Macatawa Bank Corporation (NASDAQ: MCBC) today announced its

results for the first quarter of 2019, reflecting continued strong

financial performance.

- Net income of $7.6 million in first quarter 2019 versus $5.8

million in first quarter 2018 – up 33%

- Growth in net interest income – up $1.8 million (13%) from

first quarter 2018

- Net interest margin of 3.54% in first quarter 2019, up from

3.34% in first quarter 2018

- Decrease in total non-interest expense – down $196,000 (-2%)

from first quarter 2018

- Loan portfolio balances up by $59 million (4%) from first

quarter 2018

- Core deposit balances up by $57 million (4%) from first quarter

2018

- Asset quality metrics remained strong

Macatawa reported net income of $7.6 million, or

$0.22 per diluted share, in the first quarter 2019 compared to $5.8

million, or $0.17 per diluted share, in the first quarter

2018.

"We are pleased to report a continuation of strong

performance for the first quarter of 2019,” said Ronald L. Haan,

President and CEO of the Company. “Revenue growth, primarily

from higher net interest income, along with a reduction in total

non-interest expense resulted in a 33 percent increase in net

income compared to the first quarter of 2018. Continued

growth in our balances of loans has positively affected our net

interest income while expenses have remained

well-controlled.”

Mr. Haan concluded: "Our commitment to

operating a well-disciplined company that delivers superior

financial services to the communities of Western Michigan has again

resulted in strong and consistent financial performance for our

shareholders. The banking environment in Western Michigan

remains highly competitive, and our continued success is a result

of the efforts of a strong and committed team of professional

bankers.”

Operating Results Net

interest income for the first quarter 2019 totaled $16.0 million,

an increase of $392,000 from the fourth quarter 2018 and an

increase of $1.8 million from the first quarter 2018. Net

interest margin was 3.54 percent, up 8 basis points from the fourth

quarter 2018, and up 20 basis points from the first quarter

2018. Net interest income for the first quarter 2019

benefitted from the collection of $251,000 in prepayment fees on

commercial loans, primarily related to one commercial

relationship. Prepayment fees were only $16,000 in the fourth

quarter 2018 and $2,000 in the first quarter 2018.

Average interest earning assets for the first

quarter 2019 increased $27.7 million from the fourth quarter 2018

and were up $103.3 million from the first quarter 2018. This

growth along with the improvement in net interest margin from

rising rates and the prepayment fees discussed above were the

primary contributors to the improvement in net interest income.

Non-interest income decreased $77,000 in the first

quarter 2019 compared to the fourth quarter 2018 and increased

$196,000 from the first quarter 2018. These changes were

largely due to fluctuations in gains on sales of mortgage

loans. Gains on sales of mortgage loans in the first quarter

2019 were down $80,000 compared to the fourth quarter 2018 and were

up $70,000 from the first quarter 2018. The Bank originated

$6.8 million in mortgage loans for sale in the first quarter 2019

compared to $9.9 million in the fourth quarter 2018 and $5.1

million in the first quarter 2018. The Bank originated $6.2

million in portfolio mortgage loans in the first quarter 2019

compared to $16.4 million in the fourth quarter 2018 and $16.1

million in the first quarter 2018. Investment service fees

were up $30,000 in the first quarter 2019 compared to the fourth

quarter 2018 and were up $72,000 compared to the first quarter

2018.

Non-interest expense was $11.2 million for the

first quarter 2019, compared to $10.4 million for the fourth

quarter 2018 and $11.4 million for the first quarter 2018.

The largest component of non-interest expense was salaries and

benefit expenses. Salaries and benefit expenses were down

$21,000 compared to the fourth quarter 2018 and were up $50,000

compared to the first quarter 2018. The increase compared to

the first quarter 2018 was due to annual merit and inflationary

increases in salaries. The decrease from the fourth quarter

2018 was due to a higher level of variable based compensation in

the fourth quarter 2018.

