As

filed with the Securities and Exchange Commission on August 20, 2021

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

F-3

REGISTRATION

STATEMENT UNDER SECURITIES ACT OF 1933

LUOKUNG

TECHNOLOGY CORP.

(Exact

name of registrant as specified in its charter)

|

British

Virgin Islands

|

|

Not

Applicable

|

|

(State

or other jurisdiction of

|

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

|

Identification

No.)

|

B9-8,

Block B, SOHO Phase II, No. 9, Guanghua Road, Chaoyang District,

Beijing

People’s Republic of China 100020

(86)

10-65065217

(Address,

including zip code, and telephone number, including

area

code, of Registrant’s principal executive offices)

Worldwide

Stock Transfer LLC

One

University Plaza, Suite 505

Hackensack,

New Jersey 07601

(201)

820-2008

((Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy

To:

Elizabeth

F. Chen, Esq.

Pryor

Cashman LLP

7

Times Square

New

York, New York 10036

(212)

326-0199

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to general Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

|

Amount

to be

registered (1)

|

|

|

Proposed

maximum

aggregate

price

per unit (1)

|

|

|

Proposed

maximum

aggregate

offering

price (2)

|

|

|

Amount of

registration

fee (3)

|

|

|

Ordinary Shares, $0.01 par value per share

|

|

|

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Preferred Shares, $0.01 par value per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription Rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

There are being registered under this registration statement such indeterminate number of ordinary shares, preferred shares, warrants, subscription rights, debt securities, and units, as may be sold by the registrant from time to time. The securities registered hereunder also include such indeterminate number of ordinary shares or preferred shares as may be issued upon conversion, exercise or exchange of warrants or debt securities that provide for such conversion into, exercise for or exchange into ordinary shares or preferred shares. In addition, pursuant to Rule 416 under the Securities Act of 1933, as amended, or the Securities Act, the ordinary shares and preferred shares being registered hereunder include such indeterminate number of ordinary shares and preferred shares as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends, or similar transactions.

|

|

|

|

|

(2)

|

An indeterminate aggregate amount of securities is being registered as may from time to time be sold at indeterminate prices.

|

|

(3)

|

In accordance with Rule 456(b)

and Rule 457(r), the Registrant is deferring payment of the entire registration fee.

|

PROSPECTUS

Ordinary

Shares

Preferred Shares

Warrants

Subscription Rights

Debt Securities

Units

LUOKUNG

TECHNOLOGY CORP.

We

may offer, issue and sell from time to time our securities, including in the form of ordinary shares, preferred shares, warrants to purchase

ordinary shares or preferred shares, subscription rights, debt securities and a combination of such securities, separately or as units,

in one or more offerings. This prospectus provides a general description of offerings of these securities that we may undertake.

We

refer to our ordinary shares, preferred shares, warrants, subscription rights, debt securities, and units collectively as “securities”

in this prospectus.

Each

time we sell our securities pursuant to this prospectus, we will provide the specific terms of such offering in a supplement to this

prospectus. The prospectus supplement may also add, update, or change information contained in this prospectus. You should read this

prospectus, the accompanying prospectus supplement and any free writing prospectus, together with the additional information described

under the heading “Where You Can More Find Information,” before you make your investment decision.

We

may, from time to time, offer to sell the securities, through public or private transactions, directly or through underwriters, agents

or dealers, on or off The NASDAQ Capital Market, at prevailing market prices or at privately negotiated prices. If any underwriters,

agents or dealers are involved in the sale of any of these securities, the applicable prospectus supplement will set forth the names

of the underwriter, agent or dealer and any applicable fees, commissions or discounts.

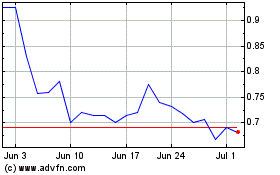

Our ordinary shares are listed on The NASDAQ Capital

Market under the symbol “LKCO”. On August 19, 2021, the last reported price of our ordinary shares on The NASDAQ Capital

Market was $1.27 per ordinary share.

This

prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

INVESTING

IN OUR ORDINARY SHARES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” ON PAGE 6, AS WELL AS THE RISKS DISCUSSED

UNDER THE CAPTION “RISK FACTORS” IN THE DOCUMENTS INCORPORATED BY REFERENCE IN THIS PROSPECTUS.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED

UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is August 20, 2021

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference in this prospectus or any supplement. We have not authorized

any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. We are not, and any underwriter or agent is not, making an offer to sell these securities in any jurisdiction where the

offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on

the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that

date.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, as a “well-known

seasoned issuer” as defined in Rule 415 under the Securities Act of 1933, as amended, using a “shelf” registration

process. Under this shelf registration process, we may sell our securities described in this prospectus in one or more offerings. Each

time we offer our securities, we will provide you with a supplement to this prospectus that will describe the specific amounts, prices

and terms of the securities we offer. The prospectus supplement or any free writing prospectus may also add, update or change information

contained in this prospectus. This prospectus, together with applicable prospectus supplements or free writing prospectus and the documents

incorporated by reference in this prospectus and any prospectus supplements, includes all material information relating to this offering.

We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these

offerings. Please read carefully both this prospectus and any prospectus supplement or free writing prospectus together with additional

information described below under “Where You Can Find More Information” and “Incorporation of Certain Information by

Reference.”

You

should rely only on the information contained in or incorporated by reference in this prospectus and any applicable prospectus supplement

or free writing prospectus. We have not authorized anyone to provide you with different or additional information. If anyone provides

you with different or inconsistent information, you should not rely on it. The information contained in this prospectus is accurate only

as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities described in this

prospectus. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any

jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus

supplement or free writing prospectus, as well as information we have previously filed with the SEC and incorporated by reference, is

accurate as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects

may have changed since those dates. This prospectus may not be used to consummate a sale of our securities unless it is accompanied by

a prospectus supplement.

In

this prospectus, unless we indicate otherwise, “we”, “us”, “our”, “the Company” and “Luokung”

refer to Luokung Technology Corp., as consolidated with its various subsidiaries. References to “ordinary shares”, “preference

shares”, “warrants” and “share capital” refer to the ordinary shares, preference shares, warrants and share

capital, respectively, of Luokung.

Certain

figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables

may not be an arithmetic aggregation of the figures that precede them.

We

have not authorized anyone to provide you with information that is different from that contained in this prospectus, any amendment or

supplement to this prospectus, or in any free writing prospectus we may authorize to be delivered or made available to you. We take no

responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus

is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale

is not permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless

of the time of delivery of this prospectus or any sale of the securities. For investors outside of the United States: We have not taken

any action to permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose

is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to

this offering and the distribution of this prospectus.

