Manitex International, Inc. (Nasdaq: MNTX), a

leading international provider of truck and knuckle boom cranes,

today announced Second Quarter 2018 results. Net revenues for

the second quarter were $63.9 million, compared to $52.1 million in

the prior year’s period*, and net loss from continuing operations

attributable to shareholders of Manitex of $(1.0) million, or

$(0.05) per share, compared to a net loss from continuing

operations attributable to shareholders of Manitex of $(1.5)

million, or $(0.09) per share, in the second quarter of

2017*. Adjusted net income** from continuing operations in

the second quarter 2018 was $1.9 million, or $0.11 per share,

compared to adjusted net loss of $(1.0) million, or $(0.06) per

share, for the second quarter of 2017*.

Highlights (versus prior year,

unless otherwise noted):

- Net revenues of $63.9 million, up 22.8%

- Adjusted EBITDA** increased 188% to $5.2 million, or 8.1% of

sales, from $1.8 million or 3.5% of sales

- Adjusted earnings per share** improved to $0.11 compared to an

adjusted loss per share of $(0.06)

- Backlog declined moderately from $88 million in Q1 2018 to $76

million, up 59% from Q2 2017

- $32.7 million strategic investment by Tadano

- Net debt of $51 million represents reduction of $39 million

from year-end 2017

*All references in this release to financial

results of periods ending prior to the third quarter of 2017

reflect such results as restated pursuant to the recently completed

restatement of such periods.**Adjusted Numbers are discussed in

greater detail and reconciled under “Non-GAAP Financial Measures

and Other Items” at the end of this release.

“The results reported today continue to show steady improvement

in our operations, with growth in sales, margins, and adjusted

income. However, we believe, the most significant event which

occurred in the second quarter was the $32.7 million investment in

Manitex by Tadano Corporation,” commented David J. Langevin, Chief

Executive Officer of Manitex.

“The Tadano investment has enabled us to reduce our net debt to

approximately $51 million, which represents a $144 million

reduction from its peak level just over three years ago. We believe

we now have sufficient working capital position to execute our

global growth plans and take advantage of opportunities that our

new relationship with Tadano presents.”

Steve Kiefer, President and Chief Operating Officer of Manitex

stated, “In the quarter, we generated improved revenue and earnings

reflecting strengthening global demand for our products and

operational execution of our sales and manufacturing teams.

Revenue of $63.9 million increased 23% versus the same period last

year, and 13% versus the previous quarter. Our ongoing

efforts to diligently manage near-term currency, inflation and

supply chain challenges allowed us to maintain our gross margin

compared to last quarter and increase by 140 basis points versus

the same period last year. To offset supply chain inflation and

continue gross profit expansion, we are currently executing the

necessary cost reductions and operational improvements that we

believe will allow us to achieve our near-term target of gross

margin exceeding 20% and EBITDA margins of 10%.

"We saw our core product lines well-positioned to allow us to

take advantage of the overall strength within the industrial goods

market during the quarter. As of the end of the June quarter,

backlog for our European Group, primarily consisting of our PM

global knuckleboom business, was up 133 percent compared to the

same period last year. Going forward, we are confident that

revenues contributed by PM will continue growing as a percentage of

our total enterprise revenues, through ongoing dealer development

and new product enhancements, as well as our important partnership

with Tadano, particularly in Asia and the Middle East.

"On the straight mast side, as we previously reported, we

experienced a spike in order rate at the beginning of the year

which has since moderated, and the total industry volume was

approximately 800 units for the first half of the year, a healthy

level, still below peak with potential to continue to go

higher. 65% of our backlog is comprised of cranes with

ratings of 30 tons and higher being driven by activity within the

energy, utility, infrastructure and general rental segments.

"Going forward, we remain focused on operational execution,

revenue expansion, and new product development, and we are working

hard to increase value for our customers, shareholders, employees

and other stakeholders,” concluded Mr. Kiefer.

