Current Report Filing (8-k)

July 24 2020 - 4:31PM

Edgar (US Regulatory)

false 0001176334 0001176334 2020-07-24 2020-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 24, 2020

MARTIN MIDSTREAM PARTNERS L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-50056

|

|

05-0527861

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

4200 Stone Road

Kilgore, Texas 75662

(Address of principal executive offices) (Zip Code)

(903) 983-6200

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Units representing limited partnership interests

|

|

MMLP

|

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On July 24, 2020, the Partnership issued a press release announcing the early tender results under the Partnership and Martin Midstream Finance Corp.’s (collectively, the “Issuers”) previously announced exchange offer, rights offering, and consent solicitation and separate but related tender offer and consent solicitation (together, the “Offers”) to certain eligible holders of the Issuers’ 7.25% senior unsecured notes due 2021 (the “Existing Notes”). A copy of the press release is filed herewith as Exhibit 99.1 and incorporated by reference herein.

The early tender and withdrawal deadline for the Offers occurred at 5:00 p.m., New York City time, on July 23, 2020 (the “Early Participation Date”). As of the Early Participation Date, holders of the Existing Notes had validly tendered (and not validly withdrawn) an aggregate principal amount of $335,463,000 of the Existing Notes, representing approximately 92.045% of the aggregate principal amount of the Existing Notes in the Offers. The Partnership received sufficient consents, which consents are no longer subject to withdrawal, from holders of the Existing Notes to effect the proposed amendments to the indenture governing the Existing Notes, which will, among other things, eliminate substantially all of the restrictive covenants in the Existing Notes indenture, delete certain events of default, and shorten the period of advance notice required to be given to holders of Existing Notes from 30 days to 3 business days in the case of a redemption of the Existing Notes.

This Current Report is not an offer to purchase, a solicitation of an offer to purchase or a solicitation of consents with respect to any of the Existing Notes. The Offers have been made solely pursuant to the Offering Memorandum or Offer to Purchase, as applicable, and the respective related documents.

The information included in this Current Report on Form 8-K under Item 7.01 and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that Section, unless the registrant specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Exchange Act or the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

Exhibit No.

|

|

Exhibit

|

|

|

|

|

99.1

|

|

Press Release

|

|

|

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MARTIN MIDSTREAM PARTNERS L.P.

|

|

|

|

|

|

|

By: Martin Midstream GP LLC,

|

|

|

|

Its General Partner

|

|

|

|

|

|

|

Date: July 24, 2020

|

|

|

|

By:

|

|

/s/ Robert D. Bondurant

|

|

|

|

|

|

|

|

Name: Robert D. Bondurant

|

|

|

|

|

|

|

|

Title: Executive Vice President, Treasurer, Principal Accounting Officer and Chief Financial Officer

|

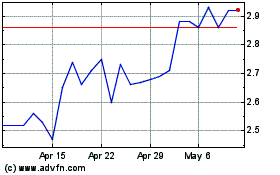

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

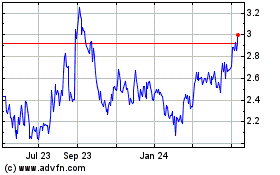

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024