In

this prospectus, we have used industry and market data obtained from our own internal estimates and research as well as from industry

publications and research, surveys and studies conducted by third parties. We have compiled, extracted and reproduced industry and market

data from external sources that we believe to be reliable. We caution prospective investors not to place undue reliance on the above

mentioned data. Unless otherwise indicated in the prospectus, the basis for any statements regarding our competitive position is based

on our own assessment and knowledge of the market in which we operate. The industry in which we operate is subject to a high degree of

uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” These and

other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

We

are a “foreign private issuer” as defined in Rule 3b-4 under the Securities Exchange Act of 1934, as amended, or the Exchange

Act. As a result, our proxy solicitations are not subject to the disclosure and procedural requirements of Regulation 14A under the Exchange

Act and transactions in our equity securities by our officers and directors are exempt from Section 16 of the Exchange Act. In addition,

we are not required under the Exchange Act to file periodic reports and financial statements as frequently or as promptly as U.S. companies

whose securities are registered under the Exchange Act.

BUSINESS

DESCRIPTION

We

are a holding company and conduct our operations through our wholly-owned subsidiary named LK Technology Ltd., a British Virgin Islands

limited liability company (“LK Technology”), and its wholly-owned subsidiaries, MMB Limited and its respective subsidiaries,

which possess two core brands “Luokuang” and “SuperEngine”. “Luokuang” is a mobile application to

provide Business to Customer (B2C) location-based services and “SuperEngine” provides Business to Business (B2B) and Business

to Government (B2G) services in connection with spatial-temporal big data processing. In May 2010, we consummated an initial public offering

of our American Depository Shares, or ADSs, for gross proceeds of $16 million, and our ADSs were listed on the NASDAQ Capital Market

under the ticker symbol “KONE”. On August 17, 2018, we completed the transactions contemplated by the Asset Exchange Agreement

(“AEA”) with C Media Limited (“C Media”) entered into on January 25, 2018. On August 20, 2018, we changed our

name to Luokung Technology Corp., our American Depository Shares (“ADSs”) were voluntarily delisted from the NASDAQ Capital

Market on September 19, 2018 and on January 3, 2019 our ordinary shares started trading on NASDAQ under the ticker symbol “LKCO”.

We

are a China-based provider of location-based services and mobile application products for long distance travelers in China. Our primary

mobile application, the Luokuang platform, consists of the Luokuang mobile applications, a series of supporting software at the server

end, and rail-Wi-Fi hardware and equipment on the trains that we serve. The Luokuang platform incorporates technologies covered by 21

patents and about 48 software copyrights, and serves as a content and service distribution platform that is tailored for particular travel

stages featuring geographic location and social interactions. The content and services distributed by Luokuang contain information, entertainment,

travel, e-commerce, online to offline (“O2O”), advertisement and other marketing features.

Luokuang

mainly provides personalized and targeted services to long distance travelers in two locations: on the train and at the destination.

Based on the travel environment, the core elements of our users’ needs include staving off boredom on trains and discovering and

exploring new locations upon arrival. The main services contain entertainment services (videos and audio, digital readings, games specific

and tailored to the travel stage) and social services (satisfying the demand for value discovery of unfamiliar destinations through social

interaction among strangers based on locations).

We

use the most valuable Wi-Fi location—the train Wi-Fi setting—as the entrance of our Luokuang platform and mobile applications.

Passengers typically ride trains for long-distance and inter-provincial travel purposes. The long periods of monotonous journeys and

the cost concerns for roaming traffic fees enable the combination of entertainment content service needs and Wi-Fi access needs. Our

rail-Wi-Fi becomes a valuable and sophisticated Wi-Fi service in this setting—not just Wi-Fi connection service, but a provider

of sophisticated services through a Wi-Fi connection. We do not define ourselves as a train Wi-Fi communication service operator but

as a long-distance travel mobile service and location-based service provider. The rail Wi-Fi is our access point to a significant pool

of users and the entrance to acquiring additional users.

The

recommended services focus on providing targeted push services to users while travelling in unfamiliar cities. Local information and

guidance service are precisely pushed according to individual user’s interest and taste, including restaurants, entertainment,

living styles, local snacks, local products, scenic spots, cultural history and stories. The guidance service is User Generated Content

which is shared and distributed by individual users including travelers, local residents and local businesses.

In

June 2018, China Railway Gecent Technology Co., Ltd. (or “Gecent”) (established jointly by China Railway Investment Co.,

Ltd., Geely Holding Group and Tencent Holdings Ltd.) obtained the exclusive right to build and operate on-train Wi-Fi for all the High-speed

trains in China. It provides a full-travelling service including on-train Wi-Fi, entertainments, news, online meals order, online specialty

retailer and connecting travel. As the pathfinder in on-train Wi-Fi market in China, we have accumulated great experiences and resources

in construction and operation on train Wi-Fi on express trains in China, which enable us to cooperate with Gecent to provide location-based

services through the provision of our map SDKs (“Software Development Kit”) and APIs (“Application-programming Interface”),

including services at train stations covering navigation and OTO services, and to provide movie content SDK, movie copyrights and operating

services to the users of Gecent’s mobile application. Through the cooperation with Gecent, we are able to expand our services to

more valuable high-speed train passengers, while the high-speed train Wi-Fi in China will cover about 3 billion passenger trips till

the year of 2020.

In

the first half of 2019, we gradually terminated the Wi-Fi provision for express trains because the increase in numbers of High-speed

trains led to the shrinkage of the passenger trips on express trains. At the beginning of 2019, we established a Luokung Location-based

services Data Marketing Platform (“LLDMP”), Luokung Location-based services (“LBS”) Data Marketing Platform,

that combines our LBS strength with existing advertising tools. Our LBS capability including indoor floor maps, location information,

and point of interest for more than twenty thousand commercial buildings covers high speed train stations, shopping malls, airports and

so on.

Through

the acquisition of Superengine, we obtained patented technologies in spatial-temporal big data indexing, storage, transmission and visualization

that can support the full vector maps without tile, which can be effectively applied to high-definition (HD) maps, location-based services,

smart cities, intelligent transportation systems, mapping and surveying, remote sensing and monitoring. We possess fifteen patents and

nine patent application rights in U.S., Europe, Japan and China. We believe our graphics processing system is a thousand times more efficient

than competing technologies in querying, retrieving, transmitting and rendering graphical information, and allowing Terabyte (TB) sized

data to be released in seconds, which enable our customers to obtain real-time operational intelligence by harnessing the value of their

database.

