Maiden Holdings, Ltd. (NASDAQ: MHLD) (“Maiden” or “the Company”)

today reported a fourth quarter 2018 net loss attributable to

Maiden common shareholders of $269.2 million or $3.25 per diluted

common share, compared to a net loss attributable to Maiden common

shareholders of $133.6 million or $1.59 per diluted common share in

the fourth quarter of 2017. The non-GAAP operating loss (11) was

$212.4 million, or $2.56 per diluted common share, compared with a

non-GAAP operating loss of $126.4 million, or $1.51 per diluted

common share in the fourth quarter of 2017. Book value per common

share (1) was $1.08 at December 31, 2018.

Commenting on the Company’s results, Maiden’s President and

Chief Executive Officer, Lawrence F. Metz said, “We recognize that

2018 was an extremely difficult year for all of our shareholders

and dedicated employees. With our recently announced revised

LPT/ADC transaction with Enstar, we believe we are nearing the end

of our strategic review process. Since our third quarter report we

have continued to take decisive action, completing the sale of our

US reinsurance business to Enstar, mutually agreeing with AmTrust

to first amend and then terminate our quota share reinsurance

contracts effective January 1, 2019, completing the sale of certain

of our European subsidiaries, and entering into a new LPT/ADC

agreement with Enstar. We look forward to now taking the necessary

steps to enhance our business and create lasting shareholder

value.”

Patrick J. Haveron, Maiden’s Chief Financial Officer and Chief

Operating Officer added, “Since September 1, 2018 the series of

strategic measures we have implemented have materially de-risked

our balance sheet, improved liquidity, significantly strengthened

our capital position relative to regulatory requirements, and cured

our breach of the Bermuda Enhanced Capital Requirement. Looking

ahead, we have also reduced our annual total operating expenses by

more than $50 million and look to improve on that to reflect the

significant changes in our business during 2018 and 2019. The new

LPT/ADC with Enstar will further solidify the progress we have made

by protecting our reserves while retaining more assets for

investment. Maiden enters 2019 with a stronger balance sheet and we

expect to further improve our solvency ratios as we look to rebuild

shareholder value and begin re-positioning our business for the

future.”

New LPT/ADC with Enstar

On March 1, 2019, the Company and Enstar Group Limited

(“Enstar”) terminated the Master Agreement between the parties

dated as of November 9, 2018 (the “Old MTA”) and simultaneously

signed a new agreement (the "New MTA") pursuant to which an Enstar

subsidiary will assume liabilities for loss reserves as of December

31, 2018 associated with the quota share reinsurance agreements

between the Company’s wholly-owned subsidiary Maiden Reinsurance

Ltd. ("Maiden Bermuda") and AmTrust Financial Services, Inc. or its

subsidiaries ("AmTrust") in excess of a $2.44 billion retention up

to $675 million. The $2.44 billion retention will be subject to

adjustment for paid losses since December 31, 2018. The New MTA and

associated pending reinsurance agreement will provide Maiden

Bermuda with $175 million in adverse development cover over its

carried AmTrust reserves at December 31, 2018. The transaction is

subject to regulatory approvals and other closing conditions.

The Company’s entry into a New MTA with Enstar, which is smaller

than the Old MTA, reflects the cumulative positive impact of

measures already implemented since the third quarter of 2018 that

have significantly improved the Company’s capital position. The New

MTA also provides Maiden with more investable assets and reserve

protection than the Old MTA, which will further support its

improving solvency ratios. Additional information regarding the New

MTA with Enstar can be found in the Company’s Annual Report on Form

10-K filing.

Discontinued Operations

As part of its strategic review announced in early 2018, during

the fourth quarter of 2018, the Company divested its U.S.

reinsurance treaty operations. Except as explicitly described as

held for sale or as discontinued operations, and unless otherwise

noted, all discussions and amounts presented herein relate to the

Company’s continuing operations except for net loss, net loss

attributable to Maiden and net loss attributable to Maiden common

shareholders.

