Filed Pursuant to Rule 424(b)(4)

Registration Statement File No.

333-240015

PROSPECTUS

8,300,000 Units (each Unit contains One Share of Common Stock and One

Common Warrant to Purchase One Share of Common Stock)

1,700,000 Pre-funded Units (each Pre-funded Unit contains One Pre-funded Warrant to Purchase

One Share of Common Stock and One Common Warrant to Purchase One Share of Common Stock)

(1,700,000 Shares of Common Stock Underlying the Pre-funded Warrants) and

(10,000,000 Shares of Common Stock Underlying the Common Warrants)

We are offering 8,300,000 units, each unit consisting of one share of our common stock and one common warrant to purchase one share of our common stock (together with the shares of common stock underlying such common warrants). Each common warrant contained in a unit will have an exercise price per share equal to $0.90 per share. The common warrants contained in the units will be exercisable immediately and will expire on the five year anniversary of the original issuance date. We are also offering the shares of our common stock that are issuable from time to time upon exercise of the common warrants contained in the units.

We are also offering the opportunity to purchase, if the purchaser so chooses, 1,700,000 pre-funded units to purchasers whose purchase of units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock immediately following the consummation of this offering (each pre-funded unit consisting of one pre-funded warrant to purchase one share of our common stock and one common warrant to purchase one share of our common stock) in lieu of units that would otherwise result in a purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock (or at the election of the purchaser, 9.99%). Each pre-funded warrant contained in a pre-funded unit will be exercisable for one share of our common stock. The purchase price of each pre-funded unit is equal to the price per unit being sold to the public in this offering, minus $0.01, and the exercise price of each pre-funded warrant included in the pre-funded unit is $0.01 per share. The pre-funded warrants expire when exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants contained in the pre-funded units sold in this offering.

For each pre-funded unit we sell, the number of units we are offering will be decreased on a one-for-one basis. Because we will issue a common warrant as part of each unit or pre-funded unit, the number of common warrants sold in this offering will not change as a result of a change in the mix of the units and pre-funded units sold. Each common warrant contained in a pre-funded unit will have an exercise price per share equal to $ 0.90 per share. The common warrants contained in the pre-funded units will be exercisable immediately and will expire on the five year anniversary of the original issuance date. We are also offering the shares of our common stock that are issuable from time to time upon exercise of the common warrants contained in the pre-funded units.

The units and the pre-funded units will not be issued or certificated. The shares of common stock or pre-funded warrants, as the case may be, and the common warrants can only be purchased together in this offering but the securities contained in the units or pre-funded units will be issued separately.

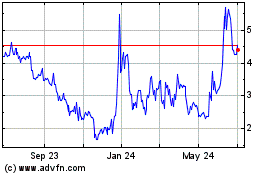

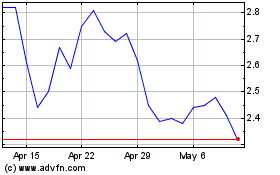

Our common stock is listed on the Nasdaq Capital Market under the symbol “LMFA”. On August 13, 2020, the last reported sale price for our common stock as reported on the Nasdaq Capital Market was $1.07 per share.

There is no established public trading market for the common warrants or the pre-funded warrants, and we do not expect a market to develop. In addition, we do not intend to apply for listing of the common warrants or the pre-funded warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants will be limited.

You should read carefully this prospectus and any applicable prospectus supplement or free writing prospectus, together with the additional information described in this prospectus under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” before you invest in any of our securities.

Investing in our securities involves risks. You should carefully read and consider the “Risk Factors” beginning on page 8 of this prospectus before investing. You should also consider the risk factors described or referred to in any documents incorporated by reference in this prospectus, and in any applicable prospectus supplement, before investing in these securities.

1

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

Per Unit

|

Per Pre-Funded Unit

|

Total

|

|

Public offering price

|

$0.90

|

$0.89

|

$8,983,000

|

|

Underwriting discount (1)

|

$0.072

|

$0.071

|

$718,640

|

|

Proceeds, before expenses, to us (2)

|

$0.828

|

$0.819

|

$8,264,360

|

|

(1)

|

The terms of our arrangement with the underwriter are described under the section entitled “Underwriting” beginning on page 19

|

|

(2)

|

We estimate the total expenses of this offering payable by us, excluding the underwriting discount, will be approximately $304,470. All costs associated with the registration will be borne by us.

|

Delivery of the securities offered hereby is expected to be made on or about August 18, 2020.

The offering is being underwritten on a firm commitment basis. The underwriter has an option exercisable within 45 days from the date of this prospectus to purchase up to an additional 1,200,000 shares of common stock and/or common warrants to purchase up to 1,200,000 shares of common stock, at the public offering price, less the underwriting discounts and commissions. If the underwriter exercises this option in full, the total underwriting discounts and commissions payable by us will be $86,400, and the total proceeds to us, before expenses, will be $993,600, excluding potential proceeds from the exercise of the common warrants included in such option.

Maxim Group LLC

The date of this prospectus is August 14, 2020.

2

TABLE OF CONTENTS

i

Unless the context otherwise requires, references in this prospectus to “we,” “us,” “our” or similar terms, as well as references to “LM Funding America” or the “Company,” refer to (i) following the date of the Corporate Reorganization (as defined herein), LM Funding America, Inc., a Delaware corporation, and its consolidated subsidiaries and (ii) prior to the date of the Corporate Reorganization, LM Funding, LLC, a Florida limited liability company, and its consolidated subsidiaries. This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission, which we refer to as the SEC or the Commission.

You should rely only on the information contained in this prospectus. We have not, and the underwriter has not, authorized anyone to provide you with any information other than that contained or incorporated by reference in this prospectus or in any applicable prospectus supplement or free writing prospectus prepared by or on behalf of us to which we have referred you. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates. We are not, and the underwriter is not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not, and the underwriter has not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the United States.

We further note that the representations, warranties and covenants made by us in any agreement that is incorporated by reference or filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Information contained in, and that can be accessed through, our web site www.lmfunding.com shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by any prospective investors for the purposes of determining whether to purchase the securities offered hereunder.

1

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus, and does not contain all of the information that you should consider before investing in our securities. You should read this summary together with the entire prospectus, including our financial statements, the notes to those financial statements and the additional information described in this prospectus under the heading “Where You Can Find More Information,” before making an investment decision. See the “Risk Factors” section of this prospectus beginning on page 8 and in the documents incorporated by reference into this prospectus for a discussion of the risks involved in investing in our securities.

