MannKind Corporation Reports 2019 First Quarter Financial Results

May 07 2019 - 8:00AM

MannKind Corporation (NASDAQ:MNKD) today reported financial results

for the quarter ended March 31, 2019.

“In the first quarter of 2019, we executed against the United

Therapeutics License and Collaboration agreement, achieving the

first of four milestone payments of $12.5 million. We also

continued to grow Afrezza net revenue by 49% compared to 1Q 2018

and we released new clinical data at scientific meetings that

continue to differentiate Afrezza from other rapid acting

insulins,” said Michael Castagna, Chief Executive Officer of

MannKind Corporation.

Total revenues were $17.4 million for the first quarter of 2019,

reflecting Afrezza net revenue of $5.1 million and collaboration

and services revenue of $12.4 million. Afrezza net revenue

increased 49% compared to $3.4 million in the first quarter of

2018, primarily driven by higher product demand, a more favorable

mix of cartridges and price. Collaboration and services revenue

increased $12.4 million, primarily due to the United Therapeutics

licensing and research agreements.

Afrezza cost of goods sold was $4.0 million for the first

quarters of both 2019 and 2018. Afrezza gross profit for the first

quarter of 2019 was $1.1 million, the second consecutive quarter

that gross profit was recognized for Afrezza. Afrezza gross profit

for the first quarter of 2018 was negative $0.6 million. The

increase was primarily driven by higher Afrezza sales.

Research and development expenses for the first quarter of 2019

were $1.7 million compared to $2.6 million for the first quarter of

2018. This 37% decrease was primarily attributable to $0.4 million

decreases in both lower clinical trial spending and lower personnel

costs.

Selling, general and administrative expenses for the first

quarter of 2019 were $25.7 million compared to $20.6 million for

the first quarter of 2018. This 25% increase was primarily due to

$9.3 million spent on direct-to-consumer television advertising

offset by a $1.2 million decrease in personnel costs, a $0.9

million decrease in stock-based compensation expense, and a $0.7

million decrease in professional fees.

Interest expense on notes (facility financing obligation and

senior convertible notes) for the first quarter of 2019 was $0.6

million compared to $1.8 million for the first quarter of 2018.

This $1.2 million decrease was primarily due to a reduction in debt

principal balances.

The net loss for the first quarter of 2019 was $14.9 million, or

$0.08 per share compared to a $30.4 million net loss in the first

quarter of 2018 or $0.25 per share. The lower net loss is mainly

attributable to a $14.0 million increase in total revenues.

Cash, cash equivalents, restricted cash, and short-term

investments at March 31, 2019 was $59.8 million compared to

$71.7 million at December 31, 2018. The decrease was primarily due

to net cash used in operating activities of $11.6 million in the

first quarter of 2019, which included the receipt of a $12.5

million milestone payment from United Therapeutics.

Conference Call

MannKind will host a conference call and presentation webcast to

discuss these results today at 9:00 a.m. Eastern Time. To

participate in the live call by telephone, please dial (800)

289-0438 or (323) 794-2423 and use the participant passcode:

6329706. Those interested in listening to the conference call live

via the Internet may do so by visiting the Company's website at

http://www.mannkindcorp.com under News & Events.

A telephone replay of the call will be accessible for

approximately 14 days following completion of the call by dialing

(844) 512-2921 or (412) 317-6671 and use the participant passcode:

6329706#. A replay will also be available on MannKind's website for

14 days.

About MannKind Corporation

MannKind Corporation (NASDAQ: MNKD) focuses on the development

and commercialization of inhaled therapeutic products for patients

with diseases such as diabetes and pulmonary arterial

hypertension. MannKind is currently commercializing Afrezza®

(insulin human) Inhalation Powder, the Company’s first FDA-approved

product and the only inhaled rapid-acting mealtime insulin in the

United States, where it is available by prescription from

pharmacies nationwide. MannKind is headquartered in Westlake

Village, California, and has a state-of-the art manufacturing

facility in Danbury, Connecticut. The Company also employs field

sales and medical representatives across the U.S. For further

information, visit www.mannkindcorp.com.

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks and uncertainties, including statements regarding

MannKind’s ability to directly commercialize pharmaceutical

products. Words such as “believes”, “anticipates”, “plans”,

“expects”, “intend”, “will”, “goal”, “potential” and similar

expressions are intended to identify forward-looking statements.

These forward-looking statements are based upon the MannKind’s

current expectations. Actual results and the timing of events could

differ materially from those anticipated in such forward-looking

statements as a result of these risks and uncertainties, which

include, without limitation, the ability to generate significant

product sales for MannKind, MannKind’s ability to manage its

existing cash resources or raise additional cash resources, stock

price volatility and other risks detailed in MannKind’s filings

with the Securities and Exchange Commission, including the Annual

Report on Form 10-K for the year ended December 31, 2018. You

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

All forward-looking statements are qualified in their entirety by

this cautionary statement, and MannKind undertakes no obligation to

revise or update any forward-looking statements to reflect events

or circumstances after the date of this press release.