Sale of Maiden Reinsurance North

America, Inc. (“Maiden US”) to Enstar

On December 27, 2018, Maiden announced that its subsidiary,

Maiden Holdings North America, Ltd., had completed the sale of

Maiden US to Enstar for initial net consideration of $272.4

million, including estimated closing adjustments. At closing,

approximately $1.3 billion of legacy reinsurance liabilities for

Maiden’s US Diversified Business were acquired by Enstar. In its

consolidated results for the fourth quarter and year-ended December

31, 2018, Maiden has booked estimated post-closing adjustments

which reduce this aggregate purchase price by $8.2 million. During

the fourth quarter ended December 31, 2018, the Company reported a

loss from discontinued operations of $52.5 million, due primarily

to the realized loss recognized on disposal of Maiden US. This loss

also included recognition of unrealized losses on investments in

Maiden US of $26.6 million. For the year ended December 31, 2018,

the Company’s loss from discontinued operations totaled $94.1

million. In addition to the fourth quarter impacts of the sale, the

loss was also due to the write-off of goodwill and related

intangible assets of $74.2 million that had previously been

reported in the third quarter, offset by results of discontinued

operations of $25.1 million through the third quarter and gain from

the sale of Maiden US’ renewal rights of $7.5 million. Additional

information regarding the Company’s discontinued operations can be

found in the Company’s Annual Report on Form 10-K filing made

concurrent with this news release.

Consolidated Results for the Quarter

Ended December 31, 2018

In the fourth quarter of 2018, gross premiums written were

$388.5 million, compared to $427.3 million in the fourth quarter of

2017 primarily due to decreases in the premiums from the AmTrust

Reinsurance segment. Net premiums written totaled $388.1 million in

the fourth quarter of 2018, compared to $434.0 million in the

fourth quarter of 2017. Net premiums earned were $484.9 million in

the fourth quarter of 2018, compared to $480.2 million in the

fourth quarter of 2017.

In the fourth quarter of 2018, net loss and loss adjustment

expenses increased to $556.6 million from $464.8 million in the

fourth quarter of 2017, due primarily to higher adverse prior

year-loss development for the AmTrust Reinsurance segment. The loss

ratio (6) in the fourth quarter of 2018 was 114.3% compared to

96.4% reported in the fourth quarter of 2017. The increase in the

loss ratio was due to adverse development of prior year losses of

$152.8 million in 2018 compared to $136.0 million for the same

period in 2017. This development was primarily in our AmTrust

Reinsurance segment for each respective period, which also recorded

higher initial loss ratios on current year premiums earned during

2018 factoring, in both market conditions and recent loss trends

and experience.

Commission and other acquisition expenses were $157.7 million in

the fourth quarter of 2018, compared to $156.0 million in the

fourth quarter of 2017, resulting in commission and other

acquisition expense ratios of 32.4% for both periods. General and

administrative expenses for the fourth quarter of 2018 totaled

$15.2 million, compared to $14.0 million in the same period one

year ago. The general and administrative expense ratio(8) in the

fourth quarter of 2018 increased modestly to 3.1% from 2.9% in the

fourth quarter of 2017, while the expense ratio(9) was 35.5% in the

fourth quarter of 2018 compared with 35.3% for the same period last

year.

The combined ratio(10) for the fourth quarter of 2018 totaled

149.8%, compared with 131.7% in the fourth quarter of 2017.

Net investment income increased modestly to $34.7 million in the

fourth quarter of 2018 from $33.0 million in the same period last

year and was largely due to the growth in average investable assets

of 8.1% from the same period in 2017.

As of December 31, 2018, the average yield on the fixed income

portfolio excluding discontinued operations was 3.20% while the

average duration of investable assets was 4.6 years.

Additional information regarding the Company’s results of

operations can be found in the Company’s Annual Report on Form 10-K

filing made concurrent with this news release.

Consolidated Results for the Twelve

Months Ended December 31, 2018

The net loss attributable to Maiden common shareholders was

$570.3 million or $6.87 per diluted common share in 2018, compared

to a net loss attributable to Maiden common shareholders of $199.1

million or $2.32 per diluted common share in 2017. The non-GAAP

operating loss(11) for 2018 was $471.6 million, or $5.68 per

diluted common share, compared with a non-GAAP operating loss of

$169.6 million, or $1.98 per diluted common share, in 2017.

