We are offering 26,666,667 of our ordinary shares,

par value $0.01 per share, together with warrants to purchase up to 26,666,667 of our ordinary shares, directly to several institutional

investors pursuant to this prospectus supplement, the accompanying prospectus, and that certain Securities Purchase Agreement, dated July

26, 2022, by and among Luokung Technology Corp. (the “Company”) and the institutional investors signatories thereto. The warrants

are exercisable immediately, at an exercise price of $0.41 per ordinary share, and expire five years from the date of issuance.

The ordinary shares and warrants will be sold together in units, each

consisting of one ordinary share and a warrant (to purchase one ordinary share for each ordinary share included in the unit). The purchase

price per unit will be $0.30. The ordinary shares and warrants will be issued separately but can only be purchased together in this offering.

The ordinary shares issuable from time to time pursuant to the exercise of the warrants, including the ordinary shares issuable from time

to time pursuant to the exercise of the warrant that we will issue to the Placement Agent (as defined below), as well as such warrants

that we will issue to the Placement Agent, are also being offered pursuant to this prospectus supplement and the accompanying prospectus.

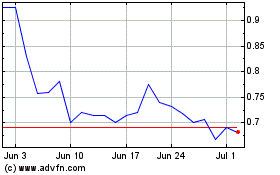

Our ordinary shares trade on the NASDAQ Capital

Market under the symbol “LKCO.” The last reported sale price of our ordinary shares on the NASDAQ Capital Market on July

25, 2022 was $0.40 per share. There is no established public trading market for the warrants that we are offering and we do not expect

a market to develop. For a more detailed description of the ordinary shares and the warrants, see the section entitled “Description

of the Securities we are Offering” beginning on page S-29 of this prospectus supplement.

As of July 26, 2022, the aggregate market value

of our outstanding ordinary shares held by non-affiliates was approximately $145.15 million based on 401,042,224 ordinary shares outstanding,

of which 38,156,430 shares were held by affiliates as of such date, and a price of $0.40 per share, which was the last reported sale

price of our ordinary shares as quoted on the NASDAQ Capital Market on July 25, 2022. Accordingly, we are not subject to the limitations

set forth in General Instruction I.B.5 of Form F-3.

We have retained FT Global Capital,

Inc. to act as exclusive placement agent (the “Placement Agent”) in connection with this offering. The Placement Agent has

agreed to use its reasonable best efforts to sell the securities offered by this prospectus supplement and the accompanying prospectus.

The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number

or dollar amount of securities. The Placement Agent will receive compensation in addition to the Placement Agent fees. We have also agreed

to issue warrants to purchase up to 800,000 ordinary shares to the Placement Agent, and to indemnify the Placement Agent. See “Plan

of Distribution” beginning on page S-31 of this prospectus supplement for more information regarding these arrangements.

We expect to deliver the securities offered pursuant

to this prospectus supplement on or about July 28, 2022.

FORWARD-LOOKING STATEMENTS

This prospectus supplement,

accompanying prospectus and the documents that we have filed with the SEC that are incorporated by reference in this prospectus supplement

contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and may involve material

risks, assumptions and uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,”

“will,” “should,” “believe,” “might,” “expect,” “anticipate,”

“intend,” “plan,” “estimate,” and similar words, although some forward-looking statements are expressed

differently.

Any forward-looking statements

contained in this prospectus supplement, accompanying prospectus and the documents that we have filed with the SEC that are incorporated

by reference in this prospectus supplement are only estimates or predictions of future events based on information currently available

to our management and management’s current beliefs about the potential outcome of future events. Whether these future events will

occur as management anticipates, whether we will achieve our business objectives, and whether our revenues, operating results, or financial

condition will improve in future periods are subject to numerous risks. There are a number of important factors that could cause actual

results to differ materially from the results anticipated by these forward-looking statements. These important factors include those

that we discuss under the heading “Risk Factors” and in other sections of our Annual Report on Form 20-F for the fiscal year

ended December 31, 2021, as well as in our other reports filed from time to time with the SEC that are incorporated by reference into

this prospectus supplement and the accompanying prospectus. You should read these factors and the other cautionary statements made in

this prospectus supplement, the accompanying prospectus and in the documents we incorporate by reference into this prospectus supplement

and the accompanying prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus

supplement or the documents we incorporate by reference into this prospectus supplement and the accompanying prospectus. If one or more

of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary

materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake

no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by law.

PROSPECTUS SUPPLEMENT SUMMARY

This summary is not complete

and does not contain all of the information that you should consider before investing in the securities offered by this prospectus. You

should read this summary together with the entire prospectus supplement and accompanying prospectus, including our risk factors (as provided

for herein and incorporated by reference), financial statements, the notes to those financial statements and the other documents that

are incorporated by reference in this prospectus supplement, before making an investment decision. You should carefully read the information

described under the heading “Where You Can Find More Information.” We have not authorized anyone to provide you with information

different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this

prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities.

Unless the context otherwise

requires, the terms “LKCO,” “the Company,” “we,” “us,” and “our” in this

prospectus each refer to Luokung Technology Corp., our subsidiaries, and our consolidated entities. “China” and the “PRC”

refer to the People’s Republic of China. “Zhong Chuan Shi Xun” or the “VIE” refer to Beijing Zhong Chuan

Shi Xun Technology Limited, the Company’s variable interest entity, unless otherwise indicated.

Overview

We

are a holding company and conduct our operations through our wholly-owned subsidiary named LK Technology Ltd., a British Virgin Islands

limited liability company (“LK Technology”), and its wholly-owned subsidiaries, MMB Limited and its respective subsidiaries,

which possess two core brands “Luokuang” and “SuperEngine”. “Luokuang” is a mobile application to

provide Business to Customer (B2C) location-based services and “SuperEngine” provides Business to Business (B2B) and Business

to Government (B2G) services in connection with spatial-temporal big data processing. In May 2010, we consummated an initial public offering

of our American Depository Shares, or ADSs, for gross proceeds of $16 million, and our ADSs were listed on the NASDAQ Capital Market

under the ticker symbol “KONE”. On August 17, 2018, we completed the transactions contemplated by the Asset Exchange Agreement

(“AEA”) with C Media Limited (“C Media”) entered into on January 25, 2018. On August 20, 2018, we changed our

name to Luokung Technology Corp., our American Depository Shares (“ADSs”) were voluntarily delisted from the NASDAQ Capital

Market on September 19, 2018 and on January 3, 2019 our ordinary shares started trading on NASDAQ under the ticker symbol “LKCO”.

We

are a spatial-temporal intelligent big data services company, as well as a provider of LBS and HD Maps for various industries in China.

Backed by our proprietary technologies and expertise in HD Maps and multi-sourced intelligent spatial-temporal big data, we established

city-level and industry-level holographic spatial-temporal digital twin systems and actively serves industries including smart transportation

with applications in autonomous driving, smart highway and vehicle-road collaboration, natural resource asset management, covering carbon

neutral and environmental protection remote sensing data service, and LBS smart industry applications, including mobile Internet LBS,

smart travel, smart logistics, new infrastructure, smart cities, emergency rescue, etc.

We

believe that road-to-vehicle coordination is the keystone for smart travel and autonomous driving in the future. Therefore, smart cars

require smart roads. We are actively deploying smart solutions for both vehicles and roads.

For

vehicles, we are supporting eMapgo’s position as an HD Map provider with continued investment in its technical R&D in the fields

of autonomous driving data services, simulation services, and full-cognition AI services with a goal of continuing to optimize, deepen

and expand services for automakers and top-tier autonomous driving firms. We believe we have led the development of the industry standard

for “Autonomous Driving HD Map Collection Element Model and Interaction Format”, and we expect that eMapgo will continue to

play an active role in setting industry standards in the near future.

