UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

|

Filed

by the Registrant [X]

|

|

Filed

by a Party other than the Registrant [ ]

|

|

Check

the appropriate box:

|

|

|

|

|

[X]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive

Proxy Statement

|

|

[ ]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material under §240.14a-12

|

Marathon

Patent Group, Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

[X]

|

No

fee required.

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

|

Marathon

Patent Group, Inc.

1180

N. Town Center Drive, Suite 100

Las

Vegas, NV 89144

September

19, 2019

To

the Shareholders of Marathon Patent Group, Inc.:

You

are cordially invited to attend Special Meeting of Shareholders (the “Special Meeting”) of Marathon Patent Group,

Inc., a Nevada corporation (the “Company”), to be held at 10:00 AM local time on November __, 2019, at the Company’s

offices at 1180 N. Town Center Drive, Suite 100, Las Vegas, Nevada 89144 to consider and vote upon the following proposals:

|

1.

|

Approval

of any change of control that could result from the potential issuance of securities in one or more non-public offerings in accordance with Nasdaq Marketplace Rule 5635(b) from the issuance of shares of common stock

to be issued in conjunction with the acquisition of 6,000 S-9 Bitmain 13.5 TH/s Bitcoin

Antminers from SelectGreen Blockchain Ltd.

|

|

2.

|

To

transact such other business as may be properly brought before the 2019 Special Meeting and any adjournments thereof.

|

THE

BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE ABOVE EIGHT PROPOSALS.

Pursuant

to the provisions of the Company’s bylaws, the board of directors of the Company (the “Board”) has fixed the

close of business on _______ __, 2019 as the record date for determining the shareholders of the Company entitled to notice of,

and to vote at, the Special Meeting or any adjournment thereof. Accordingly, only shareholders of record at the close of business

on ______ __, 2019 are entitled to notice of, and shall be entitled to vote at, the Special Meeting or any postponement or adjournment

thereof.

Please

review in detail the attached notice and proxy statement for a more complete statement of matters to be considered at the Special

Meeting.

Your

vote is very important to us regardless of the number of shares you own. Whether or not you are able to attend the Special Meeting

in person, please read the proxy statement and promptly vote your proxy via the internet, by telephone or, if you received a printed

form of proxy in the mail, by completing, dating, signing and returning the enclosed proxy in order to assure representation of

your shares at the Special Meeting. Granting a proxy will not limit your right to vote in person if you wish to attend the Special

Meeting and vote in person.

|

|

By

Order of the Board of Directors:

|

|

|

|

|

|

/s/

Merrick D. Okamoto

|

|

|

Merrick

D. Okamoto,

|

|

|

Chairman

of the Board of Directors

|

NOTICE

OF SPECIAL MEETING OF SHAREHOLDERS

The

2019 special meeting of shareholders (the “Special Meeting”) of Marathon Patent Group, Inc. (the “Company”)

will be held at the Company’s offices at 1180 N. Town Center Drive, Suite 100, Las Vegas, Nevada 89144, on , __________

__, 2019 beginning at 10:00 AM local time. At the Special Meeting, the holders of the Company’s outstanding common stock

will act on the following matters:

|

|

1.

|

Approval

of any change of control that could result from the potential issuance of securities in one or more non-public offerings in accordance with Nasdaq Marketplace Rule 5635(b) from the issuance of shares of common stock

to be issued in conjunction with the acquisition of 6,000 S-9 Bitmain 13.5 TH/s Bitcoin

Antminers from SelectGreen Blockchain Ltd.

|

|

|

2.

|

To

transact such other business as may be properly brought before the 2019 Special Meeting and any adjournments thereof.

|

Shareholders

of record at the close of business on _____ __, 2019 are entitled to notice of and to vote at the 2019 Special Meeting and any

postponements or adjournments thereof.

It

is hoped you will be able to attend the 2019 Special Meeting, but in any event, please vote according to the instructions on the

enclosed proxy as promptly as possible. If you are able to be present at the 2019 Special Meeting, you may revoke your proxy and

vote in person.

|

Dated:

September 19, 2019

|

By

Order of the Board of Directors:

|

|

|

|

|

|

/s/

Merrick D. Okamoto

|

|

|

Merrick

D. Okamoto,

|

|

|

Chairman

of the Board of Directors

|

TABLE

OF CONTENTS

MARATHON

PATENT GROUP, INC.