Overview

We are a specialty finance company that provides funding to nonprofit community associations primarily located in the state of Florida. We offer incorporated nonprofit community associations, which we refer to as “Associations,” a variety of financial products customized to each Association’s financial needs. Our original product offering consists of providing funding to Associations by purchasing their rights under delinquent accounts that are selected by the Associations arising from unpaid Association assessments. Historically, we provided funding against such delinquent accounts, which we refer to as “Accounts,” in exchange for a portion of the proceeds collected by the Associations from the account debtors on the Accounts. In addition to our original product offering, we have started purchasing Accounts on varying terms tailored to suit each Association’s financial needs, including under our New Neighbor Guaranty™ program.

Specialty Finance Company

We purchase an Association’s right to receive a portion of the Association’s collected proceeds from owners that are not paying their assessments. After taking assignment of an Association’s right to receive a portion of the Association’s proceeds from the collection of delinquent assessments, we engage law firms to perform collection work on a deferred billing basis wherein the law firms receive payment upon collection from the account debtors or a predetermined contracted amount if payment from account debtors is less than legal fees and costs owed. Under this business model, we typically fund an amount equal to or less than the statutory minimum an Association could recover on a delinquent account for each Account, which we refer to as the “Super Lien Amount”. Upon collection of an Account, the law firm working on the Account, on behalf of the Association, generally distributes to us the funded amount, interest, and administrative late fees, with the law firm retaining legal fees and costs collected, and the Association retaining the balance of the collection. In connection with this line of business, we have developed proprietary software for servicing Accounts, which we believe enables law firms to service Accounts efficiently and profitably.

Under our New Neighbor Guaranty program, an Association will generally assign substantially all of its outstanding indebtedness and accruals on its delinquent units to us in exchange for payment by us of monthly dues on each delinquent unit. This simultaneously eliminates a substantial portion of the Association’s balance sheet bad debts and assists the Association to meet its budget by receiving guaranteed monthly payments on its delinquent units and relieving the Association from paying legal fees and costs to collect its bad debts. We believe that the combined features of the program enhance the value of the underlying real estate in an Association and the value of an Association’s delinquent receivables. We intend to leverage our proprietary software platform, as well as our industry experience and knowledge gained from our original line of business, to expand the New Neighbor Guaranty program in certain situations and to potentially develop other new products in the future.

Because we acquire and collect on the delinquent receivables of Associations, the Account debtors are third parties about whom we have little or no information. Therefore, we cannot predict when any given Account will be paid off or how much it will yield. In assessing the risk of purchasing Accounts, we review the property values of the underlying units, the governing documents of the relevant Association, and the total number of delinquent receivables held by the Association.

Specialty Finance Products

Original Product

Our original product relies upon Florida statutory provisions that effectively protect the principal amount invested by us in each Account. In particular, Section 718.116(1), Florida Statutes, makes purchasers and sellers of a unit in an Association jointly and severally liable for all past due assessments, interest, late fees, legal fees, and costs payable to the Association. As discussed above, the Florida Statutes grants to Associations a so-called “super lien”, which is a category of lien that is given a statutorily higher priority than all other types of liens other than property tax liens. The amount of the Association’s priority over a first mortgage holder that takes title to a property through foreclosure (or deed in lieu), referred to as the Super Lien Amount, is limited to twelve months’ past due assessments or, if less, one percent (1.0%) of the original mortgage amount. Under our contracts with Associations for our original product, we pay Associations an amount up to the Super Lien Amount for the right to receive all collected interest and late fees on Accounts purchased from the Associations.

2

In other states in which we have offered our original product, which are currently only in Washington, Colorado and Illinois, we rely on statutes that we believe are similar to the above-described Florida statutes in relevant respects. A total of approximately 22 U.S. states, Puerto Rico and the District of Columbia have super lien statutes that give Association assessments super lien status under some circumstances, and of these states, we believe that all of these jurisdictions other than Alaska have a regulatory and business environment that would enable us to offer our original product to Associations in those states on materially the same basis.

New Neighbor Guaranty

In 2012, we developed a new product, the New Neighbor Guaranty, wherein an Association assigns substantially all of its outstanding indebtedness and accruals on its delinquent units to us in exchange for payments in an amount equal to the regular ongoing monthly or quarterly assessments for delinquent units when those amounts would be due to the Association. We assume both the payment and collection obligations for these assigned Accounts under this product. This simultaneously eliminates an Association’s balance sheet bad debts and assists the Association to meet its budget by receiving guaranteed assessment payments on its delinquent units and relieving the Association from paying legal fees and costs to collect its bad debts. We believe that the combined features of the product enhance the value of the underlying real estate in an Association and the value of an Association’s delinquent receivables.

Before we implement the New Neighbor Guaranty program for an Association, an Association typically asks us to conduct a review of its accounts receivable. After we have conducted the review, we inform the Association which Accounts we are willing to purchase and the terms of such purchase. Once we implement the New Neighbor Guaranty program, we begin making scheduled payments to the Association on the Accounts as if the Association had non-delinquent residents occupying the units underlying the Accounts. Our New Neighbor Guaranty contracts typically allow us to retain all collection proceeds on each Account other than special assessments and accelerated assessment balances. Thus, the Association foregoes the potential benefit of a larger future collection in exchange for the certainty of a steady stream of immediate payments on the Account.

For a complete description of our business, financial condition, results of operations and other important information, we refer you to our filings with the SEC that are incorporated by reference into this prospectus, including our Annual Report on Form 10-K for the year ended December 31, 2019. For instructions on how to find copies of these documents, see the section of this prospectus entitled “Where You Can Find More Information.”

Recent Developments

IIU Acquisition and Disposal

On November 2, 2018, the Company invested cash by purchasing a Senior Convertible Promissory Note in the original principal amount of $1,500,000 (the “IIU Note”) from IIU Inc. (“IIU”), a synergistic Virginia based travel insurance brokerage company controlled by Craven House North America, LLC (“Craven”) N.A., (whose ownership excluding unexercised warrants was approximately 20% of the Company’s outstanding stock at the time of the acquisition). The maturity date of the IIU Note was 360 dates after the date of issuance (subject to acceleration upon an event of default). The IIU Note carried a 3.0% interest rate, with accrued but unpaid interest being payable on the IIU Note’s maturity date.