Other Matters:As previously

disclosed, the Company has received an inquiry from the SEC

requesting certain information in connection with the Company’s

recently completed restatement of prior financial statements and is

continuing to comply with such request.

Conference

Call:

Management will host a conference call at 4:30 PM Eastern Time

today to discuss the results with the investment community. Anyone

interested in participating in the call should dial 800-949-2175 if

calling within the United States or 323-994-2132 if calling

internationally. A replay will be available until August 14, 2018,

which can be accessed by dialing 844-512-2921 if calling within the

United States, or 412-317-6671 if calling internationally. Please

use passcode 1055909 to access the replay. The call will

additionally be broadcast live and archived for 90 days over the

internet with accompanying slides, accessible at the investor

relations portion of the Company's corporate website,

www.manitexinternational.com/eventspresentations.aspx.

Non-GAAP Financial Measures

and Other Items

Results of operations reflect continuing

operations. All per share amounts are on a fully diluted basis. In

this press release, Manitex refers to various non-GAAP (U.S.

generally accepted accounting principles) financial measures which

management uses to evaluate operating performance, to establish

internal budgets and targets, and to compare the Company’s

financial performance against such budgets and targets. These

non-GAAP measures, as defined by the Company, may not be comparable

to similarly titled measures being disclosed by other companies.

While adjusted financial measures are not intended to replace any

presentation included in our consolidated financial statements

under generally accepted accounting principles (GAAP) and should

not be considered an alternative to operating performance or an

alternative to cash flow as a measure of liquidity, we believe

these measures are useful to investors in assessing our operating

results, capital expenditure and working capital requirements and

the ongoing performance of its underlying businesses. The

amounts described below are unaudited, are reported in thousands of

U.S. dollars, and are as of, for three month period ended June 30,

2018 and June 30, 2017, unless otherwise indicated. A

reconciliation of Adjusted GAAP financial measures for the three

month periods ended June 30, 2018 and 2017 is included with this

press release below and with the Company's related Form 8-K.

About Manitex International,

Inc.

Manitex International, Inc. is a leading

worldwide provider of highly engineered specialized equipment

including boom truck, truck and knuckle boom cranes. Our products,

which are manufactured in facilities located in the USA and Italy,

are targeted to selected niche markets where their unique designs

and engineering excellence fill the needs of our customers and

provide a competitive advantage. We have consistently added

to our portfolio of branded products and equipment both through

internal development and focused acquisitions to diversify and

expand our sales and profit base while remaining committed to our

niche market strategy. Our brands include Manitex, PM,

O&S, Badger, Sabre, and Valla.

Forward-Looking Statements

Safe Harbor Statement under the U.S. Private

Securities Litigation Reform Act of 1995: This release contains

statements that are forward-looking in nature which express the

beliefs and expectations of management including statements

regarding the Company’s expected results of operations or

liquidity; statements concerning projections, predictions,

expectations, estimates or forecasts as to our business, financial

and operational results and future economic performance; and

statements of management’s goals and objectives and other similar

expressions concerning matters that are not historical facts.

In some cases, you can identify forward-looking statements by

terminology such as “anticipate,” “estimate,” “plan,” “project,”

“continuing,” “ongoing,” “expect,” “we believe,” “we intend,”

“may,” “will,” “should,” “could,” and similar expressions. Such

statements are based on current plans, estimates and expectations

and involve a number of known and unknown risks, uncertainties and

other factors that could cause the Company's future results,

performance or achievements to differ significantly from the

results, performance or achievements expressed or implied by such

forward-looking statements. These factors and additional

information are discussed in the Company's filings with the

Securities and Exchange Commission and statements in this release

should be evaluated in light of these important factors. Although

we believe that these statements are based upon reasonable

assumptions, we cannot guarantee future results. Forward-looking

statements speak only as of the date on which they are made, and

the Company undertakes no obligation to update publicly or revise

any forward-looking statement, whether as a result of new

information, future developments or otherwise.