1180

N. Town Center Drive, Suite 100

Las

Vegas, NV 89144

SPECIAL

MEETING OF SHAREHOLDERS

To

Be Held November __, 2019

PROXY

STATEMENT

The

Board of Directors of Marathon Patent Group, Inc. (the “Company”) is soliciting proxies from its shareholders to be

used at the 2019 Special Meeting of shareholders (the “Special Meeting”) to be held at the Company’s offices

at 1180 N. Town Center Drive, Suite 100, Las Vegas, Nevada 89144, on November __, 2019, beginning at 10:00 AM local time. and

at any postponements or adjournments thereof. This proxy statement contains information related to the Special Meeting. This proxy

statement and the accompanying form of proxy are first being sent to shareholders on or about November 9, 2018.

ABOUT

THE SPECIAL MEETING

Why

am I receiving this proxy statement?

You

are receiving this proxy statement because you have been identified as a shareholder of the Company as of the record date which

our Board has determined to be ______ __, 2019, and thus you are entitled to vote at the Company’s 2019 Special Meeting.

This document serves as a proxy statement used to solicit proxies for the 2019 Special Meeting. This document and the Appendixes

hereto contain important information about the 2019 Special Meeting and the Company and you should read it carefully.

Who

is entitled to vote at the 2019 Special Meeting?

Only

shareholders of record as of the close of business on the record date will be entitled to vote at the 2019 Special Meeting. As

of the close of business on the record date, there were ________ shares of our common stock issued and outstanding and entitled

to vote. Each common stock shareholder is entitled to one vote for each share of our common stock held by such shareholder on

the record date on each of the proposals presented in this proxy statement.

May

I vote in person?

If

you are a shareholder of the Company and your shares are registered directly in your name with the Company’s transfer agent,

Equity Stock Transfer, you are considered, with respect to those shares, the shareholder of record, and the proxy materials and

proxy card, attached hereto as Appendix A, are being sent directly to you by the Company. If you are a shareholder of record,

you may attend the 2019 Special Meeting to be held on _____ __, 2019, and vote your shares in person, rather than signing and

returning your proxy.

If

your shares of common stock are held by a bank, broker or other nominee, you are considered the beneficial owner of shares held

in “street name,” and the proxy materials are being forwarded to you together with a voting instruction card by such

bank, broker or other nominee. As the beneficial owner, you are also invited to attend the 2019 Special Meeting. Since a beneficial

owner is not the shareholder of record, you may not vote these shares in person at the 2019 Special Meeting unless you obtain

a proxy from your broker issued in your name giving you the right to vote the shares at the 2019 Special Meeting.

Photo

identification may be required (a valid driver’s license, state identification or passport). If a shareholder’s shares

are registered in the name of a broker, trust, bank or other nominee, the shareholder must bring a proxy or a letter from that

broker, trust, bank or other nominee or their most recent brokerage account statement that confirms that the shareholder was a

beneficial owner of shares of stock of the Company as of the Record Date. Since seating is limited, admission to the meeting will

be on a first-come, first-served basis.

Cameras

(including cell phones with photographic capabilities), recording devices and other electronic devices will not be permitted at

the meeting.

If

my Company shares are held in “street name” by my broker, will my broker vote my shares for me?

Generally,

if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or

nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote

the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine”

matters, as discussed further below. Your broker will not be able to vote your shares of common stock without specific instructions

from you for “non-routine” matters.

If

your shares are held by your broker or other agent as your nominee, you will need to obtain a proxy form from the institution

that holds your shares and follow the instructions included on that form regarding how to instruct your broker or other agent

to vote your shares.

What

are “broker non-votes”?

If

you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute

“broker non-votes.” “Broker non-votes” occur on a matter when a broker is not permitted to vote on that

matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine”

matters. Since brokers are permitted to vote on “routine” matters without instructions from the beneficial owner,

“broker non-votes” do not occur with respect to “routine” matters.

Proposal

1 to approve any change of control that could result from the potential issuance of securities in the non-public offerings and

Proposal 2 to transact such other business as may be properly brought before the 2019 Special Meeting and any adjournments thereof

are “non-routine matters.”