Nonperforming asset expenses increased $635,000 in

the first quarter 2019 compared to the fourth quarter 2018 and

decreased $408,000 compared to the first quarter 2018. Net

losses of $126,000 were incurred on sales of foreclosed properties

in the first quarter 2018, while net gains of $45,000 and $689,000

were incurred on sales in the first quarter 2019 and in the fourth

quarter 2018, respectively. Net gains in the fourth quarter

of 2018 were unusually high due to the sale of a property obtained

upon default of a loan for a gain of $675,000. Additionally,

writedowns on other real estate totaled $10,000 in the first

quarter 2019 compared to $32,000 in fourth quarter 2018 and

$280,000 in first quarter 2018. Other categories of

non-interest expense were relatively flat compared to the fourth

quarter 2018 and the first quarter 2018 due to a continued focus on

expense management.

Federal income tax expense was $1.7 million for the

first quarter 2019 compared to $1.7 million for the fourth quarter

2018 and $1.2 million for the first quarter 2018. The

effective tax rate was 18.3 percent for the first quarter 2019,

compared to 19.8 percent for the fourth quarter 2018 and 17.6

percent for the first quarter 2018.

Asset QualityAs a result of the

consistent improvements in nonperforming loans and past due loans

over the past several quarters, the continued low historical loan

loss ratios, and net loan recoveries experienced in the first

quarter 2019, a negative provision for loan losses of $250,000 was

recorded in the first quarter 2019. Net loan recoveries for

the first quarter 2019 were $266,000, compared to fourth quarter

2018 net loan charge-offs of $776,000 and first quarter 2018 net

loan recoveries of $175,000. The Company has experienced net

loan recoveries in sixteen of the past seventeen quarters. Total

loans past due on payments by 30 days or more amounted to $674,000

at March 31, 2019, down 23 percent from $877,000 at December 31,

2018 and down 59 percent from $1.6 million at March 31, 2018.

Delinquency as a percentage of total loans was 0.05 percent at

March 31, 2019, well below the Company’s peer level.

The allowance for loan losses of $16.9 million was

1.22 percent of total loans at March 31, 2019, compared to 1.20

percent of total loans at December 31, 2018, and 1.26 percent at

March 31, 2018. The coverage ratio of allowance for loan

losses to nonperforming loans continued to be strong and

significantly exceeded 1-to-1 coverage at 41.3-to-1 as of March 31,

2019.

At March 31, 2019, the Company's nonperforming

loans were $409,000, representing 0.03 percent of total

loans. This compares to $1.3 million (0.09 percent of total

loans) at December 31, 2018 and $324,000 (0.02 percent of total

loans) at March 31, 2018. Other real estate owned and

repossessed assets were $3.3 million at March 31, 2019, compared to

$3.4 million at December 31, 2018 and $5.2 million at March 31,

2018. Total nonperforming assets, including other real estate owned

and nonperforming loans, decreased by $1.9 million, or 34 percent,

from March 31, 2018 to March 31, 2019.

A break-down of non-performing loans is shown in

the table below.

| Dollars in 000s |

|

Mar 31, 2019 |

|

Dec 31, 2018 |

|

Sept 30, 2018 |

|

Jun 30, 2018 |

|

Mar 31, 2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial Real

Estate |

|

$ |

213 |

|

$ |

318 |

|

$ |

121 |

|

$ |

121 |

|

$ |

121 |

|

| Commercial and

Industrial |

|

|

--- |

|

|

873 |

|

|

--- |

|

|

2 |

|

|

201 |

|

| Total

Commercial Loans |

|

|

213 |

|

|

1,191 |

|

|

121 |

|

|

123 |

|

|

322 |

|

| Residential Mortgage

Loans |

|

|

195 |

|

|

112 |

|

|

2 |

|

|

2 |

|

|

2 |

|

| Consumer Loans |

|

|

1 |

|

|

1 |

|

|

--- |

|

|

--- |

|

|

--- |

|

| Total

Non-Performing Loans |

|

$ |

409 |

|

$ |

1,304 |

|

$ |

123 |

|

$ |

125 |

|

$ |

324 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-performing assets were $3.7 million, or

0.19 percent of total assets, at March 31, 2019. A break-down

of non-performing assets is shown in the table below.