On January 16, 2019, the Company entered into a Stock Purchase Agreement with Craven (the “IIU SPA”) to purchase all the outstanding capital stock of IIU as a possible synergistic effort to diversify revenue sources that were believed to be accretive to earnings. IIU provides global medical insurance products for international travelers, specializing in policies covering high-risk destinations, emerging markets and foreign travelers coming to the United States. All policies are fully underwritten with no claim risk remaining with IIU.

The Company purchased 100% of the issued and outstanding capital stock of IIU from Craven for $5,089,357 subject to adjustment as set forth in the IIU SPA. IIU was required to have a minimum net working capital of $15,000 and at least $152,000 in cash. The Company paid the purchase price under the IIU SPA at closing as follows:

|

|

•

|

The Company cancelled all principal and accrued interest of the IIU Note, which consisted of aggregate principal indebtedness and accrued interest of $1,507,375 as of January 16, 2019.

|

|

|

•

|

The Company issued to Craven a $3,581,982 Senior Convertible Promissory Note (the “Craven Convertible Note”) for the balance of the purchase price. At the option of Craven, the Craven Convertible Note could be paid in restricted shares of our common stock or cash. The Craven Convertible Note bore simple interest at 3% per annum. The Craven Convertible Note was due and payable 360 days from the closing date of the IIU SPA. If repaid by the Company in restricted common stock, the outstanding principal and interest of the Craven Convertible Note would be paid by the Company by issuing to Craven a number of restricted common shares equal to the adjusted principal and accrued interest owing to Craven under the Craven

|

3

|

|

|

Convertible Note divided by $2.41. On the date of issuance of the Craven Convertible Note, the closing share price of the Company was $1.42.

|

|

|

•

|

Pursuant to the terms of the IIU SPA, the purchase price was subsequently reduced by $120,200, to $4,969,200.

|

On December 20, 2019, the Company loaned $1.5 million to Craven (“Craven Secured Promissory Note”) which had an initial maturity date of April 15, 2020 and carried an interest rate of 0.5% that was to be paid monthly. The Company subsequently extended the due date of the Craven Secured Promissory Note to August 1, 2021. The Craven Secured Promissory Note was secured by, among other things, a pledge of Craven’s 640,000 shares of common stock of the Company and the assignment of the assets of Craven in favor of the Company. On June 29, 2020, the Company received from Craven $1,503,719 as payment in full of all principal and accrued interest due from the Craven Secured Promissory Note.

On January 8, 2020, the Company entered into a Stock Purchase Agreement (“SPA”) with Craven pursuant to which the Company sold back to Craven all of the issued and outstanding shares of IIU for $3,562,569. The purchase price was paid by Craven through the cancellation of the $3,461,782 Craven Convertible Note plus forgiveness of $100,787 of accrued interest. The Company originally paid $4,969,200 for the purchase of IIU in January 2019, which included a negative $720,386 net fair value of assets and $5,689,586 of goodwill. As a result, goodwill was impaired by $1.65 million. The sale of IIU resulted in a gain of $16,428.

Entry into and Termination of Hanfor Share Exchange Agreement

On March 23, 2020, the Company entered into a Share Exchange Agreement, dated March 23, 2020 (the “Share Exchange Agreement”), with Hanfor (Cayman) Limited, a Cayman Islands exempted company (“Hanfor”), and BZ Industrial Limited, a British Virgin Islands business company and the sole stockholder of Hanfor (“Hanfor Owner”). The Share Exchange Agreement contemplated a business combination transaction in which Hanfor Owner would transfer and assign to the Company all of the share capital of Hanfor in exchange for a number of shares of the Company’s common stock that would result in Hanfor Owner owning 86.5% of the outstanding common stock of the Company.

Under the agreement, Hanfor Owner was required to deliver to the Company audited financial statements for Hanfor for the 2019 and 2018 fiscal years, and such audited financial statements were required to be delivered by May 31, 2020 (subject to extension to June 30, 2020 under specified circumstances). In connection with the execution of the Share Exchange Agreement, the Company and Hanfor Owner entered into a Stock Purchase Agreement, dated March 23, 2020, pursuant to which Hanfor Owner purchased from the Company an aggregate of 520,838 shares of the Company’s common stock at a price of $2.40 per share. Hanfor Owner paid $250,000 cash on March 23, 2020 and the Company received an additional $1,000,000 in April 2020 at which time the Company issued the 520,838 shares.

On July 14, 2020, the Company notified Hanfor and Hanfor Owner that the Company had elected to terminate the Share Exchange Agreement due to Hanfor’s inability to provide audited financial statements by June 30, 2020. Although the Company believes that it properly terminated the Share Exchange Agreement, on July 21, 2020, counsel to Hanfor Owner informed the Company that Hanfor Owner believes that the Company’s termination of the Share Exchange Agreement was not effected in accordance with the terms of the Share Exchange Agreement. The Company and Hanfor Owner are engaged in discussions to resolve this disagreement, but there is no assurance that this disagreement will be promptly resolved or resolved on terms favorable to the Company, and there is no assurance that Hanfor Owner will not seek to take legal action.

Nasdaq Listing

On March 27, 2020, the Company received a notification letter from the Nasdaq Listing Qualifications department of The Nasdaq Stock Market LLC (“Nasdaq”) stating that the Company has not regained compliance with Nasdaq Continued Listing Rule 5550(a)(2), which requires the Company’s listed securities to maintain a minimum bid price of $1.00 per share (the "Minimum Bid Price Rule"). The notification stated that the Company’s securities would be delisted from the Nasdaq Capital Market on April 7, 2020 unless the Company timely requested a hearing before a Nasdaq Hearing Panel. The Company timely requested a hearing. However, on April 16, 2020, Nasdaq suspended any enforcement actions relating to bid price issues through June 30, 2020. On July 1, 2020, the Company received a letter from Nasdaq that the Company had regained compliance with the Minimum Bid Price Rule because the closing price for the Company’s common stock was $1.00 per share or greater for ten (10) consecutive business days.

Additionally, on January 3, 2020, the Company received a deficiency letter from Nasdaq, indicating that it was in violation of Listing Rules 5620(a) and 5810(c)(2)(G) by virtue of passing the applicable deadline for holding of its annual general meeting of shareholders for the financial year ended December 31, 2018. The Company resolved this issue by having its annual general meeting of shareholders on May 11, 2020.