The

determination of “routine” and “non-routine” matters is determined by brokers and those firms responsible

to tabulate votes cast by beneficial owners of shares held in street name and other nominees. Firms casting such votes have generally

been guided by rules of the New York Stock Exchange when determining if proposals are considered “routine” or “non-routine”.

When a matter to be voted on is the subject of a contested solicitation, banks, brokers and other nominees do not have discretion

to vote your shares with respect to any proposal to be voted on.

How

do I cast my vote if I am a shareholder of record?

If

you are a shareholder with shares registered in your name with the Company’s transfer agent, Equity Stock Transfer, on the

record date, you may vote in person at the 2019 Special Meeting or vote by proxy by fax at (646) 201-9006 ATTN: Shareholder Services

OR EMAIL: proxy@equitystock.com or internet at proxyvote.equitystock.com or by mail. Whether or not you plan to attend the 2019

Special Meeting, please vote as soon as possible to ensure your vote is counted. You may still attend the 2019 Special Meeting

and vote in person even if you have already voted by proxy. For more detailed instructions on how to vote using one of these methods,

please see the form of proxy card attached to this Schedule 14A and the information below.

|

|

●

|

To

vote in person. You may attend the 2019 Special Meeting and the Company will give you a ballot when you arrive.

|

|

|

|

|

|

|

●

|

To

vote by proxy by fax or internet. If you have fax or internet access, you may submit your proxy by following the instructions

provided in this proxy statement, or by following the instructions provided with your proxy materials and on the enclosed

proxy card or voting instruction card.

|

|

|

|

|

|

|

●

|

To

vote by proxy by mail. You may submit your proxy by mail by completing and signing the enclosed proxy card and mailing it

in the enclosed envelope. Your shares will be voted as you have instructed.

|

How

do I cast my vote if I am a beneficial owner of shares registered in the name of any broker or bank?

If

you are a beneficial owner of shares registered in the name of your broker, bank, dealer or other similar organization, you should

have received a proxy card and voting instructions with these proxy materials from that organization rather than from the Company.

Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over

the internet as instructed by your broker or other agent. To vote in person at the 2019 Special Meeting, you must obtain a valid

proxy from your broker or other agent. Follow the instructions from your broker or other agent included with these proxy materials

or contact your broker or bank to request a proxy form.

What

constitutes a quorum for purposes of the 2019 Special Meeting?

The

presence at the meeting, in person or by proxy, of the holders of at least a majority of the issued and outstanding shares entitled

to vote are present or represented by proxy at the Special Meeting permitting the conduct of business at the meeting. On the record

date, there were _________ shares of Common Stock and 0 shares of preferred stock issued and outstanding and entitled to vote.

Accordingly, the holders of _____ shares eligible to vote must be present at the 2019 Special Meeting to have a quorum. Proxies

received but marked as abstentions or broker non-votes, if any, will be included in the calculation of the number of votes considered

to be present at the meeting for purposes of a quorum. Your shares will be counted toward the quorum at the 2019 Special Meeting

only if you vote in person at the meeting, you submit a valid proxy or your broker, bank, dealer or similar organization submits

a valid proxy.

Can

I change my vote?

Yes.

Any shareholder of record voting by proxy has the right to revoke their proxy at any time before the polls close at the 2019 Special

Meeting by sending a written notice stating that they would like to revoke his, her or its proxy to the Corporate Secretary of

the Company; by providing a duly executed proxy card bearing a later date than the proxy being revoked; or by attending the 2019

Special Meeting and voting in person. Attendance alone at the 2019 Special Meeting will not revoke a proxy. If a shareholder of

the Company has instructed a broker to vote its shares of common stock that are held in “street name,” the shareholder

must follow directions received from its broker to change those instructions.

Who

is soliciting this proxy – Who is paying for this proxy solicitation?

We

are soliciting this proxy on behalf of our Board of Directors. The Company will bear the costs of and will pay all expenses associated

with this solicitation, including the printing, mailing and filing of this proxy statement, the proxy card and any additional

information furnished to shareholders. In addition to mailing these proxy materials, certain of our officers and other employees

may, without compensation other than their regular compensation, solicit proxies through further mailing or personal conversations,

or by telephone, facsimile or other electronic means. We will also, upon request, reimburse banks,

brokers, nominees, custodians and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy materials

to the beneficial owners of our stock and to obtain proxies.