For

roads, we are actively promoting smart road services based on its spatial-temporal digital base, including but not limited to HD Map-based

smart road AI digital base, 24/7 road hazard awareness, severe weather perception and other road information data perception service

systems and smart management platforms. With these efforts, Luokung aims to assist expressway operators in managing their digitized assets

more securely and efficiently and to achieve vehicle-to-road data communication where vehicles can digitally receive roadside information

that affects safety, convenience and comfort in real time. We are providing similar smart digital services for China’s new generation

smart transportation demonstration project-Changjiu Expressway, a project that showcases our respected position in the field of smart

highways.

Although

Luokung’s AI spatial-temporal big data services do not directly solve the issue of carbon emissions, we believe that our data service

helps policymakers, industry regulators and market service participants monitor real situation and data changes, in their efforts to

reduce carbon emissions and to serve as an important digital base for carbon emission trading. We believe that Luokung has established

China’s most powerful remote sensing data engine that integrates high-resolution remote sensing, HD maps and various IoT sensor data,

enabling us to launch the most efficient remote sensing data processing service. This offering addresses a broader market focus on industrial

applications in carbon emission, carbon neutrality, geographical resources, forestry resources, water resources, crops and others, a

marketplace we define as a carbon neutrality natural resource asset service business.

As

an LBS data services provider of information flow management and market services, the growth of the business is powered by its unified

platform capabilities to manage the whole life cycle market services from planning, ordering, fulfilling, conversion monitoring and reporting.

It can optimize the delivery effectiveness through account unification for different platforms and intelligent distribution among different

marketing channels, formats and creatives to achieve higher efficiency, lower cost and better performance, based on real time feedback

loop integrating delivery and result tracking.

On

August 17, 2018, we consummated an asset exchange transaction, pursuant to which we exchanged all issued and outstanding capital stock

in Topsky Info-Tech Holdings Pte Ltd., the parent of Softech, for the issued and outstanding capital stock of LK Technology (the “Asset

Exchange”). In connection with the Asset Exchange, we changed our name on August 20, 2018, and on September 20, 2018, issued to

the shareholders of C Media Limited, the former parent of LK Technology, (i) 185,412,599 of our ordinary shares, par value $0.01 per

share and (ii) 1,000,000 of our preferred shares. Upon the consummation of the Asset Exchange, we ceased our previous business operations

and became a company focused on the provision of location-based service and mobile application products for long distance rail travelers

in China.

On

August 25, 2018, LK Technology entered into a Stock Purchase Agreement (the “Agreement”) with the shareholders (“Shareholders”)

of Superengine Holding Limited, a limited liability company incorporated under the laws of the British Virgin Islands (the “Superengine”),

pursuant to which LK Technology acquired all of the issued and outstanding shares of Superengine for an aggregate purchase price of US$60

million (the “Purchase Price”), which was paid by the issuance of our Ordinary Shares in an amount equal to the quotient

of (x) the Purchase Price divided by (y) the average of the closing prices of the Ordinary Shares on the NASDAQ Capital Market over the

12 months period preceding July 31, 2018. We are a party to the Agreement in connection with the issuance of the Ordinary Shares and

certain other limited purposes.

On

August 28, 2019, the Company entered into a Share Purchase Agreement, pursuant to which the Company will acquire 100% of the equity interests

of Saleya Holdings Limited (“Saleya”) from Saleya’s shareholders for an aggregate purchase price of approximately $120

million. On March 17, 2021, the Company completed the acquisition of 100% equity interest in Saleya for a consideration of (i) a cash

amount of $102 million (RMB666 million), (ii) 9,819,926 LKCO ordinary shares and (iii) 1,500,310 LKCO preferred shares pursuant to a

supplemental agreement dated February 24, 2021. The main operating subsidiary, eMapgo Technologies (Beijing) Co., Ltd. is a provider

of navigation and electronic map services in China.

On

May 10, 2019 and November 6, 2020, the Company entered into a Stock Purchase Agreement and The Supplementary Agreement to Stock Purchase

Agreement with the shareholders of Botbrain AI Limited (“Botbrain”), a limited liability company incorporated under the laws

of the British Virgin Islands, pursuant to which the Company acquired 67.36% of the issued and outstanding shares of Botbrain for an

aggregate purchase price of $2.5 million (RMB 16.4 million), of which $1.5 million (RMB 9.6 million) was to be paid in cash to obtain

20% of Botbrain and the Company issued 1,789,618 ordinary shares to acquire the remaining 47.36% of Botbrain. The closing of the acquisition

was completed on December 4, 2020.

On

November 13, 2019, the Company entered into a Share Subscription Agreement with Geely Technology Group Co., Ltd. (“Geely Technology”)

to issue 21,794,872 series A preferred shares at a purchase price of $1.95 per share for an aggregate purchase price of $42,500,000.

Per the terms of the agreement, the Company recognized $32,910,257 as a loan. The Company received $21,743,857 as of December 31, 2019

and the remaining amount was received in January 2020. Geely Technology may request the repayment after November 2020, under such circumstance,

the Company shall pay it back in January of 2021. On December 24, 2020, Geely Technology sent a notice of redemption. The Company is

in negotiation for an extension with Geely Technology.

On

November 13, 2019, the Company entered into a Securities Purchase Agreement with Acuitas Capital, LLC. and a Warrant to purchase the

Company’s ordinary shares pursuant to which the Purchaser subscribed to purchase up to $100,000,000 of units with up to a $10,000,000

subscription at each closing, with each Unit consisting of one ordinary share and one warrant, where each whole warrant entitles the

holder to purchase one ordinary share. The Securities Purchase Agreement contemplates periodic closings of $10,000,000. On July 16, 2020,

the Company held the first closing pursuant to the Purchase Agreement and received $10,000,000. The Purchaser had received 7,763,975

ordinary shares on November 13, 2019 in consideration for such $10,000,000. The Purchaser also exercised the Warrant and received 15,897,663

ordinary shares upon the exercise of the Warrant. On December 31, 2020, the Purchase Agreement has been terminated.

On

August 10, 2020, the Company entered into a cooperation framework agreement with Nanjing Antong Meteorological Data Limited (“Nanjing

Antong”) and Nanjing Weida Electronic Technology Co., Ltd. (“Nanjing Weida”), pursuant to which the Company would invest

$153,000 (RMB 1 million) each to Nanjing Antong and Nanjing Weida in order to establish a joint venture with Nanjing Antong. On August

27, 2020, the joint venture was established, SuperEngine, eMapgo Technologies (Beijing) Co., Ltd. (“EMG”) and Nanjing Antong

hold 50%, 20% and 30% of equity of interest, respectively. The joint venture engages in real-time traffic information services for China’s

high-class highways, urban roads, urban and rural roads, as well as expressway data and travel value-added services.

VIE Arrangements with Beijing Zhong Chuan Shi Xun Technology Limited’s

Subsidiaries and Their Respective Shareholders

To comply with the PRC

legal restrictions on foreign ownership of companies that operate mobile application services, our subsidiaries operate in such

restricted service areas in the PRC through certain PRC domestic companies, whose equity interests are held by certain management

members or founders of LK Technology Ltd. Part of the registered capital of these PRC domestic companies was funded by certain

management members or founders of LK Technology Ltd. LK Technology Ltd., through its subsidiary Shenzhen Luokuang Technology Limited

previously known as Zhong Chuan Tian Xia Information and Technology (Shenzhen) Limited (the “WFOE”), has entered into an

exclusive business cooperation agreement with Beijing Zhong Chuan Shi Xun Technology Limited (“Zhong Chuan Shi Xun” or,

for purposes of this section, the “VIE”) the PRC domestic company, which entitle the WFOE to receive a majority of the

profit of Zhong Chuan Shi Xun. In addition, Shenzhen Luokuang Technology Limited has entered into certain agreements with those

management members or founders, including an equity interest pledge agreement of the equity interests held by those management

members or founders and an exclusive option agreement to acquire the equity interests in these companies when permitted by the PRC

laws, rules and regulations. Details of the typical VIE structure of our significant consolidated VIEs, primarily domestic companies

associated with the operations such as Zhong Chuan Shi Xun and its subsidiaries of Jiangsu Zhong Chuan Rui You Information and

Technology Limited (“Zhong Chuan Rui You”), Huoerguosi Luokuang Information and Technology Limited (“Huoerguosi

Luokuang”) and Shenzhen Jiu Zhou Shi Dai Digital and Technology Limited (“Jiu Zhou Shi Dai”), are set forth

below:

Exclusive Business Cooperation Agreement

The VIE has entered into an exclusive business

services agreement with the WFOE, pursuant to which the WFOE provides exclusive business services to the VIE. In exchange, the VIE pays

a service fee to the WFOE which typically amounts to what would be substantially all of the VIE’s pre-tax profit, resulting in

a transfer of substantially all of the profits from the VIE to the WFOE.