Other

Recent Events

On

August 17, 2018, we consummated an asset exchange transaction, pursuant to which we exchanged all issued and outstanding capital stock

in Topsky Info-Tech Holdings Pte Ltd., the parent of Softech, for the issued and outstanding capital stock of LK Technology (the “Asset

Exchange”). In connection with the Asset Exchange, we changed our name on August 20, 2018, and on September 20, 2018, issued to

the shareholders of C Media Limited, the former parent of LK Technology, (i) 185,412,599 of our ordinary shares, par value $0.01 per

share and (ii) 1,000,000 of our preferred shares. Upon the consummation of the Asset Exchange, we ceased our previous business operations

and became a company focused on the provision of location-based service and mobile application products for long distance rail travelers

in China.

On

August 25, 2018, LK Technology entered into a Stock Purchase Agreement (the “Agreement”) with the shareholders of Superengine

Holding Limited, a limited liability company incorporated under the laws of the British Virgin Islands (the “Superengine”),

pursuant to which LK Technology acquired all of the issued and outstanding shares of Superengine for an aggregate purchase price of US$60

million (the “Purchase Price”), which was paid by the issuance of our ordinary shares in an amount equal to the quotient

of (x) the Purchase Price divided by (y) the average of the closing prices of the ordinary shares on the NASDAQ Capital Market over the

12 months period preceding July 31, 2018. We are a party to the Agreement in connection with the issuance of the ordinary shares and

certain other limited purposes.

On

August 28, 2019, the Company entered into a Share Purchase Agreement, pursuant to which the Company will acquire 100% of the equity interests

of Saleya Holdings Limited (“Saleya”) from Saleya’s shareholders for an aggregate purchase price of RMB 836 million

(approximately equivalent to $120 million), which includes approximately RMB 709 million (approximately equivalent to $101 million) in

cash and the remaining RMB 127 million (approximately equivalent to $18 million) will be paid by issuance of the Company’s ordinary

shares at the conversion rate of $7 per share. In connection with its acquisition of Saleya, as of December 31, 2019 and on January 21,

2020, the Company made a partial cash payment of $14,334,451 and $18,539,343, respectively, and on February 5, 2020 it issued 2,708,498

ordinary shares to certain shareholders of Saleya in accordance with Share Purchase Agreement. On December 5, 2020, the Company issued

1,500,310 of Series B preferred shares to two of the Saleya’s shareholders instead of a cash payment of $6,182,000 (RMB43,128,000)

as a change of consideration for the acquisition of Saleya, On March 17, 2021, the Company closed the acquisition of 100% equity interests

in Saleya, which is now a wholly-owned subsidiary of the Company.

On

May 10, 2019 and November 6, 2020, the Company entered into a Stock Purchase Agreement and The Supplementary Agreement to Stock Purchase

Agreement with the shareholders of Botbrain AI Limited (“Botbrain”), a limited liability company incorporated under the laws

of the British Virgin Islands, pursuant to which the Company acquired 67.36% of the issued and outstanding shares of Botbrain for an

aggregate purchase price of $2.5 million (RMB 16.4 million), of which $1.5 million (RMB 9.6 million) was to be paid in cash to obtain

20% of Botbrain and the Company issued 1,789,618 ordinary shares to acquire the remaining 47.36% of Botbrain. The closing of the acquisition

was completed on December 4, 2020.

On

November 13, 2019, the Company entered into a Share Subscription Agreement with Geely Technology Group Co., Ltd. (“Geely Technology”)

to issue 21,794,872 series A preferred shares at a purchase price of $1.95 per share for an aggregate purchase price of $42,500,000.

Per the terms of the agreement, the Company recognized $32,910,257 as a loan. The Company received $21,743,857 as of December 31, 2019

and the remaining amount was received in January 2020. Geely Technology may request the repayment after November 2020, under such circumstance,

the Company shall pay it back in January of 2021. On December 24, 2020, Geely Technology sent a notice of redemption. The Company is

in negotiation for an extension with Geely Technology.

On

November 13, 2019, the Company entered into a Securities Purchase Agreement with Acuitas Capital, LLC. and a Warrant to purchase the

Company’s ordinary shares pursuant to which the Purchaser subscribed to purchase up to $100,000,000 of units with up to a $10,000,000

subscription at each closing, with each Unit consisting of one ordinary share and one warrant, where each whole warrant entitles the

holder to purchase one ordinary share. The Securities Purchase Agreement contemplates periodic closings of $10,000,000. On July 16, 2020,

the Company held the first closing pursuant to the Purchase Agreement and received $10,000,000. The Purchaser had received 7,763,975

ordinary shares on November 13, 2019 in consideration for such $10,000,000. The Purchaser also exercised the Warrant and received 15,897,663

ordinary shares upon the exercise of the Warrant. On December 31, 2020, the Purchase Agreement has been terminated.

On

June 17, 2020, the Company entered into preferred stock subscription agreement with Daci Haojin Foundation Limited to issue 15,000,000

preferred shares for $45,000,000. Pursuant to the preferred stock subscription agreement the first closing will not occur until July

2020 and such closing will be for $13,500,000. Subsequent closings will occur on August 31 and September 30, 2020 for $13,500,000 and

$18,000,000, respectively. However, due to the impact of the travel restriction as a result of Covid-19 between Hong Kong and Mainland

China, Daci Haojin has not fulfilled their US dollars subscription obligations under the Preferred Financing Agreement and no such closings

have occurred. As of December 31, 2020, Daci Haojin has wired RMB 17.4 million ($2.7 million) to the Company and has represented to the

Company that they are working to be able to comply with their contractual obligations to fund the $45,000,000 to the Company. The Company

cannot give any assurances as to whether it will receive any monies from Daci Haojin pursuant to the Preferred Financing Agreement.

On

August 10, 2020, the Company entered into a cooperation framework agreement with Nanjing Antong Meteorological Data Limited (“Nanjing

Antong”) and Nanjing Weida Electronic Technology Co., Ltd. (“Nanjing Weida”), pursuant to which the Company would invest

$153,000 (RMB 1 million) each to Nanjing Antong and Nanjing Weida in order to establish a joint venture with Nanjing Antong. On August

27, 2020, the joint venture was established, SuperEngine, eMapgo Technologies (Beijing) Co., Ltd. (“EMG”) and Nanjing Antong

hold 50%, 20% and 30% of equity of interest, respectively. The joint venture engages in real-time traffic information services for China’s

high-class highways, urban roads, urban and rural roads, as well as expressway data and travel value-added services.