What

vote is required to approve each item?

The

following votes are required to approve each proposal:

|

●

|

Proposal

1 - To approve any change of control that could result from the potential issuance of securities in the non-public

offerings in the Acquisition (as defined below), as required by and in accordance with Nasdaq Marketplace Rule 5635(b). “FOR”

votes from the holders of a majority of the shares of the Company’s common stock present in person or represented by

proxy and entitled to vote on the matter at the 2019 Special Meeting are required to approve this proposal.

|

|

●

|

Proposal

2 - To transact such other business as may be properly brought before the Special Meeting and any adjournments thereof.

“FOR” votes from the holders of a majority of the shares of the Company’s common stock present in person

or represented by proxy and entitled to vote on the matter at the 2019 Special Meeting are required to approve this proposal.

|

Will

My Shares Be Voted If I Do Not Return My Proxy Card?

If

your shares are registered in your name or if you have stock certificates, they will not be voted if you do not return your proxy

card by mail or vote at the Special Meeting. If your broker cannot vote your shares on a particular matter because it has not

received instructions from you and does not have discretionary voting authority on that matter, or because your broker chooses

not to vote on a matter for which it does have discretionary voting authority, this is referred to as a “broker non-vote.”

The New York Stock Exchange (“NYSE”) has rules that govern brokers who have record ownership of listed company stock

(including stock such as ours that is listed on The Nasdaq Capital Market) held in brokerage accounts for their clients who beneficially

own the shares. Under these rules, brokers who do not receive voting instructions from their clients have the discretion to vote

uninstructed shares on certain matters (“routine matters”), but do not have the discretion to vote uninstructed shares

as to certain other matters (“non-routine matters”). Neither proposal herein is a routine matter.

If

your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds

your shares the bank, broker or other nominee does not have authority to vote your unvoted shares on any of the other proposals

submitted to shareholders for a vote at the Special Meeting. We encourage you to provide voting instructions. This ensures your

shares will be voted at the Special Meeting in the manner you desire.

Can

I access these proxy materials on the Internet?

Yes.

The Notice of Special Meeting, and this proxy statement and the Appendix hereto are available for viewing, printing, and downloading

at https://ir.marathonpg.com/sec-filings. All materials will remain posted on https://ir.marathonpg.com/sec-filingsat least until

the conclusion of the meeting.

What

should I do if I receive more than one set of voting materials?

You

may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards

or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate

voting instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares

are registered in more than one name, you will receive more than one proxy card. Please vote your shares applicable to each proxy

card and voting instruction card that you receive.

How

can I find out the results of the voting at the Special Meeting?

Preliminary

voting results will be announced at the Special Meeting. Final voting results will be published in a Current Report on Form 8-K

filed with the Securities and Exchange Commission within four business days of the 2019 Special Meeting.

What

interest do officers and directors have in matters to be acted upon?

No

person who has been a director or executive officer of the Company at any time since the beginning of our fiscal year, and no

associate of any of the foregoing persons, has any substantial interest, direct or indirect, in any matter to be acted upon.

Who

can provide me with additional information and help answer my questions?

If

you would like additional copies, without charge, of this proxy statement or if you have questions about the proposals being considered

at the 2019 Special Meeting, including the procedures for voting your shares, you should contact David Lieberman, the Company’s

Secretary, by telephone at (702) 945-2773.

Householding

of Annual Disclosure Documents

The

SEC previously adopted a rule concerning the delivery of annual disclosure documents. The rule allows us or brokers holding our

shares on your behalf to send a single set of our annual report and proxy statement to any household at which two or more of our

shareholders reside, if either we or the brokers believe that the shareholders are members of the same family. This practice,

referred to as “householding,” benefits both shareholders and us. It reduces the volume of duplicate information received

by you and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements.

Once shareholders receive notice from their brokers or from us that communications to their addresses will be “householded,”

the practice will continue until shareholders are otherwise notified or until they revoke their consent to the practice. Each

shareholder will continue to receive a separate proxy card or voting instruction card.