Exclusive Option Agreement

The VIE equity holders have granted the WFOE exclusive

call options to purchase their equity interest in the VIE at an exercise price equal to the minimum price as permitted by applicable

PRC laws. The WFOE may nominate another entity or individual to purchase the equity interest, if applicable, under the call options.

Each call option is exercisable subject to the condition that applicable PRC laws, rules and regulations do not prohibit completion of

the transfer of the equity interest pursuant to the call option. The VIE agrees not to distribute any dividends to the VIE equity holders

without the approval of WFOE.

Equity Interest Pledge Agreement

Pursuant to the equity pledge agreement, the VIE

equity holders have pledged all of their interests in the equity of the VIE as a continuing first priority security interest in favor

of the WFOE to secure the performance of obligations by the VIE and/or the equity holders under the exclusive business cooperation agreement.

The WFOE is entitled to exercise its right to dispose of the VIE equity holders’ pledged interests in the equity of the VIE and

has priority in receiving payment by the application of proceeds from the auction or sale of such pledged interests, in the event of

any breach or default under the exclusive business cooperation agreement, if applicable. These equity pledge agreements remain in force

until all the obligations under the exclusive business cooperation agreement have been fulfilled.

The exclusive business cooperation agreement and

equity interest pledge agreement described above also enable the Company to receive substantially all of the economic benefits from the

VIE by typically entitling the WFOE to all dividends and other distributions declared by the VIE and to any distributions or proceeds

from the disposal by the VIE equity holders of their equity interests in the VIE.

There are a number of uncertainties regarding

the status of the rights of the British Virgin Islands holding company with respect to its contractual arrangements with the VIE, its

founders and owners, including whether the PRC legal system could limit our ability to enforce these contractual agreements due to uncertainties

under Chinese law and jurisdictional limits.

Power of Attorney

As

for Zhong Chuan Shi Xun and Beijing Botbrain, pursuant to the relevant power of attorney, each of the relevant VIE equity holders irrevocably

appoints the corresponding WFOE as its attorney-in-fact to exercise on its behalf any and all rights that such equity holder has in respect

of its nominal equity interests in relevant VIE conferred by relevant laws and regulations and the articles of association of such VIE.

The power of attorney shall remain effective as long as such VIE equity holder remain as a shareholder of Zhong Chuan Shi Xun or Beijing

Botbrain.

As

for EMG, pursuant to the relevant power of attorney, the relevant VIE equity holder irrevocably appoints certain person designated by

the corresponding WFOE as its attorney-in-fact to exercise on its behalf any and all rights that such equity holder has in respect of

its nominal equity interest in relevant VIE conferred by relevant laws and regulations and the articles of association of such VIE. The

power of attorney of EMG shall remain effective until March 11, 2044, which will be renewed automatically for another ten (10) years

unless the parties to the power of attorney agree otherwise.

The VIE arrangements with eMapgo Technologies (Beijing) Co., Ltd.

(“EMG”) and its shareholders

Applicable PRC laws and regulations prohibit foreign

investors from (i) holding a majority equity interest in PRC surveying and mapping companies, (ii) holding equity interest in PRC companies

engaging in the production of digital navigation maps and aerial photogrammetry, and (iii) holding a majority equity interest in PRC

companies providing internet content or other value-added telecommunication services or internet map services. As a British Virgin Islands

corporation, the Company is deemed a foreign legal person under PRC law. Accordingly, the Company’s wholly owned subsidiary DMG

Infotech Co., Ltd. (“DMG”), as a foreign-invested company, is currently ineligible to engage in the aforementioned business

in the PRC.

The Company therefore conducts substantially all

of its spatial-temporal big data processing activities through EMG (for purposes of this section, the “VIE”) in the PRC.

To provide the Company with the power to control and the ability to receive the majority of the expected residual returns of the VIE,

DMG entered into a series of contractual arrangements with EMG on November 1, 2006.

Agreements that transfer economic benefits to DMG

Exclusive Business Cooperation Agreement. DMG

and the VIE entered into an Exclusive Business Cooperation Agreement on November 1, 2006. Pursuant to this cooperation agreement, the

VIE engages DMG as VIE’s exclusive service provider to provide the VIE with business support and technical and consulting services

during the term of the cooperation agreement, in accordance with the terms and conditions of this cooperation agreement, which may include

all services within the business scope of DMG, including, without limitation, technical services, business consultations, license of

intellectual property rights, equipment or property leasing, sales, marketing, system integration, product research and development,

systems maintenance and such other services necessary and desirable to the successful operation of VIE as may be determined in DMG’s

sole discretion. There is no limit on the amount of services DMG can potentially provide to the VIE. Since the senior management teams

of the VIE and those of DMG are all assigned by the Company, the agreement effectively entitles DMG to charge the VIE service fees that

amount to substantially all of the net income of VIE. The term of this agreement is 10 years and shall be extended automatically unless

a notice of termination is sent in writing by DMG prior to the expiration. DMG may terminate the agreement at any time by providing 30

days’ prior written notice to the VIE. The Exclusive Business Cooperation Agreement was re-signed on February 27, 2008 and March

24, 2021 respectively with the VIE arrangement unchanged. The term of the newest Exclusive Business Cooperation Agreement is extended

to March 11, 2044 and shall be automatically extended 10 years unless a notice of termination is sent in writing by DMG prior to the

expiration. The automatic renewal scheme remains effective so long as DMG does not send a written notice to terminate the cooperation

agreement prior to the expiration.

Equity Pledge Agreements. DMG and

the shareholders of the VIE entered into equity pledge agreements on November 1, 2006. Pursuant to the equity pledge agreements, the

shareholders of the VIE pledge all of their equity interests in the VIE to DMG to guarantee the VIE’s performance of its obligations

under the exclusive business cooperation agreements. If the VIE breaches its contractual obligations under those agreements, DMG, as

pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. The shareholders of the VIE agree

that, without prior written consent of DMG, they will not dispose of the pledged equity interests or create or allow any encumbrance

on the pledged equity interests that would prejudice DMG’s interest. During the term of the equity pledge agreements, DMG is entitled

to receive all the dividends paid on the pledged equity interests. The equity pledge agreement will expire when the VIE has fully performed

its obligations under the exclusive business cooperation agreement. The equity pledge agreements were re-signed on February 27, 2008,

October 15, 2010, March 18, 2018, and March 24, 2021 respectively due to changes of shareholders of the VIE.

Agreements that provide DMG effective control over the VIE

Proxy Agreements. The shareholders

of the VIE signed a proxy agreement on March 27, 2008 appointing Mr. Zhigang Wang, CEO of DMG, or any person subsequently designated

by DMG as its attorney-in-fact to vote on their behalf on all matters of the VIE requiring shareholder approval under PRC laws and regulations

and the articles of association of the VIE. The proxy agreement will remain in force until the shareholders of the VIE are instructed

by DMG to designate another PRC citizen to be the shareholders’ attorney-in-fact. The shareholders of the VIE re-signed proxy agreements

on October 15, 2010 and March 18, 2018, respectively, appointing Mr. Zhixun Wang, legal representative of the VIE, or any person subsequently

designated by DMG as its attorney-in-fact to vote on their behalf on all matters of the VIE requiring shareholder approval under PRC

laws and regulations and the articles of association of the VIE. The shareholders of the VIE re-signed a proxy agreement on March 24,

2021 appointing Mr. Jian Zhang, legal representative of the VIE, or any person subsequently designated by DMG as its attorney-in-fact

to vote on their behalf on all matters of the VIE requiring shareholder approval under PRC laws and regulations and the articles of association

of the VIE.