| Dollars in 000s |

|

Mar 31, 2019 |

|

Dec 31, 2018 |

|

Sept 30, 2018 |

|

Jun 30, 2018 |

|

Mar 31, 2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-Performing

Loans |

|

$ |

409 |

|

$ |

1,304 |

|

$ |

123 |

|

$ |

125 |

|

$ |

324 |

|

| Other Repossessed

Assets |

|

|

--- |

|

|

--- |

|

|

--- |

|

|

--- |

|

|

--- |

|

| Other Real Estate

Owned |

|

|

3,261 |

|

|

3,380 |

|

|

3,465 |

|

|

3,872 |

|

|

5,223 |

|

| Total

Non-Performing Assets |

|

$ |

3,670 |

|

$ |

4,684 |

|

$ |

3,588 |

|

$ |

3,997 |

|

$ |

5,547 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet, Liquidity and

CapitalTotal assets were $1.93 billion at March 31, 2019,

a decrease of $49.2 million from $1.98 billion at December 31, 2018

and an increase of $62.1 million from $1.86 billion at March 31,

2018. Year-end assets typically increase due to seasonal

inflow of business and municipal deposits. Total loans

were $1.38 billion at March 31, 2019, a decrease of $21.1 million

from $1.41 billion at December 31, 2018 and an increase of $59.0

million from $1.33 billion at March 31, 2018.

Commercial loans increased by $59.7 million from

March 31, 2018 to March 31, 2019, along with an increase of $2.8

million in the residential mortgage portfolio, partially offset by

a decrease of $3.5 million in the consumer loan portfolio.

Commercial real estate loans increased by $42.9 million while

commercial and industrial loans increased by $16.8 million during

the same period.

The composition of the commercial loan portfolio is

shown in the table below:

| Dollars in 000s |

|

Mar 31, 2019 |

|

Dec 31, 2018 |

|

Sept 30, 2018 |

|

Jun 30, 2018 |

|

Mar 31, 2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Construction and

Development |

|

$ |

102,133 |

|

$ |

99,867 |

|

$ |

93,794 |

|

$ |

85,193 |

|

$ |

81,948 |

|

| Other Commercial Real

Estate |

|

|

470,667 |

|

|

468,840 |

|

|

459,146 |

|

|

461,808 |

|

|

447,922 |

|

| Commercial

Loans Secured by Real Estate |

|

|

572,800 |

|

|

568,707 |

|

|

552,940 |

|

|

547,001 |

|

|

529,870 |

|

| Commercial and

Industrial |

|

|

493,891 |

|

|

513,347 |

|

|

467,703 |

|

|

458,468 |

|

|

477,088 |

|

| Total

Commercial Loans |

|

$ |

1,066,691 |

|

$ |

1,082,054 |

|

$ |

1,020,643 |

|

$ |

1,005,469 |

|

$ |

1,006,958 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bond financing to commercial customers decreased by

$9.9 million from March 31, 2018 to March 31, 2019. This

decrease in bond financing combined with loan portfolio growth led

to a total growth rate of 4% from March 31, 2018 to March 31,

2019.

Total deposits were $1.62 billion at March 31,

2019, down $58.9 million from $1.68 billion at December 31, 2018

and were up $57.0 million, or 4 percent, from $1.56 billion at

March 31, 2018. The decrease in total deposits from December

31, 2018 was primarily in demand deposits (down $68.6 million) as

municipal and business customers deployed their seasonal increase

of year-end deposits in the first quarter 2019. Demand

deposits were up $21.9 million in the first quarter 2019 compared

to the first quarter 2018. Money market deposits and savings

deposits were down $5.0 million from the fourth quarter 2018 and

were down $10.2 million from the first quarter 2018.

Certificates of deposit were up $14.7 million in the first quarter

2019 compared to December 31, 2018 and were up $45.4 million

compared to March 31, 2018. As deposit rates have risen, the

Bank has experienced some shifting between deposit types. The

Bank continues to be successful at attracting and retaining core

deposit customers. Customer deposit accounts remain insured

to the highest levels available under FDIC deposit insurance.

The Bank's risk-based regulatory capital ratios

were higher at March 31, 2019 compared to March 31, 2018 and

December 31, 2018 due to earnings growth, and continue to be at

levels comfortably above those required to be categorized as “well

capitalized” under applicable regulatory capital guidelines.

As such, the Bank was categorized as "well capitalized" at March

31, 2019.

About Macatawa BankHeadquartered

in Holland, Mich., Macatawa Bank offers a full range of banking,

retail and commercial lending, wealth management and ecommerce

services to individuals, businesses and governmental entities from

a network of 26 full-service branches located throughout

communities in Kent, Ottawa and northern Allegan counties.