Those

shareholders who either (i) do not wish to participate in “householding” and would like to receive their own sets

of our annual disclosure documents in future years or (ii) who share an address with another one of our shareholders and who would

like to receive only a single set of our annual disclosure documents should follow the instructions described below:

|

●

|

shareholders

whose shares are registered in their own name should contact our transfer agent,

shareholders

whose shares are registered in their own name should contact our transfer agent, Equity Stock Transfer LLC, and inform

them of their request by calling them at (212) 575-5757 or writing them at 237 W. 37thStreet, Suite 601, New

York, NY 10018.

|

|

|

|

|

●

|

shareholders

whose shares are held by a broker or other nominee should contact such broker or other nominee directly and inform them of

their request, shareholders should be sure to include their name, the name of their brokerage firm and their account number.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information regarding beneficial ownership of our Common Stock as of September 19, 2019: (i)

by each of our directors, (ii) by each of the named executive officers, (iii) by all of our executive officers and directors as

a group, and (iv) by each person or entity known by us to beneficially own more than five percent (5%) of any class of our outstanding

shares. As of September 19, 2019, there were 6,385,405 shares of our common stock outstanding. All share numbers set forth herein

take into account our 1:4 reverse stock split effected on April 8, 2019.

|

Amount and Nature of Beneficial Ownership as of September 19, 2019 (1)

|

|

Name and Address of Beneficial

Owner (1)

|

|

Common

Stock

|

|

|

Options

(5)

|

|

|

Warrants

|

|

|

Total

|

|

|

Percentage

of Common

Stock (%)

|

|

|

Perentage

of Common

Stock (%)

after

Acquisition

(6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Merrick Okamoto (Executive Chairman and CEO)

|

|

|

28,875

|

(4)

|

|

|

937,500

|

|

|

|

-

|

|

|

|

966,375

|

|

|

|

15.13

|

%

|

|

|

11.08

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David Lieberman (CFO)

|

|

|

3,125

|

|

|

|

100,000

|

|

|

|

-

|

|

|

|

103,125

|

|

|

|

1.06

|

%

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James Crawford (COO)

|

|

|

-

|

|

|

|

50,000

|

|

|

|

-

|

|

|

|

50,000

|

|

|

|

*

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fred Thiel

|

|

|

-

|

|

|

|

37,500

|

|

|

|

-

|

|

|

|

37,500

|

|

|

|

*

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Berg

|

|

|

-

|

|

|

|

62,500

|

|

|

|

-

|

|

|

|

62,500

|

|

|

|

*

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Rudolph

|

|

|

-

|

|

|

|

62,500

|

|

|

|

-

|

|

|

|

62,500

|

|

|

|

*

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Directors and Executive Officers (six persons)

|

|

|

32,000

|

|

|

|

1,250,000

|

|

|

|

|

|

|

|

1,282,000

|

|

|

|

20.07

|

%

|

|

|

|

|

*

Less than 1%

|

(1)

|

In

determining beneficial ownership of our common stock as of a given date, the number of shares shown includes shares of Common

Stock which may be acquired on exercise of warrants or options or conversion of convertible securities within 60 days of _______

__, 2019. In determining the percent of Common Stock owned by a person or entity on _______ __, 2019, (a) the numerator is

the number of shares of the class beneficially owned by such person or entity, including shares which may be acquired within

60 days on exercise of warrants or options and conversion of convertible securities, and (b) the denominator is the sum of

(i) the total shares of Common Stock outstanding on _______ __, 2019 and (ii) the total number of shares that the beneficial

owner may acquire upon conversion of securities and upon exercise of the warrants and options, subject to limitations on conversion

and exercise as more fully described below. Unless otherwise stated, each beneficial owner has sole power to vote and dispose

of its shares and such person’s address is c/o Marathon Patent Group, Inc., 1180 N. Town Center Drive, Suite 100, Las

Vegas, NV 89144.

|

|

|

|

|

(2)

|

Intentionally

Omitted.

|

|

|

|

|

(3)

|

Intentionally

Omitted.

|

|

|

|

|

(4)

|

Held

by First Stage Capital, Inc. over which Mr. Okamoto holds sole voting and dispositive power.

|

|

|

|

|

(5)

|

Represents

vested portion of Option Award under the Company’s 2018 Equity Incentive exercisable within 60 days.

|

|

|

|

|

(6)

|

Assumes

8,720,405 shares of Company common stock issued and outstanding upon shareholder approval

of the potential change of control resulting from the Acquisition.