The articles of association of the VIE state that

the major rights of the shareholders include the power to review and approve the annual budget, operating strategy and investment plan,

elect the members of the board of directors and approve their compensation plan. Therefore, through the irrevocable power of attorney

arrangement, DMG has the ability to exercise effective control over the VIE through shareholder votes and, through such votes, to also

control the composition of the board of directors and thus appoint the senior management of the VIE.

Exclusive Call Option Agreements. DMG,

the VIE and the shareholders of the VIE signed exclusive call option agreements on November 1, 2006, March 27, 2008, October 15, 2010,

March 18, 2018, and March 24, 2021 respectively. Pursuant to the exclusive call option agreements, the VIE’s shareholders irrevocably

grant DMG an exclusive option to purchase, or cause a person designated by it to purchase, to the extent permitted under PRC law, all

or part of the equity interests in the VIE. The purchase price would be the legally allowed minimum amount. DMG has sole discretion to

decide when to exercise the option, whether in part or in full. The term of the agreement will not expire unless all of the equity interests

in the VIE has been purchased by DMG, or by persons or entities designated by DMG. Through the exclusive call option agreements, each

of VIE’s shareholders irrevocably granted DMG an exclusive right to acquire, at any time, for its own account or through one or

more PRC individuals or entities as nominee shareholders of its choice to replace the existing shareholders of the VIE, which constitutes

a substantive kick-out right that is exercisable and enforceable under current PRC laws and regulations. This kick-out right reinforces

DMG’s ability to direct the activities that most significantly impact the VIE’s economic performance.

As a result of these contractual arrangements,

the Company, through its wholly owned subsidiary, DMG, has (1) the power to direct the activities of the VIE that most significantly

affect the entity’s economic performance and (2) the right to receive benefits from the VIE. Consequently, DMG, ultimately the

Company, is the primary beneficiary of the VIE and the Company has consolidated the financial results of the VIE in its financial statements

since the later of the date of inception or acquisition.

In concluding that the Company is the primary

beneficiary of the VIE, the Company believes that the powers of attorney are valid, binding and enforceable under existing PRC laws and

regulations and enable the Company, through DMG, to vote on all matters requiring shareholder approval for the VIE. In addition, the

Company believes that the exclusive call option agreements provide the Company, through DMG, with a substantive kick-out right. More

specifically, the terms of the exclusive call option agreements are exercisable and enforceable under current PRC laws and regulations,

and the minimum amount of consideration permitted by the applicable PRC law to exercise the purchase option does not represent a financial

barrier or disincentive for the Company, through DMG, to exercise the purchase option. The Company’s rights under the powers of

attorney and the exclusive call option agreements provide the Company with control over the shareholders of the VIE and thus provide

the Company with the power to direct the activities that most significantly impact VIE’s economic performance. The Company believes

that this ability to exercise control together with the equity pledge agreements ensure that the VIE will continue to execute and renew

the exclusive business cooperation agreement and pay related service and license fees to DMG and that accordingly the Company, through

its wholly owned subsidiary, DMG, has the rights to receive the economic benefits from the VIE.

Corporate Structure

Cash Flows through Our Organization

Luokung Technology Corp.

is a holding company with no operations of its own. We conduct our operations in China primarily through our subsidiaries and consolidated

affiliated entities in China. As a result, although other means are available for us to obtain financing at the holding company level,

Luokung Technology Corp.’s ability to pay dividends to the shareholders and to service any debt it may incur may depend upon dividends

paid by our PRC subsidiaries and service fees paid by our PRC consolidated affiliated entities. If any of our subsidiaries incurs debt

on its own behalf, the instruments governing such debt may restrict its ability to pay dividends to Luokung Technology Corp. In addition,

our PRC subsidiaries are permitted to pay dividends to Luokung Technology Corp. only out of their retained earnings, if any, as determined

in accordance with applicable accounting standards and regulations. Further, our PRC subsidiaries and consolidated affiliated entities

are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which

are not distributable as cash dividends except in the event of a solvent liquidation of the companies.

Under PRC laws and regulations, our PRC subsidiaries

and consolidated affiliated entities are subject to certain restrictions with respect to paying dividends or otherwise transferring any

of their net assets to us. Remittance of dividends by a wholly foreign-owned enterprise out of China is also subject to review by the

banks designated by State Administration of Foreign Exchange, or SAFE. The amounts restricted include the paid-up capital and

the statutory reserve funds of our PRC subsidiaries and the net assets of our consolidated affiliated entities in which we have no legal

ownership.

The following is the tabular

form condensed consolidating schedule depicting the financial position, cash flows and results of operations for the parent, the consolidated

variable interest entity, and any consolidation adjustments separately - as of and for the years ending December 31, 2021, 2020 and 2019.

| Consolidating Statements of Income Information | |

| | |

| | |

| | |

| | |

| |

| | |

Year ended December 31, 2021 | |

| | |

Parent | | |

Subsidiaries | | |

VIE and its subsidiary | | |

Consolidation

Adjustments | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| - | | |

| (2,121,185 | ) | |

| 171,503,642 | | |

| (24,314,492 | ) | |

| 145,067,965 | |

| Cost of Revenue | |

| 300,000 | | |

| (48,673 | ) | |

| 131,315,543 | | |

| (2,540,784 | ) | |

| 129,026,086 | |

| Gross profit (loss) | |

| (300,000 | ) | |

| (2,072,512 | ) | |

| 40,188,099 | | |

| (21,773,708 | ) | |

| 16,041,879 | |

| Operating expenses | |

| 29,415,319 | | |

| 37,189,215 | | |

| 21,074,461 | | |

| (6,018,545 | ) | |

| 81,660,450 | |

| Loss from operations | |

| (29,715,319 | ) | |

| (39,261,727 | ) | |

| 19,113,638 | | |

| (15,755,163 | ) | |

| (65,618,571 | ) |

| Other expenses, net | |

| 3,139 | | |

| (155,581 | ) | |

| (3,836,228 | ) | |

| 9,919 | | |

| (3,978,751 | ) |

| Provision for income tax | |

| - | | |

| - | | |

| (9,665 | ) | |

| 8,136,002 | | |

| 8,126,337 | |

| Loss before noncontrolling interest | |

| (29,712,180 | ) | |

| (39,417,308 | ) | |

| 15,267,745 | | |

| (7,609,242 | ) | |

| (61,470,985 | ) |

| Less: loss attributable to noncontrolling interest | |

| - | | |

| - | | |

| (7,330,267 | ) | |

| - | | |

| (7,330,267 | ) |

| Net loss | |

| (29,712,180 | ) | |

| (39,417,308 | ) | |

| 7,937,478 | | |

| (7,609,242 | ) | |

| (68,801,252 | ) |

| | |

Year ended December 31, 2020 | |

| | |

Parent | | |

Subsidiaries | | |

VIE and its subsidiary | | |

Consolidation

Adjustments | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| - | | |

| - | | |

| 22,268,378 | | |

| (4,004,590 | ) | |

| 18,263,788 | |

| Cost of Revenue | |

| - | | |

| - | | |

| 17,479,479 | | |

| - | | |

| 17,479,479 | |

| Gross profit (loss) | |

| - | | |

| - | | |

| 4,788,899 | | |

| (4,004,590 | ) | |

| 784,309 | |

| Operating expenses | |

| 1,575,656 | | |

| 8,956,033 | | |

| 13,157,614 | | |

| 17,345,859 | | |

| 41,035,162 | |

| Loss from operations | |

| (1,575,656 | ) | |

| (8,956,033 | ) | |

| (8,368,715 | ) | |

| (21,350,449 | ) | |

| (40,250,853 | ) |

| Other expenses, net | |

| 13,582 | | |

| 161,076 | | |

| 141,014 | | |

| (121,784 | ) | |

| 193,888 | |

| Provision for income tax | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Loss before noncontrolling interest | |