The bank is recognized for its local management team and decision

making, along with providing customers excellent service, a

rewarding experience and superior financial products. Macatawa Bank

has been recognized for the past five consecutive years as “West

Michigan’s 101 Best and Brightest Companies to Work For”. For more

information, visit www.macatawabank.com.

CAUTIONARY STATEMENT: This press release

contains forward-looking statements that are based on management's

current beliefs, expectations, assumptions, estimates, plans and

intentions. Forward-looking statements are identifiable by

words or phrases such as “anticipates,” "believe," "expect," "may,"

"should," "will," ”intend,” "continue," "improving," "additional,"

"focus," "forward," "future," "efforts," "strategy," "momentum,"

"positioned," and other similar words or phrases. Such

statements are based upon current beliefs and expectations and

involve substantial risks and uncertainties which could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements. These statements include,

among others, statements related to trends in our key operating

metrics and financial performance, future levels of earnings and

profitability, future levels of earning assets, future asset

quality, future growth, and future net interest margin. All

statements with references to future time periods are

forward-looking. Management's determination of the provision

and allowance for loan losses, the appropriate carrying value of

intangible assets (including deferred tax assets) and other real

estate owned and the fair value of investment securities (including

whether any impairment on any investment security is temporary or

other-than-temporary and the amount of any impairment) involves

judgments that are inherently forward-looking. Our ability to sell

other real estate owned at its carrying value or at all, reduce

non-performing asset expenses, utilize our deferred tax asset,

successfully implement new programs and initiatives, increase

efficiencies, maintain our current level of deposits and other

sources of funding, maintain liquidity, respond to declines in

collateral values and credit quality, improve profitability, and

produce consistent core earnings is not entirely within our control

and is not assured. The future effect of changes in the real

estate, financial and credit markets and the national and regional

economy on the banking industry, generally, and Macatawa Bank

Corporation, specifically, are also inherently uncertain.

These statements are not guarantees of future performance and

involve certain risks, uncertainties and assumptions ("risk

factors") that are difficult to predict with regard to timing,

extent, likelihood and degree of occurrence. Therefore,

actual results and outcomes may materially differ from what may be

expressed in or implied by such forward-looking statements.

Macatawa Bank Corporation does not undertake to update

forward-looking statements to reflect the impact of circumstances

or events that may arise after the date of the forward-looking

statements.

Risk factors include, but are not limited to, the

risk factors described in "Item 1A - Risk Factors" of our Annual

Report on Form 10-K for the year ended December 31,

2018. These and other factors are representative of the risk

factors that may emerge and could cause a difference between an

ultimate actual outcome and a preceding forward-looking

statement.

