Current Report Filing (8-k)

March 03 2023 - 4:11PM

Edgar (US Regulatory)

0001811210

false

--12-31

0001811210

2023-03-02

2023-03-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

March 2, 2023

Lucid Group, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-39408 |

85-0891392 |

(State or other jurisdiction of

incorporation or organization) |

(Commission File

Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

|

7373 Gateway Boulevard

Newark,

CA |

|

94560 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| Registrant’s telephone number, including area code: (510) 648-3553 |

| (Former name or former address, if changed since last report.) |

| |

|

|

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | |

Trading

Symbol(s) | |

Name

of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | |

LCID | |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.03 – Amendments to Articles of Incorporation or

Bylaws; Change in Fiscal Year.

On

March 2, 2023, the Board of Directors (the “Board”) of Lucid Group, Inc. (the “Company”)

approved and adopted amended and restated by-laws (the “Second Amended and Restated Bylaws”) of the Company

to: (i) reflect recent amendments to, and align certain provisions with, the Delaware General Corporation Law; (ii) implement

procedural and disclosure requirements for director nominees and stockholders proposing director nominees and other business for consideration

at the Company’s annual or special meetings of stockholders, including to address the U.S. Securities and Exchange Commission’s

recently adopted “universal proxy card” rules; and (iii) make technical and conforming revisions and clarifications.

Among other updates, the Second Amended and Restated Bylaws:

| · | Add a requirement that any stockholder submitting a director nomination notice make a representation as to whether such stockholder

intends to comply with Rule 14a-19(b) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and a requirement that a stockholder submitting a director nomination notice deliver reasonable evidence that it has complied with the

requirements of Rule 14a-19 of the Exchange Act; |

| · | Add a requirement that the Board or an executive officer of the Company determine whether a stockholder submitting a director nomination

has complied with the applicable notice requirements of the Second Amended and Restated Bylaws; |

| · | Require that a stockholder directly or indirectly soliciting proxies from other stockholder use a proxy card color other than white; |

| · | Incorporate changes to conform to the Company’s proposed amended and restated certificate of incorporation, included as Annex

B to the Company’s preliminary proxy statement on Schedule 14A filed on March 3, 2023; and |

| · | Remove certain outdated and inapplicable restrictions on transfer of the Company’s securities. |

Notwithstanding

the foregoing and consistent with the Company’s prior bylaws, as long as the Investor Rights Agreement, dated as of February 22,

2021 and as amended on November 8, 2022, by and among the Company, Churchill Sponsor IV LLC, Ayar Third Investment Company (“Ayar”)

and certain other parties thereto (the “Investor Rights Agreement”), remains in effect with respect to Ayar,

Ayar shall not be subject to the notice procedures set forth in Section 2.09 of the Second Amended and Restated Bylaws with respect

to any annual or special meeting of stockholders in respect of any matters that are contemplated by the Investor Rights Agreement.

The foregoing summary of the amendments does not purport to be complete

and is qualified in its entirety by reference to the full text of the Second Amended and Restated Bylaws, a copy of which is filed as

Exhibit 3.2 hereto.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated:

March 3, 2023 |

|

| |

|

| |

Lucid

Group, Inc. |

| |

|

|

| |

By: |

/s/

Sherry House |

| |

|

Sherry

House |

| |

|

Chief

Financial Officer |

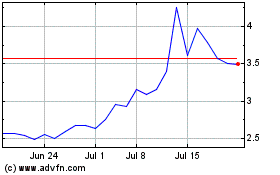

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Mar 2024 to Apr 2024

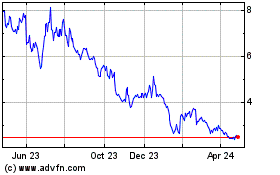

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Apr 2023 to Apr 2024