| (1,562,074 | ) | |

| (8,794,957 | ) | |

| (8,227,701 | ) | |

| (21,472,233 | ) | |

| (40,056,965 | ) |

| Less: loss attributable to noncontrolling interest | |

| - | | |

| - | | |

| 191,325 | | |

| - | | |

| 191,325 | |

| Net loss | |

| (1,562,074 | ) | |

| (8,794,957 | ) | |

| (8,036,376 | ) | |

| (21,472,233 | ) | |

| (39,865,640 | ) |

| | |

Year ended December 31, 2019 | |

| | |

Parent | | |

Subsidiaries | | |

VIE and its subsidiary | | |

Consolidation

Adjustments | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| - | | |

| - | | |

| 21,346,211 | | |

| (2,567,039 | ) | |

| 18,779,172 | |

| Cost of Revenue | |

| - | | |

| - | | |

| 14,976,016 | | |

| - | | |

| 14,976,016 | |

| Gross profit (loss) | |

| - | | |

| - | | |

| 6,370,195 | | |

| (2,567,039 | ) | |

| 3,803,156 | |

| Operating expenses | |

| 1,830,076 | | |

| 8,520,981 | | |

| 22,302,997 | | |

| 2,665,866 | | |

| 35,319,921 | |

| Loss from operations | |

| (1,830,076 | ) | |

| (8,520,981 | ) | |

| (15,932,802 | ) | |

| (5,232,905 | ) | |

| (31,516,765 | ) |

| Other expenses, net | |

| (7,989 | ) | |

| (185,204 | ) | |

| 542,810 | | |

| (855,055 | ) | |

| (505,438 | ) |

| Provision for income tax | |

| - | | |

| - | | |

| 70,992 | | |

| - | | |

| 70,992 | |

| Loss before noncontrolling interest | |

| (1,838,065 | ) | |

| (8,706,185 | ) | |

| (15,319,000 | ) | |

| (6,087,960 | ) | |

| (31,951,211 | ) |

| Less: loss attributable to noncontrolling interest | |

| - | | |

| - | | |

| 438,033 | | |

| - | | |

| 438,033 | |

| Net loss | |

| (1,838,065 | ) | |

| (8,706,185 | ) | |

| (14,880,967 | ) | |

| (6,087,960 | ) | |

| (31,513,178 | ) |

| Consolidating Balance Sheets Information | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Year ended December 31, 2021 | |