| |

|

| Company

Contact |

|

| Manitex International,

Inc. |

Darrow Associates

Inc. |

| Steve Kiefer |

Peter Seltzberg,

Managing Director |

| President and Chief

Operating Officer |

Investor

Relations |

| (708) 237-2065 |

(516) 419-9915 |

|

skiefer@manitex.com |

pseltzberg@darrowir.com |

| |

|

MANITEX INTERNATIONAL, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(In thousands, except share and per share

data)

| |

|

|

|

|

| |

|

June 30, 2018 |

|

December 31, 2017 |

| |

|

Unaudited |

|

Unaudited |

|

ASSETS |

|

|

|

|

| Current

assets |

|

|

|

|

| Cash |

|

$ |

20,630 |

|

|

$ |

5,014 |

|

| Cash -

restricted |

|

|

308 |

|

|

|

352 |

|

|

Marketable equity securities |

|

|

6,253 |

|

|

|

— |

|

| Trade

receivables (net) |

|

|

47,607 |

|

|

|

46,633 |

|

| Other

receivables |

|

|

2,898 |

|

|

|

1,946 |

|

| Inventory

(net) |

|

|

69,154 |

|

|

|

54,360 |

|

| Prepaid

expense and other |

|

|

2,369 |

|

|

|

2,017 |

|

|

Total current assets |

|

|

149,219 |

|

|

|

110,322 |

|

| Total

fixed assets, net of accumulated depreciation of $13,870 and

$12,921 for June 30, 2018 and December 31, 2017, respectively |

|

|

20,850 |

|

|

|

22,038 |

|

|

Intangible assets (net) |

|

|

29,042 |

|

|

|

31,014 |

|

|

Goodwill |

|

|

42,654 |

|

|

|

43,569 |

|

| Equity

investment in ASV Holdings, Inc. |

|

|

— |

|

|

|

14,931 |

|

| Other

long-term assets |

|

|

1,270 |

|

|

|

1,475 |

|

| Deferred

tax asset |

|

|

1,839 |

|

|

|

1,839 |

|

|

Total assets |

|

$ |

244,874 |

|

|

$ |

225,188 |

|

|

LIABILITIES AND EQUITY |

|

|

|

|

| Current

liabilities |

|

|

|

|

| Notes

payable |

|

$ |

24,263 |

|

|

$ |

29,131 |

|

| Current

portion of capital lease obligations |

|

|

398 |

|

|

|

378 |

|

| Accounts

payable |

|

|

46,183 |

|

|

|

35,386 |

|

| Accounts

payable related parties |

|

|

475 |

|

|

|

1,331 |

|

| Accrued

expenses |

|

|

9,570 |

|

|

|

10,070 |

|

| Customer

deposits |

|

|

2,556 |

|

|

|

2,242 |

|

| Other

current liabilities |

|

|

142 |

|

|

|

890 |

|

|

Total current liabilities |

|

|

83,587 |

|

|

|

79,428 |

|

| Long-term

liabilities |

|

|

|

|

| Revolving

term credit facilities |

|

|

— |

|

|

|

12,893 |

|

| Notes

payable (net) |

|

|

26,827 |

|

|

|

26,656 |

|

| Capital

lease obligations, (net of current portion) |

|

|

5,279 |

|

|

|

5,483 |

|

|

Convertible note related party (net) |

|

|

7,080 |

|

|

|

7,005 |

|

|

Convertible note (net) |

|

|

14,419 |

|

|

|

14,310 |

|

| Deferred

gain on sale of property |

|

|

906 |

|

|

|

969 |

|

| Deferred

tax liability |

|

|