On

March 17, 2021, the Company consummated an acquisition of EMG, through the purchase of the equity interests of Saleya Holdings Limited

(“Saleya”), which, through a series of contracts between its wholly-owned subsidiary DMG Infotech Co., Ltd. and EMG, made

EMG its variable interest entity. Pursuant to a Share Purchase Agreement dated August 28, 2019 (the “EMG SPA”) and a Supplemental

Agreement dated February 24, 2021. The Company purchased 100% of the equity interest of Saleya for consideration of (i) a cash amount

of USD equivalent to RMB709,567,913 and (ii) 7,111,428 Ordinary Shares, a number of the Company’s Ordinary Shares equivalent to

RMB127,028,593 with an issuing price of USD 2.00 per share after deducting 2,708,498 shares already issued in 2019 pursuant to the EMG

SPA.

Corporate

Information

Our

principal executive offices are located at B9-8, Block B, SOHO Phase II, No. 9, Guanghua Road, Chaoyang District, Beijing, People’s

Republic of China 100020. Our website is www.luokung.com. We routinely post important information on our website. The information contained

on our website is not a part of this prospectus.

Our

agent for service of process in the United States is Worldwide Stock Transfer, LLC, the current transfer agent of the Company, with a

mailing address of One University Plaza, Suite 505, Hackensack, New Jersey 07601.

The

SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that

file electronically with the SEC at www.sec.gov. The Company’s website is www.luokung.com.

RISK

FACTORS

An

investment in our ordinary shares involves risk. Before you invest in ordinary shares issued by us, you should carefully consider the

risks involved. Accordingly, you should carefully consider:

|

|

●

|

the information contained in

or incorporated by reference into this prospectus;

|

|

|

●

|

the risks described in page

1 to page 16 of our Annual Report on Form 20-F, filed on May 14, 2021, for our most recent fiscal year, which are incorporated by

reference into this prospectus; and

|

|

|

●

|

other risks and other information

that may be contained in, or incorporated by reference from, other filings we make with the SEC.

|

The

risk factors related to our business contained in or incorporated by reference into this prospectus comprise the material risks of which

we are aware. If any of the events or developments described actually occurs, our business, financial condition or results of operations

would likely suffer.

Going

Concern Note

The

Company’s consolidated financial statements that are incorporated by reference have been prepared assuming that the Company will

continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of

business. The Company had incurred losses for the past three years and as of December 31, 2020, net current liabilities of the Company

amounted to $61,564,025. These factors raised substantial doubt about the Company’s ability to continue as a going concern for

the reporting period of the consolidated financial statements that are incorporated by reference. Subsequent to the end of the reporting

period of the consolidated financial statements that are incorporated by reference, in February 2021, the substantial doubt was alleviated

as the Company closed three registered direct offering and received net proceeds (including ordinary shares and warrants) of $123.4 million

(See Note 18 of the Company’s consolidated financial statements that are incorporated by reference for details). The Company returned

to net current asset position thereafter.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about

our Company and industry and involve risks and uncertainties. All statements other than statements of historical fact in this prospectus

are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our

actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigations Reform Act of 1995.

You

can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,”

“anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,”

“likely to” or other similar expressions. We have based these forward-looking statements largely on our current expectations

and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business

strategy and financial needs. These forward-looking statements include, but are not limited to, statements about:

|

|

●

|

our future

business development, results of operations and financial condition;

|

|

|

●

|

expected

changes in our net revenues and certain cost or expense items;

|

|

|

●

|

our ability

to attract and retain customers; and

|

|

|

●

|

trends

and competition in the spatial-temporal big-data processing and interactive location-based services market.

|

You

should read this prospectus and the documents that we refer to in this prospectus and have filed as exhibits to this prospectus completely

and with the understanding that our actual future results may be materially different from what we expect. Other sections of this prospectus

discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment.

New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the

impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary

statements.

You

should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this prospectus

relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we

undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events

or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

USE

OF PROCEEDS

Except

as otherwise provided in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities offered

by this prospectus for general corporate purposes, which may include working capital, capital expenditures, research and development

expenditures and the acquisitions of new technologies and investments.

CAPITALIZATION

The

following table sets forth our capitalization as of December 31, 2020. You should read this table in conjunction with our consolidated

financial statements and the related notes included in our annual report on Form 20-F for the year ended December 31, 2020, which are

incorporated by reference herein.

The

capitalization table does not include pro-forma adjustments for the number of shares which are being registered on the registration statement

of which this prospectus is a part and may be sold under the prospectus, because the full number of shares that may be sold cannot be

specifically determined as it will be based on the market price of an ordinary share from time to time when puts are made by the Company.

|

|

|

As of December 31,

2020

|

|

|

|

|

|

USD

|

|

|

Long term borrowings

|

|

|

2,663,835

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

Preferred Shares ($0.01 par value; 1,000,000 shares authorized, issued and outstanding)

|

|

|

10,000

|

|

|

Ordinary Shares ($0.01 par value; 500,000,000 shares authorized; 239,770,000 shares issued and outstanding)

|

|

|

2,397,701

|

|

|

Series A Preferred Shares ($0.01 par value; 21,794,872 shares authorized, 21,794,872 shares issued and outstanding)

|

|

|

217,949

|

|

|

Series B Preferred Shares ($0.01 par value; 1,500,310 shares authorized, 1,500,310 shares issued and outstanding)

|

|

|

15,003

|

|

|

Additional paid in capital

|

|

|

164,753,586

|

|

|

Accumulated deficit

|

|

|

(113,242,512

|

)

|

|

Accumulated other comprehensive loss

|

|

|

(1,523,978

|

)

|

|

Total Luokung Technology Corp. shareholders’ equity

|

|

|

52,627,749

|

|

|

Total equity

|

|

|

52,694,105

|

|

|

Total capitalization

|

|

|

52,694,105

|

|

PLAN

OF DISTRIBUTION

We

may sell the securities described in this prospectus from time to time in one or more transactions, including without limitation:

|

|

●

|

to

or through underwriters, brokers or dealers;

|

|

|

●

|

on

any national exchange on which the securities offered by this prospectus are listed or any

automatic quotation system through which the securities may be quoted;

|

|

|

●

|

through

a block trade in which the broker or dealer engaged to handle the block trade will attempt

to sell the securities as agent, but may position and resell a portion of the block as principal

to facilitate the transaction;

|

|

|

●

|

directly

to one or more purchasers in negotiated sales or competitively bid transactions; or

|

|

|

●

|

through

a combination of any of these methods.

|

In

addition, we may enter into derivative or hedging transactions with third parties, or sell securities not covered by this prospectus

to third parties in privately negotiated transactions. In connection with such a transaction, the third parties may sell securities covered

by and pursuant to this prospectus and the applicable prospectus supplement. If so, the third party may use securities borrowed from

us or others to settle such sales and may use securities received from us to close out any related short positions. We may also loan

or pledge securities covered by this prospectus and an applicable prospectus supplement to third parties, who may sell the loaned securities

or, in an event of default in the case of a pledge, sell the pledged securities pursuant to this prospectus and the applicable prospectus

supplement.

