Current Report Filing (8-k)

May 27 2020 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 21, 2020

MannKind Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-50865

|

|

13-3607736

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

30930 Russell Ranch Road, Suite 300

Westlake Village, California

|

|

91362

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area

code: (818) 661-5000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. of Form 8-K):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

MNKD

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

(e)

As described under Item 5.07 of this Current Report on Form 8-K, on May 21, 2020, at the 2020 Annual Meeting of

Stockholders (the “Annual Meeting”) of MannKind Corporation (the “Company”), the Company’s stockholders, upon the recommendation of the Company’s Board of Directors (the “Board”), approved an amendment to

the Company’s 2018 Equity Incentive Plan (the “2018 Plan”) to increase the number of shares of the Company’s common stock that may be issued under the 2018 Plan by 12,500,000 shares (the “Plan Amendment”). The Plan

Amendment became effective on May 21, 2020 upon the approval of the stockholders at the Annual Meeting.

Item 5.03 Amendments to Articles of

Incorporation or Bylaws; Change in Fiscal Year.

On May 21, 2020, the Company filed with the Secretary of State of the State of Delaware a

Certificate of Amendment (the “Charter Amendment”) of its Amended and Restated Certificate of Incorporation (the “Charter”) to increase the authorized number of shares of the Company’s common stock from 280,000,000 to

400,000,000 shares. The Charter Amendment was approved by the Company’s stockholders at the Annual Meeting, as described below under Item 5.07.

On

May 21, 2020, the Board approved an amendment (the “Bylaws Amendment”) to the Company’s bylaws (the “Bylaws”), effective immediately. The Bylaws Amendment provides that, among other things, unless the Company consents

in writing to the selection of an alternative forum, the courts located within the State of Delaware will serve as the exclusive forum for the adjudication of (i) any derivative action or proceeding brought on behalf of the Company;

(ii) any action or proceeding asserting a claim of breach of a fiduciary duty owed by any current or former director, officer or other employee of the Company, to the Company or our stockholders; (iii) any action or proceeding asserting a

claim against the Company or any current or former director, officer or other employee of the Company, arising out of or pursuant to any provision of the Delaware General Corporation Law (“DGCL”), the Charter or the Bylaws (as each may be

amended from time to time); (iv) any action or proceeding to interpret, apply, enforce or determine the validity of the Charter or these Bylaws (including any right, obligation, or remedy thereunder); (v) any action or proceeding as to which the

DGCL confers jurisdiction to the Court of Chancery of the State of Delaware; and (vi) any action asserting a claim against the Company or any director, officer or other employee of the Company, governed by the internal affairs doctrine, in all

cases to the fullest extent permitted by law and subject to the court’s having personal jurisdiction over the indispensable parties named as defendants. The foregoing Delaware exclusive forum provision will not apply to suits brought to enforce

a duty or liability created by the Securities Act of 1933, as amended (the “1933 Act”), the Securities Exchange Act of 1934, as amended, or any other claim for which the federal courts have exclusive jurisdiction.

In addition, the Bylaws Amendment provides that, unless the Company consents in writing to the selection of an alternative forum, to the fullest extent

permitted by law, the federal district courts of the United States of America shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the 1933 Act.

Copies of the Charter Amendment and Bylaws Amendment are attached to this report as Exhibits 3.1 and 3.2, respectively.

Item 5.07 Submission of Matters to a Vote of Security Holders.

The following is a brief description of each matter voted upon at the Annual Meeting, as well as the number of votes with respect to each matter.

|

|

•

|

|

Our stockholders elected each of the eight individuals nominated by the Board to serve as directors until the

next annual meeting of stockholders. The tabulation of votes in the election was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

|

Shares

Voted For

|

|

|

Shares

Withheld

|

|

|

Broker

Non-Votes

|

|

|

Kent Kresa

|

|

|

50,743,364

|

|

|

|

14,025,201

|

|

|

|

105,561,036

|

|

|

Michael E. Castagna, Pharm.D.

|

|

|

50,915,780

|

|

|

|

13,852,785

|

|

|

|

105,561,036

|

|

|

Ronald J. Consiglio

|

|

|

51,084,294

|

|

|

|

13,684,271

|

|

|

|

105,561,036

|

|

|

Michael A. Friedman, M.D.

|

|

|

50,995,947

|

|

|

|

13,772,618

|

|

|

|

105,561,036

|

|

|

Jennifer Grancio

|

|

|

59,528,622

|

|

|

|

5,239,943

|

|

|

|

105,561,036

|

|

|

Anthony Hooper

|

|

|

59,905,035

|

|

|

|

4,863,530

|

|

|

|

105,561,036

|

|

|

Christine Mundkur

|

|

|

56,247,564

|

|

|

|

8,521,001

|

|

|

|

105,561,036

|

|

|

James S. Shannon, M.D., MRCP (UK)

|

|

|

52,894,224

|

|

|

|

11,874,341

|

|

|

|

105,561,036

|

|

|

|

•

|

|

Our stockholders approved the Charter Amendment. The tabulation of votes on this matter was as follows: shares

voted for: 126,692,259; shares voted against: 40,863,104; shares abstaining: 2,774,238; and broker non-votes: zero.

|

|

|

•

|

|

Our stockholders approved the Plan Amendment. The tabulation of votes on this matter was as follows: shares voted

for: 46,076,940; shares voted against: 17,217,362; shares abstaining: 1,474,263; and broker non-votes: 105,561,036.

|

|

|

•

|

|

Our stockholders approved, on an advisory basis, the compensation of our named executive officers, as disclosed

in our definitive proxy statement for the Annual Meeting, filed with the Securities and Exchange Commission on April 10, 2020. The tabulation of votes on this matter was as follows: shares voted for: 39,467,552; shares voted against:

21,127,585; shares abstaining: 4,173,428; and broker non-votes: 105,561,036.

|

|

|

•

|

|

Our stockholders ratified the selection of Deloitte & Touche LLP as our independent registered public

accounting firm for the fiscal year ending December 31, 2020. The tabulation of votes on this matter was as follows: shares voted for: 154,124,061; shares voted against: 12,751,222; shares abstaining: 3,454,318; and broker non-votes: zero.

|

Item 8.01 Other Events.

On May 21, 2020, the Company achieved the third of four specified development milestones under its licensing and collaboration agreement with United

Therapeutics, dated September 3, 2018, for the development and commercialization of a dry powder formulation of treprostinil, entitling the Company to a payment of $12.5 million. Treprostinil Technosphere (“TreT”) is an

investigational product currently being evaluated in clinical trials for the treatment of pulmonary arterial hypertension. Pursuant to the agreement, the Company is eligible to earn an additional milestone payment of $12.5 million upon the

achievement of a defined development milestone. The Company is also entitled to receive low double-digit royalties on net sales of TreT.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MANNKIND CORPORATION

|

|

|

|

|

|

|

Dated: May 27, 2020

|

|

|

|

By:

|

|

/s/ David Thomson, Ph.D., J.D.

|

|

|

|

|

|

|

|

David Thomson, Ph.D., J.D.

Corporate Vice

President, General Counsel and Secretary

|

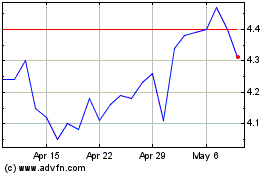

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Mar 2024 to Apr 2024

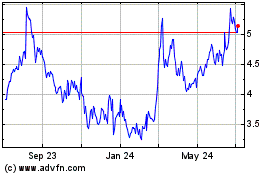

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Apr 2023 to Apr 2024