| MACATAWA BANK CORPORATION |

| CONSOLIDATED FINANCIAL SUMMARY |

| (Unaudited) |

| (Dollars in thousands except per share

information) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

1st Qtr |

|

4th Qtr |

|

1st Qtr |

|

| EARNINGS

SUMMARY |

|

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

| Total interest

income |

|

|

|

|

|

$ |

19,189 |

|

|

$ |

18,496 |

|

|

$ |

16,019 |

|

|

| Total interest

expense |

|

|

|

|

|

|

3,169 |

|

|

|

2,868 |

|

|

|

1,837 |

|

|

| Net

interest income |

|

|

|

|

|

|

16,020 |

|

|

|

15,628 |

|

|

|

14,182 |

|

|

| Provision for loan

losses |

|

|

|

|

|

|

(250 |

) |

|

|

850 |

|

|

|

(100 |

) |

|

| Net

interest income after provision for loan losses |

|

|

|

|

|

|

16,270 |

|

|

|

14,778 |

|

|

|

14,282 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| NON-INTEREST

INCOME |

|

|

|

|

|

|

|

|

|

|

|

| Deposit service

charges |

|

|

|

|

|

|

1,050 |

|

|

|

1,135 |

|

|

|

1,049 |

|

|

| Net gains on mortgage

loans |

|

|

|

|

|

|

211 |

|

|

|

291 |

|

|

|

141 |

|

|

| Trust fees |

|

|

|

|

|

|

890 |

|

|

|

884 |

|

|

|

925 |

|

|

| Other |

|

|

|

|

|

|

2,177 |

|

|

|

2,095 |

|

|

|

2,017 |

|

|

| Total

non-interest income |

|

|

|

|

|

|

4,328 |

|

|

|

4,405 |

|

|

|

4,132 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| NON-INTEREST

EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

| Salaries and

benefits |

|

|

|

|

|

|

6,244 |

|

|

|

6,265 |

|

|

|

6,194 |

|

|

| Occupancy |

|

|

|

|

|

|

1,093 |

|

|

|

948 |

|

|

|

1,072 |

|

|

| Furniture and

equipment |

|

|

|

|

|

|

844 |

|

|

|

787 |

|

|

|

805 |

|

|

| FDIC assessment |

|

|

|

|

|

|

120 |

|

|

|

127 |

|

|

|

132 |

|

|

| Problem asset costs,

including losses and (gains) |

|

|

|

|

|

|

53 |

|

|

|

(582 |

) |

|

|

461 |

|

|

| Other |

|

|

|

|

|

|

2,884 |

|

|

|

2,852 |

|

|

|

2,770 |

|

|

| Total

non-interest expense |

|

|

|

|

|

|

11,238 |

|

|

|

10,397 |

|

|

|

11,434 |

|

|

| Income before income

tax |

|

|

|

|

|

|

9,360 |

|

|

|

8,786 |

|

|

|

6,980 |

|

|

| Income tax expense |

|

|

|

|

|

|

1,714 |

|

|

|

1,743 |

|

|

|

1,225 |

|

|

| Net

income |

|

|

|

|

|

$ |

7,646 |

|

|

$ |

7,043 |

|

|

$ |

5,755 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per

common share |

|

|

|

|

|

$ |

0.22 |

|

|

$ |

0.21 |

|

|

$ |

0.17 |

|

|

| Diluted earnings per

common share |

|

|

|

|

|

$ |

0.22 |

|

|

$ |

0.21 |

|

|

$ |

0.17 |

|

|

| Return on average

assets |

|

|

|

|

|

|

1.57 |

% |

|

|

1.47 |

% |

|

|

1.25 |

% |

|

| Return on average

equity |

|

|

|

|

|

|

15.81 |

% |

|

|

15.12 |

% |

|

|

13.24 |

% |

|

| Net interest margin

(fully taxable equivalent) |

|

|

|

|

|

|

3.54 |

% |

|

|

3.46 |

% |

|

|

3.34 |

% |

|

| Efficiency ratio |

|

|

|

|

|

|

55.23 |

% |

|

|

51.90 |

% |

|

|

62.43 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| BALANCE SHEET

DATA |

|

|

|

|

|

March 31 |

|

December 31 |

|

March 31 |

|

|

Assets |

|

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

| Cash and due from

banks |

|

|

|

|

|

$ |

28,143 |

|

|

$ |

40,526 |

|

|

$ |

26,954 |

|

|

| Federal funds sold and

other short-term investments |

|

|

|

|

|

|

115,843 |

|

|

|

130,758 |

|

|

|

103,898 |

|

|

| Debt securities

available for sale |

|

|

|

|

|

|

224,645 |

|

|

|

226,986 |

|

|

|

214,269 |

|

|

| Debt securities held to

maturity |

|

|

|

|

|

|

70,336 |

|