Gross premiums written were $2.02 billion in 2018 compared to

$2.08 billion in 2017 as declines in the AmTrust Reinsurance

segment were offset by modest increases in the Diversified

Reinsurance segment from the Company’s international business. Net

premiums written totaled $2.01 billion in 2018 compared to $2.04

billion in 2017. Net premiums earned were $2.03 billion in 2018

compared to $1.99 billion in 2017.

Net loss and loss adjustment expenses of $1.88 billion compared

to $1.56 billion in 2017. The loss ratio(6) for 2018 was 92.3%,

compared to 77.7% reported for 2017. The increase in the loss ratio

was due to adverse development of prior year losses of $403.2

million in 2018 compared to $247.2 million for the same period in

2017. This development was primarily in our AmTrust Reinsurance

segment for each respective period, which also recorded higher

initial loss ratios on current year premiums earned during 2018,

factoring in both market conditions and recent loss trends and

experience.

Commission and other acquisition expenses were $654.7 million in

2018, compared to $643.8 million in 2017, resulting in a commission

and other acquisition expense ratio of 32.2%, which was unchanged

from the prior year. Total general and administrative expenses for

2018 totaled $64.9 million, compared with $53.0 million in 2017.

The general and administrative expense ratio(8) in 2018 was 3.2%,

compared to 2.6% in 2017, while the expense ratio(9) was 35.4% in

2018, compared with 34.8% in 2017.

The combined ratio(10) for 2018 totaled 127.7%, compared with

112.5% in 2017.

Net investment income was $136.3 million in 2018, compared to

$124.1 million in 2017 and was largely due to the growth in average

investable assets of 8.1% from the same period in 2017.

Additional information regarding the Company’s results of

operations can be found in the Company’s Annual Report on Form 10-K

filing made concurrent with this news release.

Quarterly Dividends

On February 26, 2019, the Company's Board of Directors did not

authorize any quarterly dividends related to either its common

shares or any series of its preferred shares. Additional

information regarding the Company’s dividends can be found in the

Company’s Annual Report on Form 10-K filing made concurrent with

this news release.

Other Financial Matters

- Total assets were $5.3 billion at

December 31, 2018, compared to $6.5 billion at September 30, 2018.

Shareholders' equity was $554.3 million at December 31, 2018,

compared to $772.6 million at September 30, 2018.

(1)(11) Please see the Non-GAAP Financial Measures table for

additional information on these non-GAAP financial measures and

reconciliation of these measures to GAAP measures.

(6)(7)(8)(9)(10) Loss ratio, commission and other acquisition

expense ratio, general and administrative expense ratio, expense

ratio and combined ratio are non-GAAP operating metrics. Please see

the additional information on these measures under Non-GAAP

Financial Measures tables.

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed

in 2007. The Company is focused on serving the needs of regional

and specialty insurers in Europe and select other global markets by

providing innovative reinsurance solutions designed to support

their capital needs.

Forward Looking Statements

This release contains "forward-looking statements" which are

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements are based on the Company's current expectations and

beliefs concerning future developments and their potential effects

on the Company. There can be no assurance that actual developments

will be those anticipated by the Company. Actual results may differ

materially from those projected as a result of significant risks

and uncertainties, including non-receipt of the expected payments,

changes in interest rates, effect of the performance of financial

markets on investment income and fair values of investments,

developments of claims and the effect on loss reserves, accuracy in

projecting loss reserves, the impact of competition and pricing

environments, changes in the demand for the Company's products, the

effect of general economic conditions and unusual frequency of

storm activity, adverse state and federal legislation, regulations

and regulatory investigations into industry practices, developments

relating to existing agreements, heightened competition, changes in

pricing environments, and changes in asset valuations. In addition,

the Company may not be able to complete the proposed transaction

with Enstar on the terms summarized above or other acceptable

terms, or at all, due to a number of factors, including but not

limited to failure to obtain governmental and regulatory approvals

or to satisfy other closing conditions. Additional information

about these risks and uncertainties, as well as others that may

cause actual results to differ materially from those projected is

contained in Item 1A. Risk Factors in the Company's Annual Report

on Form 10-K for the year ended December 31, 2018 as updated

in periodic filings with the SEC. However these factors should not

be construed as exhaustive. Forward-looking statements speak only

as of the date they are made and the Company undertakes no

obligation to update or revise any forward-looking statement that

may be made from time to time, whether as a result of new

information, future developments or otherwise, except as required

by law.