| | |

Parent | | |

Subsidiaries | | |

VIE and its subsidiary | | |

Consolidation

Adjustments | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| |

| Cash | |

| 5,655,725 | | |

| 6,670,647 | | |

| 4,468,891 | | |

| - | | |

| 16,795,263 | |

| Accounts receivable | |

| - | | |

| (4,996,556 | ) | |

| 39,240,616 | | |

| (20,440,693 | ) | |

| 13,803,367 | |

| Other current asset | |

| 80,544,830 | | |

| 65,027,240 | | |

| 63,223,526 | | |

| (181,668,212 | ) | |

| 27,127,384 | |

| Total current asset | |

| 86,200,555 | | |

| 66,701,331 | | |

| 106,933,033 | | |

| (202,108,905 | ) | |

| 57,726,014 | |

| Property and equipment, net | |

| - | | |

| 943,401 | | |

| 4,639,079 | | |

| - | | |

| 5,582,480 | |

| Intangible asset, net | |

| - | | |

| - | | |

| 449,320 | | |

| 102,435,697 | | |

| 102,885,017 | |

| Right of use asset, net | |

| - | | |

| 1,228,469 | | |

| 3,256,374 | | |

| - | | |

| 4,484,843 | |

| Other-non-current asset | |

| 66,059,641 | | |

| 61,687,704 | | |

| 63,974,874 | | |

| (97,211,714 | ) | |

| 94,510,505 | |

| Total Non-current asset | |

| 66,059,641 | | |

| 63,859,574 | | |

| 72,319,647 | | |

| 5,223,983 | | |

| 207,462,845 | |

| Total Asset | |

| 152,260,196 | | |

| 130,560,905 | | |

| 179,252,680 | | |

| (196,884,922 | ) | |

| 265,188,859 | |

| Accounts payable | |

| - | | |

| 21,767,415 | | |

| 23,652,117 | | |

| (36,226,913 | ) | |

| 9,192,619 | |

| Lease liability | |

| - | | |

| 463,332 | | |

| 983,491 | | |

| - | | |

| 1,446,823 | |

| Other current liabilities | |

| 530,238 | | |

| 98,265,875 | | |

| 149,931,485 | | |

| (157,658,534 | ) | |

| 91,069,064 | |

| Total current liabilities | |

| 530,238 | | |

| 120,496,622 | | |

| 174,567,093 | | |

| (193,885,447 | ) | |

| 101,708,506 | |

| Lease liability-NC | |

| - | | |

| 804,303 | | |

| 2,260,054 | | |

| - | | |

| 3,064,357 | |

| Other non-current liabilities | |

| - | | |

| - | | |

| 941,073 | | |

| 5,626,921 | | |

| 6,567,994 | |

| Total non-current liabilities | |

| - | | |

| 804,303 | | |

| 3,201,127 | | |

| 5,626,921 | | |

| 9,632,351 | |

| Total liabilities | |

| 530,238 | | |

| 121,300,925 | | |

| 177,768,220 | | |

| (188,258,526 | ) | |

| 111,340,857 | |

| Accumulated deficit | |

| (34,074,308 | ) | |

| (129,796,725 | ) | |

| (78,586,946 | ) | |

| 59,747,703 | | |

| (182,710,276 | ) |

| Other equity | |

| 185,804,266 | | |

| 139,056,705 | | |

| 80,071,406 | | |

| (68,374,099 | ) | |

| 336,558,278 | |

| Total equity | |

| 151,729,958 | | |

| 9,259,980 | | |

| 1,484,460 | | |

| (8,626,396 | ) | |

| 153,848,002 | |

| Total Liability and stockholders’ equity | |

| 152,260,196 | | |

| 130,560,905 | | |

| 179,252,680 | | |

| (196,884,922 | ) | |

| 265,188,859 | |

| | |

Year ended December 31, 2020 | |

| | |

Parent | | |

Subsidiaries | | |

VIE and its subsidiary | | |

Consolidation

Adjustments | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| |

| Cash | |

| - | | |

| 17,366 | | |

| 54,427 | | |

| - | | |

| 71,793 | |

| Accounts receivable | |

| - | | |

| - | | |

| 23,177,923 | | |

| (19,196,981 | ) | |

| 3,980,942 | |

| Other current asset | |

| 21,421 | | |

| 60,750,751 | | |

| 80,963,861 | | |

| (133,739,655 | ) | |

| 7,996,378 | |

| Total current asset | |

| 21,421 | | |

| 60,768,117 | | |

| 104,196,211 | | |

| (152,936,636 | ) | |

| 12,049,113 | |

| Property and equipment, net | |

| - | | |

| 16,421 | | |

| 497,942 | | |

| - | | |

| 514,363 | |

| Intangible asset, net | |

| - | | |

| - | | |

| 414,989 | | |

| 42,301,605 | | |

| 42,716,594 | |

| Right of use asset, net | |

| - | | |

| 210,239 | | |

| 159,508 | | |

| - | | |

| 369,747 | |

| Other-non-current asset | |

| - | | |

| 9,569,825 | | |

| 11,158,142 | | |

| 52,805,090 | | |

| 73,533,057 | |

| Total Non-current asset | |

| - | | |

| 9,796,485 | | |

| 12,230,581 | | |

| 95,106,695 | | |

| 117,133,761 | |

| Total Asset | |

| 21,421 | | |

| 70,564,602 | | |

| 116,426,792 | | |

| (57,829,941 | ) | |

| 129,182,874 | |

| Accounts payable | |

| - | | |

| 20,638,035 | | |

| 20,656,467 | | |

| (35,452,991 | ) | |

| 5,841,511 | |

| Lease liability | |

| - | | |

| 191,099 | | |

| 145,438 | | |

| - | | |

| 336,537 | |

| Other current liabilities | |

| 4,089,281 | | |

| 36,742,660 | | |

| 107,596,720 | | |

| (80,993,571 | ) | |

| 67,435,090 | |

| Total current liabilities | |

| 4,089,281 | | |

| 57,571,794 | | |

| 128,398,625 | | |

| (116,446,562 | ) | |

| 73,613,138 | |

| Lease liability-NC | |

| | | |

| | | |

| | | |

| - | | |

| | |

| Other non-current liabilities | |

| - | | |

| - | | |

| - | | |

| 2,875,631 | | |

| 2,875,631 | |

| Total non-current liabilities | |

| - | | |

| - | | |

| - | | |

| 2,875,631 | | |

| 2,875,631 | |

| Total liabilities | |

| 4,089,281 | | |

| 57,571,794 | | |

| 128,398,625 | | |

| (113,570,931 | ) | |

| 76,488,769 | |

| Accumulated deficit | |

| (4,172,799 | ) | |

| (51,352,319 | ) | |

| (40,856,100 | ) | |

| (16,861,294 | ) | |

| (113,242,512 | ) |

| Other equity | |

| 104,939 | | |

| 64,345,127 | | |

| 28,884,267 | | |

| 72,602,284 | | |

| 165,936,617 | |

| Total equity | |

| (4,067,860 | ) | |

| 12,992,808 | | |

| (11,971,833 | ) | |

| 55,740,990 | | |

| 52,694,105 | |

| Total Liability and stockholders’ equity | |

| 21,421 | | |

| 70,564,602 | | |

| 116,426,792 | | |

| (57,829,941 | ) | |

| 129,182,874 | |

Consolidating Cash Flows Information

| | |

Year ended December 31, 2021 | |

| | |

Parent | | |

Subsidiaries | | |

VIE | | |

Elimination | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| |

| Net cash (used in)/provided by operation activities | |

| (86,208,510 | ) | |

| 18,418,485 | | |

| 15,901,191 | | |

| (1,899,125 | ) | |

| (53,787,959 | ) |

| Net cash (used in)/provided by investing activities | |

| (72,449,477 | ) | |

| (52,735,367 | ) | |

| (13,978,334 | ) | |

| 60,766,693 | | |

| (78,396,485 | ) |

| Net cash (used in)/provided by financing activities | |

| 164,103,934 | | |

| 40,474,282 | | |

| 4,696,253 | | |

| (60,363,735 | ) | |

| 148,910,734 | |

| Effect of exchange rate changes on cash | |

| 209,778 | | |

| 102,830 | | |

| (1,591,543 | ) | |

| 1,276,116 | | |

| (2,820 | ) |

| Net increase in cash and cash equivalents | |

| 5,655,725 | | |

| 6,260,229 | | |

| 5,027,567 | | |

| (220,051 | ) | |

| 16,723,470 | |

| | |

Year ended December 31, 2020 | |

| | |

Parent | | |

Subsidiaries | | |

VIE | | |

Elimination | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| |

| Net cash (used in)/provided by operation activities | |

| 21 | | |

| (4,229,760 | ) | |

| (11,651,021 | ) | |

| 56,952 | | |

| (15,823,808 | ) |

| Net cash (used in)/provided by investing activities | |

| - | | |

| (19,237,128 | ) | |

| (4,817,894 | ) | |

| 4,673,626 | | |

| (19,381,396 | ) |

| Net cash (used in)/provided by financing activities | |

| (21 | ) | |

| 21,430,816 | | |

| 14,964,574 | | |

| (4,856,951 | ) | |

| 31,538,418 | |

| Effect of exchange rate changes on cash | |

| - | | |

| 25,684 | | |

| 17,207 | | |

| - | | |

| 42,891 | |

| Net increase in cash and cash equivalents | |

| - | | |

| (2,010,388 | ) | |

| (1,487,134 | ) | |

| (126,373 | ) | |

| (3,623,895 | ) |

| | |

Year ended December 31, 2019 | |

| | |

Parent | | |

Subsidiaries | | |

VIE | | |

Elimination | | |

Consolidated | |

| Net cash (used in)/provided by operation activities | |

| 49 | | |

| (5,396,893 | ) | |

| (11,256,732 | ) | |

| (1,609,968 | ) | |

| (18,263,544 | ) |

| Net cash (used in)/provided by investing activities | |

| - | | |

| (14,626,876 | ) | |

| (1,669,990 | ) | |

| 1,669,990 | | |

| (14,626,876 | ) |

| Net cash (used in)/provided by financing activities | |

| (49 | ) | |

| 21,397,864 | | |

| 14,168,216 | | |

| (125,778 | ) | |

| 35,440,252 | |

| Effect of exchange rate changes on cash | |

| - | | |

| (26,970 | ) | |

| (16,798 | ) | |

| (2,595 | ) | |

| (46,363 | ) |

| Net increase in cash and cash equivalents | |

| - | | |

| 1,347,125 | | |

| 1,224,696 | | |

| (68,352 | ) | |

| 2,503,469 | |

Chinese Regulatory Developments

We

conduct all of our business through our subsidiaries in China. Our operations in China are governed by PRC laws and regulations. Our PRC

subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws and regulations

applicable to wholly foreign-owned enterprises. The PRC legal system is based on statutes. Prior court decisions may be cited for reference

but have limited precedential value.

The

recent regulatory developments in China, in particular with respect to restrictions on China-based companies raising capital offshore,

may lead to additional regulatory review in China over our financing and capital raising activities in the United States. In addition,

we may be subject to industry-wide regulations that may be adopted by the relevant PRC authorities, which may have the effect of limiting

our service offerings, restricting the scope of our operations in China, or causing the suspension or termination of our business operations

in China entirely, all of which will materially and adversely affect our business, financial condition and results of operations. We may

have to adjust, modify, or completely change our business operations in response to adverse regulatory changes or policy developments,

and we cannot assure you that any remedial action adopted by us can be completed in a timely, cost-efficient, or liability-free manner

or at all.

On

July 30, 2021, in response to the recent regulatory developments in China and actions adopted by the PRC government, the Chairman of the

SEC issued a statement asking the SEC staff to seek additional disclosures from offshore issuers associated with China-based operating

companies before their registration statements will be declared effective. On August 1, 2021, the China Securities Regulatory Commission

(the “CSRC”) stated in a statement that it had taken note of the new disclosure requirements announced by the SEC regarding

the listings of Chinese companies and the recent regulatory development in China, and that both countries should strengthen communications

on regulating China-related issuers. To the best knowledge of this Company, as of the date of this prospectus supplement, current Chinese laws

and regulations do not forbid us from issuing securities overseas. On December 24, 2021, the CSRC published draft regulations on domestic

enterprises issuing securities and being listed overseas. According to the draft regulations, it will become compulsory for all relevant

Chinese enterprises to register their overseas listing activities with the CSRC, and enterprises will be required to undertake the primary

responsibilities of providing reliable information and ensuring their overseas listing activities meet relevant rules and laws at home

and overseas. We will file required documentation once the final regulation is published by CSRC. We cannot guarantee that we will not

be subject to tightened regulatory review and we could be exposed to government interference in China.

Since

1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in

China. However, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently

cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of

the limited volume of published decisions and their nonbinding nature, the interpretation and enforcement of these laws and regulations

involve uncertainties. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are

not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these

policies and rules until some time after the violation. In addition, any litigation in China may be protracted and result in substantial

costs and diversion of resources and management attention.