|

|

70,334 |

|

|

|

90,513 |

|

|

| Federal Home Loan Bank

Stock |

|

|

|

|

|

|

11,558 |

|

|

|

11,558 |

|

|

|

11,558 |

|

|

| Loans held for

sale |

|

|

|

|

|

|

512 |

|

|

|

415 |

|

|

|

- |

|

|

| Total loans |

|

|

|

|

|

|

1,384,567 |

|

|

|

1,405,658 |

|

|

|

1,325,545 |

|

|

| Less allowance for loan

loss |

|

|

|

|

|

|

16,892 |

|

|

|

16,876 |

|

|

|

16,675 |

|

|

| Net

loans |

|

|

|

|

|

|

1,367,675 |

|

|

|

1,388,782 |

|

|

|

1,308,870 |

|

|

| Premises and equipment,

net |

|

|

|

|

|

|

44,805 |

|

|

|

44,862 |

|

|

|

46,110 |

|

|

| Bank-owned life

insurance |

|

|

|

|

|

|

41,433 |

|

|

|

41,185 |

|

|

|

40,494 |

|

|

| Other real estate

owned |

|

|

|

|

|

|

3,261 |

|

|

|

3,380 |

|

|

|

5,223 |

|

|

| Other assets |

|

|

|

|

|

|

17,669 |

|

|

|

16,338 |

|

|

|

15,891 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total

Assets |

|

|

|

|

|

$ |

1,925,880 |

|

|

$ |

1,975,124 |

|

|

$ |

1,863,780 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing

deposits |

|

|

|

|

|

$ |

466,631 |

|

|

$ |

485,530 |

|

|

$ |

453,993 |

|

|

| Interest-bearing

deposits |

|

|

|

|

|

|

1,151,233 |

|

|

|

1,191,209 |

|

|

|

1,106,879 |

|

|

| Total

deposits |

|

|

|

|

|

|

1,617,864 |

|

|

|

1,676,739 |

|

|

|

1,560,872 |

|

|

| Other borrowed

funds |

|

|

|

|

|

|

60,000 |

|

|

|

60,000 |

|

|

|

80,667 |

|

|

| Long-term debt |

|

|

|

|

|

|

41,238 |

|

|

|

41,238 |

|

|

|

41,238 |

|

|

| Other liabilities |

|

|

|

|

|

|

8,812 |

|

|

|

6,294 |

|

|

|

5,627 |

|

|

| Total

Liabilities |

|

|

|

|

|

|

1,727,914 |

|

|

|

1,784,271 |

|

|

|

1,688,404 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Shareholders'

equity |

|

|

|

|

|

|

197,966 |

|

|

|

190,853 |

|

|

|

175,376 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total

Liabilities and Shareholders' Equity |

|

|

|

|

|

$ |

1,925,880 |

|

|

$ |

1,975,124 |

|

|

$ |

1,863,780 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| MACATAWA BANK CORPORATION |

| SELECTED CONSOLIDATED FINANCIAL

DATA |

| (Unaudited) |

| (Dollars in thousands except per share

information) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarterly |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

1st Qtr |

|

4th Qtr |

|

3rd Qtr |

|

2nd Qtr |

|

1st Qtr |

|

| |

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2018 |

|

|

| EARNINGS

SUMMARY |

|

|

|

|

|

|

|

|

|

|

|

| Net interest

income |

|

$ |

16,020 |

|

|

$ |

15,628 |

|

|

$ |

15,162 |

|

|

$ |

14,653 |

|

|

$ |

14,182 |

|

|

| Provision for loan

losses |

|

|

(250 |

) |

|

|

850 |

|

|

|

- |

|

|

|

(300 |

) |

|

|

(100 |

) |

|

| Total non-interest

income |

|

|

4,328 |

|

|

|

4,405 |

|

|

|

4,499 |

|

|

|

4,468 |

|

|

|

4,132 |

|

|

| Total non-interest

expense |

|

|

11,238 |

|

|

|

10,397 |

|

|

|

11,239 |

|

|

|

11,259 |

|

|

|

11,434 |

|

|

| Federal income tax

expense |

|

|

1,714 |

|

|

|

1,743 |

|

|

|

1,570 |

|

|

|

1,434 |

|

|

|

1,225 |

|

|

| Net income |

|

$ |

7,646 |

|

|

$ |

7,043 |

|

|

$ |

6,852 |

|

|

$ |

6,728 |

|

|

$ |

5,755 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per

common share |

|

$ |

0.22 |

|

|

$ |

0.21 |

|

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.17 |

|

|

| Diluted earnings per

common share |

|

$ |

0.22 |

|

|

$ |

0.21 |

|

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.17 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| MARKET