Maiden Holdings, Ltd. Consolidated Balance

Sheets (in thousands (000's), except per share data)

December 31, 2018 December 31, 2017

(Unaudited) (Audited) Assets

Fixed maturities, available-for-sale, at

fair value (Amortized cost 2018: $3,109,980 ; 2017:$2,699,297)

$ 3,051,568 $ 2,707,516

Fixed maturities, held-to-maturity, at

amortized cost (Fair value 2018: $998,012; 2017:$1,125,626)

1,015,681 1,097,801 Other investments

23,716 6,600 Total

investments 4,090,965 3,811,917 Cash and cash

equivalents

200,841 54,470 Restricted cash and cash

equivalents

130,148 94,905 Accrued investment income

27,824 28,798 Reinsurance balances receivable, net

67,308 72,494 Reinsurance recoverable on unpaid

losses Loan to related party

167,975 167,975 Deferred

commission and other acquisition expenses, net

388,442

380,204 Goodwill and intangible assets, net

-

- Other assets

39,482 131,608 Assets held for

sale

174,475 1,901,818

Total Assets $ 5,287,460 $

6,644,189 Liabilities and Equity

Liabilities Reserve for loss and loss adjustment expenses

$ 3,055,976 $ 2,386,722 Unearned

premiums

1,200,419 1,230,882 Accrued expenses and

other liabilities

65,494 90,069 Senior notes -

principal amount

262,500 262,500 Less: unamortized

debt issuance costs

7,806 8,018

Senior notes, net

254,694

254,482 Liabilities held for sale

155,961 1,449,408 Total

Liabilities 4,732,544

5,411,563 Commitments and Contingencies

Equity Preference Shares

465,000 465,000

Common shares

879 877 Additional paid-in capital

749,418 748,113 Accumulated other comprehensive

(loss) income

(65,616 ) 13,354 (Accumulated

deficit) retained earnings

(563,891 ) 35,472

Treasury shares, at cost

(31,515 )

(30,642 ) Total Maiden Shareholders’ Equity

554,275 1,232,174 Noncontrolling interest in

subsidiaries 641 452

Total Equity 554,916

1,232,626 Total Liabilities and Equity

$ 5,287,460 $ 6,644,189

Book value per common share(1) $

1.08 $ 9.25 Common shares

outstanding 82,948,577 82,974,895

Maiden Holdings, Ltd. Consolidated Statements of

Income (in thousands (000's), except per share data)

(Unaudited) For the Three

Months Ended December 31, For the Year Ended December

31, 2018 2017 2018 2017

Revenues: Gross premiums written

$ 388,451

$ 427,329 $ 2,017,798

$ 2,078,091 Net premiums written

$ 388,112 $ 433,963 $

2,014,597 $ 2,037,377 Change in unearned

premiums 96,812 46,259 11,605

(44,718 )

Net premiums earned 484,924 480,222

2,026,202 1,992,659 Other insurance revenue 2,052 1,986 9,681 9,802

Net investment income 34,737 32,960 136,285 124,135 Net realized

(losses) gains on investment (1,247 ) 3,906 (1,529 ) 12,222 Total

other-than-temporary impairment losses (5,353 ) - (5,832 ) -

Portion of loss recognized in other comprehensive income (loss)

- - - - Net

impairment losses recognized in earnings (5,353 ) -

(5,832 ) -

Total revenues

515,113 519,074 2,164,807

2,138,818

Expenses: Net loss and loss adjustment

expenses 556,618 464,825 1,880,121 1,555,433 Commission and other

acquisition expenses 157,714 156,026 654,740 643,797 General and

administrative expenses 15,201 14,034

64,940 53,004

Total expenses

729,533 634,885 2,599,801

2,252,234

Non-GAAP loss from

operations(2) (214,420 )

(115,811 ) (434,994 )

(113,416 ) Other expenses: Interest and

amortization expenses (4,831 ) (4,830 ) (19,318 ) (23,260 )

Accelerated amortization of senior note issuance cost - - - (2,809

) Foreign exchange and other gains (losses) 2,599

(2,728 ) 4,461 (14,921 )

Total other

expenses (2,232 ) (7,558 ) (14,857 )

(40,990 )