The

Holding Foreign Companies Accountable Act, or the HFCAA, was enacted on December 18, 2020. The HFCAA states if the SEC determines that we

have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three

consecutive years beginning in 2021, the SEC shall prohibit our shares from being traded on a national securities exchange or in the over-the-counter trading

market in the United States.

Our

independent registered public accounting firm issued an audit opinion on the financial statements incorporated by reference from our

Annual Report on Form 20-F for the year ended December 31, 2021 filed with the SEC and will issue audit reports related to us in the

future. As auditors of companies that are traded publicly in the United States and a firm registered with the PCAOB, our auditor is

required by the laws of the United States to undergo regular inspections by the PCAOB. However, to the extent that our

auditor’s work papers become located in China, such work papers will not be subject to inspection by the PCAOB because the

PCAOB is currently unable to conduct inspections without the approval of the Chinese authorities. Inspections of certain other firms

that the PCAOB has conducted outside of China have identified deficiencies in those firms’ audit procedures and quality

control procedures, which may be addressed as part of the inspection process to improve future audit quality. We are required by the

HFCAA to have an auditor that is subject to the inspection by the PCAOB. While our present auditor is located in the United States

and the PCAOB is able to conduct inspections on such auditor, to the extent this status changes in the future and our

auditor’s audit documentation related to their audit reports for our company becomes outside of the inspection by the PCAOB or

if the PCAOB is unable to inspect or investigate completely our auditor because of a position taken by an authority in a foreign

jurisdiction, trading in our ordinary shares could be prohibited under the HFCAA, and as a result our ordinary shares could be

delisted from Nasdaq.

On

March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements

of the HFCAA, which became effective on May 5, 2021. We will be required to comply with these rules if the SEC identifies our auditors

as having a “non-inspection” year under a process to be subsequently established by the SEC.

On

May 13, 2021, the PCAOB proposed a new rule for implementing the HFCAA. Among other things, the proposed rule provides a framework for

the PCAOB to use when determining, under the HFCAA, whether it is unable to inspect or investigate completely registered public accounting

firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. The proposed rule

would also establish the manner of the PCAOB’s determinations; the factors the PCAOB will evaluate and the documents and information

it will consider when assessing whether a determination is warranted; the form, public availability, effective date, and duration of such

determinations; and the process by which the board of the PCAOB can modify or vacate its determinations. The proposed rule was adopted

by the PCAOB on September 22, 2021 and approved by the SEC on November 5, 2021.

On

June 22, 2021, the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the

number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two.

The

SEC is assessing how to implement other requirements of the HFCAA, including the listing and trading prohibition requirements described

above. The SEC may propose additional rules or guidance that could impact us if our auditor is not subject to the PCAOB inspection. For

example, on August 6, 2020, the President’s Working Group on Financial Markets, or the PWG, issued the Report on Protecting United

States Investors from Significant Risks from Chinese Companies to the then President of the United States. This report recommended the

SEC implement five recommendations to address companies from jurisdictions that do not provide the PCAOB with sufficient access to fulfill

its statutory mandate. Some of the concepts of these recommendations were implemented with the enactment of the HFCAA. However, some of

the recommendations were more stringent than the HFCAA. For example, if a company was not subject to the PCAOB inspection, the report

recommended that the transition period before a company would be delisted would end on January 1, 2022.

On

December 2, 2021, the SEC issued amendments to finalize the interim final rules previously adopted in March 2021, and established procedures

to identify issuers and prohibit the trading of the securities of certain registrants as required by the HFCAA.

While

the HFCAA is not currently applicable to us because our current auditors are subject to PCAOB review, if this changes in the future for

any reason, we may be subject to the HFCAA. The implications of this regulation if we were to become subject to it are uncertain. Such

uncertainty could cause the market price of our ordinary shares to be materially and adversely affected, and our securities could be delisted

or prohibited from being traded on Nasdaq earlier than would be required by the HFCAA. If our ordinary shares is unable to be

listed on another securities exchange by then, such a delisting would substantially impair your ability to sell or purchase the ordinary

shares when you wish to do so, and the risk and uncertainty associated with a potential delisting would have a negative impact on the

price of our ordinary shares.

The

following is a summary of the principal risks we face related to our doing business in China. These risks are discussed more fully in

the section titled “Risk Factors” and should be read in conjunction with those risk factors and the other risk factors included

herein and incorporated by reference in our Annual Report on Form 20-F.

| ● | If the PRC government deems that our agreements

with our variable interest entities (our “VIEs”) do not comply with PRC regulatory restrictions on foreign investment in the

relevant industries or other laws or regulations of the PRC, or if these regulations or the interpretation of existing regulations change

in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations, which may therefore

materially reduce the value of our ordinary shares. |

| ● | Adverse changes in political and economic policies

of the PRC government could have a material adverse effect on the overall economic growth of China, which could reduce the demand for

our services and materially and adversely affect our competitive position. |

| ● | Our business benefits from certain government

tax incentives. Expiration, reduction or discontinuation of, or changes to, these incentives will increase our tax burden and reduce our

net income. |

| ● | If we were deemed a “resident enterprise”

by PRC tax authorities, we could be subject to tax on our global income at the rate of 25% under the New EIT Law and our non-PRC shareholders

could be subject to certain PRC taxes. |

| ● | Our holding company structure may limit the payment

of dividends. |

| ● | Adverse regulatory developments in China may

subject us to additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted by the SEC in

response to risks related to recent regulatory developments in China may impose additional compliance requirements for companies like

us with significant China-based operations, all of which could increase our compliance costs, subject us to additional disclosure requirements.

In addition, uncertainties with respect to the PRC legal system could adversely affect us. |

| ● | Compliance with China’s new Data Security

Law, Measures on Cybersecurity Review (revised draft for public consultation), Personal Information Protection Law (second draft for consultation),

regulations and guidelines relating to the multi-level protection scheme and any other future laws and regulations may entail significant

expenses and could materially affect our business. |

| ● | Recent greater oversight by the CAC over data

security, particularly for companies seeking to list on a foreign exchange, could adversely impact our business and our offering. |

| ● | Governmental control of currency conversion may

affect the value of your investment. |

| ● | Fluctuation in the value of the RMB may have

a material adverse effect on the value of your investment. |

| ● | PRC laws and regulations governing our businesses.

If we are found to be in violation of such PRC laws and regulations, we could be subject to sanctions. In addition, changes in such PRC

laws and regulations may materially and adversely affect our business. |

| ● | Our auditor is headquartered in the United States,

and is subject to inspection by the PCAOB on a regular basis. To the extent that our independent registered public accounting firm’s

audit documentation related to their audit reports for our company become located in China, the PCAOB may not be able inspect such audit

documentation and, as such, you may be deprived of the benefits of such inspection and our ordinary shares could be delisted from the

stock exchange pursuant to the Holding Foreign Companies Accountable Act. |

| ● | It may be difficult for U.S. regulators, such

as the Department of Justice, the SEC, and other authorities, to conduct investigation or collect evidence within China. |

Other Recent Developments

On each of February 5, 2021, February 11, 2021,

February 17, 2021 and September 20, 2021, we entered into Securities Purchase Agreements (collectively, the “Purchase Agreements”)

with certain institutional investors (the “Buyers”) pursuant to which we agreed to sell to the Buyers, in registered direct

offerings, units consisting of one of our ordinary shares and a warrant to purchase ordinary shares (“Units”). These registered

direct offerings closed on February 9, 2021, February 16, 2021, February 19, 2021 and September 22, 2021, respectively. The Placement

Agent served as, and received customary compensation for serving as, the placement agent in each of these offerings.