DATA |

|

|

|

|

|

|

|

|

|

|

|

| Book value per common

share |

|

$ |

5.81 |

|

|

$ |

5.61 |

|

|

$ |

5.41 |

|

|

$ |

5.28 |

|

|

$ |

5.16 |

|

|

| Tangible book value per

common share |

|

$ |

5.81 |

|

|

$ |

5.61 |

|

|

$ |

5.41 |

|

|

$ |

5.28 |

|

|

$ |

5.16 |

|

|

| Market value per common

share |

|

$ |

9.94 |

|

|

$ |

9.62 |

|

|

$ |

11.71 |

|

|

$ |

12.14 |

|

|

$ |

10.27 |

|

|

| Average basic common

shares |

|

|

34,040,380 |

|

|

|

34,031,454 |

|

|

|

34,014,319 |

|

|

|

34,016,679 |

|

|

|

34,010,396 |

|

|

| Average diluted common

shares |

|

|

34,040,380 |

|

|

|

34,031,454 |

|

|

|

34,014,319 |

|

|

|

34,016,679 |

|

|

|

34,011,592 |

|

|

| Period end common

shares |

|

|

34,044,149 |

|

|

|

34,045,411 |

|

|

|

34,014,319 |

|

|

|

34,014,319 |

|

|

|

34,017,525 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| PERFORMANCE

RATIOS |

|

|

|

|

|

|

|

|

|

|

|

| Return on average

assets |

|

|

1.57 |

% |

|

|

1.47 |

% |

|

|

1.43 |

% |

|

|

1.44 |

% |

|

|

1.25 |

% |

|

| Return on average

equity |

|

|

15.81 |

% |

|

|

15.12 |

% |

|

|

15.12 |

% |

|

|

15.23 |

% |

|

|

13.24 |

% |

|

| Net interest margin

(fully taxable equivalent) |

|

|

3.54 |

% |

|

|

3.46 |

% |

|

|

3.37 |

% |

|

|

3.37 |

% |

|

|

3.34 |

% |

|

| Efficiency ratio |

|

|

55.23 |

% |

|

|

51.90 |

% |

|

|

57.16 |

% |

|

|

58.88 |

% |

|

|

62.43 |

% |

|

| Full-time equivalent

employees (period end) |

|

|

332 |

|

|

|

334 |

|

|

|

332 |

|

|

|

339 |

|

|

|

332 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| ASSET

QUALITY |

|

|

|

|

|

|

|

|

|

|

|

| Gross charge-offs |

|

$ |

157 |

|

|

$ |

1,179 |

|

|

$ |

30 |

|

|

$ |

30 |

|

|

$ |

97 |

|

|

| Net

charge-offs/(recoveries) |

|

$ |

(266 |

) |

|

$ |

776 |

|

|

$ |

(108 |

) |

|

$ |

(320 |

) |

|

$ |

(175 |

) |

|

| Net charge-offs to

average loans (annualized) |

|

|

-0.08 |

% |

|

|

0.23 |

% |

|

|

-0.03 |

% |

|

|

-0.10 |

% |

|

|

-0.05 |

% |

|

| Nonperforming

loans |

|

$ |

409 |

|

|

$ |

1,304 |

|

|

$ |

123 |

|

|

$ |

125 |

|

|

$ |

324 |

|

|

| Other real estate and

repossessed assets |

|

$ |

3,261 |

|

|

$ |

3,380 |

|

|

$ |

3,465 |

|

|

$ |

3,872 |

|

|

$ |

5,223 |

|

|

| Nonperforming loans to

total loans |

|

|

0.03 |

% |

|

|

0.09 |

% |

|

|

0.01 |

% |

|

|

0.01 |

% |

|

|

0.02 |

% |

|

| Nonperforming assets to

total assets |

|

|

0.19 |

% |

|

|

0.24 |

% |

|

|

0.19 |

% |

|

|

0.21 |

% |

|

|

0.30 |

% |

|

| Allowance for loan

losses |

|

$ |

16,892 |

|

|

$ |

16,876 |

|

|

$ |

16,803 |

|

|

$ |

16,695 |

|

|

$ |

16,675 |

|

|

| Allowance for loan

losses to total loans |

|

|

1.22 |

% |

|

|

1.20 |

% |

|

|

1.25 |

% |

|

|

1.26 |

% |

|

|

1.26 |

% |

|

| Allowance for loan

losses to nonperforming loans |

|

|

4130.07 |

% |

|

|

1293.18 |

% |

|

|

13660.98 |

% |

|

|

13356.00 |

% |

|

|