We

may issue the securities as a dividend or distribution or in a subscription rights offering to our existing security holders. In some

cases, we or dealers acting for us or on our behalf may also repurchase securities and reoffer them to the public by one or more of the

methods described above. This prospectus may be used in connection with any offering of our securities through any of these methods or

other methods described in the applicable prospectus supplement.

We

may sell the securities offered by this prospectus at:

|

|

●

|

a

fixed price or prices, which may be changed;

|

|

|

●

|

market

prices prevailing at the time of sale;

|

|

|

●

|

prices

related to such prevailing market prices; or

|

We

may solicit offers to purchase the securities directly from the public from time to time. We may also designate agents from time to time

to solicit offers to purchase securities from the public on our or their behalf. The prospectus supplement relating to any particular

offering of securities will name any agents designated to solicit offers, and will include information about any commissions to be paid

to the agents, in that offering. Agents may be deemed to be "underwriters" as that term is defined in the Securities Act. From

time to time, we may sell securities to one or more dealers as principals. The dealers, who may be deemed to be "underwriters"

as that term is defined in the Securities Act, may then resell those securities to the public. We may sell securities from time to time

to one or more underwriters, who would purchase the securities as principal for resale to the public, either on a firm-commitment or

best-efforts basis. If we sell securities to underwriters, we will execute an underwriting agreement with them at the time of sale and

will name them in the applicable prospectus supplement. In connection with those sales, underwriters may be deemed to have received compensation

from us in the form of underwriting discounts or commissions and may also receive commissions from purchasers of the securities for whom

they may act as agents. Underwriters may resell the securities to or through dealers, and those dealers may receive compensation in the

form of discounts, concessions or commissions from the underwriters and/or commissions from purchasers for whom they may act as agents.

Underwriters, dealers, agents and other persons may be entitled, under agreements that they may enter into with us, to indemnification

by us against civil liabilities, including liabilities under the Securities Act, or to contribution with respect to payments which they

may be required to make.

The

applicable prospectus supplement will describe the terms of the offering of the securities, including the following:

|

|

●

|

the

name of the agent or any underwriters;

|

|

|

●

|

the

public offering or purchase price;

|

|

|

●

|

any

discounts and commissions to be allowed or paid to the agent or underwriters;

|

|

|

●

|

all

other items constituting underwriting compensation;

|

|

|

●

|

any

discounts and commissions to be allowed or paid to dealers; and

|

|

|

●

|

any

exchanges on which the securities will be listed.

|

If

we offer securities in a subscription rights offering to our existing security holders, we may enter into a standby underwriting agreement

with dealers, acting as standby underwriters. We may pay the standby underwriters a commitment fee for the securities they commit to

purchase on a standby basis. If we do not enter into a standby underwriting arrangement, we may retain a dealer-manager to manage a subscription

rights offering for us.

Any

underwriters, dealers and agents, as well as their associates, may be customers of or lenders to, and may engage in transactions with

and perform services for, us and our subsidiaries. In addition, we may offer securities to or through our affiliates, as underwriters,

dealers or agents. Our affiliates may also offer the securities in other markets through one or more selling agents, including one another.

If so indicated in an applicable prospectus supplement, we will authorize dealers or other persons acting as our agent to solicit offers

by some institutions to purchase securities from us pursuant to contracts providing for payment and delivery on a future date. Institutions

with which these contracts may be made include commercial and savings banks, insurance companies, pension funds, investment companies,

educational and charitable institutions and others.

In

order to facilitate the offering of the securities, any underwriters may engage in transactions that stabilize, maintain or otherwise

affect the price of the securities or any other securities the prices of which may be used to determine payments on such securities.

Specifically, any underwriters may overallot in connection with the offering, creating a short position for their own accounts. In addition,

to cover overallotments or to stabilize the price of the securities or of any such other securities, the underwriters may bid for, and

purchase, the securities or any such other securities in the open market. Finally, in any offering of the securities through a syndicate

of underwriters, the underwriting syndicate may reclaim selling concessions allowed to an underwriter or a dealer for distributing the

securities in the offering if the syndicate repurchases previously distributed securities in transactions to cover syndicate short positions,

in stabilization transactions or otherwise. Any of these activities may stabilize or maintain the market price of the securities above

independent market levels. Any such underwriters are not required to engage in these activities and may end any of these activities at

any time.

Unless

otherwise indicated in an applicable prospectus supplement or confirmation of sale, the purchase price of the securities will be required

to be paid in immediately available funds in New York City.

The

securities may be new issues of securities and may have no established trading market. The securities may or may not be listed on a national

securities exchange. We can make no assurance as to the liquidity of or the existence of trading markets for any of the securities.

DESCRIPTION

OF SHARE CAPITAL

As

of the date of this prospectus, our memorandum and articles of association authorize the issuance of up to a maximum of 522,794,872 shares,

which are designated as (i) 500,000,000 of ordinary shares, par value $0.01 per share, of which 336,582,160 ordinary shares are issued

and outstanding, (ii) 1,000,000 preferred shares, par value $0.01 per share (“Preferred Shares” and each a “Preferred

Share”), of which 1,000,000 Preferred Shares are issued and outstanding, (iii) 21,794,872 series A preferred shares of par value

$0.01 per share (“Series A Preferred Shares” and each a “Series A Preferred Share”), of which 21,794,872 Series

A Preferred Shares are issued and outstanding and (iv) 1,500,310 series B preferred shares of par value $0.01 per share (“Series

B Preferred Shares” and each a “Series B Preferred Share”), of which 0 Series B Preferred Shares are issued and outstanding,

in each case with the rights, preferences and privileges as set out in the memorandum and articles of association of the Company, in

each case with the rights, preferences and privileges as set out in the memorandum and articles of association of the Company.

Our

Amended and Restated Memorandum and Articles of Association

The

following are summaries of material provisions of our amended and restated memorandum and articles of association.

