recurring Executive Compensation

-

-

-

1.0

Severance and Restructuring Expenses3

12.7

5.9

59.1

109.8

Inclined Sleeper Product Recalls4

3.1

-

32.0

-

Sale of Assets

-

-

-

(1.4)

Operating Income (Loss), As Adjusted

$

109.3

$

111.5

$

156.2

$

(113.0)

Other Information Toys

“R” Us Net Sales Reversal5

$

-

$

-

$

-

$

29.5

Toys “R” Us Bad Debt Expense, Net5

$

(4.7)

$

(5.1)

$

(6.1)

$

32.2

Inclined Sleeper Product Recalls4

$

3.5

$

-

$

37.8

$

-

1 Amounts may not foot due to rounding. 2 Toys “R” Us Net

Sales Reversal and Toys “R” Us Bad Debt Expense, Net are not

presented as non-GAAP adjustments for the three months and year

ended December 31, 2019 and 2018. 3For the three months ended

December 31, 2019, severance and restructuring expenses include

$9.8 million related to the Capital Light program of which $6.7

million was recorded to Cost of Sales and $3.1 million was recorded

to Other Selling and Administrative Expenses. For the year ended

December 31, 2019, severance and restructuring expenses include

$37.6 million related to the Capital Light program of which $18.6

million was recorded to Cost of Sales and $19.0 million was

recorded to Other Selling and Administrative Expenses. 4 Mattel

recorded an estimated impact of $3.5 million and $37.8 million

related to inclined sleeper product recalls for the three months

and year ended December 31, 2019, respectively. Of the $37.8

million recorded during the year ended December 31, 2019, $5.8

million was a reduction to Net Sales for estimated retailer

returns. 5 As a result of the Toys “R” Us liquidation, Mattel

reversed Net Sales for the estimated uncollectible portion of its

outstanding receivables originating from first quarter 2018 sales.

As such, Gross Profit, As Reported includes the Cost of Sales for

the inventory sold to Toys “R” Us but excludes the corresponding

Net Sales. Additionally, during 2018, Mattel recorded Bad Debt

Expense, Net for the estimated uncollectible portion of its

outstanding receivables, net of recoveries and other reductions. 8

For the three months and year ended December 31, 2019, asset

impairments represent write-offs of American Girl retail store

assets of $25.9 million, which were recorded in other selling and

administrative expenses.

For the Three Months Ended

December 31, For the Year Ended December 31,

(In millions, except per share and

percentage information)

20192

20182

20192

20182

Earnings Per Share Net Income

(Loss) Per Common Share, As Reported

$

0.00

$

0.03

$

(0.62)

$

(1.55)

Adjustments: Asset Impairments8

0.07

-

0.07

0.03

Severance and Restructuring Expenses3

0.04

0.02

0.17

0.32

Inclined Sleeper Product Recalls4

0.01

-

0.09

-

Tax Effect of Adjustments6

(0.01)

-

(0.02)

(0.01)

Tax Items7

-

(0.02)

-

0.05

Net Income (Loss) Per Common Share, As Adjusted

$

0.11

$

0.03

$

(0.30)

$

(1.15)

EBITDA and Adjusted

EBITDA Net Income (Loss), As Reported

$

0.2

$

9.6

$

(213.5)

$

(533.3)

Adjustments: Interest Expense

60.2

49.2

201.0

181.9

Provision for Income Taxes

9.0

44.7

55.2

116.2

Depreciation

48.2

53.2

204.4

232.8

Amortization

10.0

9.2

40.1

39.1

EBITDA

127.5

165.9

287.3

36.8

Adjustments: Asset Impairments8

25.9

-

25.9

11.9

Shared-based Compensation

16.8

12.7

56.0

48.9

Severance and Restructuring Expenses3

12.0

5.9

52.0

104.1

Inclined Sleeper Product Recalls4

3.1

-

32.0

-

Sale of Assets

-

-

-

(1.4)

Adjusted EBITDA

$

185.2

$

184.5

$

453.1

$

200.2

Free Cash Flow Net Cash

Flows Provided By (Used For) Operating Activities

$

181.0

$

(27.3)

Capital Expenditures

$

(116.4)

$

(152.4)

Free Cash Flow

$

64.6

$

(179.7)

1 Amounts may not foot due to rounding. 2 Toys “R” Us Net

Sales Reversal and Toys “R” Us Bad Debt Expense, Net are not

presented as non-GAAP adjustments for the three months and year

ended December 31, 2019 and 2018. 3For the three months ended

December 31, 2019, severance and restructuring expenses include

$9.8 million related to the Capital Light program of which $6.7

million was recorded to Cost of Sales and $3.1 million was recorded

to Other Selling and Administrative Expenses. For the year ended

December 31, 2019, severance and restructuring expenses include

$37.6 million related to the Capital Light program of which $18.6

million was recorded to Cost of Sales and $19.0 million was

recorded to Other Selling and Administrative Expenses. 4 Mattel

recorded an estimated impact of $3.5 million and $37.8 million

related to inclined sleeper product recalls for the three months

and year ended December 31, 2019, respectively. Of the $37.8

million recorded during the year ended December 31, 2019, $5.8

million was a reduction to Net Sales for estimated retailer

returns. 6 The aggregate tax effect of the adjustments is

calculated by tax effecting the adjustments by the current

effective tax rate, and dividing by the reported weighted average

number of of common and potential common shares. Adjustments for

the U.S. and certain International affiliates were not tax effected

because of the valuation allowance on deferred tax assets. 7 For

the three months and year ended December 31, 2018, the amount

includes a benefit of approximately $6 million and expense of

approximately $18 million, respectively, related to the provisional

tax for deemed repatriation of accumulated foreign earnings and

changes to the indefinite reinvestment assertion made as a result

of U.S. Tax Reform. 8 For the three months and year ended December

31, 2019, asset impairments represent write-offs of American Girl

retail store assets of $25.9 million, which were recorded in other

selling and administrative expenses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200213005885/en/

News Media Dena Cook dena.cook@mattel.com

310-252-4247

Securities Analysts David Zbojniewicz

david.zbojniewicz@mattel.com 310-252-2703

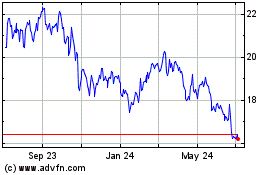

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

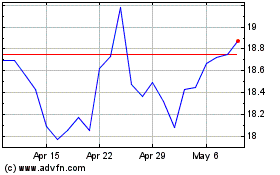

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Apr 2023 to Apr 2024