5146.60 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

CAPITAL |

|

|

|

|

|

|

|

|

|

|

|

| Average equity to

average assets |

|

|

9.93 |

% |

|

|

9.71 |

% |

|

|

9.47 |

% |

|

|

9.44 |

% |

|

|

9.42 |

% |

|

| Common equity tier 1 to

risk weighted assets (Consolidated) |

|

|

12.55 |

% |

|

|

12.01 |

% |

|

|

12.13 |

% |

|

|

11.83 |

% |

|

|

11.67 |

% |

|

| Tier 1 capital to

average assets (Consolidated) |

|

|

12.22 |

% |

|

|

12.12 |

% |

|

|

11.90 |

% |

|

|

11.91 |

% |

|

|

11.83 |

% |

|

| Total capital to

risk-weighted assets (Consolidated) |

|

|

16.14 |

% |

|

|

15.54 |

% |

|

|

15.79 |

% |

|

|

15.49 |

% |

|

|

15.36 |

% |

|

| Common equity tier 1 to

risk weighted assets (Bank) |

|

|

14.66 |

% |

|

|

14.09 |

% |

|

|

14.28 |

% |

|

|

14.01 |

% |

|

|

13.87 |

% |

|

| Tier 1 capital to

average assets (Bank) |

|

|

11.90 |

% |

|

|

11.78 |

% |

|

|

11.56 |

% |

|

|

11.58 |

% |

|

|

11.50 |

% |

|

| Total capital to

risk-weighted assets (Bank) |

|

|

15.73 |

% |

|

|

15.13 |

% |

|

|

15.36 |

% |

|

|

15.09 |

% |

|

|

14.96 |

% |

|

| Tangible common equity

to assets |

|

|

10.29 |

% |

|

|

9.67 |

% |

|

|

9.59 |

% |

|

|

9.60 |

% |

|

|

9.42 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| END OF PERIOD

BALANCES |

|

|

|

|

|

|

|

|

|

|

|

| Total portfolio

loans |

|

$ |

1,384,567 |

|

|

$ |

1,405,658 |

|

|

$ |

1,344,683 |

|

|

$ |

1,327,686 |

|

|

$ |

1,325,545 |

|

|

| Earning assets |

|

|

1,809,469 |

|

|

|

1,849,630 |

|

|

|

1,804,672 |

|

|

|

1,751,167 |

|

|

|

1,751,315 |

|

|

| Total assets |

|

|

1,925,880 |

|

|

|

1,975,124 |

|

|

|

1,919,273 |

|

|

|

1,872,541 |

|

|

|

1,863,780 |

|

|

| Deposits |

|

|

1,617,864 |

|

|

|

1,676,739 |

|

|

|

1,617,743 |

|

|

|

1,580,461 |

|

|

|

1,560,872 |

|

|

| Total shareholders'

equity |

|

|

197,966 |

|

|

|

190,853 |

|

|

|

183,976 |

|

|

|

179,714 |

|

|

|

175,376 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE

BALANCES |

|

|

|

|

|

|

|

|

|

|

|

| Total portfolio

loans |

|

$ |

1,399,464 |

|

|

$ |

1,363,548 |

|

|

$ |

1,325,268 |

|

|

$ |

1,327,408 |

|

|

$ |

1,314,838 |

|

|

| Earning assets |

|

|

1,833,924 |

|

|

|

1,806,229 |

|

|

|

1,799,600 |

|

|

|

1,756,909 |

|

|

|

1,730,576 |

|

|

| Total assets |

|

|

1,948,301 |

|

|

|

1,918,543 |

|

|

|

1,915,655 |

|

|

|

1,872,559 |

|

|

|

1,845,911 |

|

|

| Deposits |

|

|

1,646,268 |

|

|

|

1,618,861 |

|

|

|

1,614,151 |

|

|

|

1,575,408 |

|

|

|

1,537,376 |

|

|

| Total shareholders'

equity |

|

|

193,463 |

|

|

|

186,361 |

|

|

|

181,329 |

|

|

|

176,749 |

|

|

|

173,913 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Contact:

Jon Swets, CFO

616-494-7645

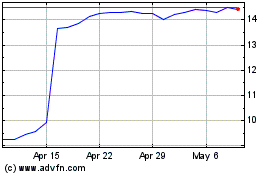

Macatawa Bank (NASDAQ:MCBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

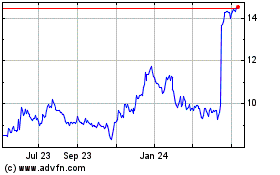

Macatawa Bank (NASDAQ:MCBC)

Historical Stock Chart

From Apr 2023 to Apr 2024