Ordinary

Shares

All

of our issued and outstanding ordinary shares are fully paid and non-assessable and may only be issued as registered shares. Holders

of our ordinary shares who are non-residents of the British Virgin Islands may freely hold and vote their shares.

Subject

to the memorandum and articles of association (and, for greater clarity, without prejudice to any special rights conferred thereby on

the holders of any other shares), an ordinary share of the Company confers on the holder:

|

|

(a)

|

the

right to one vote at a meeting of the members or on any resolution of members;

|

|

|

(b)

|

the

right to an equal share in any distribution paid by the Company; and

|

|

|

(c)

|

the

right to an equal share in the distribution of the surplus assets of the Company on a winding up.

|

Preferred

Shares

Subject

to the memorandum and articles of association (and, for greater clarity, without prejudice to any special rights conferred thereby on

the holders of any other shares), a preferred share of the Company confers on the holder:

|

|

(a)

|

the

right to 399 votes at a meeting of the members or on any resolution of members;

|

|

|

(b)

|

the

right to an equal share in any distribution paid by the Company;

|

|

|

(c)

|

the

right to an equal share in the distribution of the surplus assets of the Company on a winding up;

|

|

|

(d)

|

be

freely transferable, in whole or in part, by Mr. Xuesong Song to any third party through one or more private transactions, subject

to applicable law; and

|

|

|

(e)

|

be

freely transferable, in whole or in part, by Mr. Xuesong Song to any third party through one or more public transactions, subject

to applicable law and automatic conversion of such preferred share(s) into ordinary share(s).

|

Each

Preferred Share shall be automatically converted at any time after issue and without the payment of any additional sum into an equal

number of fully paid ordinary shares upon the conclusion of any transfer by Mr. Xuesong Song to any third party through one or more Public

Transactions.

Series

A Preferred Shares

Subject

to the memorandum and articles of association (and, for greater clarity, without prejudice to any special rights conferred thereby on

the holders of any other shares), a Series A Preferred Share of the Company confers on the holder:

|

|

(a)

|

no

right to vote at a meeting of the members of our company or on any resolution of members;

|

|

|

(b)

|

the

right to an equal share in any distribution paid by our company;

|

|

|

(c)

|

the

right to an equal share in the distribution of the surplus assets of our company on our liquidation;

|

|

|

(d)

|

the

right, at such holder’s sole discretion, to convert all or any portion of the holder’s Series A Preferred Shares into ordinary

shares at any time commencing after the date of issue of such Series A Preferred Shares. The conversion rate for the Series A Preferred

Shares shall be one (1) Ordinary Share for every one (1) Series A Preferred Share. Before any holder of Series A Preferred Shares shall

be entitled to convert the same into ordinary shares and to receive certificate(s) for such ordinary shares, he shall surrender the certificate(s)

for his Series A Preferred Shares at the office of our company and shall give written notice to our company at such office that he elects

to convert the same. Our company shall, as soon as practicable thereafter, issue and deliver at such office to such holder of Series

A Preferred Shares a certificate(s) for the number of ordinary shares to which he shall be entitled. Such conversion shall be deemed

to have been made immediately prior to the close of business on the date of such surrender of the certificate(s) for the Series A Preferred

Shares to be converted, and the person or persons entitled to receive the ordinary shares issuable upon such conversion shall be treated

for all purposes as the record holder(s) of such ordinary shares on such date. The directors may effect conversion in any matter permitted

by law including, without prejudice to the generality of the foregoing, repurchasing or redeeming the relevant Series A Preferred Shares

and applying the proceeds towards the issue of the relevant number of new ordinary shares. The provisions of clause 8(3)(e) of our memorandum

of association shall not apply to the ordinary shares so converted; and

|

|

|

(e)

|

the

right, at such holder’s sole discretion, to require the redemption or repurchase by our company of all or any portion of the holder’s

Series A Preferred Shares (the “Purchased Shares”) in cash at a Repurchase Price defined below upon the following events:

(1) six (6) months after the closing date as defined in the share subscription agreement entered into between our company and Geely Technology

dated 13 November 2019 (the “Share Subscription Agreement”); (2) the proposed acquisition of eMapgo Technologies (Beijing)

Co., Ltd. (the “Proposed Acquisition”) by our company is terminated; (3) our company breaches the Share Subscription Agreement;

or (4) within six (6) months from the closing date as defined in the Share Subscription Agreement provided that our company has sufficient

funds after completing the Proposed Acquisition by our company. The repurchase price for each Series A Preferred Shares shall be the

higher of (i) US$1.95 per share; or (ii) the US dollars equivalent to RMB13.7648 per share (the “Repurchase Price”), where

the exchange rate shall be the central parity rate between RMB and USD published by the People’s Bank of China the day before Geely

Technology issues the repurchase notice, plus an eight percent (8%) annual simple interest rate basis calculated from the date such Repurchase

Price was fully paid until the date of full payment of the Repurchase Price, which shall be made in a lump sum on the date of the payment

of the Repurchase Price, plus all declared but unpaid dividends with respect to the Series A Preferred Shares. Before any holder of Series

A Preferred Shares shall be entitled to require the redemption or repurchase by our company of all or any portion of the holder’s

Series A Preferred Shares, he shall surrender the certificate(s) for his Series A Preferred Shares at the office of our company and shall

give written notice to our company (the “Redemption Notice”) at such office that he elects to require the redemption or repurchase

by our company of the same. Our company shall pay the corresponding Repurchase Price within sixty (60) days following twelve (12) months

after the Purchased Shares are issued.

|

Series

B Preferred Shares

Subject

to the memorandum and articles of association (and, for greater clarity, without prejudice to any special rights conferred thereby on

the holders of any other shares), a Series B Preferred Share of our company confers on the holder:

|

|

(a)

|

Subject

to compliance with the requirements of the laws of the Hong Kong Special Administrative Region of the People’s Republic of China

and other restrictions under the purchase agreement entered into by and among our company, Zhi-Xun Wang and Hong-Bin Lu (the “Parties”)

and other parties named therein on August 27, 2019 and the supplemental agreement entered into by and among the Parties and other parties

on October 11, 2019, the Series B Preferred Shares shall be redeemable at the option of holders of the Series B Preferred Shares by delivery

of a written request to the Purchaser (“Redemption Request”) within the period from 6th month to 12th month after its issuance.