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

Other

than disclosed herein, there were no transactions during the year ended December 31, 2018 or any currently proposed transactions,

in which the Company was or is to be a participant and the amount involved exceeds $120,000, and in which any related person had

or will have a direct or indirect material interest.

Corporate

Governance Matters

We

are committed to maintaining strong corporate governance practices that benefit the long-term interests of our shareholders by

providing for effective oversight and management of the Company. Our governance policies, including a Code of Business Conduct

and Ethics (“Code”) can be found on our website at www.marathonpg.com by following the link to “Investors”

and then to “Governance Docs.”

Our

Code of Business Conduct and Ethics, effective December 2017, applies to directors, executive officers and employees of the Company.

This Code is intended to focus the directors, executive officers and employees on areas of ethical risk, provide guidance to directors,

executive officers and employees to help them recognize and deal with ethical issues, provide mechanisms to report unethical conduct,

and help foster a culture of honesty and accountability. Each director, executive officer and employee must comply with the letter

and spirit of this Code.

We

require that Directors and executive officers must be loyal to the Company and must act at all times in the best interest of the

Company and its shareholders and subordinate self-interest to the corporate and shareholder good. Directors and executive officers

should never use their position to make a personal profit. Directors and executive officers must perform their duties in good

faith, with sound business judgment and with the care of a prudent person.

A

“conflict of’ interest” occurs when the private interest of’ a director, executive officer or employee

interferes in any way, or appears to interfere, with the interests of the Company as a whole. Conflicts of interest also arise

when a director, executive officer or employee, or a member of his or her family, receives improper personal benefits as a result

of his or her position as a director, executive officer or employee of the Company. Loans to, or guarantees of the obligations

of a director, executive officer or employee or of a member of his or her family, may create conflicts of interest. Directors

and executive officers must avoid conflicts of interest with the Company. Any situation that involves, or may reasonably be expected

to involve, a conflict of interest with the Company must be disclosed immediately to the Chairman of the Board. This Code does

not attempt to describe all possible conflicts of interest that could develop. Some of the more common conflicts from which directors

and executive offices must refrain, however, are set out below.

●

Relationship of Company with third-parties. Directors, executive officers and employees may not engage in any conduct or activities

that are inconsistent with the Company’s best interests or that disrupt or impair the Company’s relationship with

any person or entity with which the Company has or proposes to enter into a business or contractual relationship.

●

Compensation from non-Company sources. Directors, executive officers and employees may not accept compensation, in any form, for

services performed for the Company from any source other than the Company.

●

Gifts. Directors, executive officers and employees and members of their families may not offer, give or receive gifts from persons

or entities who deal with the Company in those cases where any such gift is being made in order to influence the actions of a

director as a member of the Board or the actions of an executive officer as an officer of the Company, or where acceptance of

the gifts would create the appearance of a conflict of interest

Directors,

executive officers and employees must maintain the confidentiality of information entrusted to them by the Company or its customers,

and any other confidential information about the Company that comes to them, from whatever source, in their capacity as a director,

executive officer or employee, except when disclosure is authorized or required by laws or regulations. Confidential information

includes all non-public information that might be of use to competitors, or harmful to the Company or its customers, if disclosed.

No

waiver of any provisions of the Code for the benefit of a director or an executive officer (which includes without limitation,

for purposes of this Code, the Company’s principal executive, financial and accounting officers) shall be effective unless

(i) approved by the Board of Directors, and (ii) if applicable, such a waiver is promptly disclosed to the Company’s shareholders

in accordance with applicable United States securities laws and/or the rules and regulations of the exchange or system on which

the Company’s shares are traded or quoted, as the case may be.

