Current Report Filing (8-k)

December 29 2020 - 4:09PM

Edgar (US Regulatory)

0001176334False00011763342020-12-222020-12-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

`

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): December 22, 2020

MARTIN MIDSTREAM PARTNERS L.P.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

000-50056

|

|

05-0527861

|

|

(State of incorporation

or organization)

|

(Commission file number)

|

(I.R.S. employer identification number)

|

|

4200 Stone Road

|

|

|

|

|

|

|

Kilgore, Texas 75662

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (903) 983-6200

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Units representing limited partnership interests

|

MMLP

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

|

|

|

|

|

|

|

|

|

|

|

Item 1.01

|

|

Entry into a Material Definitive Agreement

|

On December 22, 2020, Martin Midstream Partners L.P. (the “Partnership”) entered into an Asset Purchase and Sale Agreement (the “Agreement”) to sell certain assets used in connection with the Partnership’s Mega Lubricants shore-based terminals business (“Mega Lubricants”) to John W. Stone Oil Distributor, LLC (“Stone Oil”) for $22.4 million (the “Sale”). Mega Lubricants is engaged in the business of blending, manufacturing and delivering various marine application lubricants, sub-sea specialty fluids, and proprietary developed commercial and industrial products. The Sale closed on December 22, 2020. The proceeds from the Sale will be used to reduce outstanding borrowings under the Partnership’s revolving credit facility. The Agreement contains customary representations, warranties, covenants and agreements by the Partnership and Stone Oil. The Agreement also contains indemnification obligations of both the Partnership and Stone Oil with respect to customary matters, including breaches of representations and warranties, and non-fulfillment or breaches of covenants.

The preceding summary of the Agreement does not purport to be complete and is qualified in its entirety by the full text of the Agreement, a copy of which is filed herewith as Exhibits 10.1 and 10.2 and incorporated herein by reference.

|

|

|

|

|

|

|

|

|

|

|

Item 2.01

|

|

Completion of Acquisition or Disposition of Assets.

|

The information contained in Item 1.01 of this Current Report on Form 8-K (this “Current Report”) is incorporated herein by reference.

|

|

|

|

|

|

|

|

|

|

|

Item 7.01

|

|

Regulation FD Disclosure

|

On December 22, 2020, the Partnership issued a press release announcing the Sale. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference. The information included in this Current Report under this Item 7.01 and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that Section, unless the registrant specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Exchange Act or the Securities Act of 1933, as amended.

|

|

|

|

|

|

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits.

|

(b) Pro Forma Financial Information

The Partnership’s Unaudited Pro Forma Condensed Consolidated Financial Information as of and for the nine months ended September 30, 2020 and the year ended December 31, 2019, and the related notes thereto, giving effect to the Sale, is attached hereto as Exhibit 99.2.

(d) Exhibits

In accordance with General Instruction B.2 of Form 8-K, the information set forth in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

10.1*

|

|

|

|

10.2

|

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File. The cover page XBRL tags are embedded within the inline XBRL document (contained in Exhibit 101).

|

* The schedules and exhibits to this Exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARTIN MIDSTREAM PARTNERS L.P.

By: Martin Midstream GP LLC,

Its General Partner

|

|

Date: December 29, 2020

|

|

By: /s/ Robert D. Bondurant

|

|

|

|

Robert D. Bondurant

|

|

|

|

Executive Vice President, Treasurer, Principal Accounting Officer and

Chief Financial Officer

|

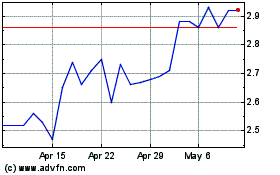

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

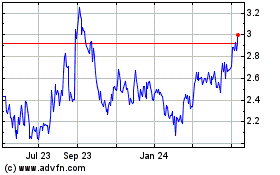

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024