MarketAxess Announces Monthly Volume Statistics for February 2019

March 04 2019 - 4:00PM

MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading

electronic trading platform for fixed-income securities, and the

provider of market data and post-trade services for the global

fixed-income markets, today announced total monthly trading volume

for February 2019 of $167.0 billion, consisting of $88.1 billion in

U.S. high-grade volume, $73.5 billion in other credit volume, and

$5.4 billion in liquid products volume.

Record monthly trading volume was achieved in

February 2019 for the following categories:

- Overall average daily trading volume of $8.7 billion

- Open Trading average daily trading volume of $2.3 billion

- U.S. high-grade average daily trading volume of $4.6

billion

- Emerging markets average daily trading volume of $1.9

billion

- Eurobond average daily trading volume of $1.0 billion and

overall trading volume of $20.3 billion

MarketAxess trading volumes, TRACE reported

volumes and Trax® processed volumes are available on the Company’s

website at investor.marketaxess.com/volume.cfm

Cautionary Note Regarding Forward-Looking

StatementsThis press release may contain forward-looking

statements, including statements about the outlook and prospects

for Company and industry growth, as well as statements about the

Company’s future financial and operating performance. These

and other statements that relate to future results and events are

based on MarketAxess’ current expectations. Actual results in

future periods may differ materially from those currently expected

or desired because of a number of risks and uncertainties,

including: the volatility of financial services markets generally;

the level of trading volume transacted on the MarketAxess platform;

the absolute level and direction of interest rates and the

corresponding volatility in the corporate fixed-income market; the

level and intensity of competition in the fixed-income electronic

trading industry and the pricing pressures that may result; the

variability of our growth rate; the rapidly evolving nature of the

electronic financial services industry; our ability to introduce

new fee plans and our clients’ response; our exposure to risks

resulting from non-performance by counterparties to transactions

executed between our clients in which we act as an intermediary in

matching back-to-back trades; our dependence on our broker-dealer

clients; the loss of any of our significant institutional investor

clients; our ability to develop new products and offerings and the

market’s acceptance of those products; the effect of rapid market

or technological changes on us and the users of our technology; our

ability to successfully maintain the integrity of our trading

platform and our response to system failures, capacity constraints

and business interruptions; our vulnerability to cyber security

risks; our ability to protect our intellectual property rights or

technology and defend against intellectual property infringement or

other claims; our ability to enter into strategic alliances and to

acquire other businesses and successfully integrate them with our

business; our ability to comply with new laws, rules and

regulations both domestically and internationally; our ability to

maintain effective compliance and risk management methods; the

strain of growth initiatives on management and other resources; our

future capital needs and our ability to obtain capital when needed;

limitations on our operating flexibility contained in our credit

agreement; and other factors. The Company’s actual results

and financial condition may differ, perhaps materially, from the

anticipated results and financial condition in any such

forward-looking statements. The Company undertakes no

obligation to update any forward-looking statements, whether as a

result of new information, future events or otherwise. More

information about these and other factors affecting MarketAxess’

business and prospects is contained in MarketAxess’ periodic

filings with the Securities and Exchange Commission and can be

accessed at www.marketaxess.com.

About MarketAxessMarketAxess operates a

leading, institutional electronic trading platform delivering

expanded liquidity opportunities, improved execution quality and

significant cost savings across global fixed-income markets.

More than 1,500 firms - comprising the world’s leading asset

managers and institutional broker-dealers - traded a record $1.7

trillion of U.S. investment-grade bonds, U.S. high yield bonds,

emerging market debt, Eurobonds and other fixed income securities

through MarketAxess’ patented trading technology in

2018. MarketAxess’ award-winning Open Trading™

marketplace is regarded as the preferred all-to-all trading

solution in the global credit markets, creating a unique liquidity

pool for the broad range of credit market participants.

Drawing on its deep data and analytical resources, MarketAxess

enables automated trading solutions and, through its Trax®

division, provides a range of pre- and post-trade services and

products.

MarketAxess is headquartered in New York and has

offices in London, Amsterdam, Boston, Chicago, Los Angeles, Miami,

Salt Lake City, San Francisco, São Paulo, Hong Kong and Singapore.

For more information, please visit www.marketaxess.com.

Investor Relations Contact:Tony

DeLiseMarketAxess Holdings Inc.+1-212-813-6017

Media Relations Contacts:Mary

SedaratMarketAxess Holdings Inc.+1-212-813-6226

William McBrideRF | Binder +1-917-239-6726

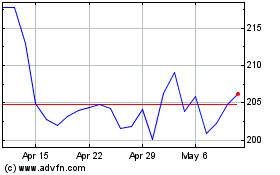

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

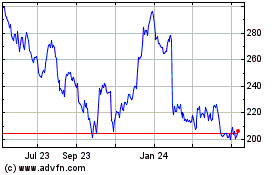

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024