3,558 |

|

|

|

3,384 |

|

| Other

long-term liabilities |

|

|

3,883 |

|

|

|

4,215 |

|

|

Total long-term liabilities |

|

|

61,952 |

|

|

|

74,915 |

|

|

Total liabilities |

|

|

145,539 |

|

|

|

154,343 |

|

| Commitments and

contingencies |

|

|

|

|

|

Equity |

|

|

|

|

| Preferred

Stock—Authorized 150,000 shares, no shares issued or outstanding

at June 30, 2018 and December 31, 2017 |

|

|

— |

|

|

|

— |

|

| Common

Stock—no par value 25,000,000 shares authorized, 19,606,518 and

16,617,932 shares issued and outstanding |

|

|

|

|

|

|

|

|

| at

June 30, 2018 and December 31, 2017, respectively |

|

|

130,083 |

|

|

|

97,661 |

|

| Paid in

capital |

|

|

2,708 |

|

|

|

2,802 |

|

| Retained

deficit |

|

|

(31,035 |

) |

|

|

(28,583 |

) |

|

Accumulated other comprehensive loss |

|

|

(2,421 |

) |

|

|

(1,035 |

) |

|

Total equity |

|

|

99,335 |

|

|

|

70,845 |

|

|

Total liabilities and equity |

|

$ |

244,874 |

|

|

$ |

225,188 |

|

| |

|

|

|

|

MANITEX INTERNATIONAL, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands, except for

share and per share amounts)

| |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| |

|

Unaudited |

|

Unaudited |

|

Unaudited |

|

Unaudited |

| Net revenues |

|

$ |

63,904 |

|

|

$ |

52,051 |

|

|

$ |

120,579 |

|

|

$ |

92,170 |

|

| Cost of sales |

|

|

51,463 |

|

|

|

42,647 |

|

|

|

97,038 |

|

|

|

75,374 |

|

|

Gross profit |

|

|

12,441 |

|

|

|

9,404 |

|

|

|

23,541 |

|

|

|

16,796 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

| Research

and development costs |

|

|

726 |

|

|

|

596 |

|

|

|

1,378 |

|

|

|

1,283 |

|

| Selling,

general and administrative expenses |

|

|

9,008 |

|

|

|

8,574 |

|

|

|

18,994 |

|

|

|

17,515 |

|

|

Total operating expenses |

|

|

9,734 |

|

|

|

9,170 |

|

|

|

20,372 |

|

|

|

18,798 |

|

|

Operating income (loss) |

|

|

2,707 |

|

|

|

234 |

|

|

|

3,169 |

|

|

|

(2,002 |

) |

| Other (expense)

income |

|

|

|

|

|

|

|

|

| Interest

expense: |

|

|

|

|

|

|

|

|

| Interest

expense |

|

|

(1,503 |

) |

|

|

(1,574 |

) |

|

|

(3,056 |

) |

|

|

(2,782 |

) |

| Change in

fair value of securities held |

|

|

(1,588 |

) |

|

|

— |

|

|

|

(1,401 |

) |

|

|

— |

|

| Foreign

currency transaction loss |

|

|

(106 |

) |

|

|

(256 |

) |

|

|

(225 |

) |

|

|

(339 |

) |

| Interest

income and other (loss) income |

|

|

29 |

|

|

|

70 |

|

|

|

(325 |

) |

|

|

343 |

|

|

Total other expense |

|

|

(3,168 |

) |

|

|

(1,760 |

) |

|

|

(5,007 |

) |

|

|

(2,778 |

) |

|

Income (loss) before income taxes and income (loss)