PROPOSAL

NO. 1

APPROVAL

OF ANY CHANGE OF CONTROL THAT COULD RESULT FROM THE POTENTIAL ISSUANCE OF SECURITIES IN ONE OR MORE NON-PUBLIC OFFERINGS AS AUTHORIZED

BY THE ACQUISITION, IN ACCORDANCE WITH NASDAQ MARKETPLACE RULE 5635(b)

Nasdaq

Marketplace Rule 5635(b) requires us to obtain shareholder approval prior to certain issuances with respect to Common Stock or

securities convertible into Common Stock which will result in a change of control of the Company. This rule does not specifically

define when a change in control of a Company may be deemed to occur. However, guidance suggests that a change of control would

occur, subject to certain limited exceptions, if after a transaction a person or an entity will hold 20% or more of the Company’s

then outstanding capital stock. For the purpose of calculating the holdings of such person or entity, the Nasdaq Capital Market

would take into account, in addition to the securities received by such person or entity in the transaction, all of the shares

owned by such person or entity unrelated to the transaction and would assume the conversion of any convertible securities held

by such person or entity. Since the issuance of the Acquisition Shares will significantly increase the amount of shares of Common

Stock outstanding, we do not anticipate that the issuance of securities pursuant to the Acquisition will result in a change in

control; however, we are seeking the shareholders’ approval on any change in control in accordance with Nasdaq Marketplace

Rule 5635(b) in the event that potential issuance of securities in the offerings proposed in Proposal No. 1 would result in a

change in control.

Shareholders

should note that a change of control as described under Nasdaq Marketplace Rule 5635(b) applies only with respect to the application

of such Nasdaq rule. Neither Nevada law nor our articles of incorporation or bylaws requires us to obtain shareholder approval

of such change in control. It should be noted that the Company is not seeking approval of

the Acquisition (as defined below) or of the issuance of shares of its common stock in the Acquisition, as neither action requires

shareholder approval.

On

August 28, 2019, Marathon Patent Group, Inc. (the “Company”) entered into an Asset Purchase Agreement with SelectGreen

Blockchain Ltd, a British Columbia corporation (“Seller”)

to acquire 6,000 S-9 Bitmain 13.5 TH/s Bitcoin Antminers (“Antminer S-9 miners”

or “S-9s”). The transaction (“Acquisition”), which is scheduled to close upon completion of the review

of the Listing of Additional Shares application filed with Nasdaq with regard to the transaction, will be an all-stock private

placement whereby the Company will issue 2,335,000 unregistered Common Stock shares at a price above the current market in a transaction

exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended. Upon consummation of the transaction,

the Company will have 8,720,405 shares of common stock issued and outstanding. The asset purchase agreement contains a share cap

provision which states that the Company will not issue more than the number of shares of our Common Stock issuable by the Company

pursuant to Nasdaq Marketplace Rule 5635(b) before receipt of shareholder approval of Proposal No. 1.

The

Miners will be placed into service in a Co-Location hosting facility with electricity costs of $0.035 per KwH and $0.02 per KwH

for the all-in hosting management. The combined cost of $0.055 per KwH equates to a breakeven of approximately $5,050 per Bitcoin

resulting in a 100% increase in gross profit from breakeven for each Bitcoin earned from mining at a price of $10,000/BTC.

Selectgreen

Blockchain, Ltd. is a British Columbia company which was incorporated in 2019 as a vehicle pursuant to which the services of various

individuals with expertise in the cryptocurrency industry and individuals who have contacts to obtain S9 antiminers to be aggregated

and sold to Marathon. Selectgreen does not currently have nor has it ever had an operating business. Pursuant to a series of management

services agreements, all dated on or about August 1, 2019, the below described parties were each independently engaged to provide

the described services as described for each individual. Selectgreen Blockchain has represented that the agreements with each

individual were entered into separately, and that it is unaware of any relationships between the various service providers or

of any relationships between the service providers and Selectgreen other than provision of services under the various master service

agreements.

The

breakdown of the distribution of the shares to be paid as consideration is as follows. All of the recipients are unrelated parties,

do not share any voting or other power and are not a group. Furthermore, none of the recipients is a shareholder, director or

employee of Selectgreen and as a result of the issuances, no one person will own 10% or more of the issued and outstanding shares

of Marathon.