In the February 5, 2021 offering, we sold Units

consisting of an aggregate of 9,615,387 ordinary shares and warrants exercisable to purchase 4,807,694 at a price of $0.52 per Unit, for

aggregate gross proceeds to us of approximately $5 million before deducting fees to the Placement Agent and other offering expenses payable

by us. The warrants sold in the February 5, 2021 offering are exercisable for up to three years from the date of issuance at $0.68 per

ordinary share, which exercise price will be reduced to a price being the lower of $0.30 and the

lowest daily volume weighted average price of the ordinary shares on the Nasdaq stock exchange on any trading day during the five trading

day period immediately following the date of the securities purchase agreement signed on July 26, 2022 and future similar anti-dilution

protection during the term of such warrant. The Placement Agent was paid a cash fee equal to 7.5% of the aggregate proceeds received

by us from the sale of securities in the offering, and warrants, also exercisable at a price of $0.68 per ordinary share, to purchase

5.0% of the aggregate ordinary shares sold to the Buyers in the offering.

In the February 11, 2021 offering, we sold Units

consisting of an aggregate of 16,891,892 ordinary shares and warrants to purchase 8,445,946 ordinary shares at a price of $0.888 per Unit,

for aggregate gross proceeds to us of approximately $15 million before deducting fees to the Placement Agent and other offering expenses

payable by us. The warrants sold in the February 11, 2021 offering are exercisable for up to three years from the date of issuance at

$1.11 per ordinary share, which exercise price will be reduced to a price being the lower of $0.30

and the lowest daily volume weighted average price of the ordinary shares on the Nasdaq stock exchange on any trading day during the five

trading day period immediately following the date of the securities purchase agreement signed on July 26, 2022 and future similar anti-dilution

protection during the term of such warrant. The Placement Agent was paid a cash fee equal to 7.5% of the aggregate proceeds received

by us from the sale of securities in the offering, and warrants, also exercisable at a price of $1.11 per ordinary share, to purchase

5.0% of the aggregate ordinary shares sold to the Buyers in the offering.

In the February 17, 2021 offering, we sold Units

consisting of an aggregate of 48,076,923 ordinary shares and warrants to purchase 19,230,768 ordinary shares at a price of $2.08 per Unit,

for aggregate gross proceeds to us of approximately $100 million before deducting fees to the Placement Agent and other offering expenses

payable by us. The warrants sold in the February 17, 2021 offering were initially exercisable for up to three years from the date of issuance

at $2.38 per ordinary share, which exercise price was lowered to $1.60 as a result of the September 20, 2021 offering and the anti-dilution

provisions therein, and will be further reduced to a price being the lower of $0.30 and the lowest

daily volume weighted average price of the ordinary shares on the Nasdaq stock exchange on any trading day during the five trading day

period immediately following the date of the securities purchase agreement signed on July 26, 2022 and future similar anti-dilution protection

during the term of such warrant. The Placement Agent was paid a cash fee equal to 7.0% of the aggregate proceeds received by us

from the sale of securities in the offering, and warrants, exercisable at a price of $2.60 per ordinary share, to purchase 5.0% of the

aggregate ordinary shares sold to the Buyers in the offering.

In the September 20, 2021 offering, we sold Units

consisting of an aggregate of 27,333,300 ordinary shares and warrants to purchase 13,666,650 ordinary shares at a price of $1.20 per Unit,

for aggregate gross proceeds to us of approximately $32.8 million before deducting fees to the Placement Agent and other offering expenses

payable by us. The warrants sold in the September 20, 2021 offering were initially exercisable for up to three years from the date of

issuance at $1.60 per ordinary share, which exercise price will be reduced to a price being the

lower of $0.30 and the lowest daily volume weighted average price of the ordinary shares on the Nasdaq stock exchange on any trading day

during the five trading day period immediately following the date of the securities purchase agreement signed on July 26, 2022 and future

similar anti-dilution protection during the term of such warrant. The Placement Agent was paid a cash fee equal to 6.5% of the

aggregate proceeds received by us from the sale of securities in the offering, and warrants, exercisable at a price of $1.60 per ordinary

share, to purchase 4.0% of the aggregate ordinary shares sold to the Buyers in the offering.

Corporate Information

Our principal executive office is located at

B9-8, Block B, SOHO Phase II, No. 9, Guanghua Road, Chaoyang District, Beijing, People’s Republic of China 100020. Our website

is www.luokung.com. We routinely post important information on our website. The information contained on our website is not a part of

this prospectus supplement.

Our agent for service of process in the United

States is Worldwide Stock Transfer, LLC, the current transfer agent of the Company, with a mailing address of One University Plaza, Suite

505, Hackensack, New Jersey 07601.

The SEC maintains an internet site that contains

reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

The Offering

| Issuer: |

Luokung Technology Corp. |

| |

|

| Units offered by us: |

26,666,667 units |

| |

|

| Ordinary shares offered by us: |

26,666,667 shares |

| |

|

| Ordinary shares to be outstanding after this offering

(assuming no exercise of the warrants offered by us): |

427,708,891 shares |

| |

|

| Warrants offered by us: |

We are offering to investors warrants to purchase up to an

aggregate of 26,666,667 ordinary shares at an exercise price of $0.41 per share. The warrants have a term of five years. We are also

issuing to the Placement Agent the Placement Agent Warrants (as defined under “Plan of Distribution – Fees”) to

purchase up to an aggregate of 800,000 ordinary shares at an exercise price of $0.41 per share.

This prospectus also relates to the ordinary shares issuable upon

exercise of the warrants that we are offering to investors and to the Placement Agent. |

| |

|

| Use of proceeds: |

We intend to use the net proceeds from this offering

solely for working capital and other general corporate purposes. There is no assurance that any of the warrants will ever be exercised

for cash, if at all. See “Use of Proceeds” on page S-26. |

| |

|

| Lock-up: |

We have agreed, subject to certain exceptions, not to file registration statements, sell, offer or otherwise dispose of or transfer, directly or indirectly, any of our capital stock (including ordinary shares) or any securities convertible into or exchangeable for our capital stock, during a period commencing on the date of this prospectus supplement and ending 60 days after the closing of this offering, without the prior consent of the Placement Agent. See “Plan of Distribution” in this prospectus supplement.

Additionally, our directors and officers have executed lock-up agreements prohibiting them from trading in our equity securities, for a period of 60 days from closing of the offering, subject in each case to certain exceptions. |

| |

|

| Risk factors: |

You should read the “Risk Factors” section

beginning on page S-16 of this prospectus supplement, the “Risk Factors” section beginning on page 15 of the accompanying

prospectus, and the “Risk Factors” section in our Annual Report for the year ended December 31, 2021 on Form 20-F for

a discussion of factors to consider before deciding to purchase our securities. |

| |

|

| Market for the shares and warrants: |

Our ordinary shares are quoted and traded on the NASDAQ

Capital Market under the symbol “LKCO.” However, there is no established public trading market for the warrants, and

we do not expect a market to develop. In addition, we do not intend to apply to list the warrants on any securities exchange. The

warrants are immediately separable from the shares being offered as part of the units. |

The number of ordinary shares to be outstanding

immediately after the completion of this offering is based on the actual number of shares outstanding as of July 26, 2022, which was

401,042,224, and does not include, as of that date:

| |

● |

26,666,667 ordinary shares issuable to investors upon

exercise of the warrants offered in this offering; |

| |

● |

800,000 ordinary shares issuable to the Placement Agent

upon exercise of the Placement Agent Warrants to be issued in connection with this offering; |

| |

|

|

| |

● |

13,666,650 ordinary shares issuable upon the exercise of warrants to

purchase ordinary shares at an initial exercise price of $1.60 per share that we issued to investors and to the Placement Agent in a registered

direct offering of securities that closed on September 22, 2021 (such exercise price for warrants held by investors reduced

to a price being the lower of $0.30 and the lowest daily volume weighted average price of the ordinary shares on the Nasdaq stock exchange

on any trading day during the five trading day period immediately following the date of the securities purchase agreement signed on July

26, 2022 and future similar anti-dilution protection during the term of such warrant as a result of this offering); |

| |

|

|

| |

● |