in equity interest from continuing operations |

|

|

(461 |

) |

|

|

(1,526 |

) |

|

|

(1,838 |

) |

|

|

(4,780 |

) |

|

Income tax expense (benefit) from continuing operations |

|

|

506 |

|

|

|

(36 |

) |

|

|

205 |

|

|

|

135 |

|

| Loss on equity

investments (including loss on sale of shares) |

|

|

— |

|

|

|

— |

|

|

|

(409 |

) |

|

|

— |

|

|

Net loss from continuing operations |

|

|

(967 |

) |

|

|

(1,490 |

) |

|

|

(2,452 |

) |

|

|

(4,915 |

) |

| Discontinued

operations |

|

|

|

|

|

|

|

|

| Loss from

operations of discontinued operations (including loss on

disposal for the three and six months 2017 of

$1,133) |

|

|

— |

|

|

|

(805 |

) |

|

|

— |

|

|

|

(573 |

) |

| Income

tax benefit |

|

|

— |

|

|

|

6 |

|

|

|

— |

|

|

|

(13 |

) |

| Loss from

discontinued operations |

|

|

— |

|

|

|

(811 |

) |

|

|

— |

|

|

|

(560 |

) |

|

Net loss |

|

|

(967 |

) |

|

|

(2,301 |

) |

|

|

(2,452 |

) |

|

|

(5,475 |

) |

| Net income attributable

to noncontrolling interest from discontinued operations |

|

|

— |

|

|

|

(160 |

) |

|

|

— |

|

|

|

(274 |

) |

|

Net loss attributable to shareholders of Manitex

International, Inc. |

|

$ |

(967 |

) |

|

$ |

(2,461 |

) |

|

$ |

(2,452 |

) |

|

$ |

(5,749 |

) |

| Earnings (loss)

Per Share |

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

| Earnings

(loss) from continuing operations attributable to shareholders of

Manitex International, Inc. |

|

$ |

(0.05 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.30 |

) |

| Loss from

discontinued operations attributable to shareholders of Manitex

International, Inc. |

|

$ |

— |

|

|

$ |

(0.06 |

) |

|

$ |

— |

|

|

$ |

(0.05 |

) |

| Net

earnings (loss) attributable to shareholders of Manitex

International, Inc. |

|

$ |

(0.05 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.35 |

) |

|

Diluted |

|

|

|

|

|

|

|

|

| Earnings

(loss) from continuing operations attributable to

shareholders of Manitex International, Inc. |

|

$ |

(0.05 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.30 |

) |

| Loss from

discontinued operations attributable to shareholders of Manitex

International, Inc. |

|

$ |

— |

|

|

$ |

(0.06 |

) |

|

$ |

— |

|

|

$ |

(0.05 |

) |

| Net

earnings (loss) attributable to shareholders of Manitex

International, Inc. |

|

$ |

(0.05 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.35 |

) |

| Weighted

average common shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

|

17,734,383 |

|

|

|

16,553,667 |

|

|

|

17,200,660 |

|

|

|

16,512,061 |

|

|

Diluted |

|

|

17,734,383 |

|

|

|

16,553,667 |

|

|

|

17,200,660 |

|

|

|

16,512,061 |

|

| |

|

|

|

|

|

|

|

|

Reconciliation of GAAP Operating Income

(Loss) from Continuing Operations to Adjusted EBITDA (in

thousands)

|

|

Three Months Ended |

Six Months Ended |

|

|

June 30, 2018 |

June 30, 2017 |

June 30, 2018 |

June 30, 2017 |

|

Operating income (loss) |

$2,707 |

$234 |

$3,169 |

($2,002) |

|

Adjustments related to restatement, restructuring, discontinued

model, restricted stock, and other expenses |

1,196 |

397 |

3,138 |

1,416 |

|

Adjusted operating income (loss) |

3,903 |

631 |

6,307 |

(586) |

|

Depreciation and amortization |

1,258 |

1,165 |

2,551 |

2,688 |

|

Adjusted EBITDA |

$5,161 |

$1,796 |

$8,858 |

$2,102 |

|

Adjusted EBITDA % to sales |

8.1% |

3.5% |

7.3% |

2.3% |

| |

|

|

|

|

Reconciliation of GAAP Net Income (Loss)