Our company cannot reject such Redemption Request and shall make the best efforts to implement such redemption by paying cash within

10 working days after receipt of the Redemption Request. The redemption price for each Series B Preferred Share redeemed shall be an

amount of USD equivalent to RMB28.75 per share plus an internal rate of return of 10% per year.

|

|

|

(b)

|

Any

Series B Preferred Share may, at the option of the holder thereof, be converted into fully-paid and non-assessable ordinary shares without

any restrictions under the Securities Act of 1933, the laws of the Hong Kong Special Administrative Region of the People’s Republic

of China, the Company’s memorandum and articles of association or any other contracts within the period from 9th month to 12th

month after its issuance. The conversion ratio for Series B Preferred Shares to ordinary shares shall be 1:1.

|

The

directors may at their discretion by resolution of directors redeem, purchase or otherwise acquire all or

any

of the shares in the Company subject to the Articles.

Objects

of the Company.

Under

our amended and restated memorandum and articles of association, the objects of our company are unrestricted and we have the

full power and authority to carry out any object not prohibited by the laws of the British Virgin Islands.

Register

of Members

The

Company shall keep a register of members containing;

|

|

(a)

|

the

names and addresses of the persons who hold registered shares in the Company;

|

|

|

|

|

|

|

(b)

|

the

number of each class and series of registered shares held by each member;

|

|

|

|

|

|

|

(c)

|

the

date on which the name of each member was entered in the register of members;

|

|

|

|

|

|

|

(d)

|

the

date on which any person ceased to be a member; and

|

|

|

|

|

|

|

(e)

|

such

other information as may be prescribed pursuant to the Act.

|

Dividends

The

Company may by a resolution of directors declare a distribution by way of dividend and pay such distribution in money, shares or other

property. In the event that distributions by way of dividend are paid in specie the directors shall have responsibility for establishing

and recording in the resolution of directors authorizing the distribution by way of dividend, a fair and proper value for the assets

to be so distributed.

The

directors may from time to time pay to the members such interim distributions by way of dividend as appear to the directors to be justified

by the profits of the Company.

Issuance

of Additional Shares

Subject

to the provisions of the Company’s Memorandum and Articles of Association and, if applicable, the rules of the stock exchange on

which the Company is listed, and any resolution of members, the directors of the Company may, without limiting or affecting any rights

previously conferred on the holders of any existing shares or class or series of shares, offer, allot, grant options over or otherwise

dispose of shares to such persons, at such times and upon such terms and conditions as the Company may by resolution of directors determine.

The directors shall not issue more shares than the maximum number provided for in the Memorandum and Articles of Association.

Transfer of Shares

The Company may, upon receipt of an instrument

of transfer, enter the name of the transferee in the register of members subject to the prior or simultaneous approval of the Company

as evidenced by a resolution of directors or by a resolution of members. Subject to any resolution of the members to the contrary, the

directors may resolve by resolution of directors to refuse or delay the registration of the transfer for reasons that shall be specified

in the resolution of directors.

Interested Transactions

A director of the Company who is interested in

a transaction entered into or to be entered into by the Company may:

|

|

(i)

|

vote on a matter relating to the transaction;

|

|

|

(ii)

|

attend a meeting of directors at which a matter relating

to the transaction arises and be included among the directors present at the meeting for the purposes of a quorum; and

|

|

|

(iii)

|

sign a document on behalf of the Company, or do any other

thing in his capacity as a director, that relates to the transaction,

|

and, subject to compliance

with the Act shall not, by reason of his office be accountable to the Company for any benefit which he derives from such transaction

and no such transaction shall be liable to be avoided on the grounds of any such interest or benefit.

Borrowing Powers

The directors may by resolution of directors exercise

all the powers of the Company to borrow money and to mortgage or charge its undertakings and property or any part thereof, to issue debentures,

debenture stock and other securities whenever money is borrowed or as security for any debt, liability or obligation of the Company or

of any third party.

Meetings and Consents of Members

The directors of the Company may convene meetings

of the members of the Company at such times and in such manner and places within or outside the British Virgin Islands as the directors

consider necessary or desirable. The Company may hold an annual general meeting, but shall not (unless required by stock exchange on which

the Company’s securities are listed) be obliged to hold an annual general meeting.

Upon the written request of members holding 30

percent or more of the outstanding voting shares in the Company the directors shall convene a meeting of members.

The directors shall give not less than 7 days notice

of meetings of members to those persons whose names on the date the notice is given appear as members in the share register of the Company

and are entitled to vote at the

meeting.

The directors may fix the date notice is given

of a meeting of members as the record date for determining those shares that are entitled to vote at the meeting.

A meeting of members may be called on short notice:

|

|

(a)

|

if members holding not less than 90 percent of the total number

of shares entitled to vote on all matters to be considered at the meeting, or 90 percent of the votes of each class or series of shares

where members are entitled to vote thereon as a class or series together with not less than a 90 percent majority of the remaining votes,

have agreed to short notice of the meeting, or

|

|

|

(b)

|

if all members holding shares entitled to vote on all or any

matters to be considered at the meeting have waived notice of the meeting and for this purpose presence at the meeting shall be deemed

to constitute waiver.

|

Forfeiture of Shares

When shares not fully paid on issue or issued for

a promissory note or other written obligation for payment of a debt have been issued subject to forfeiture, the directors may at any time

before tender of payment forfeit and cancel the shares to which the notice relates upon (i) written notice specifying a date for payment

to be made and the shares in respect of which payment is to be made being served on the member who defaults in making payment pursuant

to a promissory note or other written obligations to pay a debt and (ii) failure to comply with such notice within the prescribed time.

Redemption or Repurchase of Shares

Subject to the Memorandum and Articles of Association,

the Company may purchase, redeem or otherwise acquire and hold its own shares save that the Company may not purchase, redeem or otherwise

acquire its own shares without the consent of the member whose shares are to be purchased, redeemed or otherwise acquired unless the Company

is permitted by the Act or any other provision in the Memorandum or Articles of Association to purchase, redeem or otherwise acquire the

shares without their consent. No purchase, redemption or other acquisition of shares shall be made unless the directors determine by resolution

of the directors that immediately after the purchase, redemption or other acquisition the value of the Company’s assets will exceed

its liabilities and the Company will be able to pay its debts as they fall due.

Anti-takeover Provisions in Our Memorandum

of Association and Articles of Association

Some provisions of our memorandum

of association and articles of association may discourage, delay or prevent a change in control of our company or management that shareholders

may consider favorable, including provisions that authorize our board of directors to issue preference shares in one or more series and

to designate the price, rights, preferences, privileges and restrictions of such preference shares.