Loss before income taxes

(216,652 ) (123,369 ) (449,851

) (154,406 ) Less: income tax expense

(benefit) 40 (6,903 ) 441

(6,757 )

Net loss from continuing operations (216,692

) (116,466 ) (450,292 )

(147,649 ) Loss from discontinued operations, net

of income tax (52,504 )

(8,391 ) (94,113 )

(22,096 ) Net loss (269,196 )

(124,857 ) (544,405 ) (169,745

)

Add: net income from continuing operations

attributable to noncontrollinginterests

(39 ) (185 ) (219 ) (151 )

Net loss

attributable to Maiden (269,235 ) (125,042

) (544,624 ) (169,896 )

Dividends on preference shares(3) - (8,545 )

(25,636 ) (29,156 )

Net loss attributable to

Maiden common shareholders $ (269,235 )

$ (133,587 ) $ (570,260 )

$ (199,052 )

Basic and diluted loss from continuing

operations per share attributable to Maiden common

shareholders(15)

$ (2.61 ) $ (1.49 )

$ (5.74 ) $ (2.06 )

Basic and diluted loss from

discontinued operations per share attributable to Maiden

common shareholders(15)

(0.64 ) (0.10 )

(1.13 ) (0.26 )

Basic and diluted loss per share

attributable to Maiden common

shareholders(15)

$ (3.25 ) $ (1.59 )

$ (6.87 ) $ (2.32 )

Dividends declared per common share $ -

$ 0.15 $ 0.35 $

0.60 Annualized return on average common

equity -538.3 % -61.5 %

-133.2 % -22.0 % Weighted

average number of common shares - basic and diluted(15)

82,946,266 83,962,325 83,050,362 85,678,232

Maiden Holdings, Ltd.

Supplemental Financial Data - Segment Information (in

thousands (000's)) (Unaudited) For the Three

Months Ended December 31, 2018

Diversified Reinsurance

AmTrust Reinsurance

Other Total Gross premiums written $ 20,379 $

368,072 $ - $ 388,451 Net premiums written $

20,040 $ 368,072 $ - $ 388,112 Net

premiums earned $ 29,649 $ 455,275 $ - $ 484,924 Other insurance

revenue 2,052 - - 2,052 Net loss and loss adjustment expenses

("loss and LAE") (19,613 ) (536,689 ) (316 ) (556,618 ) Commissions

and other acquisition expenses (10,488 ) (147,226 ) - (157,714 )

General and administrative expenses(4) (4,066 ) (891

) - (4,957 )

Underwriting

loss(5) $ (2,466 ) $ (229,531 ) $ (316 ) $ (232,313 )

Reconciliation to net loss from continuing operations

Net investment income and realized losses on investment 33,490

Total other-than-temporary impairment losses (5,353 ) Interest and

amortization expenses (4,831 ) Foreign exchange and other gains

2,599 Other general and administrative expenses(4) (10,244 ) Income

tax expense (40 )

Net loss from continuing operations

$ (216,692 ) Net loss and LAE ratio(6) 61.9 %

117.9 % 114.3 % Commission and other acquisition

expense ratio(7) 33.1 % 32.3 % 32.4 % General and administrative

expense ratio(8) 12.8 % 0.2 % 3.1 % Expense

ratio(9) 45.9 % 32.5 % 35.5 %

Combined

ratio(10) 107.8 % 150.4 % 149.8 %

For the Three Months Ended December

31, 2017

Diversified Reinsurance

AmTrust Reinsurance

Other Total Gross premiums written $ 9,528 $

417,801 $ - $ 427,329 Net premiums written $

9,087 $ 424,876 $ - $ 433,963 Net

premiums earned $ 21,389 $ 458,833 $ - $ 480,222 Other insurance

revenue 1,986 - - 1,986 Net loss and LAE (13,166 ) (451,659 ) -

(464,825 ) Commissions and other acquisition expenses (7,036 )

(148,988 ) (2 ) (156,026 ) General and administrative expenses(4)

(4,145 ) (812 ) - (4,957 )

Underwriting loss(5) $ (972 ) $ (142,626 ) $ (2 ) $

(143,600 )

Reconciliation to net loss from continuing

operations Net investment income and realized gains on

investment 36,866 Interest and amortization expenses (4,830 )