From Continuing Operations Attributable to Shareholders of Manitex

International to Adjusted Net Income (Loss) From continuing

Operations Attributable to Shareholders of Manitex International

(in thousands)

|

|

Three Months Ended |

Six Months Ended |

|

|

June 30, 2018 |

June 30, 2017 |

June 30, 2018 |

June 30, 2017 |

|

Net Income (Loss) from continuing operations attributable to

shareholders |

($967) |

($1,490) |

($2,452) |

($4,915) |

|

Adjustments related to restatement, restructuring, discontinued

model, restricted stock, foreign exchange, change in fair value of

securities and other expenses |

2,859 |

533 |

5,132 |

1,635 |

|

Adjusted Net Income (Loss) from continuing operations attributable

to shareholders |

1,892 |

(957) |

2,680 |

(3,280) |

|

Weighted diluted shares outstanding |

17,734,383 |

16,553,667 |

17,200,660 |

16,512,061 |

|

Diluted (loss) per share attributable to shareholders as

reported |

($0.05) |

($0.09) |

($0.14) |

($0.30) |

|

Total EPS effect |

$0.16 |

$0.03 |

$0.30 |

$0.10 |

|

Adjusted diluted income (loss) per share attributable to

shareholders |

$0.11 |

($0.06) |

$0.16 |

($0.20) |

| |

|

|

|

|

Foreign Exchange, Restatement, Restructuring, Restricted

Stock and other Expenses

|

|

Three Months Ended |

Six Months Ended |

|

Pre-tax adjustments |

June 30, 2018 |

June 30, 2017 |

June 30, 2018 |

June 30, 2017 |

|

Restatement expenses |

$626 |

- |

$1,823 |

- |

|

Foreign exchange |

106 |

256 |

225 |

339 |

|

Discontinued model |

188 |

|

188 |

|

|

Restructuring |

74 |

301 |

654 |

574 |

|

Restricted stock |

268 |

96 |

391 |

325 |

|

Change in fair market value of securities, and other expenses |

1,628 |

|

2,245 |

517 |

|

Total |

$2,890 |

$653 |

$5,526 |

$1,755 |

| |

|

|

|

|

Backlog from Continuing

Operations

Backlog is defined as purchase orders that have

been received by the Company. The disclosure of backlog aids in the

analysis the Company’s customers’ demand for product, as well as

the ability of the Company to meet that demand. Backlog is not

necessarily indicative of sales to be recognized in a specified

future period.

| |

|

|

|

|

|

|

|

June 30, 2018 |

March 31, 2018 |

December 31, 2017 |

September 30, 2017 |

June 30, 2017 |

|

Backlog |

$75,601 |

$87,860 |

$61,530 |

$50,281 |

$47,554 |

|

Change Versus Current Period |

|

(14.0%) |

22.9% |

50.4% |

59.0% |

| |

|

|

|

|

|

Net Debt is calculated using

the Condensed Consolidated Balance Sheet amounts for current and

long term portion of long term debt, capital lease obligations,

notes payable, convertible notes and revolving credit facilities

minus cash.

|

|

June 30, 2018 |

December 31, 2017 |

|

Cash |

$27,191 |

$5,366 |

|

|

|

|

|

Notes payable - short term |

$24,263 |

$29,131 |

|

Current portion of capital leases |

398 |

378 |

|

Revolving term credit facilities |

0 |

12,893 |

|

Notes payable - long term |

26,827 |

26,656 |

|

Capital lease obligations |

5,279 |

5,483 |

|

Convertible notes |

21,499 |

21,315 |

|

Total debt |

$78,266 |

$95,856 |

|

Net Debt |

51,075 |

90,490 |

| |

|

|

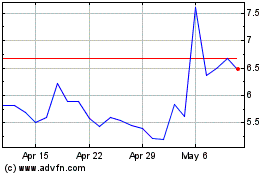

Manitex (NASDAQ:MNTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Manitex (NASDAQ:MNTX)

Historical Stock Chart

From Apr 2023 to Apr 2024