4

Reverse Stock Split Approval

On May 11, 2020, our shareholders voted in favor of the approval of an amendment to our Certificate of Incorporation, in the event it is deemed advisable by our Board of Directors, to effect an additional reverse stock split of the Company’s issued and outstanding common stock at a ratio within the range of one-for-two (1:2) and one-for-ten (1:10), as determined by the Board of Directors. However, a reverse stock split has not yet been effected pursuant to such approval.

Corporate Information

LM Funding, LLC, our wholly-owned subsidiary, was originally organized in January 2008 as a Florida limited liability company. Historically, all of our business was conducted through LM Funding, LLC and its subsidiaries. Immediately prior to our initial public offering in October 2015, the members of the LM Funding, LLC contributed all of their membership interests to LM Funding America, Inc., a Delaware corporation incorporated on April 20, 2015, in exchange for an aggregate of 210,000 shares of the common stock of LM Funding America, Inc. (the “Corporate Reorganization”). Immediately after such contribution and exchange, the former members of LM Funding, LLC became the holders of 100% of the issued and outstanding common stock of LM Funding America, Inc., thereby making LM Funding, LLC a wholly-owned subsidiary of LM Funding America, Inc.

Our principal executive offices are located at 1200 Platt Street, Suite 1000, Tampa, Florida 33602, and our telephone number is (813) 222-8996. Our website is www.lmfunding.com and all of our filings with the SEC are available free of charge on our website. Information contained on our website is not incorporated by reference into this prospectus, and such information should not be considered to be part of this prospectus.

Emerging Growth Company Status

We qualify as an “emerging growth company,” as that term is defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For as long as we qualify as an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that do not qualify as emerging growth companies, including, without limitation, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended, reduced disclosure obligations relating to executive compensation and exemptions from the requirements of holding advisory “say-on-pay,” “say-when-on-pay” and “golden parachute” executive compensation votes.

Under the JOBS Act, we will remain an emerging growth company until the earliest of:

|

|

•

|

the last day of the fiscal year during which we have total annual gross revenues of $1.0 billion or more;

|

|

|

•

|

the last day of the fiscal year following the fifth anniversary of the completion of our initial public offering, or December 31, 2020;

|

|

|

•

|

the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; and

|

|

|

•

|

the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (i.e., the first day of the fiscal year after we have (1) more than $700 million in outstanding common equity held by our non-affiliates, measured each year on the last day of our second fiscal quarter, and (2) been public for at least 12 months).

|

We have elected to take advantage of certain of the reduced disclosure obligations regarding executive compensation in this prospectus and may elect to take advantage of other reduced reporting requirements in future filings with the SEC. As a result, the information that we provide to our stockholders may be different than the information you receive from other public reporting companies.

5

The Offering

|

|

|

|

Units offered by us in this offering

|

8,300,000 units, each consisting of one share of our common stock and one common warrant to purchase one share of our common stock.

|

|

Pre-funded units offered by us in this offering

|

We are also offering the opportunity to purchase, if the purchaser so chooses, 1,700,000 pre-funded units to purchasers whose purchase of units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock immediately following the consummation of this offering (each pre-funded unit consisting of one pre-funded warrant to purchase one share of our common stock and one common warrant to purchase one share of our common stock) in lieu of units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock (or, at the election of the purchaser, 9.99%). The purchase price of each pre-funded unit is equal to the price at which the units are being sold to the public in this offering, minus $0.01, and the exercise price of each pre-funded warrant included in each pre-funded unit is $0.01 per share. For each pre-funded unit we sell, the number of units we are offering will be decreased on a one-for-one basis. Because we will issue a common warrant as part of each unit or pre-funded unit, the number of common warrants sold in this offering will not change as a result of a change in the mix of the units and pre-funded units sold. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering.

|

|

Common warrants offered by us in the offering

|

Common warrants to purchase an aggregate of 10,000,000 shares of our common stock. Each unit and each pre-funded unit includes a common warrant to purchase one share of our common stock. Each common warrant will have an exercise price per share equal to $0.90 per share, will be immediately separable from the common stock or pre-funded warrant, as the case may be, will be immediately exercisable and will expire on the five year anniversary of the original issuance date. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the common warrants.

|

|

Option to purchase additional securities

|

The underwriter has an option to purchase up to an additional 1,200,000 shares of common stock and/or common warrants to purchase up to 1,200,000 shares of common stock, at the public offering price less discounts and commissions. The underwriter may exercise this option at any time and from time to time within 45 days from the date of this prospectus.

|

|

Common stock outstanding prior to this offering

|

5,068,799 shares of common stock.

|

|

Common stock outstanding after this offering

|

15,068,799 shares of common stock or 16,268,799 shares of common stock if the underwriter exercises in full its option to purchase additional securities in the form of shares of common stock (assuming no exercise of any pre-funded warrants included in the pre-funded units sold in this offering and no exercise of the common warrants issued in this offering).

|

|

Use of proceeds

|

We intend to use the net proceeds received from this offering for general corporate purposes, including working capital. See “Use of Proceeds” on page 12 of this prospectus.

|

|

Risk factors

|

Investing in our securities involves a high degree of risk. For a discussion of factors to consider before deciding to invest in our securities, you should carefully review and consider the “Risk Factors” section of this prospectus, as well as the risk factors described or referred to in any documents incorporated by reference in this prospectus, and in any applicable prospectus supplement.

|

|

Trading Symbol

|

Our common stock is listed on the Nasdaq Capital Market under the symbol “LMFA”. There is no established trading market for the pre-funded warrants or common warrants, and we do not expect a trading market to develop. We do not plan on applying to list the common warrants or the pre-funded warrants on the Nasdaq Capital Market, any national securities exchange or any other nationally recognized trading system. Without an active trading market, the liquidity of the common warrants and the pre-funded warrants will be limited.

|

The number of shares of common stock outstanding after this offering, as reflected above, is based on the actual number of shares outstanding as of June 30, 2020, which was 5,068,799, and does not include, as of that date:

6

|

|

•

|

1,263,000 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $2.40 per share;

|

|

|

•

|

143,587 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $1.84 per share;

|

|

|

•

|

125,000 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $2.64 per share;

|

|

|

•

|

120,000 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $125 per share; and

|

|

|

•

|

60,000 shares of common stock reserved for future grant or issuance as of June 30, 2020 under our 2015 Omnibus Incentive Plan.

|

|

|

•

|

1,700,000 shares of common stock issuable upon exercise of the pre-funded warrants offered hereby by us at an exercise price of $0.01 per share; and

|

|

|

•

|

10,000,000 shares of common stock issuable upon exercise of the common warrants offered hereby by us at an exercise price of $0.90 per share.

|

Unless otherwise indicated:

|

|

•

|

All historical shares and per share information included in this prospectus have been retroactively adjusted to reflect the Company’s 1-for-10 reverse stock split (the “Reverse Stock Split”); and

|

|

|

•

|

all information contained in this prospectus assumes no exercise of the warrants offered hereby.

|

.