| MANNKIND CORPORATION |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (Unaudited) |

| (In thousands, except per share amounts) |

| |

|

|

Three Months Ended March 31, |

|

|

|

2019 |

|

|

2018 |

|

| Revenues: |

|

|

|

|

|

|

|

| Net revenue

- commercial product sales |

$ |

5,076 |

|

|

$ |

3,402 |

|

| Revenue -

collaborations and services |

|

12,372 |

|

|

|

63 |

|

| Total

revenues |

|

17,448 |

|

|

|

3,465 |

|

| Expenses: |

|

|

|

|

|

|

|

| Cost of

goods sold |

|

4,020 |

|

|

|

4,008 |

|

| Cost of

revenue - collaborations and services |

|

1,537 |

|

|

|

— |

|

| Research and

development |

|

1,667 |

|

|

|

2,644 |

|

| Selling,

general and administrative |

|

25,673 |

|

|

|

20,618 |

|

| (Gain) Loss

on foreign currency translation |

|

(1,935 |

) |

|

|

2,984 |

|

| Total

expenses |

|

30,962 |

|

|

|

30,254 |

|

| Loss from operations |

|

(13,514 |

) |

|

|

(26,789 |

) |

| Other (expense)

income: |

|

|

|

|

|

|

|

| Interest

income |

|

318 |

|

|

|

106 |

|

| Interest

expense on notes |

|

(593 |

) |

|

|

(1,794 |

) |

| Interest

expense on note payable to related party |

|

(1,080 |

) |

|

|

(1,114 |

) |

| Loss on

extinguishment of debt |

|

— |

|

|

|

(825 |

) |

| Other income

(expense) |

|

(14 |

) |

|

|

31 |

|

| Total other

expense |

|

(1,369 |

) |

|

|

(3,596 |

) |

| Loss before provision for

income taxes |

|

(14,883 |

) |

|

|

(30,385 |

) |

| Provision for income

taxes |

|

— |

|

|

|

— |

|

| Net loss |

$ |

(14,883 |

) |

|

$ |

(30,385 |

) |

| Net loss per share - basic

and diluted |

$ |

(0.08 |

) |

|

$ |

(0.25 |

) |

| Shares used to compute

basic and diluted net loss per share |

|

187,434 |

|

|

|

120,911 |

|

| MANNKIND CORPORATION |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (Unaudited) |

| (In thousands except share data) |

| |

|

|

|

March 31, 2019 |

|

|

December 31, 2018 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

34,530 |

|

|

$ |

71,157 |

|

| Restricted

cash |

|

|

527 |

|

|

|

527 |

|

| Short-term

investments |

|

|

24,764 |

|

|

|

— |

|

| Accounts

receivable, net |

|

|

3,759 |

|

|

|

4,017 |

|

|

Inventory |

|

|

3,720 |

|

|

|

3,597 |

|

| Prepaid

expenses and other current assets |

|

|

2,392 |

|

|

|

2,556 |

|

| Total

current assets |

|

|

69,692 |

|

|

|

81,854 |

|

| Property and equipment,

net |

|

|

25,750 |

|

|

|

25,602 |

|

| Right-of-use and other

assets |

|

|

5,519 |

|

|

|

249 |

|

| Total

assets |

|

$ |

100,961 |

|

|

$ |

107,705 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

6,978 |

|

|

$ |

5,379 |

|

| Accrued

expenses and other current liabilities |

|

|

18,064 |

|

|

|

15,022 |

|

| Facility

financing obligation |

|

|

11,385 |

|

|

|

11,298 |

|

| Deferred

revenue - current |

|

|

32,384 |

|

|

|

36,885 |

|

| Recognized

loss on purchase commitments - current |

|

|

9,057 |

|

|

|

6,657 |

|

| Total

current liabilities |

|

|

77,868 |

|

|

|

75,241 |

|

| Senior convertible

notes |

|

|

19,065 |

|

|

|

19,099 |

|

| Note payable to related

party |

|

|

72,036 |

|

|

|

72,089 |

|

| Accrued interest - note

payable to related party |

|

|

7,969 |

|

|

|

6,835 |

|

| Recognized loss on

purchase commitments - long term |

|

|

85,344 |

|

|

|

91,642 |

|

| Deferred revenue - long

term |

|

|

15,867 |

|

|

|

10,680 |

|

| Milestone rights

liability |

|

|

7,201 |

|

|

|

7,201 |

|

| Operating lease

liabilities |

|

|

3,615 |

|

|

|

— |

|

| Total

liabilities |

|

|

288,965 |

|

|

|

282,787 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Stockholders'

deficit: |

|

|

|

|

|

|

|

|

| Common stock, $0.01 par

value - 280,000,000 shares authorized, 187,778,236 and

187,029,967 shares issued and outstanding at March 31, 2019

and December 31, 2018, respectively |

|

|

1,878 |

|

|

|

1,870 |

|

| Additional paid-in

capital |

|

|

2,765,020 |

|

|

|

2,763,067 |

|

| Accumulated other

comprehensive loss |

|

|

(19 |

) |

|

|

(19 |

) |

| Accumulated deficit |

|

|

(2,954,883 |

) |

|

|

(2,940,000 |

) |

| Total

stockholders' deficit |

|

|

(188,004 |

) |

|

|

(175,082 |

) |

| Total

liabilities and stockholders' deficit |

|

$ |

100,961 |

|

|

$ |

107,705 |

|

Company Contact: Rose Alinaya SVP, Investor Relations and

Treasury 818-661-5000 ir@mannkindcorp.com

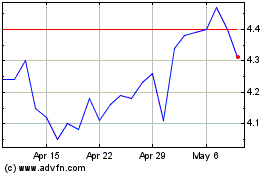

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Aug 2024 to Sep 2024

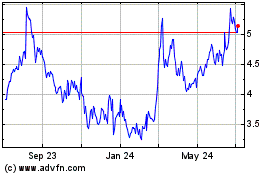

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Sep 2023 to Sep 2024