LCID Stock: Why Lucid Group Tanked Over 5% Yesterday?

December 07 2021 - 8:28AM

Finscreener.org

Shares of electric vehicle

company Lucid Group (NASDAQ: LCID)

are down more than 5% on Monday, December 6, 2021. Lucid disclosed

it received a subpoena from the SEC or Securities and Exchange

Commission to produce certain documents relating to an

investigation by the regulatory body.

A report from TheFly states,

“Although there is no assurance as to the scope or outcome of this

matter, the investigation appears to concern the business

combination between the company and Atieva, Inc. and certain

projections and statements.”

It’s quite possible that the

ongoing pullback might be temporary offering investors an

opportunity to buy the dip in a company with enticing growth

prospects.

The bull case for LCID stock

Lucid Group has been on an

absolute tear this year and has surged over 300%, valuing the stock

at a market cap of $77.8 billion. The company is a technology and

automotive entity that develops electric vehicles. It announced the

first group of Dream Edition car deliveries on October 30, shortly

after Lucid Group started production at the Arizona factory in

September. The facility is in fact the first dedicated EV

manufacturing hub in North America.

The Dream Edition models are

equipped with a special 118 kWh version of Lucid’s long-range

battery pack, featuring 22 modules totaling 6,600 cylindrical

cells. It has a certified range of 520 miles on a single charge

which is the

longest for any electric

vehicle.

Lucid Group plans to deliver 520

Dream Editions followed by deliveries of the Air Grand Touring

versions. As of November 15, 2021, it has over 17,000 reservations

and an order book of $1.3 billion. The Advanced Manufacturing Plant

in Arizona has a production capacity of up to 34,000 units each

year.

Lucid Group ended Q3 of

2021

with a cash balance of

$4.4 billion as it continues to invest in the expansion of

manufacturing capabilities.

What next for Lucid Group investors?

Lucid Group expects sales to

touch $2 billion by end of 2022. Further, it plans to expand its

portfolio and enter the luxury SUV space by end of 2023. This might

drive sales to $10 billion by 2024.

In addition to automobiles, Lucid

Group will also leverage its proprietary engineering technology for

applications in energy storage systems. Expansion into other

international markets will also be a key revenue driver for Lucid

Group in the upcoming decade.

The company’s CEO, Peter

Rawlinson explained, “We see significant demand for the

award-winning Lucid Air, with accelerating reservations as we ramp

production at our factory in Arizona. We remain confident in our

ability to achieve 20,000 units in 2022.”

He added, “This target is not

without risk given ongoing challenges facing the automotive

industry, with global disruptions to supply chains and logistics.

We are taking steps to mitigate these challenges, however, and look

forward to the launch of the Grand Touring, Touring, and Pure

versions of Lucid Air through 2022.”

The final verdict

Lucid Group is a company part of

a rapidly expanding addressable market providing it with enough

room to grow revenue at an enviable pace in the upcoming decade.

Despite its strong balance sheet, the company will have to raise

capital to fund its expansion plans going forward.

This in turn will dilute

shareholder wealth significantly which might drive LCID stock

lower.

Further, Lucid Group also remains

vulnerable in a market that is extremely overvalued at current

levels. Investors should be ready for freefall in LCID stock if it

misses earnings or revenue estimates in the upcoming

quarters.

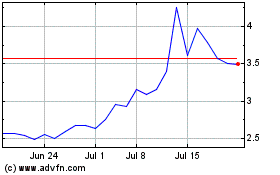

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Mar 2024 to Apr 2024

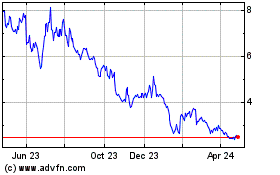

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Apr 2023 to Apr 2024