7

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding to invest in our securities or to maintain or increase your investment, you should carefully consider the risks described below, in addition to the other information contained in this prospectus as well as the risks and uncertainties set forth under the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, and in our other filings with the SEC, which are incorporated by reference herein. The risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business and results of operations. If any of these risks actually occur, our business, financial condition or results of operations could be seriously harmed. In that event, the market price for our common stock could decline and you may lose all or part of your investment.

Risks Related to This Offering

Management will have broad discretion with respect to the use of the proceeds from this offering.

Our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. It is possible that our management may use the net proceeds for general corporate purposes that may not improve our financial condition or market value.

You will experience immediate and substantial dilution in the net tangible book deficit per share of the common stock included in the units or issuable upon exercise of the common warrants or pre-funded warrants in this offering and may experience additional dilution of your investment in the future.

Since the effective price per share of common stock included in the units or issuable upon exercise of the common warrants or the pre-funded warrants being offered is substantially higher than the net tangible book deficit per share of our common stock outstanding prior to this offering, you will suffer immediate and substantial dilution in the net tangible book deficit of the common stock included in the units or issuable upon the exercise of the common warrants or the pre-funded warrants issued in this offering. See the section titled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase units in this offering.

Subject to the lock-up provisions described under “Underwriting,” we are generally not restricted from issuing additional securities including shares of common stock, securities that are convertible into or exchangeable for, or that represent the right to receive common stock or substantially similar securities. We may conduct one or more additional offerings following this offering.

The issuance of securities in these or any other offerings may cause further dilution to our stockholders, including investors in this offering. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders, including investors who purchase securities in this offering. The exercise of outstanding stock options and warrants may also result in further dilution to your investment.

If our common stock is delisted from Nasdaq, the liquidity and price of our common stock could decrease and our ability to obtain financing could be impaired.

On March 27, 2020, the Company received a notification letter from the Nasdaq Listing Qualifications department of The Nasdaq Stock Market LLC (“Nasdaq”) stating that the Company was not in compliance with the Minimum Bid Price Rule, which requires the Company’s listed securities to maintain a minimum bid price of $1.00 per share. The notification stated that the Company’s securities would be delisted from the Nasdaq Capital Market on April 7, 2020 unless the Company timely requested a hearing before a Nasdaq Hearing Panel. The Company timely requested a hearing. However, the delisting of the Company’s securities was stayed due to the Nasdaq’s decision to suspend any enforcement actions relating to bid price issues. On July 1, 2020, the Company received a letter from Nasdaq that the Company has regained compliance with the Minimum Bid Price Rule because the closing price for the Company’s common stock was $1.00 per share or greater for ten (10) consecutive business days.

Additionally, on January 3, 2020, the Company received a deficiency letter from Nasdaq, indicating that it was in violation of Listing Rules 5620(a) and 5810(c)(2)(G) by virtue of passing the applicable deadline for holding of its annual general meeting of shareholders for the financial year ended December 31, 2018. The Company resolved this issue by having its annual general meeting of shareholders on May 11, 2020.

Any delisting of our common stock from the Nasdaq Capital Market could adversely affect our ability to attract new investors, decrease the liquidity of our outstanding shares of common stock, reduce our ability to raise additional capital, reduce the price at which our common stock trades, and increase the transaction costs inherent in trading such shares with overall negative effects for our

8

stockholders. In addition, the delisting of our common stock could deter broker-dealers from making a market in or otherwise seeking or generating interest in our common stock and might deter certain institutions and persons from investing in our securities at all.

The exclusive jurisdiction clause set forth in the common warrants and pre-funded warrants to be issued to investors in this offering may have the effect of limiting an investor’s rights to bring legal action against us and could limit the investor’s ability to obtain a favorable judicial forum for disputes with us.

The common warrants and pre-funded warrants to be issued in this offering provides for investors to consent to exclusive jurisdiction to courts located in New York, New York. This exclusive jurisdiction may have the effect of limiting the ability of investors to bring a legal claim against us due to geographic limitations and may limit an investor’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us. Alternatively, if a court were to find this exclusive forum provision inapplicable to, or unenforceable in respect of, one or more of the specified types of actions or proceedings, we may incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect our business and financial condition.

A decline in the price of our common stock could adversely affect our ability to raise working capital.

Although there is a public market for our common stock, we can give no assurance that an active and liquid public market for the shares of the common stock will continue in the future. In addition, future sales of large amounts of common stock could adversely affect the market price of our common stock and our ability to raise capital. The price of our common stock could also drop as a result of the exercise of options for common stock or the perception that such sales or exercise of options could occur. These factors could also have a negative impact on the liquidity of our common stock and our ability to raise working capital through future stock offerings.

We do not pay cash dividends.

We have never paid any cash dividends on our common stock and do not intend to pay cash dividends in the foreseeable future. Instead, we intend to apply earnings, if any, to the expansion and development of our business. Thus, the liquidity of your investment is dependent upon your ability to sell stock at an acceptable price. The price may increase or decrease and may limit your ability to realize any value from your investment, including the initial purchase price.

Holders of our warrants will have no rights as a common stockholder until they acquire our common stock.

Until you acquire shares of our common stock upon exercise of your warrants, you will have no rights with respect to shares of our common stock issuable upon exercise of your warrants. Upon exercise of your warrants, you will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

A large number of shares issued in this offering may be sold in the market following this offering, which may depress the market price of our common stock.

A large number of shares issued in this offering may be sold in the market following this offering, which may depress the market price of our common stock. Sales of a substantial number of shares of our common stock in the public market following this offering could cause the market price of our common stock to decline. If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and sellers remain willing to sell the shares. All of the shares of common stock issued in the offering will be freely tradable without restriction or further registration under the Securities Act of 1933, as amended (the “Securities Act”).