100,000

– Recipient 1

|

|

○

|

Analysis

for hosting facility - independent

|

100,000

– Recipient 2

|

|

○

|

Analysis

for valuation of machines - independent

|

100,000

– Recipient 3

|

|

○

|

Analysis

for valuation of machines – independent to corroborate Growth Ventures

|

135,000

– Recipient 4

175,000

– Recipient 5

|

|

○

|

Arrange

shipping of machines to storage facility in Buffalo

|

400,000

– Recipient 6

|

|

○

|

Advisor

to Select Green working directly with Marathon to close deal.

|

425,000

– Recipient 7

|

|

○

|

Hosting

Facility referral source

|

|

|

○

|

Referral

for 5,000 S9’s

|

Thus,

under Nasdaq FAQ 195, the transaction will not result in a change in control as no one recipient will receive even 10%

of the issued and outstanding shares of Marathon, and there are no arrangements or other agreements among the recipients and/or

the recipients and Marathon or Selectgreen. Rather, each issuance is solely as a result of compensation for services to Selectgreen

as described above.

Nonetheless,

since all of the S9’s were aggregated under Selectgreen, we are seeking shareholder approval of any potential change in

control which could result from the Acquisition at the request of Nasdaq.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

This

prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference”

into this proxy statement on Schedule 14A the information that we file with them, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus,

and information that we file later with the SEC will automatically update and supersede this information. The following documents

are incorporated by reference and made a part of this prospectus:

|

|

●

|

Annual

Report on Form 10-K for the year ended December 31, 2018 filed on March 25, 2019 and Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2019 and June 30, 2019, filed on May 10, 2019 and August 1, 2019, respectively;

|

|

|

|

|

|

|

●

|

Our

Definitive Proxy Statement on Schedule 14A and accompanying additional proxy materials filed with the SEC on November 5, 2018

and November 14, 2018

|

|

|

|

|

|

|

●

|

Current

Reports on Form 8-K (excluding any reports or portions thereof that are deemed to be furnished and not filed) filed on March

25, 2019, April 5, 2019, April 25, 2019, May 10, 2019, May 24, 2019, July 19, 2019 and August 29, 2019; and

|

|

|

|

|

|

|

●

|

Our

registration statement on Form 8-A filed on April 12, 2012 and June 22, 2014.

|

We

also incorporate by reference all additional documents that we file with the Securities and Exchange Commission under the terms

of Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act that are made after the date of the initial registration statement but

prior to effectiveness of the registration statement and after the date of this prospectus but prior to the termination of the

offering of the securities covered by this prospectus. We are not, however, incorporating, in each case, any documents or information

that we are deemed to furnish and not file in accordance with Securities and Exchange Commission rules.

You

may request, and we will provide you with, a copy of these filings, at no cost, by calling us at (702) 945-2773 or by writing

to us at the following address:

Marathon

Patent Group, Inc.

1180 North Town Center Drive, Suite 100

Las Vegas, NV 89114

Vote

Required

The

affirmative vote of a majority of the votes cast for this proposal is required to approve any change of control that could result

from the issuance of shares of our common stock in the Acquisition, as required by and in accordance with Nasdaq Marketplace Rule

5635(b).

THE

BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL NO. 1.

PROPOSAL

NO. 2 - OTHER MATTERS

The

Board knows of no matter to be brought before the Special Meeting other than the matters identified in this proxy statement. However,

if any other matter properly comes before the Special Meeting or any adjournment of the meeting, it is the intention of the persons

named in the proxy solicited by the Board to vote the shares represented by them in accordance with their best judgment.

ANNUAL

REPORT

Upon

written request to Secretary, Marathon Patent Group, Inc. at 1180 N. Town Center Drive, Suite 100, Las Vegas, NV 89144, we will

provide without charge to each person requesting a copy of our 2018 Annual Report, including the financial statements filed therewith.

We will furnish a requesting shareholder with any exhibit not contained therein upon specific request. In addition, this Proxy

Statement, as well as our 2018 Annual Report, and Quarterly Report for the quarter ended June 30, 2019, are available on our Internet

website at www.marathonpg.com.

|

BY

ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

|

/s/

Merrick D. Okamoto

|

|

|

Merrick

D. Okamoto

|

|

|

Chairman

of the Board of Directors

|

|

APPENDIX

A

[To

be added to the Definitive Schedule 14 A]

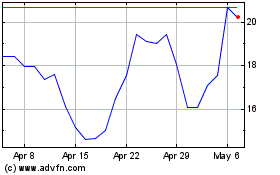

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Apr 2023 to Apr 2024