Foreign exchange losses (2,728 ) Other general and administrative

expenses(4) (9,077 ) Income tax benefit 6,903

Net

loss from continuing operations $ (116,466 ) Net loss

and LAE ratio(6) 56.3 % 98.4 % 96.4 %

Commission and other acquisition expense ratio(7) 30.1 % 32.5 %

32.4 % General and administrative expense ratio(8) 17.8 %

0.2 % 2.9 % Expense ratio(9) 47.9 %

32.7 % 35.3 %

Combined ratio(10) 104.2

% 131.1 % 131.7 %

Maiden Holdings, Ltd. Supplemental

Financial Data - Segment Information (in thousands

(000's)) (Unaudited) For the

Year Ended December 31, 2018

Diversified Reinsurance

AmTrust Reinsurance

Other Total Gross premiums written $ 131,518 $

1,886,280 $ - $ 2,017,798 Net premiums written

$ 129,319 $ 1,885,278 $ - $ 2,014,597

Net premiums earned $ 112,487 $ 1,913,715 $ - $ 2,026,202 Other

insurance revenue 9,681 - - 9,681 Net loss and LAE (71,441 )

(1,806,995 ) (1,685 ) (1,880,121 ) Commissions and other

acquisition expenses (38,749 ) (615,991 ) - (654,740 ) General and

administrative expenses(4) (17,396 ) (3,845 )

- (21,241 )

Underwriting loss(5) $

(5,418 ) $ (513,116 ) $ (1,685 ) $ (520,219 )

Reconciliation to net loss from continuing operations Net

investment income and realized losses on investment 134,756 Total

other-than-temporary impairment losses (5,832 ) Interest and

amortization expenses (19,318 ) Foreign exchange and other gains

4,461 Other general and administrative expenses(4) (43,699 ) Income

tax expense (441 )

Net loss from continuing

operations $ (450,292 ) Net loss and LAE ratio(6)

58.5 % 94.4 % 92.3 % Commission and other acquisition

expense ratio(7) 31.7 % 32.2 % 32.2 % General and administrative

expense ratio(8) 14.2 % 0.2 % 3.2 % Expense

ratio(9) 45.9 % 32.4 % 35.4 %

Combined

ratio(10) 104.4 % 126.8 % 127.7 %

For the Year Ended December 31, 2017

Diversified Reinsurance

AmTrust Reinsurance

Other Total Gross premiums written $ 84,613 $

1,993,478 $ - $ 2,078,091 Net premiums written

$ 82,521 $ 1,954,856 $ - $ 2,037,377

Net premiums earned $ 83,015 $ 1,909,644 $ - $ 1,992,659 Other

insurance revenue 9,802 - - 9,802 Net loss and LAE (54,714 )

(1,498,881 ) (1,838 ) (1,555,433 ) Commissions and other

acquisition expenses (29,018 ) (614,777 ) (2 ) (643,797 ) General

and administrative expenses(4) (15,976 ) (3,052 )

- (19,028 )

Underwriting loss(5)

$ (6,891 ) $ (207,066 ) $ (1,840 ) $ (215,797 )

Reconciliation to net loss from continuing operations Net

investment income and realized gains on investment 136,357 Interest

and amortization expenses (23,260 ) Accelerated amortization of

senior note issuance cost (2,809 ) Foreign exchange losses (14,921

) Other general and administrative expenses(4) (33,976 ) Income tax

benefit 6,757

Net loss from continuing

operations $ (147,649 ) Net loss and LAE ratio(6)

58.9 % 78.4 % 77.7 % Commission and other acquisition

expense ratio(7) 31.3 % 32.2 % 32.2 % General and administrative

expense ratio(8) 17.2 % 0.2 % 2.6 % Expense

ratio(9) 48.5 % 32.4 % 34.8 %

Combined

ratio(10) 107.4 % 110.8 % 112.5 %

Maiden Holdings, Ltd. Non - GAAP Financial

Measures (in thousands (000's), except per share data)

(Unaudited) For the Three

Months Ended December 31, For the Year Ended December

31, 2018 2017 2018

2017

Non-GAAP operating loss attributable to Maiden common

shareholders(11) $ (212,414 ) $ (126,372 ) $ (471,562 )