The warrants issued in this offering may not have any value.

Each warrant will have an exercise price equal to $ and will expire on the fifth anniversary of the date they first become exercisable. In the event our common stock price does not exceed the exercise price of the warrants during the period when the warrants are exercisable, the warrants may not have any value.

There is no public market for the common warrants or the pre-funded warrants to purchase shares of our common stock included in the units and the pre-funded units being offered by us in this offering.

There is no established public trading market for the common warrants or the pre-funded warrants included in the units and the pre-funded units being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the common warrants or the pre-funded warrants on any national securities exchange or other nationally recognized trading system, including the Nasdaq Capital Market. Without an active market, the liquidity of the common warrants and the pre-funded warrants will be limited.

9

Risk Relating to Potential Legal Dispute

A potential legal dispute between Hanfor Owner and the Company could have material adverse effect on our business, financial condition, and results of operations.

On March 23, 2020, the Company entered into the Share Exchange Agreement with Hanfor and Hanfor Owner. The Share Exchange Agreement contemplated a business combination transaction in which Hanfor Owner would transfer and assign to the Company all of the share capital of Hanfor in exchange for a number of shares of the Company’s common stock that would result in Hanfor Owner owning 86.5% of the outstanding common stock of the Company. Under the agreement, Hanfor Owner was required to deliver to the Company audited financial statements for Hanfor for the 2019 and 2018 fiscal years, and such audited financial statements were required to be delivered by May 31, 2020 (subject to extension to June 30, 2020 under specified circumstances). On July 14, 2020, the Company notified Hanfor and Hanfor Owner that the Company had terminated the Share Exchange Agreement due to Hanfor’s inability to provide audited financial statements by June 30, 2020. Although the Company believes that it properly terminated the Share Exchange Agreement, on July 21, 2020, counsel to Hanfor Owner informed the Company that Hanfor Owner believes that the Company’s termination of the Share Exchange Agreement was not effected in accordance with the terms of the Share Exchange Agreement. The Company and Hanfor Owner are engaged in discussions to resolve this disagreement, but there is no assurance that this disagreement will be promptly resolved or resolved on terms favorable to the Company. If the Company and Hanfor Owner cannot resolve this disagreement, any resulting formal legal dispute could have a material adverse effect on the Company’s business, financial conditions, and results of operation.

10

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. We have made these statements in reliance on the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts included in this prospectus and the documents incorporated by reference into this prospectus, including, without limitation, statements regarding our future financial position, business strategy, budgets, projected revenues, projected costs, and plans and objectives of management for future operations, are forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expects,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “believes,” or the negative thereof or any variation thereon or similar terminology or expressions.

We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are not guarantees and are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Important factors which could materially affect our results and our future performance include, without limitation:

|

|

•

|

our ability to purchase defaulted consumer receivables at appropriate prices,

|

|

|

•

|

competition to acquire such receivables,

|

|

|

•

|

our dependence upon third party law firms to service our accounts,

|

|

|

•

|

our ability to obtain funds to purchase receivables,

|

|

|

•

|

our ability to manage growth or declines in the business,

|

|

|

•

|

changes in government regulations that affect our ability to collect sufficient amounts on our defaulted consumer receivables,

|

|

|

•

|

the impact of class action suits and other litigation on our business or operations,

|

|

|

•

|

our ability to keep our software systems updated to operate our business,

|

|

|

•

|

our ability to employ and retain qualified employees,

|

|

|

•

|

our ability to establish and maintain internal accounting controls,

|

|

|

•

|

changes in the credit or capital markets,

|

|

|

•

|

changes in interest rates,

|

|

|

•

|

deterioration in economic conditions,

|

|

|

•

|

negative press regarding the debt collection industry which may have a negative impact on a debtor’s willingness to pay the debt we acquire,

|

|

|

•

|

the spread of the novel coronavirus (COVID-19), its impact on the economy generally and, more specifically, the specialty finance or specialty health insurance industries,

|

|

|

•

|

negative press regarding the debt collection industry which may have a negative impact on a debtor’s willingness to pay the debt we acquire, and

|

|

|

•

|

other factors set forth under “Risk Factors” in this prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2019, as filed with the SEC, as well as our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, as well as any update in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed from time to time with the SEC, that are incorporated by reference into this prospectus.

|

11

USE OF PROCEEDS

We estimate that the net proceeds of this offering will be approximately $7,959,890, after deducting the underwriting fees and estimated offering expenses payable by us. If the underwriter exercises its option to purchase additional shares of common stock and/or common warrants, we estimate the net proceeds from this offering will be approximately $8,953,490 from the sale of our securities (assuming that the option is exercised solely with respect to shares of common stock), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. These amounts exclude the proceeds, if any, from the exercise of common warrants and pre-funded warrants in this offering. If all of the common warrants sold in this offering were to be exercised in cash at an exercise price of $0.90 per share, we would receive additional net proceeds of approximately $9.0 million. If all of the pre-funded warrants sold in this offering were to be exercised in cash at an exercise price of $0.01 per share, we would receive additional net proceeds of $17,000. We cannot predict when or if these common warrants or pre-funded warrants will be exercised. It is possible that the common warrants and pre-funded warrants may expire and may never be exercised.

We intend to use the net proceeds from this offering for general corporate purposes, including working capital.

We have not otherwise determined the amounts we plan to spend on more specific areas or the timing of these expenditures. As a result, our management will have broad discretion to allocate the net proceeds from this offering. Pending application of the net proceeds as described above, we intend to invest the net proceeds of this offering in short-term, investment-grade, interest-bearing securities.

