Julius Baer Goes Live With Pilot of MarketAxess’ New Order & Execution Workflow Solution, Axess IQ

November 21 2019 - 8:00AM

MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a

leading electronic trading platform for fixed-income securities,

and the provider of market data and post-trade services for the

global fixed-income markets, announced today that Bank Julius Baer

& Co. Ltd (Julius Baer), one of the world’s leading private

banking groups, has gone live with a pilot version of MarketAxess’

new order and execution workflow solution, Axess IQ.

Axess IQ is designed to meet the needs of wealth

management and private banking community by improving liquidity

discovery, execution efficiency and alpha generation across

execution operations of firms with large numbers of individual

client orders. The connectivity of Axess IQ and the MarketAxess

trading network means clients can access unparalleled global fixed

income market liquidity with added order management and automation

capabilities. Axess IQ offers a unique combination of:

- liquidity and pricing data aggregation to better visualize

market depth and inform trading decisions;

- seamless OMS integration and optimised execution efficiency

with integration to Auto-X™ automated trading solutions and the

all-to-all Open Trading™ marketplace; and

- support for trading a range of diverse credit products

including U.S. Investment Grade, U.S. High Yield and Emerging

Market hard currency debt as a part of the pilot.

Following a successful implementation period,

this new solution allows Julius Baer to streamline and enhance

their order workflow and demonstrate best execution by utilizing

MarketAxess’ award-winning AI-powered Composite+™ pricing engine

for monitoring limit orders and MarketAxess’ Auto-X™ solution for

efficient, low-touch automated execution. Axess IQ will be made

available to additional clients post the pilot phase.

Stefan Rosskopf, Head of Fixed Income

Advisory and Execution with Julius Baer, commented: “Our

focus on service orientation and best execution are the pillars of

our success at Julius Baer. At a trade execution level, that means

ensuring the highest level of operational efficiency, counterparty

selection and price discovery for the client. It also means

efficiently managing order flow through more automated processes so

that our traders can focus on bigger sized or less liquid trades,

which many times need special attention or manual intervention.

Efficiency means being able to assess and access liquidity across

the broadest possible range of credit products and markets, as well

as supporting the trader in the counterparty selection. We’ve been

very pleased with the success of the Axess IQ pilot so far and look

forward to working with MarketAxess further as new functionality

and products are added.”

Christophe Roupie, Head of EMEA and APAC

with MarketAxess, said: “Execution desks at wealth

managers and private banks have very specific needs when it comes

to their execution workflow. Working with Julius Baer to deliver

the Axess IQ pilot has been an ideal partnership – marrying the

sophistication of Julius Baer’s global private banking team with

MarketAxess’ leading technology and market data to create the

right, tailored solution to those needs. We’re excited about what

this launch heralds as we roll out new Axess IQ technology to more

clients in 2020.”

About MarketAxess

MarketAxess operates a leading, institutional electronic trading

platform delivering expanded liquidity opportunities, improved

execution quality and significant cost savings across global

fixed-income markets. A record $1.7 trillion of U.S.

investment-grade bonds, U.S. high yield bonds, emerging market

debt, Eurobonds and other fixed income securities traded through

MarketAxess’ patented trading technology in 2018. The global

community of 1,600 firms trading on MarketAxess today include the

world’s leading asset managers and institutional broker-dealers.

MarketAxess’ award-winning Open Trading™ marketplace is regarded as

the preferred all-to-all trading solution in the global credit

markets, creating a unique liquidity pool for a broad range of

credit market participants. Drawing on its deep data and

analytical resources, MarketAxess enables automated trading

solutions and, through its Trax® division, provides a range of pre-

and post-trade services and products.

MarketAxess is headquartered in New York and has

offices in London, Amsterdam, Boston, Chicago, Los Angeles, Miami,

Salt Lake City, San Francisco, São Paulo, Hong Kong and Singapore.

For more information, please visit www.marketaxess.com.

|

MarketAxess Media Relations Contacts: |

|

|

| New York: |

|

London: |

| Kyle White |

|

Toby West |

| MarketAxess

Holdings Inc. |

MarketAxess

Holdings Inc. |

| +1 212 813

6355 |

|

+44 (0)20 7709

3270 |

|

kwhite@marketaxess.com |

twest@marketaxess.com |

| |

|

|

|

|

|

| Davis

MacMillan |

|

Tom Engleback |

| RF |

Binder |

|

Cognito |

| +1 212 994

7509 |

|

+44 (0)20 7426

9400 |

|

MarketAxessPR@rfbinder.com |

|

|

marketaxess@cognitomedia.com |

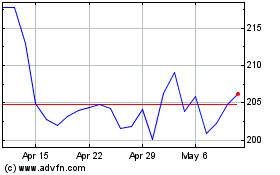

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

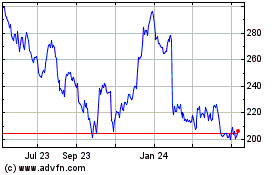

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024