$ (169,608 )

Non-GAAP basic and diluted operating loss per share

attributable to Maiden common shareholders $ (2.56 ) $ (1.51 )

$ (5.68 ) $ (1.98 )

Annualized non-GAAP operating return on

average common equity(12) -424.7 % -58.2 % -110.1 %

-18.7 %

Reconciliation of net loss attributable

to Maiden common shareholders to non-GAAP operating loss

attributable to Maiden common shareholders:

Net loss attributable to Maiden common shareholders $ (269,235 ) $

(133,587 ) $ (570,260 ) $ (199,052 ) Add (subtract) Net realized

losses (gains) on investment 1,247 (3,906 ) 1,529 (12,222 ) Total

other-than-temporary impairment losses 5,353 - 5,832 - Foreign

exchange and other (gains) losses (2,599 ) 2,728 (4,461 ) 14,921

Divested NGHC Quota Share run-off 316 2 1,685 1,840 Accelerated

amortization of senior note issuance cost - - - 2,809 Loss from

discontinued operations, net of income tax 52,504

8,391 94,113 22,096

Non-GAAP operating loss attributable to Maiden common

shareholders(11) $ (212,414 )

$ (126,372 ) $ (471,562 )

$ (169,608 ) Weighted average number

of common shares - basic and diluted(15) 82,946,266

83,962,325 83,050,362 85,678,232

Reconciliation of diluted loss per

share attributable to Maiden common shareholders to non-GAAP

diluted operating loss per share attributable to Maiden

common shareholders:

Diluted loss per share attributable to Maiden common shareholders $

(3.25 ) $ (1.59 ) $ (6.87 ) $ (2.32 ) Add (subtract) Net

realized losses (gains) on investment 0.02 (0.05 ) 0.02 (0.14 )

Total other-than-temporary impairment losses 0.07 - 0.07 - Foreign

exchange and other (gains) losses (0.03 ) 0.03 (0.05 ) 0.17

Divested NGHC Quota Share run-off - - 0.02 0.02 Accelerated

amortization of senior note issuance cost - - - 0.03 Loss from

discontinued operations, net of income tax 0.63

0.10 1.13 0.26

Non-GAAP diluted operating loss per share attributable to Maiden

common shareholders $ (2.56 ) $

(1.51 ) $ (5.68 ) $

(1.98 ) Reconciliation of net loss

attributable to Maiden to non-GAAP (loss) income from

operations: Net loss attributable to Maiden $ (269,235 ) $

(125,042 ) $ (544,624 ) $ (169,896 ) Add (subtract) Foreign

exchange and other (gains) losses (2,599 ) 2,728 (4,461 ) 14,921

Interest and amortization expenses 4,831 4,830 19,318 23,260

Accelerated amortization of senior note issuance cost - - - 2,809

Income tax expense (benefit) 40 (6,903 ) 441 (6,757 ) Net income

attributable to noncontrolling interest 39 185 219 151 Loss from

discontinued operations, net of income tax 52,504

8,391 94,113 22,096

Non-GAAP loss from operations(2) $

(214,420 ) $ (115,811 ) $

(434,994 ) $ (113,416 )

Maiden Holdings, Ltd. Non - GAAP

Financial Measures (in thousands (000's), except per share

data) (Unaudited) December 31,

2018 December 31, 2017 Investable assets: Total

investments $ 4,090,965 $ 3,811,917 Cash and cash equivalents

200,841 54,470 Restricted cash and cash equivalents 130,148 94,905

Loan to related party 167,975 167,975 Total

investable assets(13)

$ 4,589,929 $

4,129,267 December 31, 2018 December 31,

2017 Capital: Preference shares $ 465,000 $ 465,000

Common shareholders' equity 89,275 767,174

Total

Maiden shareholders' equity 554,275 1,232,174 2016 Senior Notes

110,000 110,000 2013 Senior Notes 152,500 152,500

Total capital resources(14) $ 816,775

$ 1,494,674 (1) Book value per common share is

calculated using Maiden common shareholders’ equity (shareholders'

equity excluding the aggregate liquidation value of our preference

shares) divided by the number of common shares outstanding.