12

CAPITALIZATION

The following table sets forth our cash, cash equivalents and capitalization as of June 30, 2020:

|

|

•

|

on an actual basis; and

|

|

|

•

|

on an as adjusted basis to give effect to the sale of our securities in this offering and the receipt of approximately $7,959,890 in net proceeds from the sale of such shares, based on a public offering price of $0.90 per unit, and $0.89 per pre-funded unit and the sale of 8,300,000 units and 1,700,000 pre-funded units in this offering after deducting the underwriting discount and estimated offering expenses payable by us.

|

You should read this information in conjunction with our consolidated financial statements and notes thereto incorporated by reference into this prospectus.

|

|

Actual

|

As Adjusted

|

|

Cash and cash equivalents

|

$ 6,238,678

|

$ 14,198,568

|

|

Total liabilities

|

709,367

|

709,367

|

|

Stockholders’ equity:

|

|

|

|

Common stock, par value $.001; 30,000,000 shares authorized; 5,068,799 shares issued and outstanding on an actual basis, 15,068,799 issued and outstanding on an as adjusted basis

|

5,069

|

15,069

|

|

Additional paid-in capital

|

21,653,342

|

29,603,232

|

|

Accumulated deficit

|

(15,483,824)

|

(15,483,824)

|

|

Total stockholders’ equity

|

$ 6,174,587

|

$ 14,134,477

|

|

Total liabilities and stockholders’ equity

|

$ 6,883,954

|

$ 14,843,844

|

The table above is based on 5,068,799 shares of our common stock outstanding as of June 30, 2020 and excludes:

|

|

•

|

1,263,000 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $2.40 per share;

|

|

|

•

|

143,587 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $1.84 per share;

|

|

|

•

|

125,000 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $2.64 per share;

|

|

|

•

|

120,000 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $125 per share;

|

|

|

•

|

60,000 shares of common stock reserved for future grant or issuance as of June 30, 2020 under our 2015 Omnibus Incentive Plan; and

|

|

|

•

|

1,700,000 shares of common stock issuable upon exercise of the pre-funded warrants offered hereby by us at an exercise price of $0.01 per share;

|

|

|

•

|

10,000,000 shares of common stock issuable upon exercise of the common warrants offered hereby by us at an exercise price of $0.90 per share.

|

13

DILUTION

If you purchase our securities in this offering, you will experience dilution in the net tangible book value per share of the common stock you purchase to the extent of the difference between the combined public offering price per share and related warrants and the as adjusted net tangible book value per share of our common stock immediately after this offering, assuming no value is attributed to the warrants.

Net tangible book value per share is equal to the amount of our total tangible assets, less total liabilities, divided by the number of outstanding shares of our common stock. As of June 30, 2020, our historical net tangible book value was approximately $6.2 million, or approximately $1.22 per share of common stock.

As adjusted net tangible book value is our historical net tangible book value, after giving effect to the sale of our securities in this offering based on a public offering price of $0.90 per unit and $0.89 per pre-funded unit and the sale of 8,300,000 units and 1,700,000 pre-funded units after deducting the underwriting discount and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2020, would have been approximately $14.2 million, or approximately $0.94 per share, which excludes the common warrants to purchase shares of our common stock to be issued to investors in this offering. This represents an immediate decrease in net tangible book value of approximately $0.28 per share to existing stockholders and an immediate dilution of approximately $(0.04) per share to new investors purchasing shares of our common stock and warrants in this offering. The following table illustrates this per share dilution:

|

|

|

|

|

Assumed combined public offering price per unit

|

|

$0.90

|

|

Historical net tangible book value per share as of June 30, 2020

|

$1.22

|

|

|

Decrease in historical net tangible book value per share attributable to this offering

|

$0.28

|

|

|

As adjusted net tangible book value per share as of June 30, 2020 after this offering

|

|

$0.94

|

|

Dilution in as adjusted net tangible book value per share to new investors

|

|

$ (0.04)

|

|

|

|

|

If the underwriter exercises its option to purchase additional shares of common stock and/or common warrants at the public offering price of $0.90 per unit (and only shares of common stock are purchased pursuant to the option), less underwriting discounts and commissions, our pro forma as adjusted net tangible book value after this offering would be approximately $15.1 million, or approximately $0.93 per share, and have no significant impact on dilution per share to existing shareholders and immediate dilution in pro forma net tangible book value of approximately $(0.03) per share to investors purchasing our securities in this offering at the public offering price.

This table does not take into account further dilution to new investors that could occur upon the exercise of the warrants offered hereby or outstanding options and warrants having a per share exercise price less than the public offering price per share in this offering. To the extent that outstanding options or warrants are exercised, or restricted stock units vest and settle, investors purchasing our common stock will experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

The number of shares of common stock outstanding after this offering as reflected in the table above, is based on the actual number of shares outstanding as of June 30, 2020, which was 5,068,799, and does not include, as of that date:

|

|

•

|

1,263,000 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $2.40 per share;

|

|

|

•

|

143,587 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $1.84 per share;

|

|

|

•

|

125,000 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $2.64 per share;

|

|

|

•

|

120,000 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2020, with a weighted average exercise price of $125 per share;

|

|

|

•

|

60,000 shares of common stock reserved for future grant or issuance as of June 30, 2020 under our 2015 Omnibus Incentive Plan; and

|

14

|

|

•

|

1,700,000 shares of common stock issuable upon exercise of the pre-funded warrants offered hereby by us at an exercise price of $0.01 per share;

|

|

|

•

|

10,000,000 shares of common stock issuable upon exercise of the common warrants offered hereby by us at an exercise price of $0.90 per share.

|

15

DESCRIPTION OF SECURITIES WE ARE OFFERING

We are offering (i) 8,300,000 units, each unit consisting of one share of our common stock and one common warrant to purchase one share of our common stock, and (ii) 1,700,000 pre-funded units, each pre-funded unit consisting of one pre-funded warrant to purchase one share of our common stock and one common warrant to purchase one share of our common stock. The share of common stock and accompanying common warrant included in each unit will be issued separately, and the pre-funded warrant to purchase one share of common stock and the accompanying common warrant included in each pre-funded unit will be issued separately. Units will not be issued or certificated. We are also registering the shares of common stock included in the units and the shares of common stock issuable from time to time upon exercise of the pre-funded warrants included in pre-funded units and common warrants included in the units and the pre-funded units offered hereby.

Common Stock

Authorized Capital Stock. Under our Certificate of Incorporation, we are authorized to issue 30,000,000 shares of Common Stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per share, in one or more series designated by our board of directors (the “Board of Directors”).

Voting Rights. The holders of our Common Stock are entitled to one vote per share. Holders of our common stock are not entitled to cumulate their votes in the election of directors. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all holders of Common Stock present in person or represented by proxy, voting together as a single class. The number of authorized shares of Common Stock may be increased or decreased (but not below the number of shares then outstanding) by (in addition to any vote of the holders of one or more series of preferred stock that may be required to vote pursuant to the terms of our Certificate of Incorporation) the affirmative vote of holders of shares of capital stock of the Company representing a majority of the votes represented by all outstanding shares of capital stock of the Company entitled to vote, irrespective of any of the provisions of the DGCL.