Limitation on Liability and Indemnification

Matters

Under British Virgin Islands

laws, each of our directors and officers, in performing his or her functions, is required to act honestly and in good faith with a view

to our best interests and exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances.

Such limitation of liability does not affect the availability of equitable remedies such as injunctive relief or rescission. These provisions

will not limit the liability of directors under United States federal securities laws.

We may indemnify any of our

directors or anyone serving at our request as a director of another entity against all expenses, including legal fees, and against all

judgments, fines and amounts paid in settlement and reasonably incurred in connection with legal, administrative or investigative proceedings.

We may only indemnify a director if he or she acted honestly and in good faith with the view to our best interests and, in the case of

criminal proceedings, the director had no reasonable cause to believe that his or her conduct was unlawful. The decision of our board

of directors as to whether the director acted honestly and in good faith with a view to our best interests and as to whether the director

had no reasonable cause to believe that his or her conduct was unlawful, is in the absence of fraud sufficient for the purposes of indemnification,

unless a question of law is involved. The termination of any proceedings by any judgment, order, settlement, conviction or the entry of

no plea does not, by itself, create a presumption that a director did not act honestly and in good faith and with a view to our best interests

or that the director had reasonable cause to believe that his or her conduct was unlawful. If a director to be indemnified has been successful

in defense of any proceedings referred to above, the director is entitled to be indemnified against all expenses, including legal fees,

and against all judgments, fines and amounts paid in settlement and reasonably incurred by the director or officer in connection with

the proceedings.

We may purchase and maintain

insurance in relation to any of our directors or officers against any liability asserted against the directors or officers and incurred

by the directors or officers in that capacity, whether or not we have or would have had the power to indemnify the directors or officers

against the liability as provided in our memorandum of association and articles of association.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted for our directors or officers under the foregoing provisions, we have

been informed that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed

in the Securities Act and is therefore unenforceable as a matter of United States law.

Differences in Corporate Law

We were incorporated under,

and are governed by, the laws of the British Virgin Islands. The corporate statutes of the State of Delaware and the British Virgin Islands

are similar, and the flexibility available under British Virgin Islands law has enabled us to adopt memorandum of association and articles

of association that will provide shareholders with rights that do not vary in any material respect from those they would enjoy if we were

incorporated under the Delaware General Corporation Law, or Delaware corporate law. Set forth below is a summary of some of the differences

between provisions of the BVI Act applicable to us and the laws application to companies incorporated in Delaware and their shareholders.

Director’s Fiduciary Duties

Under Delaware corporate law,

a director of a Delaware corporation has a fiduciary duty to the corporation and its stockholders. This duty has two components: the duty

of care and the duty of loyalty. The duty of care requires that a director act in good faith, with the care that an ordinarily prudent

person would exercise under similar circumstances. Under this duty, a director must inform himself of, and disclose to stockholders, all

material information reasonably available regarding a significant transaction. The duty of loyalty requires that a director act in a manner

he reasonably believes to be in the best interests of the corporation. He must not use his corporate position for personal gain or advantage.

This duty prohibits self-dealing by a director and mandates that the best interest of the corporation and its stockholders take precedence

over any interest possessed by a director, officer or controlling stockholder and not shared by the stockholders generally. In general,

actions of a director are presumed to have been made on an informed basis, in good faith and in the honest belief that the action taken

was in the best interests of the corporation. However, this presumption may be rebutted by evidence of a breach of one of the fiduciary

duties. Should such evidence be presented concerning a transaction by a director, a director must prove the procedural fairness of the

transaction, and that the transaction was of fair value to the corporation.

British Virgin Islands law

provides that every director of a British Virgin Islands company in exercising his powers or performing his duties shall act honestly

and in good faith and in what the director believes to be in the best interests of the company. Additionally, the director shall exercise

the care, diligence and skill that a reasonable director would exercise in the same circumstances taking into account the nature of the

company, the nature of the decision and the position of the director and his responsibilities. In addition, British Virgin Islands law

provides that a director shall exercise his powers as a director for a proper purpose and shall not act, or agree to the company acting,

in a manner that contravenes the BVI Act or the memorandum of association or articles of association of the company.

Amendment of Governing Documents

Under Delaware corporate law,

with very limited exceptions, a vote of the stockholders is required to amend the certificate of incorporation. Under British Virgin Islands

law and our memorandum of association and articles of association, (i) our shareholders may amend our memorandum of association and articles

of association by a resolution of shareholders, or (ii) our board of directors may amend our memorandum of association and articles of

association by a resolution of directors without a requirement for a resolution of shareholders so long as the amendment does not:

|

|

●

|

restrict the rights of the shareholders

to amend the memorandum of association and articles of association;

|

|

|

●

|

change the percentage of shareholders

required to pass a resolution of shareholders to amend the memorandum of association and articles of association;

|

|

|

●

|

amend the memorandum of association

and articles of association in circumstances where the memorandum of association and articles of association cannot be amended by the

shareholders; or

|

|

|

●

|

amend the provisions of memorandum

of association or the articles of association pertaining to “rights, privileges, restrictions and conditions attaching to shares,”

“rights not varied by the issue of shares pari passu,” “variation of class rights” and “amendment of memorandum

and articles of association”.

|

Written Consent of Directors

Under Delaware corporate law,

directors may act by written consent only on the basis of a unanimous vote. Under British Virgin Islands law, directors may pass a written

resolution (a) by such majority of the votes of the directors entitled to vote on the resolution as may be specified in the memorandum

of association or articles of association or (b) in the absence of any provision in the memorandum of association or the articles of association,

by all the directors entitled to vote on the resolution. Our articles of association provide that a resolution consented to in writing

by the directors may be passed by a simply majority of the directors or of all members of the committee, as the case may be.

Written Consent of Shareholders

Under Delaware corporate law,

unless otherwise provided in the certificate of incorporation, any action to be taken at any annual or special meeting of stockholders

of a corporation, may be taken by written consent of the holders of outstanding stock having not less than the minimum number of votes

that would be necessary to take such action at a meeting. As permitted by British Virgin Islands law, subject to the memorandum or articles

of association, an action that may be taken by members of the company at a meeting of shareholders may also be taken by a resolution of

shareholders consented to in writing. Our articles of association provide that shareholders may approve corporate matters by way of a

resolution consented to at a meeting of shareholders or in writing by a majority of shareholders entitled to vote thereon.

Shareholder Proposals

Under Delaware corporate law,

a shareholder has the right to put any proposal before the annual meeting of shareholders, provided it complies with the notice provisions

in the governing documents. A special meeting may be called by the board of directors or any other person authorized to do so in the governing