(2) Non-GAAP loss from operations is a non-GAAP financial measure

defined by the Company as net loss attributable to Maiden excluding

foreign exchange and other gains and losses, interest and

amortization expenses, accelerated amortization of senior note

issuance cost, income tax expense, net income or loss attributable

to noncontrolling interest and loss from discontinued operations,

net of income tax and should not be considered as an alternative to

net income (loss). The Company’s management believes that non-GAAP

loss from operations is a useful measure of the Company’s

underlying earnings fundamentals based on its underwriting and

investment income before financing costs. This loss from operations

enables readers of this information to more clearly understand the

essential operating results of the Company. The Company’s measure

of non-GAAP loss from operations may not be comparable to similarly

titled measures used by other companies. (3) Dividends on

preference shares consist of $0 and $3,093 paid to Preference

shares - Series A for the three months ended December 31, 2018 and

2017, respectively, $9,282 and $12,375 paid to Preference shares -

Series A for the twelve months ended December 31, 2018 and 2017,

respectively, $0 and $2,940 paid to Preference shares - Series C

for the three months ended December 31, 2018 and 2017,

respectively, $8,816 and $11,756 paid to Preference shares - Series

C for the twelve months ended December 31, 2018 and 2017,

respectively, and $0 and $2,512 paid to Preference shares - Series

D for the three months ended December 31, 2018 and 2017,

respectively, and $7,538 and $5,025 for the twelve months ended

December 31, 2018 and 2017, respectively. (4) Underwriting

related general and administrative expenses is a non-GAAP measure

and includes expenses which are segregated for analytical purposes

as a component of underwriting income. (5) Underwriting loss

is a non-GAAP measure and is calculated as net premiums earned plus

other insurance revenue less net loss and LAE, commission and other

acquisition expenses and general and administrative expenses

directly related to underwriting activities. Management believes

that this measure is important in evaluating the underwriting

performance of the Company and its segments. This measure is also a

useful tool to measure the profitability of the Company separately

from the investment results and is also a widely used performance

indicator in the insurance industry. (6) Calculated by

dividing net loss and LAE by the sum of net premiums earned and

other insurance revenue. (7) Calculated by dividing

commission and other acquisition expenses by the sum of net

premiums earned and other insurance revenue. (8) Calculated

by dividing general and administrative expenses by the sum of net

premiums earned and other insurance revenue. (9) Calculated

by adding together the commission and other acquisition expense

ratio and general and administrative expense ratio. (10)

Calculated by adding together the net loss and LAE ratio and the

expense ratio. (11) Non-GAAP operating loss is a non-GAAP

financial measure defined by the Company as net loss attributable

to Maiden common shareholders excluding realized and unrealized

investment gains and losses, total other-than-temporary impairment

losses, foreign exchange and other gains and losses, Divested NGHC

Quota Share run-off, accelerated amortization of senior note

issuance cost, and loss from discontinued operations, net of income

tax and should not be considered as an alternative to net loss. The

Company's management believes that non-GAAP operating loss is a

useful indicator of trends in the Company's underlying operations.

The Company's measure of non-GAAP operating loss may not be

comparable to similarly titled measures used by other companies.

(12) Non-GAAP operating return on average common equity is a

non-GAAP financial measure. Management uses non-GAAP operating

return on average common shareholders' equity as a measure of

profitability that focuses on the return to Maiden common

shareholders. It is calculated using non-GAAP operating loss

attributable to Maiden common shareholders divided by average

Maiden common shareholders' equity. (13) Investable assets

is the total of the Company's investments, cash and cash

equivalents and loan to a related party. (14) Total capital

resources is the sum of the Company's principal amount of debt and

Maiden shareholders' equity. (15) During a period of loss,

the basic weighted average common shares outstanding is used in the

denominator of the diluted loss per common share computation as the

effect of including potential dilutive shares would be

anti-dilutive.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190315005079/en/

Sard Verbinnen & Co.Maiden-SVC@sardverb.com

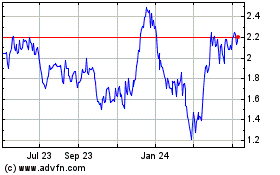

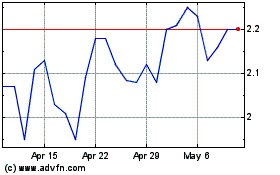

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Apr 2023 to Apr 2024