Dividends. Holders of our Common Stock will share ratably (based on the number of shares of Common Stock held) if and when any dividend is declared by the Board of Directors out of funds legally available therefor, subject to any statutory or contractual restrictions on the payment of dividends by us and subject to any restrictions or preferential rights on the payment of dividends imposed by the terms of any outstanding series of preferred stock.

Liquidation Rights. In the event of our liquidation, dissolution or winding up, the holders of our Common Stock are entitled to share ratably in all assets of the Company remaining after the payment of its liabilities, subject to the prior distribution rights of any series of preferred stock then outstanding.

Other Rights. Our Common Stock is not subject to redemption nor do holders of our Common Stock have any preemptive rights to purchase additional shares of Common Stock. Holders of shares of our Common Stock do not have subscription, redemption or conversion rights. There are no redemption or sinking fund provisions applicable to the Common Stock. All of the outstanding shares of Common Stock are validly issued, fully paid and non-assessable.

Reverse Stock Split. On October 15, 2018, the Company effected the Reverse Stock Split by means of a one-for-ten (1:10) reverse split of its outstanding Common Stock, par value $0.001 per share. As a result of the Reverse Stock Split, every ten shares of Common Stock were consolidated into one share of Common Stock, effective as of October 16, 2018. On May 11, 2020, our shareholders voted in favor of the approval of an amendment to our Certificate of Incorporation, in the event it is deemed advisable by our Board of Directors, to effect an additional reverse stock split of the Company’s issued and outstanding common stock at a ratio within the range of one-for-two (1:2) and one-for-ten (1:10), as determined by the Board of Directors. However, a reverse stock split has not yet been effected pursuant to such approval.

Listing on The Nasdaq Global Market. Our Common Stock is listed on The Nasdaq Capital Market under the symbol “LMFA”.

Pre-Funded Warrants

The following summary of certain terms and provisions of pre-funded warrants included in the pre-funded units that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the pre-funded warrant, the form of which is filed as an exhibit to the registration statement of which this prospectus forms a part. Prospective investors should carefully review the terms and provisions of the form of pre-funded warrant for a complete description of the terms and conditions of the pre-funded warrants.

16

Duration and Exercise Price

Each pre-funded warrant will have an initial exercise price per share equal to $0.01. The pre-funded warrants will be immediately exercisable and may be exercised at any time until the pre-funded warrants are exercised in full. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price. The pre-funded warrants will be issued separately from the accompanying common warrants included in the pre-funded units and may be transferred separately immediately thereafter.

Exercisability

The pre-funded warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of the pre-funded warrant to the extent that the holder would own more than 4.99% of the outstanding common stock immediately after exercise. However, any holder may increase such percentage to any other percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after the holder give notice to us of such increase. Purchasers of pre-funded units in this offering may also elect, prior to the issuance of the pre funded warrants, to have the initial exercise limitation set at 9.99% of our outstanding common stock.

Cashless Exercise

If, at the time a holder exercises its pre-funded warrants, a registration statement registering the issuance of the shares of common stock underlying the pre-funded warrants under the Securities Act is not then effective or available for the issuance of such shares, then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the pre-funded warrants.

Transferability

Subject to applicable laws, a pre-funded warrant may be transferred at the option of the holder upon surrender of the pre-funded warrant to us together with the appropriate instruments of transfer.

Fractional Shares

No fractional shares of common stock will be issued upon the exercise of the pre-funded warrants. Rather, the number of shares of common stock to be issued will, at our election, either be rounded up to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price.

Trading Market

There is no trading market available for the pre-funded warrants on any securities exchange or nationally recognized trading system.

Rights as a Stockholder

Except as otherwise provided in the pre-funded warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the pre-funded warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their pre-funded warrants.

Common Warrants

The following summary of certain terms and provisions of common warrants included in the units and the pre-funded units that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the common warrants, the form of which is filed as an exhibit to the registration statement of which this prospectus forms a part. Prospective investors should carefully review the terms and provisions of the form of common warrant for a complete description of the terms and conditions of the common warrants.

Duration and Exercise Price

Each common warrant included in the units and the pre-funded units offered hereby will have an initial exercise price per whole share equal to $0.90. The common warrants will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the

17

event of stock dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price. The common warrants will be issued separately from the common stock included in the units, or the pre-funded warrants included in the pre-funded units, as the case may be, and may be transferred separately immediately thereafter. A common warrant to purchase one share of our common stock will be included in each unit or pre-funded unit purchased in this offering.

Exercisability

The common warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of the common warrant to the extent that the holder would own more than 4.99% of the outstanding common stock immediately after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising the holder’s common warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the common warrants.

Cashless Exercise

If, at the time a holder exercises its common warrants, a registration statement registering the issuance of the shares of common stock underlying the common warrants under the Securities Act is not then effective or available for the issuance of such shares, then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the common warrants.

Fractional Shares

No fractional shares of common stock will be issued upon the exercise of the common warrants. Rather, the number of shares of common stock to be issued will, at our election, either be rounded up to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price.

Transferability

Subject to applicable laws, a common warrant may be transferred at the option of the holder upon surrender of the common warrant to us together with the appropriate instruments of transfer.

Exchange Listing

We do not intend to list the common warrants on any securities exchange or nationally recognized trading system.

Rights as a Stockholder

Except as otherwise provided in the common warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the common warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their common warrants.

Anti-Dilution

The warrants contain a full-ratchet anti-dilution exercise price adjustment upon the issuance of any common stock, securities convertible into common stock or certain other issuances at a price below the then-existing exercise price of the warrants, with certain exceptions. The terms of the warrants, including these anti-dilution protections, may make it difficult for us to raise additional capital at prevailing market terms in the future.

Fundamental Transactions

If we (i) effect any merger or consolidation with or into another person, (ii) effect any sale of all or substantially all of our assets in one or a series of related transactions, (iii) complete any tender offer or exchange offer pursuant to which holders of common stock are permitted to tender or exchange their shares for other securities, cash or property, (iv) effect any reclassification of our common stock or any compulsory share exchange pursuant to which our common stock is effectively converted into or exchanged for other securities, cash or property, or (v) other similar transactions, then the warrant will become the right thereafter to receive, upon exercise, the number of shares of common stock of the successor or acquiring corporation (or the Company, if it is the survivor) and

18